|

|

市場調査レポート

商品コード

1910614

量子センサー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Quantum Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 量子センサー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 121 Pages

納期: 2~3営業日

|

概要

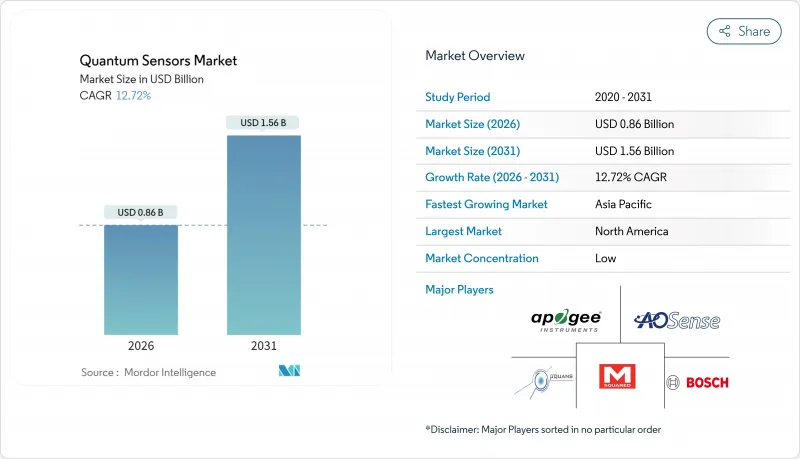

2026年の量子センサー市場規模は8億6,000万米ドルと推定され、2025年の7億6,000万米ドルから成長し、2031年には15億6,000万米ドルに達すると予測されています。

2026年から2031年にかけての年間平均成長率(CAGR)は12.72%となる見込みです。

この急速な拡大は、タイミング、航法、現場測定タスクにおける従来のセンシング技術の限界を克服することを目的とした、政府と民間による協調的な投資に起因しています。GPS偽装対策の米国防総省プログラム、中国および欧州の旗艦プロジェクト、ボーイング社の量子慣性システムの飛行試験は、戦略レベルの性能を発揮できる堅牢なデバイスに対する短期的な需要を裏付けています。250億米ドルを超える国家量子予算は、国内サプライチェーン確保に向けた競争を激化させています。一方、ウエハー規模の製造技術は単価を低下させ、新たな商業的道筋を開拓しています。宇宙機関、通信事業者、自動運転車開発企業、クラウドデータセンター所有者は現在、ナノ秒単位の同期から地下資源マッピングに至るシステムレベルの利点を模索しています。冷原子デバイスにおけるデコヒーレンス、輸出管理規制、アルカリ蒸気セルのボトルネックといった逆風は依然として存在しますが、誤差補償アルゴリズムとCMOS互換プロセスの進歩により、導入リスクは継続的に低減されています。

世界の量子センサー市場の動向と展望

量子PNT(測位・航法・時刻)技術への防衛資金増加

2024年以降に発行された総額27億米ドルに上る米国防総省の契約は、GPS信号が妨害または偽装された状況下でも精度を維持する量子測位・航法・時刻システムへの戦略的必要性を示しています。NATO防衛イノベーション加速機構も同様の優先度を表明し、英国は2024年に量子タイミング・航法技術の研究開発に1億8,500万ポンドを計上しました。オーストラリアも同様の取り組みに1億2,700万豪ドルを追加投入しており、量子PNTが自律兵器、耐障害性通信、遠征兵站の重要な基盤技術であるという世界の合意が示されています。その結果、各国防衛省は現在、原子時計、量子加速度計、量子磁力計を並行して調達しており、初期段階のサプライチェーンを安定させるロングテール需要を生み出しています。ベンダー各社のロードマップでは、厳しい軍事規格を満たすため、耐放射線性パッケージング、耐衝撃性、現場校正ツールの重要性がますます強調されています。

国家量子イニシアチブと予算

中国の150億米ドル規模「量子情報科学国家実験室」、更新された米国120億米ドル「国家量子イニシアチブ」、EUの70億ユーロ「量子フラッグシップ」は、量子センサーを主権技術として制度化する取り組みです。日本の1兆円規模のムーンショット計画は、2030年までの商業化マイルストーンを明確に目標とし、学術的ブレークスルーと企業生産ラインを結びつけています。こうした複数年にわたる予算配分は、大学、防衛主要企業、スタートアップ企業に対して予測可能な資金提供を実現し、共同パイロットプロジェクトやクロスライセンシング契約を促進します。また、蒸気セル部品、レーザー、真空サブアセンブリの国内調達を促す輸出管理規制の発動も引き起こします。結果として生まれる政策ミックスは、短期的なコンプライアンスコストを増加させますが、量子センサー市場に供給する持続的な研究開発パイプラインを保証します。

高い導入・維持コスト

冷原子干渉計には超高真空チャンバー、レーザー周波数ロック、磁気シールドが必要であり、これらを組み合わせると1サイトあたり最大200万米ドルの資本支出が発生します。これは従来の加速度計を桁違いに上回る金額です。窒素空孔ダイヤモンドデバイスは極低温での動作が必要な場合があり、ヘリウム取り扱いシステムやサーボ制御サブシステムが追加されます。原子物理学や光学に精通した熟練技術者は不足しており、その人件費が運用コストを押し上げます。移動式および航空機搭載ユーザーは、厳しいSWaP(サイズ・重量・電力)制約下での振動隔離、加圧、熱管理という追加負担に直面し、量子性能が明確な投資対効果をもたらすプレミアム用途への採用が限定されます。

セグメント分析

2025年、量子センサー市場において原子時計が31.45%の最大シェアを維持しました。これは通信キャリアやデータセンター事業者が、ナノ秒単位の精度を必要とするネットワークの同期化を進めたためです。量子重力計および勾配計は最も成長が速い製品群であり、地球観測衛星や石油・ガス探査プロジェクトが高解像度の質量密度マップを求める中、2031年までCAGR15.92%で拡大しています。量子磁力計は神経学、鉱物探査、電子戦任務に活用され、量子加速度計とジャイロスコープはGPSが利用できない状況下での慣性航法を支えます。PAR量子センサーや各種ニッチデバイスが、多様化する製品ラインアップを補完しています。ベンダー各社は複数のセンサータイプをハイブリッドペイロードに統合し、単一モジュールでタイミング・慣性・磁気データストリームを出力可能とすることで、自律システム向け融合アルゴリズムを実現しています。この融合は規模の経済と顧客基盤の拡大を約束し、量子センサー市場の持続的な収益向上を支えます。

第二の革新の波は、CMOSバックプレーン上に直接蒸気セルやフォトニック導波路を埋め込むウエハースケール製造技術に焦点を当てています。初期プロトタイプでは部品コスト40%削減と熱安定性の向上が達成されています。これらのプロセスを習得したサプライヤーは、ダイレベルサブシステムを大量生産向けに供給可能となり、産業オートメーション、精密農業、スマートグリッド監視分野への普及を加速させます。スタートアップ企業、防衛主要企業、半導体ファウンダリ間のクロスライセンシングは、古典的MEMSセンサーの商品化を反映した標準化されたフォームファクターへの移行が差し迫っていることを示しています。

2025年、量子センサー市場ではコールドアトム干渉計が44.35%のシェアを占めました。これは数十年にわたる実験室での検証と、着実に成熟したレーザー冷却技術によるものです。重力測定と慣性計測における比類なき感度は、測地学や防衛プログラムの中核を成し続けています。窒素空孔ダイヤモンドセンサーは、常温動作と生体適合性により磁気心電図・磁気脳波・ナノスケール材料研究への道を開き、16.63%という最速のCAGRを記録しています。100MHzの瞬時帯域幅を有するリドベリ原子電界センサーは、従来量子技術では到達困難だったレーダー・スペクトル解析領域をターゲットとしています。光機械・フォトニックデバイスは既存光学機器とのチップレベル統合を可能とし、超電導干渉計システムは極低温物理学向けにサブフェムトテスラ感度を実現します。

メカニズムの多様化は対応可能な市場を拡大する一方で、部品サプライチェーンに負荷をかけています。ダイヤモンド成長チャンバー、セシウム/ルビジウム蒸気セル、高コヒーレンスレーザーダイオードは、それぞれ専用の製造設備を必要とします。エコシステムプレイヤーは、知的財産を共有し共同施設に共同投資するコンソーシアムを形成することで対応し、量子センサー市場における多分野の需要急増を満たすために必要な規模の経済を予測しています。

量子センサー市場は、製品タイプ(原子時計、量子磁力計など)、検知メカニズム(冷原子干渉法、窒素空孔ダイヤモンドなど)、展開プラットフォーム(地上型、航空機搭載型、宇宙搭載型など)、エンドユーザー(防衛・セキュリティ、宇宙・衛星など)、地域別に市場セグメンテーションされます。市場予測は金額(米ドル)ベースで提供されます。

地域別分析

北米は2025年に世界収益の36.40%を占めました。これはDARPA、NASA、米国国立科学財団(NSF)が資金提供する研究クラスターに加え、頑丈な設計へのサプライヤー投資のリスクを軽減する国防総省からの安定した契約の流れに支えられています。ITARなどの輸出管理枠組みはライセンシングの負担を課す一方で、現地の知的財産を保護し、初期生産を米国拠点のファブに集中させています。カナダのウォータールー周辺に形成された量子研究回廊は、補完的なフォトニック統合技術を加え、地域エコシステムを拡大しています。

アジア太平洋地域は15.95%という最速のCAGRを達成する見込みであり、中国による150億米ドル規模の量子プログラムと、日本の学術コンソーシアムと電子・材料分野の産業大手企業を連携させる野心的なイニシアチブが牽引役となります。オーストラリアは鉱業・防衛分野のエンドユーザーとスタートアップ企業を結びつける商業化センターに資金を提供し、韓国は蒸着セルやダイヤモンド欠陥製造が可能な半導体ファウンダリに税制優遇措置を配分するロードマップを策定しています。この投資の波により、同地域は需要と供給の両面で中核的役割を担い、量子センサー市場における存在感を高めています。

欧州は70億ユーロ規模の「量子技術フラッグシップ」計画のもと、結束した緩やかな成長軌道を維持しています。ドイツ、フランス、オランダはそれぞれ半導体製造装置、レーザーシステム、原子チップパッケージングを専門とし、国境を越えたサプライチェーンを形成しています。欧州宇宙機関(ESA)の宇宙センサー契約により、大学と航空宇宙主要企業が共同事業を展開し、冷原子ペイロードと先進的な小型衛星バスを統合しています。デュアルユース輸出規制やデータ主権問題に関する規制の明確化により、欧州ベンダーは精密農業やスマートグリッド監視といった民間市場のニッチ分野を、ITAR規制の制約を同程度に受けずに狙うことが可能となっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 量子PNT技術への防衛資金の増加

- 国家量子イニシアチブと予算

- 高精度自律航行に対する需要

- 通信・データセンター分野における量子時計の商用展開

- 宇宙搭載型気候監視重力計

- ウエハー規模の製造技術がコスト低減を推進

- 市場抑制要因

- 導入および維持コストの高さ

- 環境への感受性/冷原子システムのデコヒーレンス

- アルカリ蒸気セルのサプライチェーンにおけるボトルネック(注目されていない)

- 量子技術に対する輸出管理規制(注目されていない)

- 業界バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 製品タイプ別

- 原子時計

- 量子磁力計

- 量子加速度計・ジャイロスコープ

- 量子重力計・勾配計

- PAR量子センサー

- その他の製品タイプ

- センシングメカニズム別

- 低温原子干渉法

- 窒素空孔(NV)ダイヤモンド

- リドベリ・アトム電気場センサー

- 光機械式/フォトニックセンサー

- 超伝導量子干渉素子

- 展開プラットフォーム別

- 地上ベース

- 航空機搭載型

- 宇宙搭載型

- 海洋/地下

- エンドユーザー別

- 防衛・セキュリティ

- 宇宙・衛星

- 石油・ガス・鉱業

- ヘルスケア・ライフサイエンス

- 運輸・自動車

- 通信・データセンター

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- チリ

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- オーストラリア

- インド

- その他アジア太平洋

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- AOSense Inc.

- Robert Bosch GmbH

- Muquans SAS(iXblue)

- M Squared Lasers Ltd.

- Microchip Technology Inc.

- Apogee Instruments Inc.

- Campbell Scientific Inc.

- LI-COR Biosciences Inc.

- Skye Instruments Ltd.

- Q-CTRL Pty Ltd

- Infleqtion Inc.

- SBQuantum Inc.

- iXblue SAS

- Teledyne e2v Semiconductors

- Honeywell Quantum Solutions(Quantinuum)

- Surrey Satellite Technology Ltd.

- SiTime Corp.

- Micro-G LaCoste LLC

- Atomionics Pte Ltd.

- SBQ Instruments AB