|

市場調査レポート

商品コード

1642162

電磁適合性試験装置と試験サービス:市場シェア分析、産業動向、成長予測(2025年~2030年)Electromagnetic Compatibility Test Equipment And Testing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電磁適合性試験装置と試験サービス:市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 103 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

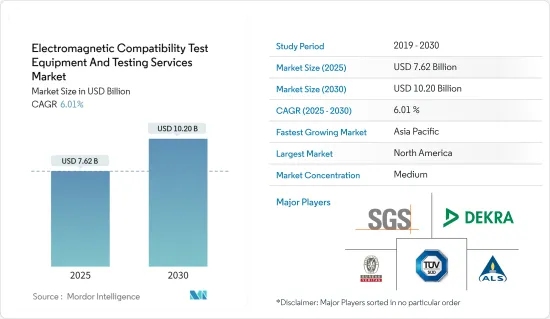

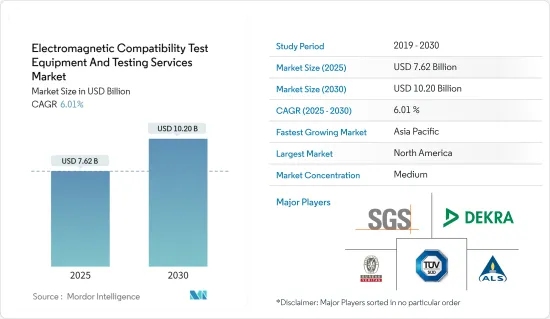

電磁適合性試験装置と試験サービス市場規模は、2025年に76億2,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは6.01%で、2030年には102億米ドルに達すると予測されます。

主要ハイライト

- さまざまなエンドユーザー産業で電子機器の使用が増加しているため、電磁両立性(EMC)は不可欠なサービスとなっています。電磁両立性(EMC)は、機器から発生する放射または伝導エミッションが、その周辺にある他の電子製品と干渉する可能性を最小限に抑えるのに役立つからです。

- 電磁適合性試験装置と試験サービスは、他の電子機器に近接したり、意図した動作に干渉する可能性のある電磁妨害が存在する場合に、その電磁環境において電子機器が想定通りに動作する能力を分析します。

- したがって、電磁両立性(EMC)試験は、電子機器の設計と製造プロセスにおいて極めて重要なステップです。FCC、FDA、ISOを含む様々な規制機関は、電子機器から放出される可能性のあるエミッションに関する特定の制限/枠組みを設定しています。これらの規制は、デバイスが他の機器に干渉したり、意図したとおりに動作しないことを保証することで、電気/電子機器を使用するすべての人に安全性と信頼性の向上を記載しています。

- 市場要件に準拠し、費用のかかるリコールを回避するために、消費者製品、医療機器、産業機械、鉄道、自動車、航空宇宙、軍事機器などの産業のメーカーは、電磁妨害が製品の機能を妨げないことを保証しなければなりません。これらのメーカーはまた、関連する規制の枠組みが存在感を増しているため、コストを削減し、市場投入までの時間を短縮しながら品質を維持する必要に迫られています。

- 世界の人口と経済の成長、急速な都市化により、今後数年間のエネルギー需要の増加が見込まれています。国連(UN)は、世界人口が2017年の76億人から2050年には98億人に増加すると推定しています。これにより、使用される電気・電子機器の数が増加し、調査対象市場にビジネス機会が生まれると予想されます。

- 近年、自動車産業では電動化の動きが加速しています。電気自動車には高周波/電磁干渉を発する電子部品が多く組み込まれているため、自動車の性能や運転体験に悪影響を及ぼす可能性があります。半導体のスイッチング周波数が高くなり、高電圧・高電流によるエミッションが増加するため、自動車の電動化は新たなEMC課題につながります。

- こうした動向を考慮し、市場には革新的なソリューションを提供するベンダーが複数存在しています。例えば、2022年11月、自動車試験システムの著名なプロバイダーであるAVLとRohde & Schwarzは、開発プロセスを簡素化・迅速化するため、実際の走行条件下で電気ドライブトレインの電磁両立性データ分析を自動化する革新的なソリューションを発表しました。

- しかし、電磁適合性試験装置と試験サービスに関連する高価格タグは、調査対象市場の成長を阻む主要要因のひとつです。さらに、EMC試験の平均期間が長いことも、調査対象市場の成長を抑制する主要要因の1つです。

電磁適合性試験装置と試験サービス市場の動向

民生用電子機器セグメントが市場成長を牽引する見込み

- デジタル化、スマートホーム、モノのインターネット(IoT)のためのコネクテッドデバイスなどの動向により、エレクトロニクスベースの製品の密度はほとんどの垂直セグメントで増加しています。電磁両立性(EMC)の観点から製品の品質を確保するため、規制機関は設計や製造に関する規則や指示を絶えず進化させています。

- さらに、CiscoのAnnual Internet Reportによると、2023年までにネットワークに接続されるデバイスと接続数は、2018年の184億から300億近くに増加するといいます。さらに、2023年までにIoTデバイスはネットワーク接続デバイス全体の50%(147億)を占めるようになり、2018年の33%(61億)から増加します。さらに、Ericssonによると、5Gの契約数は2019~2027年にかけて世界的に急増し、1,200万件超から40億件超に増加すると予想されています。これらの要因が相まって、民生用電子機器産業の規模は大幅に拡大すると予想されます。

- 製造業者は、市場参入前に認証を通じて最新のEMC指令や地域・産業レベルの規制・規格に準拠する必要があります。例えば、EMC問題を未然に防ぐため、英国政府は厳格な法律を制定し、電子製品の輸入業者や製造業者はすべて、自社の製品が電磁気的に適合していることを確認するよう強制しています。こうした動きは、民生用電子機器セグメントにおけるEMC試験装置とサービスの必要性を高めると予想されます。したがって、このような産業規制は、調査対象市場の成長を促進すると予想されます。

- 中国は、特に茶色製品カテゴリーにおいて、著名な民生用電子機器生産国です。中国は、広範なエレクトロニクス製造エコシステムとサプライチェーンを特徴としています。例えば、中国国家統計局によると、2022年5月には中国で約3,700万台のコンピュータが生産され、2022年4月の3,266万台から増加しています。この地域の堅調な民生用電子機器製造能力は、研究市場の成長に有利な機会を記載しています。

- 同様に、コンシューマー技術協会(CTA)によると、米国におけるコンシューマー・エレクトロニクス/技術製品の小売販売収入は、2023年には4,850億米ドルになると予想されています。これは2022年の数字と比べると減少しているが、予測期間中は安定した成長が見込まれ、特に米国のような先進国では製品の品質に関する法律が厳しいため、予測期間中に消費者向け電子製品のEMC試験需要が高まると考えられます。

北米が主要市場シェアを占める見込み

- 北米は、政府の支援施策、消費者の意識向上、研究開発のためのインフラ整備など、最新技術の開発・導入に有利な経済的・社会的条件が整っているため、EMC試験市場の参入企業にとって有力な地域です。同地域の民生用電子機器産業は、スマートフォン、タブレット、パソコン、HVACシステム、洗濯機、テレビの普及により繁栄しています。

- 米国は、自動車、航空宇宙、民生用電子機器、医療産業が盛んであることから、電磁適合性試験装置と試験サービスにとって重要な市場のひとつです。近年、すべての主要エンドユーザー部門で電子部品/デバイスの採用が増加しているため、EMC試験装置/サービスの需要は予測期間中にさらに拡大すると予想されます。

- さらに、米国では電磁波に関する規制が厳しいです。例えば米国では、連邦通信委員会(FCC)がすべての商用電磁波源を規制しています。FCCのTitle 47, Part 15規制は、様々な放射源からの放射に関する制限を規定しており、これには、事務機器、コンピュータとコンピュータ周辺機器、電子ゲーム、POS端末など、マイクロプロセッサを使用するほぼすべての製品が含まれます。

- 北米地域には、複数の電磁適合性試験装置と試験サービスプロバイダーが存在しており、このことも同地域における研究市場の成長を促進しています。例えば、米国にあるWashington Laboratories Ltd.の試験場は、メリーランド州コロンビアにあるFCCのEquipment Authorizations Branchに登録されており、ANSI C63.4~2003に準拠しています。

- さらに、北米の自動車産業は自律走行車に向けて着実に前進しています。これらの自動車には複数の電子ユニットが搭載されているため、自動車のエラーなき動作を保証するために電磁適合性試験の役割はさらに重要になっています。したがって、このような動向はすべて、予測期間中の北米における調査市場の成長を補完すると予想されます。

電磁適合性試験装置と試験サービス産業概要

数多くの地域と世界参入企業が存在するため、世界の電磁適合性試験装置と試験サービス市場は統合されると予想されます。市場参入企業は、世界の電磁適合性試験装置と試験サービス市場における地位を強化するために、提携、新製品開発、市場開拓などの競合戦略的取り組みを積極的に行っています。

2023年4月、自動車セグメントの製品認定に向けた応用試験を専門とするEmitechは、フランスのモンティニー・ル・ブルトンヌーに最新鋭の車両試験センターを開設しました。Emitechの新しいEMCチャンバーには、R&S BBA130、R&S BBA150、R&S BBL200広帯域アンプ、R&S SMB100B RF信号発生器、パワーメーター、R&S ESW44テストレシーバーなど、ローデ・シュワルツの包括的なEMCテストシステムが装備されています。

2023年2月、ISROのChandrayaan-3着陸機は、ベンガルールのU R Rao衛星センターでEMI/EMC試験に成功しました。ISROの試験手順には、ランチャーの互換性、すべてのRFシステムのアンテナ偏波、着陸後のミッション段階のランダーとローバーの互換性試験、軌道上と動力降下ミッション段階のスタンドアロン自動互換性試験が含まれ、ランダーのミッションへの準備態勢を確保しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- マクロ動向の産業への影響評価

第5章 市場力学

- 市場促進要因

- ワイヤレスブロードバンドインフラの成長と5gモバイルネットワークの開発

- 各産業における電磁干渉(EMI)に対する政府の厳しい規制

- 市場抑制要因

- 電磁適合性(EMC)試験装置に関連する高コスト

第6章 市場セグメンテーション

- タイプ別

- テスト機器

- EMIテストレシーバ

- 信号発生器

- アンプ

- スペクトラムアナライザ

- その他テスト機器

- サービス別

- テスト機器

- エンドユーザー産業別

- 自動車

- コンシューマー・エレクトロニクス

- IT・通信

- 航空宇宙・防衛

- 医療

- その他

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Rohde & Schwarz GmbH & Co. KG

- HV Technologies, Inc.

- ETS-Lindgren Inc.

- Keysight Technologies Inc.

- SGS S.A.

- Bureau Veritas S.A.

- Intertek Group PLC

- Dekra Certification GmbH

- ALS Limited

- TUV SUD

第8章 投資分析

第9章 市場機会と今後の動向

The Electromagnetic Compatibility Test Equipment And Testing Services Market size is estimated at USD 7.62 billion in 2025, and is expected to reach USD 10.20 billion by 2030, at a CAGR of 6.01% during the forecast period (2025-2030).

Key Highlights

- The increasing usage of electronic devices across various end-user industries makes electromagnetic compatibility (EMC) an essential service, as it helps minimize the possibility that radiated or conducted emissions produced by a device interfere with other electronic products in its vicinity.

- Electromagnetic Compatibility testing equipment and services analyze the ability of electronic devices to operate as anticipated in their electromagnetic environment when in proximity to other electronic devices or in the presence of electromagnetic disturbances that can interfere with their intended operation.

- Hence, electromagnetic compatibility (EMC) testing is a crucial step in electronic device design and manufacturing processes. Various regulatory bodies, including the FCC, FDA, and ISO, have set specific limits/frameworks on the emissions that can be released from an electronic device. These regulations provide improved safety and reliability for anyone using electrical/electronic equipment by assuring the device does not interfere with other equipment or fail to operate as intended.

- To comply with market requirements and avoid costly recalls, manufacturers in industries such as consumer products, medical devices, industrial machinery, railway, automotive, aerospace, and military equipment must ensure that electromagnetic disturbances do not interfere with the function of their products. These manufacturers are also under pressure to maintain quality while reducing costs and time to market owing to the growing presence of related regulatory frameworks.

- Growth in the world's population and economy and rapid urbanization are expected to increase energy demand over the coming years. The United Nations (UN) estimates that the world's population will grow from 7.6 billion in 2017 to 9.8 billion by 2050. This is anticipated to drive the number of electrical/electronic devices in use, thereby creating opportunities in the studied market.

- In recent years, the electrification trend has been gaining traction in the automotive industry. As electric vehicles incorporate many electronic components that emit radio-frequency/electromagnetic interference, they have the potential to negatively impact the vehicle's performance and driving experience. Hence, the electrification of vehicles leads to new EMC challenges because of higher switching frequencies of semiconductors and higher emissions due to high voltages and currents.

- Considering such trends, there are several vendors offering innovative solutions in the market. For instance, in November 2022, to ease and speed up the development process, AVL and Rohde & Schwarz, two of the prominent providers of automotive test systems, presented an innovative solution for automated electromagnetic compatibility data analysis of an electric drivetrain under real driving conditions.

- However, a higher price tag associated with electromagnetic compatibility test equipment and services is among the major factors challenging the studied market's growth. Furthermore, a higher average time period of EMC testing is also among the key restraining factors for the studied market's growth.

Electromagnetic Compatibility Test Equipment Market Trends

The Consumer Electronics Segment is Expected to Drive the Market's Growth

- The density of electronics-based products is increasing in most verticals due to trends such as digitization, smart homes, and connected devices for the Internet of Things (IoT). To ensure the quality of the product from an electromagnetic compatibility (EMC) standpoint, regulatory bodies have enforced constantly evolving rules and directions on designing and manufacturing.

- Moreover, according to Cisco's Annual Internet Report, by 2023, there will be close to 30 billion network-connected devices and connections, up from 18.4 billion in 2018. Additionally, by 2023, IoT devices will make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Further, according to Ericsson, 5G subscriptions are expected to skyrocket globally between 2019 and 2027, rising from over 12 million to over 4 billion. Combined, these factors are anticipated to expand the consumer electronics industry's size significantly.

- Manufacturers must comply with the latest EMC directives and regional and industry-level regulations and standards through certification before market entry. For instance, to pree of EMC problems, the UK government has adopted stringent laws, forcing all importers and manufacturers of electronic goods to ensure that their products are electromagnetically compatible. Such initiations are anticipated to drive the need for EMC test equipment and services in the consumer electronics segment. Hence, such industry regulations are anticipated to drive the growth of the studied market.

- China is a prominent consumer electronics producer, especially in the brown goods product category. It features an extensive electronics manufacturing ecosystem and supply chain. For instance, according to the National Bureau of Statistics of China, in May 2022, around 37 million computers were produced in China, an increase from 32.66 million computers in April 2022. The region's robust consumer electronics manufacturing capabilities offer lucrative opportunities for the growth of the studied market.

- Similarly, according to the Consumer Technology Association (CTA), the retail sales revenue of consumer electronic/technology products in the United States is anticipated to be valued at USD 485 billion in 2023. Although this is a decline compared to the figures of 2022, stable growth is still anticipated during the forecast period, which in turn will drive the demand for EMC testing of consumer electronic products during the forecast period as several countries, especially developed ones such as the United States have stringent laws pertaining to product quality.

North America is Expected to Hold a Major Market Share

- North America is a prominent region for the EMC testing market players due to favorable economic and social conditions for developing and adopting modern technologies, including supportive government policies, higher consumer awareness, and developed infrastructure for research and development. The region's consumer electronics industry thrives due to the widespread use of smartphones, tablets, personal computers, HVAC systems, washing machines, and television sets.

- The United States is one of the significant markets for Electromagnetic Compatibility Test Equipment and Testing Services owing to the presence of strong automotive, aerospace, consumer electronics, and healthcare industries. As the adoption of electronic components/devices has increased across all the major end-user sectors in recent years, the demand for EMC test equipment/services is anticipated to grow further during the forecast period.

- Furthermore, the country has stringent regulations pertaining to electromagnetic radiation. For instance, in the United States, the Federal Communications Commission (FCC) regulates all commercial sources of electromagnetic radiation. The Title 47, Part 15 regulation of FCC specifies limits on the radiation from various radiation sources, which include virtually every product that employs a microprocessor, including office equipment, computers and computer peripherals, electronic games, and point-of-sale terminals.

- The North American region has the presence of several electromagnetic compatibility test equipment and testing services providers, which also facilitates the studied market's growth in the region. For instance, Washington Laboratories Ltd's test sites in the United States are listed by the FCC's Equipment Authorizations Branch in Columbia, Maryland, and conform to ANSI C63.4-2003.

- Furthermore, the North American automotive industry is progressing steadily toward autonomous vehicles. As these vehicles are loaded with multiple electronic units, the role of electromagnetic compatibility testing becomes even more important to ensure the error-free working of the automobile. Hence, all such trends together are anticipated to supplement the studied market's growth in North America during the forecast period.

Electromagnetic Compatibility Test Equipment Industry Overview

With the presence of numerous regional and global players, the global electrical test equipment market is expected to be consolidated. Nevertheless, market participants are actively engaging in competitive strategic initiatives, including partnerships, new product development, and market expansion, to strengthen their positions in the global electromagnetic test equipment and test services market.

In April 2023, Emitech, a company specializing in applied testing for product qualification in the automotive sector, inaugurated its state-of-the-art vehicle test center in Montigny-le-Bretonneux, France. Emitech's new EMC chamber is equipped with a comprehensive EMC test system from Rohde & Schwarz, featuring R&S BBA130, R&S BBA150, and R&S BBL200 broadband amplifiers, as well as R&S SMB100B RF signal generators and power meters, along with R&S ESW44 test receivers.

In February 2023, ISRO's Chandrayaan-3 lander successfully underwent EMI/EMC testing at the U R Rao Satellite Centre in Bengaluru. ISRO's testing procedures encompassed Launcher compatibility, Antenna Polarization for all RF systems, Lander & Rover compatibility tests for the post-landing mission phase, and Standalone auto compatibility tests for orbital and powered descent mission phases, ensuring the lander's readiness for its mission.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Wireless Broadband Infrastructure and Development of 5g Mobile Network

- 5.1.2 Stringent Government Regulations Against Electromagnetic Interference(EMI) Across the Industries

- 5.2 Market Restraints

- 5.2.1 High Cost Affiliated With the Electromagnetic Compatibility (EMC) Test Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Test Equipment

- 6.1.1.1 EMI Test Receiver

- 6.1.1.2 Signal Generator

- 6.1.1.3 Amplifiers

- 6.1.1.4 Spectrum Analyzer

- 6.1.1.5 Other Test Equipments

- 6.1.2 Services

- 6.1.1 Test Equipment

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 IT and Telecom

- 6.2.4 Aerospace and Defense

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rohde & Schwarz GmbH & Co. KG

- 7.1.2 HV Technologies, Inc.

- 7.1.3 ETS-Lindgren Inc.

- 7.1.4 Keysight Technologies Inc.

- 7.1.5 SGS S.A.

- 7.1.6 Bureau Veritas S.A.

- 7.1.7 Intertek Group PLC

- 7.1.8 Dekra Certification GmbH

- 7.1.9 ALS Limited

- 7.1.10 TUV SUD