|

市場調査レポート

商品コード

1852203

美容レーザー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aesthetic Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 美容レーザー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年09月23日

発行: Mordor Intelligence

ページ情報: 英文 116 Pages

納期: 2~3営業日

|

概要

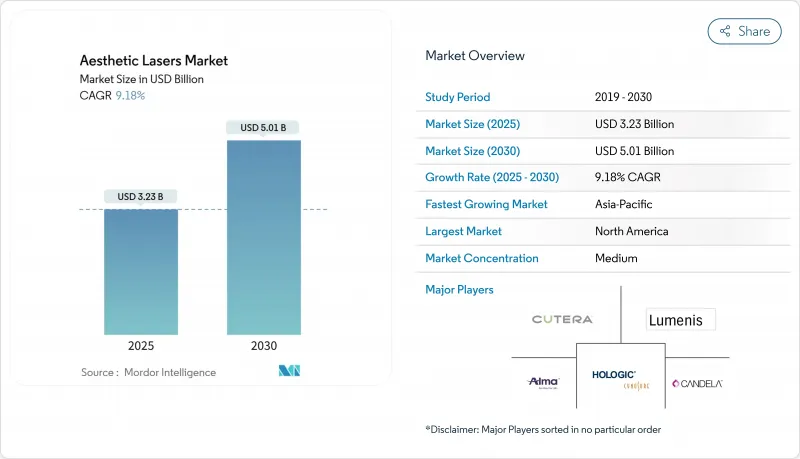

美容レーザーの世界市場規模は2025年に32億3,000万米ドルとなり、2030年までのCAGRは9.18%で推移すると予測されています。

限られたダウンタイムで目に見える結果をもたらす低侵襲の美容介入に対する消費者の需要の高まりは、皮膚科診療所の資本設備購入基準を再定義し続けています。このような成長のダイナミズムから派生した新たな意味合いとして、施術者の学習曲線を短縮できる機器ベンダーは、以前は臨床効果のみに関連していた価格設定にプレミアムをつけることができるようになるかもしれないです。

世界の美容レーザー市場の動向と洞察

人口動態の高齢化が精密標的治療を牽引

急速に拡大する65歳以上のコホートでは、レーザータイトニングによる皮膚の弛み矯正が優先されるようになり、外科的フェイスリフトに代わって外来患者による治療が行われるようになっています。高齢者の真皮はよりゆっくりと回復するため、機器メーカーはより細かいエネルギー増量設定と閉ループ温度フィードバックを統合し、過剰治療のリスクを軽減しています。これらのプロトコルを虚栄心のアピールではなく「活力の維持」と位置づけるクリニックは、可動性や回復時間に密接に関わる高齢患者に、より高い受容性を見出しています。

技術の融合がイノベーションのサイクルを加速する

メーカー各社は、複数の波長と高周波チャンネルを1つの筐体に積み重ね、事実上、4つか5つの独立した機器を1つにまとめています。直接的な効果は、単一モダリティの主力製品がスペック不足に見えるため、買い替えサイクルが短くなることだが、副次的な効果は、ソフトウェアのアップグレード可能性が、ハードウェア・シェルではなく、真のロックイン・メカニズムになることです。アルマハイブリッドのCO2+1570nmの組み合わせは、将来の競争優位性が、光源からファームウェアのアップデートによって制御される治療アルゴリズムに軸足を移す可能性を示しています。

限られた保険償還が市場の階層化を生む

酒さとにきびのレーザー治療は、ユナイテッドヘルスケアの医療政策では「医療上必要でない」とされ、選択的治療として広く分類されています。その結果、都市部に住む高所得者層がプレミアム・クリニックの収益を押し上げる一方、中堅市場のプロバイダーは、アクセスの幅を広げるために独創的な資金調達やセッションごとの有料プランに頼っています。この層別化によって、フラッグシップ・システムを導入する資金に乏しい新興市場の起業家をターゲットとした、低価格のポータブル・ユニットというニッチが開かれることになります。

セグメント分析

2024年の美容レーザー市場規模では、非アブレーション治療システムのシェアが65%を占め、日常生活に支障をきたさない治療に対する消費者のこだわりが後押ししました。フラクショナル・ツリウム・ファイバー・レーザーがアジア人の光損傷症例で表皮の厚さを改善することを示す証拠は、その民族を超えた適用可能性を強調しています。この優位性はまた、クリニックがダウンタイムのない結果を強調するためにマーケティング予算の不均衡な割合を割り当て、競合の言説を単回セッションの有効性から累積的な肌質の向上へと微妙にシフトさせる可能性があることを示唆しています。

スタンドアローンレーザーは2024年に72%のシェアを維持したが、マルチプラットフォームハイブリッドは13.5%のCAGRを記録しています。このことから推測されるのは、金融会社は近いうちに減価償却スケジュールを見直す可能性があり、マルチプラットフォームユニットを従来の資本設備よりもソフトウェアでアップグレード可能な資産のように扱う可能性があるということです。経済的耐用年数が長くなれば、リース・モデルの魅力が増し、貸手とメーカーの双方に経常収益の流れが生まれます。

地域分析

北米は、強固なプロバイダーネットワークと早期の技術導入に支えられ、2024年の世界市場シェアの40%を占める。米国の低侵襲「微調整」施術の市場規模は、施術者が劇的なイメチェンよりも漸進的な修正を重視していることを裏付けています。これと並行して、大都市圏では、注射とサブアブレイティブ・レーザーを組み合わせた相乗的なプロトコルを中心に、患者の期待がますます高まっていることが観察され、統合型診療所のクロスセリング機会を示唆しています。

アジア太平洋は2030年までCAGR12.2%を記録すると予測され、これはどの地域よりも速いペースです。文化的理想として均一な肌色を強調する国々は、ピコ秒およびナノ秒色素レーザーの平均を上回る採用を推進しています。肝斑と血管性赤ら顔の両方に対応できる機器を在庫しているクリニックは、シェアを獲得する見込みです。なぜなら、施術の価格競争が厳しい市場では、二重適応の汎用性の方が設備投資をより迅速に回収できるからです。

欧州は成熟した市場でありながら拡大しており、自然な仕上がりが好まれるため、低エネルギーの照射を複数回行うプロトコルが推奨されています。間接的な意味合いとして、特にドイツ、フランス、英国では、口コミによる紹介が大きなウェイトを占めており、多くのクリニックにとって、患者の維持が新規患者の獲得に取って代わる可能性があります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高齢化社会と肌のたるみによるレーザータイトニングの増加

- 成長する技術進歩

- AIを活用したレーザーパラメーターの最適化により有害事象が減少

- ミレニアル世代における色素性病変に対するピコ秒レーザーの使用率

- 医療ツーリズムが牽引するレーザー脱毛ブーム

- ライフスタイルの変化と可処分所得の増加

- 市場抑制要因

- 公的医療制度における限られた償還

- 厳しいレーザー安全規制が製品発売を遅らせる

- 美容医療にまつわる社会的スティグマ

- 新興国における訓練されたレーザー技術者の不足

- サプライチェーン分析

- 規制シナリオ

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- アブレイティブレーザー

- 二酸化炭素(CO2)レーザー

- エルビウムレーザー

- 非アブレイティブレーザー

- パルス色素レーザー(PDL)

- Nd:YAGレーザー

- アレキサンドライトレーザー

- ダイオードレーザー

- アブレイティブレーザー

- モダリティ別

- 独立型レーザーシステム

- マルチプラットフォーム/ハイブリッドシステム

- ポータビリティ別

- 非ポータブル

- ポータブル

- 用途別

- スキンリサーフェシング&若返り

- 脱毛

- にきび・瘢痕治療

- タトゥー除去

- ボディスカルプティング&スキンタイトニング

- 血管・色素性病変治療薬

- エンドユーザー別

- 病院

- 皮膚科&美容クリニック

- メディカルスパ&ビューティーセンター

- 外来手術センター

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東

- GCC

- 南アフリカ

- その他中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Alma Lasers

- Candela Medical

- Cynosure

- Lumenis

- Cutera

- Solta Medical

- Aerolase Corporation

- Sciton Inc.

- El.En. Group

- IRIDEX Corporation

- sharplight technologies

- Fotona d.o.o.

- Jeisys Medical

- Lutronic Corporation

- Venus Concept Inc.

- InMode Ltd.

- Quanta System S.p.A.

- Zimmer MedizinSysteme

- BTL Industries