|

市場調査レポート

商品コード

1851125

感染症診断:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Infectious Disease Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 感染症診断:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月21日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

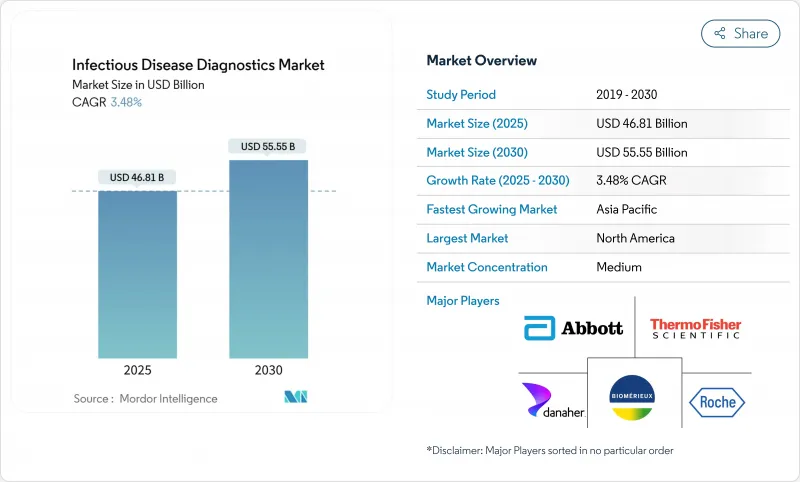

感染症診断市場は、2025年に468億1,000万米ドル、2030年には555億5,000万米ドルに達し、CAGR 3.48%で成長する見通しです。

この着実な軌跡は、感染症診断市場がパンデミック主導の需要から、風土病管理、気候に関連したアウトブレイク、継続的な技術アップグレードに支えられた長期的成長へと移行していることを示しています。支出は呼吸器検査だけでなく、媒介性病原体、抗菌剤耐性病原体、新興病原体などにも広がっており、COVID-19の数量減少を補うのに役立っています。試薬販売は依然として収益の基幹であるが、自動化の効率化を求める検査室では、ソフトウェア対応のワークフローツールが急速に拡大しています。CRISPR、アイソサーマル、AIで武装した新規参入企業が感染症診断市場で既存企業のシェア争いに挑んでいるため、競合の激しさは増しています。

世界の感染症診断市場の動向と洞察

感染症の流行と再燃の高まり

気候変動により蚊の生息域が広がっているため、プロバイダーはかつて熱帯に限られていた病原体の検査を行うようになっています。世界保健機関(WHO)は2024年8月、天然痘をグレード3の緊急事態に分類しました。WHOの2024年優先順位リストでは、迅速診断を必要とする15の耐性菌が挙げられています。新たな脅威が表面化するにつれ、検査室は頻繁にメニューを更新する必要があり、感染症診断市場全体の企業に経常収益をもたらします。

ポイントオブケアと在宅検査への需要の高まり

規制当局による消費者向け検査の承認は急速に進んでいます。2024年8月、FDAは初のOTC梅毒検査法を認可し、小売診断が主流となりました。梅毒罹患率は2018年から2022年にかけて80%上昇したため、地域薬局やeコマースポータルは現在、迅速キットを在庫しています。セファイドのフィンガースティックC型肝炎検査は、プライマリ・クリニックにおけるケアギャップを解消するため、来院時のウイルス確認を追加します。支払者は、下流のコストを削減する早期の治療開始を評価するため、複雑なコーディングが続く中でも、償還プロセスが追いついてきています。

断片的で不十分な償還の枠組み

支払者は請求を承認する前に厳格なコーディングを要求しており、追加されたペーパーワークが小規模ラボのキャッシュサイクルを引き延ばしています。政府の診療報酬体系は、特に低・中所得国において、先進的な分子プラットフォームの全コストをカバーすることは稀であり、そのため導入が制限されています。このような環境下にある検査室は、ドナープログラムに依存しており、臨床上の必要性は明らかであるにもかかわらず、商業的な勢いは弱まっています。統一された支払いモデルによって、感染症診断市場全体への普及が進むと思われます。

セグメント分析

呼吸器パネルは2024年に感染症診断市場シェアの20.13%を占めたが、媒介病原体および新興病原体は2030年までCAGR 5.78%で上昇する見込みです。2024-2025年に記録的な1,300万人のデング熱患者が発生し、病院は検査メニューの拡充を余儀なくされます。Mpox、肝炎、HIV自己検査、AIアシスト結核アッセイが臨床の幅を広げます。世界的な移動と気候変動により感染地域が変化するため、媒介虫検査に付随する感染症診断市場規模は増加し続ける。

成長は、院内感染に対する迅速な抗菌薬感受性ツールや、STIホームキットに対するFDAのOTC認可に依存しています。検査施設は、WHOが耐性菌リストに細菌を追加した際に迅速に更新するプラットフォームを重視しています。このような柔軟性は、感染症診断市場におけるベンダーの粘着性を強化します。

アッセイ、キット、試薬は2024年の感染症診断市場規模の53.45%を占める。ソフトウェアとインフォマティクスは、規模は小さいもの、ラボのワークフローがデジタル化されるにつれて、CAGRが最も早く5.66%に達すると思われます。検査機器は現在、生のスループットだけでなく、自動化の深さ、サンプルから回答までのスピード、AIとの連携で競争しています。

病院が複雑なシーケンシングや薬剤耐性パネルを外注することで、受託検査サービスが成長します。クラウドベースのアナリティクスは、生データを実用的なレポートに結びつけ、検査ごとの価値を高める。感染症診断市場全体でハードウェアの利幅が縮小しても、試薬とインフォマティクスをバンドルするベンダーはシェアを維持。

地域分析

北米は、確立された償還ルール、迅速なFDA承認、ルーチンスクリーニング量の多さに支えられ、2024年には世界売上高の45.26%を占めました。しかし、同地域ではCOVID-19検査の収益が減少するにつれて予算の圧縮に直面しており、検査施設はメニューの拡大と自動化の加速を迫られています。

アジア太平洋地域は、インフラ投資と感染症負担の増加により、2030年までCAGR 5.36%で成長すると予測されています。中国、インド、日本の政府プログラムでは、迅速デング熱、mpox、抗菌薬耐性パネルに助成金を出しており、導入サイクルを短縮しています。デジタルヘルスパイロットは遠隔キットを遠隔診察に結びつけ、地方での普及を促進します。

欧州は安定した需要を維持し、シンドロミックマルチプレックスの採用をリード。しかし、抗菌薬管理に関するイニシアチブは、迅速診断薬を導入するよう病院に圧力をかけ続けています。中東・アフリカ市場は依然として小さいが、ドナー資金によるアップグレードが進んでおり、感染症診断市場内で地理的多様化を目指すサプライヤーの足がかりとなっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 感染症の蔓延と再流行

- ポイントオブケアと在宅検査の需要拡大

- Pcr/Ngsプラットフォームとケミストリーの絶え間ない革新

- 感染症の予防、診断、啓発に対する政府の取り組み

- 分子診断と迅速抗原検査の拡大

- AI主導の検査ワークフロー

- 市場抑制要因

- 細分化された不十分な償還制度

- COVID-19試験終了後の予算縮小

- スワブ/PCRキット製造資産の過剰能力

- マルチプレックスCRISPRアッセイの規制グレーゾーン

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの見通し

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 用途別

- 肝炎(A、B、C、D、E)

- HIV/エイズ

- CT/NGおよびその他のSTI

- 結核

- 呼吸器(インフルエンザ、RSV、COVID-19、その他)

- 媒介病原体および新興病原体(デング熱、ジカ熱、Mpox)

- 院内感染(MRSA、C. diffなど)

- その他(マラリア、ライム、トキソプラズマ症)

- 製品・サービス別

- アッセイ、キット、試薬

- 分析機器

- ソフトウェア&インフォマティクス

- サービス&受託試験

- 技術別

- PCRおよびqPCR

- 等温NAAT(LAMP、INAAT、TMA)

- 免疫診断(ELISA、CLIA、LFIA)

- DNA/RNAシーケンスおよびNGS

- マイクロアレイ&マルチプレックスパネル

- CRISPRベースの診断

- メタゲノム&ショットガンシーケンス

- エンドユーザー別

- 病院・臨床検査室

- リファレンス/中央研究所

- ポイントオブケア/分散型設定

- ホームケア&OTC消費者

- 学術・研究機関

- 検査設定別

- ラボベースの検査

- ポイントオブケア検査

- 市販/在宅検査

- 検体タイプ別

- 血液/血漿/血清

- スワブ(NP/OP、唾液)

- 尿

- 便

- その他の液体(髄液、喀痰など)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Danaher(Cepheid & Beckman Coulter)

- bioMerieux SA

- Thermo Fisher Scientific

- Becton, Dickinson and Company

- Siemens Healthineers

- Bio-Rad Laboratories

- DiaSorin(Luminex)

- Quidel-Ortho

- Hologic Inc.

- Qiagen N.V.

- Sysmex Corporation

- Seegene Inc.

- Quest Diagnostics

- Lucira Health

- GenMark Diagnostics

- Oxford Nanopore Technologies

- T2 Biosystems

- Sherlock Biosciences