|

市場調査レポート

商品コード

1910452

ポリテトラフルオロエチレン(PTFE):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Polytetrafluoroethylene (PTFE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリテトラフルオロエチレン(PTFE):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

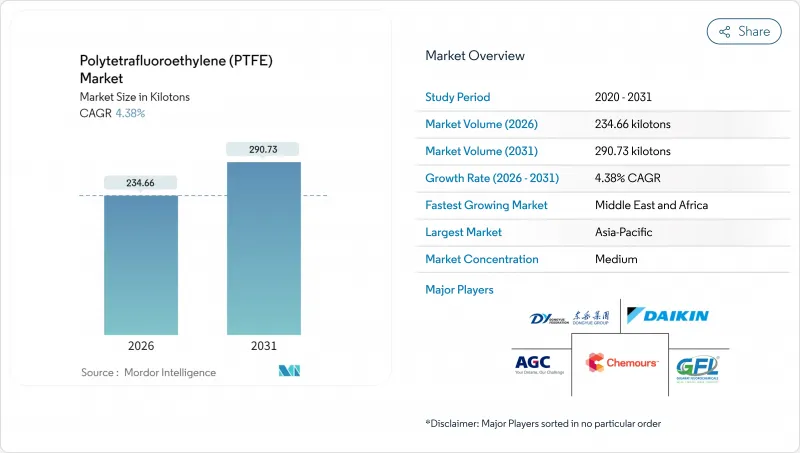

ポリテトラフルオロエチレン(PTFE)市場は、2025年の224.82キロトンから2026年には234.66キロトンへ成長し、2026年から2031年にかけてCAGR4.38%で推移し、2031年までに290.73キロトンに達すると予測されております。

この成長は、化学的不活性、低摩擦、熱安定性といった特性を代替が困難な過酷な産業環境における本材料の確固たる地位を反映しています。半導体製造、石油化学処理、電気自動車(EV)インフラ分野における継続的な生産能力増強が、潜在的なPFAS規制が新規用途の認証手続きを厳格化させる中でも、ベースライン消費量を支えています。また、高電圧・軽量化を追求したワイヤーハーネス、固体電池用膜、積層造形による機械部品など、絶縁耐力と耐熱性を兼ね備えたポリマーの特性が求められる設計への移行も、PTFE市場を後押ししています。競争戦略では、蛍石供給の垂直統合、PFAS規制対応製品ラインの開発、電子機器クラスターへの地理的近接性がますます重要視されています。

世界のポリテトラフルオロエチレン(PTFE)市場の動向と洞察

アジアにおける電子機器製造の急速な拡大

中国本土、台湾、韓国、シンガポールに相次いで建設される新たなウエハー製造ラインでは、過酷な化学薬品を管理するための超高純度PTFE製バルブ、ライナー、ウエハー加工部品が求められています。3nmおよび2nmロジックノードへの大規模投資は、汎用プラスチックでは経済的に代替不可能な耐プラズマ性フッ素樹脂部品の需要を押し上げています。チップファウンドリ、受託組立工場、ディスプレイメーカーが密集して立地していることは需要の磁石として機能し、PTFE市場を、厳しい公差の部品を加速された建設スケジュールで納入できる地域サプライヤーへと引き寄せています。これに対し、装置サプライヤーは、クリーンルーム認定の継続性を確保するため、粒状PTFE原料の複数年契約を締結しています。こうした連携により、アジア太平洋地域は世界PTFE市場の消費の中心地としての役割を確固たるものにしています。

世界の化学プロセス処理能力の拡大

サウジアラビア、アラブ首長国連邦、インドの炭化水素生産企業は、操業条件がますます厳しくなる統合製油所・石油化学コンビナートの認可を継続しています。これらのプラント内の反応器、熱交換器、配管は、酸、過熱蒸気、高速粒子といった環境に曝され、ガスケット、バルブシート、ライニングにおけるPTFEの優位性をさらに強固なものとしています。同時に、特殊化学品のボトルネック解消に伴い、成形ビレットやアイソスタティックブロックの需要量が増加しています。化学工業団地では長寿命と低ダウンタイムが重視されるため、調達部門は包括購入契約においてPTFEグレードを指定することが多く、経済サイクルを超えた安定的な需要を支えています。こうした数量保証が、PTFE市場の着実な基盤成長を支える基盤となっています。

PFASおよびPTFEに対する環境規制

欧州化学物質庁(ECHA)が2025年に予定するPFAS規制案は、必須用途の免除が維持されない限り、広範なフッ素樹脂を脅かします。主要加工メーカーはこれに対応し、PFAS準拠またはPFASフリー製品ラインを投入。アビエント社は2024年初頭、精密歯車・ブッシング向けPTFEフリー潤滑剤「LubriOne」シリーズを発表しました。コンプライアンス試験の費用を償却できない中小メーカーは撤退を余儀なくされており、マイクロパウダース社が2025年末までにPTFE事業を縮小する旨の通知(2024年プレスリリース)がこれを反映しています。消費者向け調理器具やアパレル分野のエンドユーザーは、シリコンコーティングやゾルゲル技術を用いた代替品によるデュアルソーシングを加速させており、これらのセグメントにおける需要増加を鈍化させるとともに、PTFE市場の潜在的需要基盤を縮小させています。

セグメント分析

2025年時点で、粒状および成形グレードがPTFE市場シェアの56.74%を占めました。これはガスケット、バルブ、ベアリングメーカーにおける確立された圧縮成形インフラに支えられたものです。典型的なバッチサイズは数トン規模に達し、規模の経済性を確保することで競争力のある価格設定の基盤となっています。本セグメントは、その物理的特性範囲が幅広い産業機器規格に適合するため、統合生産者にとって安定した基盤収益をもたらします。一流の化学加工メーカーは、特定の粒状PTFE樹脂を工場全体の承認材料リストに明文化することが多く、これにより保守・修理・オーバーホールサイクルにおける需要がさらに強化されます。

微粉化粉末は、ベースが小さいもの、2031年までにCAGR5.82%と予測され、全形態の中で最も高い成長率を示します。10マイクロメートル未満の微粒子は、高性能グリース用の摩擦低減添加剤、レーザー焼結3Dプリントギア、航空宇宙用コーティングのテクスチャー制御剤などへの応用を可能にします。メーカー各社はジェットミルシステムやインライン分級装置への投資により、狭い粒子径分布を実現しており、この特性がプレミアム価格設定を可能にしております。積層造形技術の成長がこの動向を加速させており、設計者は複雑な形状における離型性や寸法精度を向上させるため、PTFE微粉末を指定するケースが増加しております。このため、微粉化グレードのPTFE市場規模は、価値面・数量面ともに、PTFE市場全体を上回る成長率で拡大すると予測されております。

ポリテトラフルオロエチレン(PTFE)レポートは、製品形態(粒状/成形PTFE、微粉末/分散PTFEなど)、エンドユーザー産業(航空宇宙、自動車、建築・建設、電気・電子、産業・機械など)、地域(アジア太平洋、北米、欧州、南米など)別に分類されています。市場予測は、数量(トン)および金額(米ドル)で提供されます。

地域別分析

アジア太平洋地域は2025年にPTFE市場シェアの52.28%を占め、新たなウエハー工場や電池材料工場の稼働により、2031年まで首位を維持すると予測されています。中国では、蛍石採掘から完成品ケーブル押出まで一貫したバリューチェーンが構築されており、現地サプライヤーは短納期と競争力のある価格設定を実現しています。第14次五カ年計画に基づく政府の優遇措置により、フッ素化学品への資本流入が促進され、国内樹脂需要が拡大しています。インドでは、耐食性ライニングを必要とする製油所・石油化学合弁事業が展開され、韓国と日本は計測機器や医療機器向け高精度フッ素樹脂部品に注力しています。

中東・アフリカ地域はベースラインこそ小さいもの、2031年までにCAGR5.72%を記録し、他地域を凌駕すると予測されています。サウジアラビアのNEOMメガプロジェクトやUAEのADNOC下流部門拡張では、硫酸・塩素・リチウム処理ユニットにPTFE部品が組み込まれています。現地ケーブルメーカーは、砂漠気候における太陽光発電配線向けのIEC 62893難燃性基準を満たすため、PTFEジャケットへの転換を進めています。

北米と欧州は成熟した需要構造を示していますが、規制や技術的要因が消費パターンを再構築しています。米国商務省がグジャラート・フルオロケミカル社からの粒状PTFE輸入品に課した4.70~4.89%の相殺関税は、国内加工業者間でリショアリングの議論を促進しています。

一方、欧州連合(EU)のPFAS規制ロードマップの進展に伴い、機器OEMメーカーは必須用途の正当性を文書化する必要が生じております。これは受注サイクルを遅らせる可能性のある障壁であると同時に、準備が整っていないサプライヤーの参入障壁を高めるものでもあります。しかしながら、航空宇宙プライムメーカーは、-55℃から+200℃の温度範囲で機能する油圧シール材としてPTFEを指定し続けており、強靭な高付加価値ニッチ市場を確保しております。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- アジアにおける電気・電子機器製造業の急速な拡大

- 世界の化学処理能力の成長

- EV需要による軽量電線・ケーブル絶縁材の需要

- 焦げ付き防止調理器具市場におけるPTFE使用量の急増

- 固体電池におけるPTFE膜の採用

- 市場抑制要因

- PFASおよびPTFEに対する環境規制の動向

- 蛍石供給に対する地政学的リスク

- 5Gハードウェア向けエンジニアリングプラスチック代替品

- バリューチェーン分析

- ポーターのファイブフォース

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 輸入・輸出動向

- 形態の動向

- 規制の枠組み

- アルゼンチン

- オーストラリア

- ブラジル

- カナダ

- 中国

- EU

- インド

- 日本

- マレーシア

- メキシコ

- ナイジェリア

- ロシア

- サウジアラビア

- 南アフリカ

- 韓国

- アラブ首長国連邦

- 英国

- 米国

- 最終用途セクター動向

- 航空宇宙(航空宇宙部品生産収益)

- 自動車(自動車生産台数)

- 建築・建設(新築床面積)

- 電気・電子(電気・電子製品生産収益)

- 包装(プラスチック包装量)

第5章 市場規模と成長予測(金額および数量)

- 製品形態別

- 粒状/成形PTFE

- 微粉末/分散PTFE

- 微粉化粉末PTFE

- 水性分散PTFE

- エンドユーザー業界別

- 航空宇宙

- 自動車

- 建築・建設

- 電気・電子

- 産業・機械

- 包装

- その他のエンドユーザー産業

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- フランス

- ドイツ

- イタリア

- ロシア

- 英国

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- 3M

- AGC Inc.

- Arkema

- Daikin Industries, Ltd.

- Dongyue Group

- Gujarat Fluorochemicals Limited(GFL)

- HaloPolymer, OJSC

- Saint-Gobain

- Shanghai Huayi 3F New Materials Co., Ltd.

- Sinochem Holdings

- Syensqo

- The Chemours Company