|

市場調査レポート

商品コード

1687918

モバイル機器向けMEMS-市場シェア分析、産業動向・統計、成長予測(2025~2030年)MEMS for Mobile Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| モバイル機器向けMEMS-市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 132 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

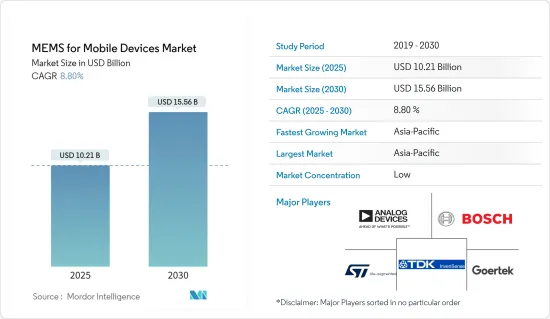

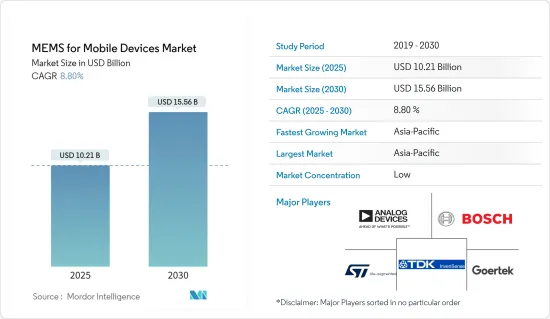

モバイル機器向けMEMS市場規模は、2025年に102億1,000万米ドルと推定・予測され、予測期間中(2025~2030年)のCAGRは8.8%で、2030年には155億6,000万米ドルに達すると予測されます。

スマートフォンにおける加速度計とジャイロスコープの需要増加に伴い、モバイル機器向けMEMS市場は予測期間中に大きく成長すると見られています。例えば、2022年には世界のモバイル契約総数は約84億件に達する見込みです。Ericssonの予測によると、さらに増加する見込みです。

主要ハイライト

- MEMSデバイスの低消費電力化の動向。また、充電速度の高速化、充電時間の短縮、充電の最適化といった消費者ニーズの変化が、スマートモバイルデバイスにおけるセンサの必要性を高めています。これらのデバイスは消費電力が少ないため、充電速度が格段に速くなります。

- さらに、スマートフォンが画像用途に使用されることが増えているため、光学式手ブレ補正(OIS)や電子式手ブレ補正(EIS)の使用がMEMSセンサによって可能になります。このような幅広い特徴と革新的な機能により、予測期間におけるスマートモバイルデバイス向けMEMSセンサの成長はさらに加速します。

- 調査対象市場の世界の動向は、5Gの商用化によって後押しされています。例えば、5Gへの移行は先進的モバイル機器の需要を加速します。2022年11月に発表されたEricsson Mobility Reportによると、5Gモバイル契約数は2028年末までに50億に達すると予測されています。さらに、5Gの人口カバー率は85%に達し、5Gネットワークはモバイルトラフィックの約70%を伝送すると予測されています。5Gでは要求される帯域数が増えるため、RF MEMSの需要も高まると予想され、RFフィルタの需要も誘発されます。

- MEMS企業は、プロトタイプやデバイス製造のためのMEMS製造施設や鋳造へのアクセスは最小限です。また、この技術の恩恵を受けると期待される組織の大半は、現在MEMS製造をサポートするために必要な能力やコンピテンシーを有しておらず、製造の標準化に直接影響を与えています。これは市場の成長を妨げると予想されます。

- COVID-19のモバイル機器市場への影響は緩やかです。さらに、パンデミックは製造業における現在の世界サプライチェーンに対する認識を変え、近い将来、同様のリスクを最小化するために、より地域化されたバリューチェーンとさらなる地域化につながる可能性があります。

モバイル機器向けMEMS市場の動向

小型化動向の受け入れ拡大が市場を牽引

- 機器の小型化は、モバイル機器向けMEMSの需要を促進する主要因の1つです。エンドデバイスの小型化に伴い、メーカーは継続的に技術をアップグレードして利益を得る方法を模索しています。モバイル機器に搭載されるセンサの数が増えるにつれて、設計要素を満たすための小型MEMSの必要性が高まっています。モバイル機器には、近接センサ、加速度計、ジャイロスコープ、指紋センサ、環境光センサ、コンパス、ホール効果センサ、気圧計などのセンサが搭載されています。

- さらに、小型化と音響特性の向上により、MEMSマイクロフォンはスマートフォンの動画による情報共有を容易にしました。MEMSマイクロフォンは、長距離フライトや、邪魔されずに音楽を聴きたいときなど、アクティブノイズキャンセリングにも役立ちます。

- 世界中のベンダーは、MEMSがもたらすコストメリットを高めるため、さらなる小型化に注力しています。さらに、MEMSセンサのメーカーは、モバイル機器の小型化ニーズに対応するため、MEMSの小型化を推進しています。例えば、さらに小型のモバイル機器の需要をサポートするため、1.5 x 0.8 x 0.55 mmのCSP(チップ・スケール包装)で入手可能なSiT15xx MEMS発振器は、標準的な2.0 x 1.2 mmのSMD XTAL包装と比較して、フットプリントを85%も削減しています。XTALとは異なり、SiT15xxファミリーはチップセットのXTAL-INピンを直接駆動する独自の出力を備えています。

- 従来のセンサが効率的に動作できないセグメントでは、超小型で高感度の次世代マイクロ加速度計の開発が求められています。また、加速度計を小型化するための絶え間ないプロセスは、包装の小型化につながり、最終的にはコスト削減につながります。

- グラフェンを使用したナノ電気機械システム(NEMS)ベースの加速度計は、従来のシリコンMEMS加速度計よりもダイ面積が桁違いに小さく、しかも競合感度を維持しています。このような機器の小型化の動向は、モバイル機器に使用されるMEMS市場を牽引しています。より多くの電力を追加し、コストとスペースを削減する必要性は、今後も市場のイノベーターにとって重要な要素であり続けると考えられます。市場のイノベーターは、高性能を求める消費者向けのデバイスにさらなる機能を追加するために、このような動向を利用しています。

アジア太平洋が著しい成長を遂げる見込み

- アジア太平洋はスマートフォンにとって最も重要な市場の一つであり、その主要理由は高度に発展している通信セクターと大規模な顧客基盤にあります。さらに、同地域では先進的なモバイルネットワークへの投資が増加しています。中国、インド、日本、オーストラリア、シンガポール、韓国などの国々は、国内通信市場の開拓にますます投資しており、これも同地域の市場を牽引すると予想されます。

- また、原料が入手しやすく、設立や労働者への給与にかかるコストが低いため、企業はこの地域に生産拠点を設けています。

- インド、中国、韓国、シンガポールといった国々からの携帯電話やその他の民生用電子機器製品に対する需要の高まりは、多くの企業がアジア太平洋に工場を設立することを後押ししています。

- 中国政府が発表した最新の数字によると、中国の加入者は高価な新しい5G携帯電話を購入するために集まっています。中国の5G携帯電話の出荷台数は2021年に2億6,600万台を突破し、前年比63.5%増となりました。中国情報通信技術研究院(CAICT)のデータによると、出荷された携帯電話の75.9%が5Gでした。

- 指紋認証技術によってスマートフォンのロック解除が簡単かつ迅速に行えるようになったため、MEMSセンサのニーズが高まっています。指紋認証は、パスワードや個人識別番号に依存する従来の技術よりも安全性が高いです。指紋認証技術は、スマートフォンやタブレットのような民生用電子機器製品で一般的になりつつあります。これは、人気が高く、各人の隆起、谷、小さな点を認識できるなど、独自の特質を備えているためです。

モバイル機器向けMEMS産業概要

モバイル機器向けMEMS市場には、後方統合と前方統合の両方が可能で、大きな収益創出能力を持つ大規模ベンダーがひしめいています。市場の競合レベルは中程度に高く、今後数年でさらに悪化する可能性が高いです。

2022年10月、Bosch Sensortecは、I3CインターフェースとI2CとSPIインターフェースを搭載した初のIMUデバイス、BMI323を発表しました。BMI323は6軸加速度計とジャイロスコープで、消費財の動きに敏感な向けに設計されています。ジャイロスコープと加速度計の両方を使用した高性能モードでの消費電流は、BMI160の925Aに対し、BMI323は790Aと、約15%の削減を実現しています。

2022年5月、Analog Devices, Inc.(ADI)は3軸MEMS加速度計を発表しました。ADXL367加速度計は、前世代(ADXL362)と比較して消費電力を2倍削減するとともに、ノイズ性能を最大30%改善しました。また、新しい加速度計はフィールド時間が長いため、バッテリーの寿命が延びるとともに、メンテナンスの頻度とコストが削減されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 小型化動向の受け入れ拡大

- 高性能デバイスへの需要の高まり

- 市場抑制要因

- 複雑な製造プロセスとサイクルタイム

- 標準化された製造プロセスの欠如

第6章 市場セグメンテーション

- センサタイプ別

- 指紋センサ

- 加速度計センサ

- ジャイロスコープ

- 圧力センサ

- BAWセンサ

- マイクロフォン

- その他のセンサ

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Analog Devices Inc.

- Bosch Sensortec GmbH

- STMicroelectronics NV

- InvenSense Inc.(TDK)

- Goertek Inc.

- Knowles Corporation

- Murata Manufacturing

- AAC Technologies

- MEMSIC Inc.

- BSE Co. Ltd

第8章 投資分析

第9章 市場の将来

The MEMS for Mobile Devices Market size is estimated at USD 10.21 billion in 2025, and is expected to reach USD 15.56 billion by 2030, at a CAGR of 8.8% during the forecast period (2025-2030).

With an increase in demand for accelerometers and gyroscopes in smartphones, the MEMS for mobile devices market is expected to grow significantly during the forecast period. For instance, in 2022, the total number of mobile subscriptions globally is expected to reach around 8.4 billion. It is poised to increase further, according to Ericsson forecasts.

Key Highlights

- The studied market has been marked by a trend toward lower power consumption of MEMS devices. Also, changing consumer needs, like faster charging speeds, shorter charging times, and better charging optimization, drive the need for sensors in smart mobile devices. These devices are made to use less power, which makes them charge much faster.

- Moreover, as smartphones are increasingly being used for image applications, the usage of optical image stabilization (OIS) and electronic image stabilization (EIS) is enabled by MEMS sensors. This broad set of features and innovative functions further augments MEMS sensor growth for smart mobile devices in the forecast period.

- Global trends in the market studied are boosted by the commercialization of 5G. For instance, the transition toward 5G accelerates the demand for advanced mobile devices. According to the Ericsson Mobility Report released in November 2022, 5G mobile subscriptions are anticipated to reach 5 billion by the end of 2028. Further, 5G population coverage is projected to reach 85%, while 5G networks are expected to carry around 70% of mobile traffic. Such events are also expected to drive the demand for RF MEMS, owing to the higher number of bands that 5G demands, triggering the demand for RF filters.

- MEMS companies have minimal access to MEMS fabrication facilities or foundries for prototypes and device manufacture. Also, most organizations expected to benefit from this technology do not currently have the required capabilities and competencies to support MEMS fabrication, directly impacting fabrication standardization. This is expected to hinder the market's growth.

- The effect of COVID-19 on the mobile device market has been moderate. Moreover, the pandemic changed the perception of the current global supply chain in manufacturing, potentially leading to more localized value chains and further regionalization to minimize similar risks in the near future.

MEMS for Mobile Devices Market Trends

Increasing Acceptance of Miniaturization Trend to Drive the Market

- The miniaturization of devices is one of the major factors driving the demand for MEMS in mobile devices. With the size of end devices shrinking, manufacturers continuously look for ways to upgrade their technology to reap benefits. As the number of sensors on a mobile device increases, the need for smaller MEMS is required to fulfill design factors. Mobile devices have sensors like proximity sensors, accelerometers, gyroscopes, fingerprint sensors, ambient light sensors, compasses, hall effect sensors, barometers, and others.

- Furthermore, miniaturization and improvements in their acoustic properties have enabled MEMS microphones to facilitate the sharing of information through smartphone videos. MEMS microphones are also useful for active noise cancellation, like on long-distance flights or when you want to listen to music without being disturbed.

- Vendors worldwide are focusing on reducing the size of MEMS further to enhance the cost benefits it reaps. Furthermore, the manufacturers of MEMS sensors are pushing to reduce the size of MEMS to meet the need for smaller mobile devices. For instance, in order to support the demand for even smaller mobile devices, the SiT15xx MEMS oscillators available in 1.5 x 0.8 x 0.55 mm CSPs (chip-scale packages) reduce footprint by as much as 85% compared to standard 2.0 x 1.2 mm SMD XTAL packages. Unlike XTALs, the SiT15xx family has a unique output that directly drives the chipset's XTAL-IN pin.

- In areas where traditional sensors cannot efficiently operate, developing next-generation micro-accelerometers with ultra-small dimensions and high sensitivity is required. Also, the constant process of making accelerometers smaller has led to smaller packages and, in the end, lower costs.

- Nano Electromechanical Systems (NEMS)-based accelerometers using graphene occupy orders of magnitude smaller die areas than conventional silicon MEMS accelerometers while retaining competitive sensitivities. Such trends in the miniaturization of devices drive the market for MEMS used in mobile devices. The need to add more power and reduce cost and space will remain a key factor for innovators in the market. Market innovators are banking on such trends to add more functionalities to their devices for high-performance-demanding consumers.

Asia Pacific is Expected to Witness Significant Growth

- The Asia-Pacific region has been one of the most significant markets for smartphones, primarily due to the highly developing telecom sector and large customer base. Furthermore, the region is increasingly investing in advanced mobile networks. Countries such as China, India, Japan, Australia, Singapore, and South Korea are increasingly investing in developing their domestic telecom markets, which are also expected to drive the market in the region.

- Also, companies set up their production centers in the area because raw materials are easy to get and there are low costs to set up and pay workers.

- Growing demand for mobile phones and other consumer electronics products from countries such as India, China, the Republic of Korea, and Singapore is encouraging many companies to set up factories in the Asia-Pacific region.

- According to the most recent figures given by the Chinese government, Chinese subscribers are flocking to buy pricey new 5G cellphones. China's 5G phone shipments surpassed 266 million units in 2021, an increase of 63.5 percent over the previous year. Data from the China Academy of Information and Communications Technology (CAICT) shows that 75.9% of all mobile phones shipped were 5G.

- There is a growing need for MEMS sensors because of the ease and speed with which fingerprint technology allows smartphones to be unlocked. Fingerprint authentication is more secure than traditional techniques, which rely on passwords and personal identification numbers. Fingerprint sensing technology is becoming more common in consumer electronics like smartphones and tablets. This is because it is popular and has unique qualities, like being able to recognize each person's ridges, valleys, and small points.

MEMS for Mobile Devices Industry Overview

The MEMS market is riddled with large-scale vendors that are capable of both backward and forward integration and command significant revenue generation capabilities. The level of competition in the market is moderately high, and it is likely to get worse in the years to come.

In October 2022, Bosch Sensortec announced its first IMU device, the BMI323, to include the I3C interface and the I2C and SPI interfaces. The BMI323 is a six-axis accelerometer and gyroscope designed for motion-sensitive applications in consumer goods. The BMI323 has a current consumption of 790 A in high-performance mode, using both the gyroscope and the accelerometer, compared to 925 A on the BMI160, representing a nearly 15% reduction.

In May 2022, Analog Devices, Inc. (ADI) released a three-axis MEMS accelerometer. The ADXL367 accelerometer reduces power consumption twice compared to the previous generation (ADXL362) while improving noise performance by up to 30%. The new accelerometer also has a longer field time, which increases battery life while decreasing maintenance frequency and cost.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Acceptance of Miniaturization Trend

- 5.1.2 Increasing Demand for High-Performance Devices

- 5.2 Market Restraints

- 5.2.1 Highly Complex Manufacturing Process and Demanding Cycle Time

- 5.2.2 Lack of Standardized Fabrication Process

6 MARKET SEGMENTATION

- 6.1 By Type of Sensor

- 6.1.1 Fingerprint Sensor

- 6.1.2 Accelerometer Sensor

- 6.1.3 Gyroscope

- 6.1.4 Pressure Sensor

- 6.1.5 BAW Sensor

- 6.1.6 Microphones

- 6.1.7 Other Types of Sensors

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Bosch Sensortec GmbH

- 7.1.3 STMicroelectronics NV

- 7.1.4 InvenSense Inc. (TDK)

- 7.1.5 Goertek Inc.

- 7.1.6 Knowles Corporation

- 7.1.7 Murata Manufacturing

- 7.1.8 AAC Technologies

- 7.1.9 MEMSIC Inc.

- 7.1.10 BSE Co. Ltd