|

市場調査レポート

商品コード

1851089

防空システム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Air Defense Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 防空システム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月18日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

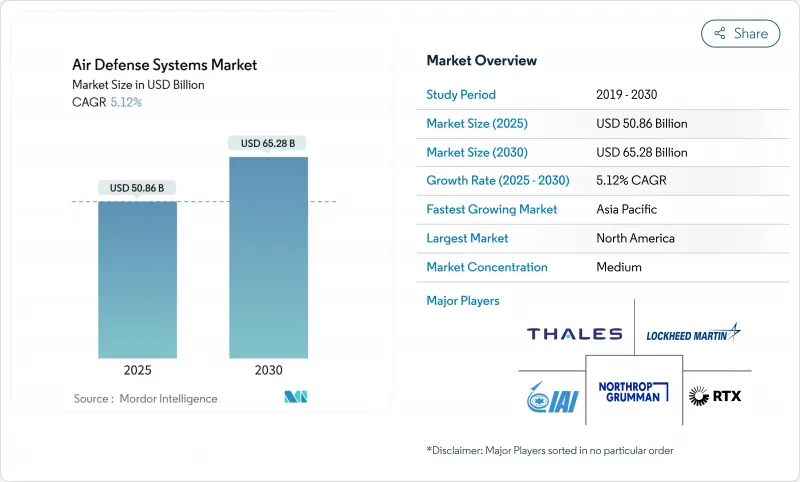

防空システム市場は、2025年に508億6,000万米ドルと評価され、2030年には652億8,000万米ドルに上昇し、CAGR 5.12%で進展すると予測されています。

需要は航空機中心の兵器から、極超音速滑空機、機動弾道ミサイル、低コストのドローン群に対抗する多層ソリューションに軸足を移します。防衛省は予算を統合アーキテクチャ、高出力マイクロ波エフェクター、交戦サイクルを短縮するAI対応コマンドネットワークに再優先します。北米が最大の買い手であることに変わりはないが、アジア太平洋地域は領土問題によって調達と国産化が加速し、最も速い成長を記録しています。プライムコントラクターは、記録的なバックログを通じて複数年の見通しを維持しているが、半導体のサプライチェーンと輸出管理体制のギャップが短期納入を抑制しています。

世界の防空システム市場動向と洞察

統合防空・ミサイル防衛調達の加速

世界の軍隊は現在、センサーからシューターへの統合を重要視しており、レーダー、電気光学センサー、エフェクターを単一の火器管制エコシステムに融合するオープンアーキテクチャのコマンドネットワークに資金を提供しています。米国陸軍の統合戦闘指揮システムはポーランドで初期運用能力を達成し、パトリオット、センチネル、THAAD砲台間のリアルタイムのデータ交換を実証しました。欧州では、タレスが主導する23のパートナーからなるEISNETプログラムが、コマンドの待ち時間を短縮し、サプライヤーの参加を広げるためにインターフェースを標準化しています。各国政府は、緊急時に航空交通規制当局が防衛ノードと連携できるよう、民間と軍のリンクに資金を提供しています。ハードウェアの発注に付随するポーランドの25億米ドルのソフトウェア・パッケージに見られるように、統合契約はしばしば個々の発射機のコストを上回る。その結果、ソフトウェア・エンジニアリングとサイバー・セキュア・ネットワーキング能力が入札の結果を左右することが多くなっています。

増大する空中脅威のスペクトル

極超音速の滑空ビークルは交戦ウィンドウを数秒に圧縮するため、宇宙ベースの赤外線衛星やノースロップ・グラマンが開発中の新型の滑空位相迎撃ミサイルへの投資を余儀なくされます。同時に、1機あたり1,000米ドル以下のドローン群が司令部や弾薬庫を脅かします。軍隊は現在、コストと脅威の規模を一致させるために、キネティック・ミサイルとハイパワー・マイクロウェーブ・トラックや無線周波数ジャマーを組み合わせたレイヤード・アーキテクチャを調達しています。米国陸軍は2025年の防空・ミサイル防衛予算をほぼ倍増の56億米ドルに増額し、このような混合能力部隊の配備を加速させています。財政上の緊急性は、迎撃ミサイル、レーダーのアップグレード、対UASキットを優先するNATOの補正予算にも反映されています。

GaNベースのレーダーT/Rモジュールにおけるサプライチェーンのボトルネック

窒化ガリウムはアクティブ電子走査アレイレーダーに不可欠であるが、ガリウム化合物に対する中国の輸出規制により、2024年に供給が厳しくなります。米国政府説明責任局は、西側の工場は新たな設備投資を行わなければ軍事需要を満たすことができず、リードタイムは12~18ヶ月延びると警告しています。国防当局は現在、ウエハーの二重供給を行い、戦略的備蓄を働きかけているが、新しいファブの再整備には時間とコストがかかります。同じ基板をめぐる5G通信事業者との競合は、価格競争をさらに激化させ、軍からの注文は鋳造工場の順番待ちの後方に追いやられます。

セグメント分析

ミサイル防衛システムは2024年の収益の51.85%を占め、264億米ドルの防空システム市場規模を支えています。需要は、パトリオット、THAAD、S-400など、人口集中地区や抑止力を守る国家戦略プログラムに起因します。しかし、対UASソリューションの2030年までのCAGRは11.21%であり、都市や戦場の空域における小型ドローンの拡散を反映しています。軍隊は、500ドルのクアッドコプターに300万米ドルの迎撃ミサイルを発射する持続不可能なコストを考慮し、無線周波数ジャマー、ハイパワーマイクロウェーブトレーラー、キネティックコヨーテ迎撃ミサイルの調達を加速させています。レイヤーミックスは交戦あたりの支出を削減し、より価値の高い目標のために長距離迎撃ミサイルを温存します。

対ロケット砲、大砲、迫撃砲システムは、間接砲の脅威にも同じ論理を展開し、対空砲と地対空ミサイルは中高度の航空機に不可欠なままです。カタールなどのバイヤーは最近、音響、レーダー、EOセンサーをコヨーテ・ブロック2エフェクターにリンクさせる完全統合型の対ドローン・ノードを10億米ドルで発注しました。このような専門化により、サプライヤーは多様化し、かつてはレガシーミサイルメーカーに限られていた分野で新規参入企業が力を発揮できるようになります。需要ポートフォリオのバランス調整により、Counter-UASはより広範な防空システム市場において重要な成長エンジンとして位置づけられています。

陸上発射機は2024年の支出額の42.90%を占め、首都、航空基地、産業中枢を守る固定設備として防空システム市場シェアを支えています。各国はパトリオットやS-400を拡張し続けているが、対艦弾道ミサイルの脅威が高まっているため、海上ベースのプラットフォームはCAGR 5.89%を記録しています。最新のイージス駆逐艦は、弾道ミサイル防衛を組み込んだソフトウェアの改訂版を搭載し、いくつかの海軍はドローン制圧のために甲板搭載レーザーを追加しています。沿岸諸国は港湾や海上プラットフォーム周辺の領域拒否を求め、協同交戦機能を備えた艦船統合レーダーの需要を高めています。

航空機搭載システムは、遠征航空援護を提供し、陸上バッテリーが到着する前にギャップを埋めることが多いです。宇宙ベースのセンサーは、早期警戒データを各プラットフォームに配信し、グローバルなミサイル追跡のバックボーンとして機能します。現在では領域横断的なキューイングが生存性を定義しているため、海軍はリアルタイムの衛星フィードと地上レーダー・トラックを受け入れるオープン・インターフェースを指定しています。この収束は、海上と地上の調達サイクルの歴史的境界を曖昧にし、防空システム市場の機会をさらに拡大します。

地域分析

北米は2024年の世界売上高の37.90%を占め、米国の多層的な国土シールドと強固な対外軍事販売パイプラインに支えられています。RTXとロッキード・マーチンの2025年第1四半期の売上高は合わせて380億米ドルを超え、国内の大規模な技術基盤を提供しています。カナダのNORAD近代化は、オーバー・ザ・ホライズン・レーダー・サイトと北極衛星通信に資金を投入し、メキシコは重要なエネルギー・インフラのためにモバイルSHORADの購入を検討しています。米国宇宙軍による宇宙ベースのミサイル警報プログラムは、そのデータが多くの同盟国の迎撃チェーンに供給されるため、地域的影響力を増幅します。

アジア太平洋地域は、2030年までのCAGRが最速の7.90%を記録します。日本はイージス・アショアの派生型に着手し、韓国の請負業者はKM-SAM IIを湾岸諸国の顧客に輸出し、この地域が輸入国から純輸出国へとシフトしていることを示します。インドは統合防空兵器システムの開発を加速させ、センサー・パッケージの共同生産オフセットを交渉。オーストラリアは共同プロジェクト9102に資金を提供し、イージス艦に接続するソブリン衛星通信を追加します。フィリピンのような小規模なプレイヤーは、群島地形への迅速な対応への欲求を反映し、スパイダーとFA-50艦隊を拡大します。

欧州は、欧州スカイシールドイニシアチブの下で投資を拡大し、21カ国を共通の調達・組織化・訓練モデルに参加させ、需要を集約します。ドイツはIRIS-T SLMバッテリーを、ポーランドはIBCSベースのWisla大隊を、そして最近NATOに加盟したスウェーデンはロッキード・マーチンにTPY-4監視レーダーを発注しました。EUの資金は、国境を越えたキューイングを確保するためのオープン・アーキテクチャのコマンド・システムに焦点を当てています。

中東では、湾岸諸国が巡航ミサイルや無人偵察機に対して製油所や空港を強化するため、米国、欧州、自国のソリューションが混在しています。サウジアラビアは2025年にTHAADの部品組み立てを国内で開始し、「ビジョン2030」の下での国産化を強化しています。イスラエルは、アイアンドームやデイビッズ・スリングなどの多層アドオンを開発し、戦闘で実証されたベンチマークを提供することで、世界中の入札仕様を形成しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 統合防空・ミサイル防衛調達の加速

- 激化する空中からの脅威

- ステルス検知のためのAI対応センサーフュージョン

- モバイル指向エネルギーSHORADの採用

- GaNベースAESAレーダーのコスト低下

- 対UASおよびポイント・ディフェンスに対する予算の増加

- 市場抑制要因

- GaNレーダーモジュールのサプライチェーンボトルネック

- 厳しいITARとMTCRの輸出規制が新興国へのシステム販売を制限

- 機動する極超音速目標を確実に迎撃するための技術的・材料的課題、研究開発リスクの増大

- 電磁波の混雑が相互運用性の課題を高める

- バリューチェーン分析

- 規制とテクノロジーの展望

- ポーターのファイブフォース分析

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- システム別

- ミサイル防衛システム

- 対空砲・SAMシステム

- 対無人航空機システム(C-UAS)

- 対ロケット砲・大砲・迫撃砲(C-RAM)

- プラットフォーム別

- 陸上ベース

- 海上ベース

- 航空ベース

- 宇宙ベースの早期警戒アセット

- 範囲別

- 短距離

- 中距離

- 長距離

- サブシステム別

- 兵器システム

- 火器管制システム

- コマンド&コントロールシステム

- その他

- 技術別

- キネティックキルエフェクター

- 高エネルギーレーザーシステム

- ハイパワーマイクロ波システム

- 電子戦(EW)ソフトキルソリューション

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- RTX Corporation

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Northrop Grumman Corporation

- Thales Group

- Saab AB

- Rheinmetall AG

- Leonardo S.p.A.

- Kongsberg Gruppen ASA

- The Boeing Company

- ASELSAN Elektronik Sanayi ve Ticaret A.S.

- Hanwha Systems Co., Ltd.

- Rafael Advanced Defense Systems Ltd.

- L3Harris Technologies, Inc.

- BAE Systems plc

- MBDA

- Diehl Group

- Elbit Systems Ltd.

- Bharat Dynamics Limited(BDL)

- China Aerospace Science and Technology Corporation

- MDA Ltd.

- China North Industries Group Corporation(Norinco)