|

市場調査レポート

商品コード

1687915

MEMSマイクロフォン:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)MEMS Microphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MEMSマイクロフォン:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

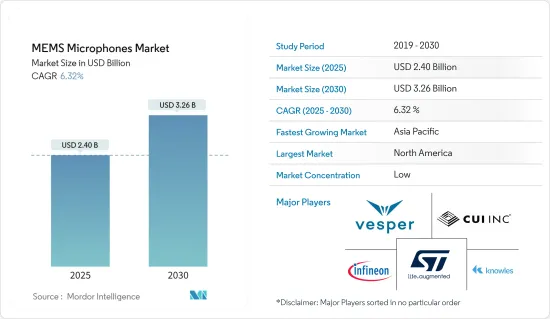

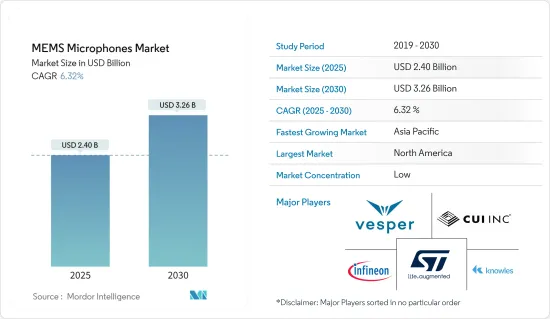

MEMSマイクロフォンの市場規模は、2025年に24億米ドルと推定され、予測期間(2025-2030年)のCAGRは6.32%で、2030年には32億6,000万米ドルに達すると予測されています。

MEMS(微小電気機械システム)技術のマイクロホンへの応用により、非常に高性能な小型マイクロホンが開発されています。さらに、世界のコンシューマーエレクトロニクス需要の増加が、これらの製品の需要を促進すると予想されます。

主なハイライト

- スマートフォンの普及が市場を牽引先進的なMEMSマイクロフォンは、スマートフォンやポータブルコンピュータのオーディオ体験を向上させることができます。高機能スマートフォンの採用により、エコーやノイズキャンセリング、風切り音フィルタリング、ビームステアリング、3Dサウンド、その他の興味深い効果などのオーディオ処理に、1台のスマートフォンあたり1つ以上のマイクロフォンが使用されるようになっています。

- IoTベースのコネクテッドスマホやVR技術の普及は、業界に新たな可能性をもたらしました。MEMSマイクロフォンは、音声制御の指示で動作するAmazon Echoインテリジェントスピーカーなど、モノのインターネットに対応したスマートデバイスで一般的に採用されています。MEMSマイクロフォンはヘッドフォンにも搭載されており、ゲームプレイやVRベースのエンターテインメントにおけるユーザー体験を向上させています。これらの製品における技術進歩の増加は、予測期間中の製品需要を押し上げると予想されます。

- さらに、車載アプリケーションにおけるマイクロフォンの使用拡大により、今後数年間で新たな市場の可能性が開けると予測されます。Knowles Corporationは、2021年4月に車載産業向けのSiSonic MEMSマイクロフォン2機種、SPH1878とSPH9855を発表しました。ノウルズ社のアナログおよびデジタルマイクは、自動車産業で高まる音声アシスト、ハンズフリー通信、ライダーの利便性を高める車内ノイズキャンセリングの改善ニーズに対応するため、より優れた品質とサプライヤー保証レベルで開発されています。

- さらに、ロックダウン期間中、技術業界とオーディオ業界はCOVID-19の影響による新製品を発表しており、規制が緩和され始めています。発生期間中、住宅用オートメーション機器、小売店、医療、食料品などにおけるマイクロフォンへのニーズが、MEMSマイクロフォン業界の開発を支えました。さらに、監禁規制の緩和により、音声インターフェース技術への需要が急増し、予測期間を通じてMEMSマイクロフォン需要が回復する可能性が高いです。

MEMSマイクロフォン市場動向

コンシューマーエレクトロニクスが大幅成長

- コンシューマーエレクトロニクスとアクセサリは、過去数年間で採用が大幅に増加したため、MEMSマイクロフォン産業に大きく貢献しています。スマートフォン、タブレット、ノートPC、スマートスピーカー、スマートTV、PCアクセサリ、ハンドヘルドGPSなどが、コンシューマエレクトロニクスおよびアクセサリ分野を評価する際に考慮されます。

- MEMSマイクロフォンは、その小型サイズと音響特性の進歩により、スマートフォンのビデオやFaceTimeを介して情報を送信するアプリケーションに使用されています。多くの消費者向けガジェットは音声通話や音声コントロールをサポートしています。

- さらに、ユーザー体験を向上させるためにMEMSマイクロフォンの使用が増加しているスマートホーム製品の動向の高まりによるスマートスピーカーの需要の増加も、予測期間における調査対象市場の成長を促進します。例えば、Apple iPhoneは4つのマイクを使用し、Amazon Echoは7つのマイクを使用しています。スマートスピーカーを使用する世帯の急増が観察され、音声に対する消費者の習慣の大幅なシフトがこれを後押ししています。

- スマートフォンやタブレットを含む家電製品の需要増加により、同市場で事業を展開する大手企業による製品投入が増加しており、市場成長に寄与すると予想されます。例えば、TDKは2022年1月、スマートフォン、カメラ、タブレット、スマートスピーカーに適した、オーディオワイヤ接続、トゥルーワイヤレスステレオ、低消費電力モードを特徴とするデジタル化MEMSマイクロホンを発表しました。

北米が大きなシェアを占める

- 米国ではコンシューマーエレクトロニクス市場がすでに大きな規模を占めており、同地域ではスマートフォンの普及率が高いことから、MEMSマイクロフォンはかなりの普及率が見込まれます。スマートフォン市場はMEMSマイクロフォン技術を最も積極的に採用している市場の1つであるため、同技術の採用率は大幅に押し上げられる可能性が高いです。米国には最大級のスマートフォン・メーカーがあります。アップルはMEMSマイクロホンをiPhoneの様々なモデルに搭載しており、この技術の最大の購入者の1つとして注目されています。

- スマートフォンの普及が進んでいることから、今後数年間はこうした技術の需要が高まると予想されます。米国は世界最大級のスマートフォン市場であり、スマートフォンの普及率も世界トップクラスです。例えば、米国国勢調査局と消費者技術協会によると、2022年の米国におけるスマートフォン販売額は約747億米ドルに達します。

- さらに、北米の通信事業者は、旅行や輸送のためのエネルギー使用を削減するなど、温室効果ガス排出を削減するデジタル・ソリューションのための接続性を提供しています。例えば、イリノイ州を拠点とする先進的なマイクロ音響およびヒューマンインターフェースソリューションのサプライヤーであるKnowles Electronics社は、OEMがスマートスピーカー、テレビ、コネクテッドホーム機器、ウェアラブル、ヘッドセット、スマートフォン、補聴器などのコネクテッドデバイスで優れたオーディオ体験と自然な音声対話を提供できるようにしています。

- 米国国立聴覚障害研究所(NIDCD)が2021年3月に発表した調査によると、耳鳴りとそれに伴う聴覚障害は、米国の成人社会の約10%に影響を及ぼしています。さらに、65歳以降の約4分の1が障害のある難聴を経験しており、国全体の補聴器需要を押し上げています。さらに、米国では難聴に敏感な高齢者人口が増加しており、市場の拡大が見込まれています。国連によると、米国の65歳以上の人口は2000年の3,500万人から2040年には8,000万人に増加すると予測されており、予測可能な数年間にこれらの技術に対する多大なニーズが生まれ、市場拡大に寄与します。

MEMSマイクロフォン産業の概要

MEMSマイクロフォン市場は、市場に存在する様々な主要企業で構成されています。MEMSマイクロフォンは、コンシューマーエレクトロニクス業界で大きな人気を得ていることから、生産性の高い投資先として注目されています。大企業は新規拡大、提携、新規参入に多額の投資を行っています。新規参入企業が多いため、市場は断片化に向かっています。既存プレーヤーは、製品イノベーションを達成するため、研究開発への支出を増やしています。市場に参入しているプレーヤーには、Vesper Technologies Inc.、CUI Inc.、STMicroelectronics NV、Infineon Technologies AG、Knowles Electronics LLCなどです。

2022年9月、NOVOSENSE Microelectronicsは、絶縁型ドライバ、絶縁型サンプリング、ゲートドライバ、シリコンマイクコンディショニングチップ、非絶縁型高電圧ハーフブリッジドライバ、ゲージ圧センサとともに、6つの新しい製造および自動車認定チップシリーズのリリースを宣言し、新エネルギー自動車、産業、電子製品、医療分野で活用される予定です。

2022年8月、サウンズクリットは、標準的なマイクパネルを優れた代替品に置き換えることができる高性能MEMSマイクを発売しました。SKR0400は、現在および今後のコンシューマー・エレクトロニクスの設計コンセプト向けに設計された世界初の次元MEMSマイクロホンです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19がMEMSマイクロフォン産業に与える影響

第5章 市場力学

- 市場促進要因

- スマートフォン普及率の増加

- 音声対応スマートデバイスの普及拡大

- 市場抑制要因

- MEMSマイクロフォンの平均販売価格の低下

第6章 市場セグメンテーション

- SNR範囲別

- 60dB未満

- 60~65 dB

- 65dB以上

- 信号タイプ別

- アナログ

- デジタル

- 用途別

- コンシューマーエレクトロニクスおよびアクセサリー

- 補聴器

- ウェアラブルおよびIoTデバイス

- ヘッドマウントディスプレイ(AR、VR、MR)

- 自動車

- その他の用途

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第7章 競合情勢

- 企業プロファイル

- Vesper Technologies Inc.

- CUI Inc.

- STMicroelectronics NV

- Infineon Technologies AG

- Knowles Electronics LLC

- GoerTek Inc.

- AAC Technologies

- New Japan Radio Company Ltd.

- TDK Corporation

- BSE Co. Ltd.

- Hosiden Corporation

- NeoMEMS Technologies Inc.

第8章 投資分析

第9章 市場機会と今後の動向

The MEMS Microphones Market size is estimated at USD 2.40 billion in 2025, and is expected to reach USD 3.26 billion by 2030, at a CAGR of 6.32% during the forecast period (2025-2030).

The application of MEMS (micro-electro-mechanical systems) technology to microphones has led to development of small microphones with very high performance. Further, increasing global consumer electronics demand is expected to drive the demand for these products.

Key Highlights

- Increasing smartphone penetration is driving the market. Advanced MEMS microphones can enhance the audio experience in smartphones and portable computers. The adoption of highly featured smartphones has led to the usage of more than one microphone per phone for audio processing, such as echo and noise cancellation, wind noise filtering, beam steering, 3D sounds, and other interesting effects.

- The proliferation of IoT-based connected phones and VR technology has opened up new industry opportunities. MEMS microphones are commonly employed with the Internet of Things-enabled smart devices, such as Amazon Echo intelligent speakers that operate on voice control instructions. MEMS microphones are also included in the headphones, which improve the user experiences for gameplay and VR-based entertainment. Increasing technology advancement in these products is expected to boost product demand over the forecast period.

- Furthermore, the growing use of microphones in automotive applications is projected to open up new market possibilities in the coming years. Knowles Corporation released two SiSonic MEMS microphones, SPH1878 and SPH9855, for vehicle industries in April 2021. Knowles' analog and digital mics are developed to a better quality and supplier guarantee level to serve the automobile industry's rising need for improved voice assist, hands-free communication, and in-cabin noise-canceling for rider convenience.

- Moreover, during the lockdown period, the tech and audio industries are announcing new products due to the Covid-19 impact, and restrictions are starting to be relaxed. Throughout the outbreak, the need for microphones in residential automation equipment, retail outlets, medical, and grocery supported the development of the MEMS microphone industry. Furthermore, with the easing of lockdown restrictions, demand for speech interface technologies is likely to surge, resulting in a rebound in the MEMS Microphones demand throughout the forecasted period.

MEMS Microphone Market Trends

Consumer Electronics to Witness Significant Growth

- Consumer electronics and accessories are significant contributors to the MEMS microphone industry as they have witnessed a significantly increased adoption over the past few years. Smartphones, Tablets, Laptops, Smart Speakers, Smart TVs, PC Accessories, and Handheld GPS, among others, are considered while evaluating the consumer electronics and accessories segment.

- MEMS microphones have been used in applications for transmitting information via smartphone video or FaceTime due to their tiny size and progress in acoustic qualities. Many consumer gadgets support voice calls or voice control, as most people interact and manage their devices using their voices.

- Further, the increasing demand for smart speakers due to rising trends in smart home products with increasing use of MEMS microphones to boost user experience will also drive the growth of the studied market over the forecast period. For instance, Apple iPhone uses four microphones, and Amazon Echo uses seven. A surge in households using smart speakers is observed, and a significant shift in consumer habits towards voice has driven the same.

- Increasing product launches by major players operating in the market due to increasing demand for consumer electronics, including smartphones and tablets, is expected to contribute to market growth. For instance, TDK introduced a digitized MEMS microphone featuring an audio wire connection, true wireless stereo, and reduced power mode in January 2022, suited for smartphones, cameras, tablets, and smart speakers.

North America Accounts to Hold Significant Share

- With the already significant consumer electronics market in the United States, the MEMS Microphone will expect a considerable adoption rate due to the vast smartphone penetration rates in the region. As the smartphone market is one of the most intense adopters of MEMS microphone technology, the adoption rate of the technology is likely to be boosted substantially. The United States is home to one of the largest smartphone manufacturers. Apple has been noted as one of the largest buyers of the technology, incorporating MEMS microphones in various iPhone models.

- The increasing adoption of smartphones is expected to boost the demand for these technologies over the coming years. The United States is one of the largest smartphone markets in the world, with one of the highest smartphone penetration rates worldwide. For instance, according to the US Census Bureau and Consumer Technology Association, in 2022, smartphone sales value in the United States will be around USD 74.7 billion.

- Furthermore, operators in North America are providing connectivity for digital solutions that reduce GHG emissions, such as reducing energy use for travel and transport. For instance, Knowles Electronics, a supplier of advanced micro-acoustic and human interface solutions based in Illinois, enables OEMs to deliver superior audio experiences and natural voice interactions with connected devices, like smart speakers, TVs, and connected home devices, wearables, headsets, smartphones, and hear-aids.

- Tinnitus and associated auditory impairments affect around 10% of the adult community in the United States, according to research released in March 2021 by the National Institute on Deafness and Other Communicable Disorders (NIDCD). Furthermore, about a quarter of postage 65 experience disabling loss, boosting hearing aid demand across the country. Furthermore, the growing elderly population in the United States, which is sensitive to hearing loss, is expected to drive market expansion. According to the United Nations, the number of people aged 65 and over in the United States is forecast to grow from 35 million in 2000 to 80 million in 2040, creating a tremendous need for these technologies in the foreseeable years, thus contributing to market growth.

MEMS Microphone Industry Overview

The MEMS Microphone Market consists of various major players existing in the market. It is viewed as a productive investment due to the huge popularity gained in the consumer electronics industry. Large organizations invest heavily in new expansion, partnerships, and new players' entrance. The market is moving towards fragmented nature due to a large number of new entrants. The existing players are spending increasingly on R&D to achieve product innovations. Some players operating in the market include Vesper Technologies Inc. , CUI Inc., STMicroelectronics NV, Infineon Technologies AG, and Knowles Electronics LLC.

In September 2022, NOVOSENSE Microelectronics declared the release of six new manufacturing and automotive-qualified chip series, along with an isolated driver, isolated sampling, gate driver, silicon microphone conditioning chip, non-isolated high-voltage half-bridge driver, and gauge pressure sensor, which will be utilized in new energy vehicles, industrial, electronic goods, and medical sectors.

In August 2022, Soundskrit launched a high-performance MEMS mic capable of replacing standard microphone panels with a superior alternative. The SKR0400 is the world's first dimensional MEMS microphone designed for present and upcoming consumer electronics design concepts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the MEMS Microphone Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Smartphone Penetration

- 5.1.2 Expanding Adoption of Voice-enabled Smart Devices

- 5.2 Market Restraints

- 5.2.1 Erosion of Average Selling Price of MEMS Microphones

6 MARKET SEGMENTATION

- 6.1 By SNR Range

- 6.1.1 SNR Range Less Than 60 dB

- 6.1.2 Medium SNR Range from 60 - 65 dB

- 6.1.3 SNR Range More than 65 dB

- 6.2 By Signal Type

- 6.2.1 Analog

- 6.2.2 Digital

- 6.3 By Application

- 6.3.1 Consumer Electronics and Accessories

- 6.3.2 Hearing Aids

- 6.3.3 Wearables and IoT Devices

- 6.3.4 Head-mounted Displays (AR, VR, MR)

- 6.3.5 Automotive

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vesper Technologies Inc.

- 7.1.2 CUI Inc.

- 7.1.3 STMicroelectronics NV

- 7.1.4 Infineon Technologies AG

- 7.1.5 Knowles Electronics LLC

- 7.1.6 GoerTek Inc.

- 7.1.7 AAC Technologies

- 7.1.8 New Japan Radio Company Ltd.

- 7.1.9 TDK Corporation

- 7.1.10 BSE Co. Ltd.

- 7.1.11 Hosiden Corporation

- 7.1.12 NeoMEMS Technologies Inc.