|

市場調査レポート

商品コード

1851092

MEMS:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)MEMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| MEMS:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月21日

発行: Mordor Intelligence

ページ情報: 英文 182 Pages

納期: 2~3営業日

|

概要

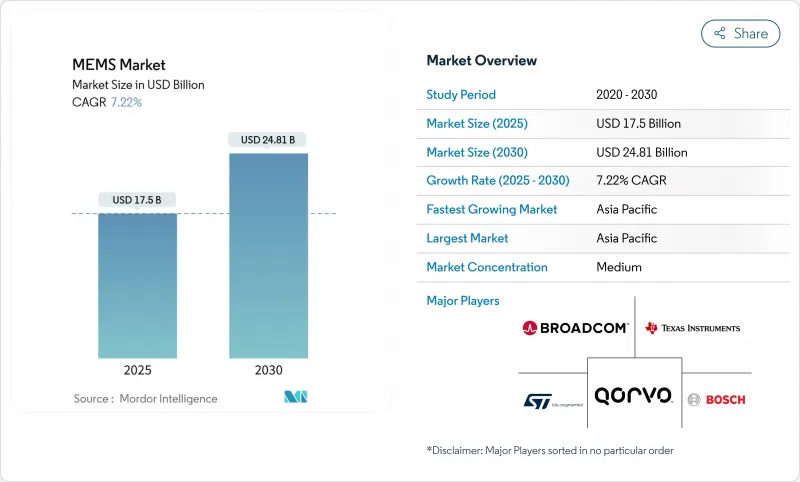

MEMSの世界市場規模は、2025年に175億米ドル、2030年には248億1,000万米ドルに達すると予測され、CAGRは7.22%と堅調です。

この勢いは、スマートフォン、電気自動車、医療用ウェアラブル、産業用IoTノードでセンサーの普及が進み、耐久性が高く、低消費電力で小型化された部品が求められていることに起因しています。自動車の電動化は、1台当たりの圧力、温度、慣性センサー数を増加させ、ポイントオブケア診断は、パイロットラインから大量生産にマイクロ流体チップを引き上げます。5Gインフラストラクチャの進展は、拡大する周波数帯域で低挿入損失を維持するRFフィルタの需要をさらに増大させる。米国では300mmウエハーのパイロット生産が開始され、供給の回復力が向上していますが、競合は依然として細分化されており、ニッチな専門家がエッジAIセンサーフュージョンなどの新たな使用事例で設計の勝利を獲得しています。

世界のMEMS市場の動向と洞察

IoTとエッジデバイスの採用増加

コネクテッドエンドポイントの増加により、工場、ビル、ロジスティクスハブでは資産ごとに数十個のセンサを組み込むことが義務付けられ、低消費電力の加速度計、ジャイロスコープ、環境モニタが標準的な部品となっています。半導体企業は、MEMSセンサーをマイクロコントローラーとパッケージ化し、バックホール帯域幅とクラウドのレイテンシーを削減するローカライズされた分析を提供するようになっています。決定木や軽量ニューラルネットワークをセンサーノード上で直接実行するエッジAIチップは、50μW以下の電力バジェットの設計ルールを見直すようサプライヤーを後押しし、MEMS市場を拡大する持続的な再設計サイクルを促します。

EVとADASにおけるセンサー・コンテンツの拡大

電気自動車には、圧力、慣性、環境センサーが内燃車より2~3倍多く搭載されています。村田製作所の車載用慣性センサの新しい国内ラインは、レガシー携帯端末の販売台数が伸び悩む中、日本のサプライヤーがいかにモビリティ収益に軸足を置いているかを示しています。TDKの光学式MEMSミラーは、アダプティブヘッドライトとソリッドステートLiDARを可能にし、車両ごとに差別化されたソケットを追加します。LiDARベンダーのRoboSenseは、2024年に自動車用LiDARの世界売上高の33.5%を獲得し、先進運転支援と高精度センシングが相互に絡み合って成長していることを明らかにしました。

複雑で資本集約的な製造

300mmウエハーへの移行はダイコストを削減するが、新しいリソグラフィー、ボンディング、計測ツールを必要とし、その取得額は1ライン当たり5億米ドルを超えます。SEMIは、2025年第1四半期に300mmウエハー出荷が6%成長すると予測しているが、中小のMEMS工場は、アップグレードのための資金調達に苦戦しています。米国CHIPS法優遇措置は、2025年生産予定のRogue Valley Microdevicesのフロリダ工場を含む一握りの国内プロジェクトに対する資金調達を緩和します。300mmの生産能力を持たないサプライヤーは、マージンを圧迫するコスト格差の拡大に直面しています。

セグメント分析

センサーは、携帯電話OEM、自動車Tier-1サプライヤー、産業オートメーション企業が慣性、圧力、環境パッケージの標準化を進めていることから、2024年の売上高の57%を占める。MEMS市場におけるこの圧倒的なシェアは、成熟した製造ノードが過酷な環境下でも信頼性を維持しながらコスト効率を実現していることを示しています。このセグメントでは、最大6つのディスクリート・モーション・センサーとオーディオ・センサーを内蔵するスマートフォンや、エアバッグ、安定性、ADAS機能用に3重の冗長加速度計を内蔵する自動車から恩恵を受けています。対照的に、アクチュエーターは、光学式イメージスタビライゼーションモーターやLiDARビームステアリング用マイクロミラーアレイに関連し、安定的ではあるが成長は緩やかです。発振器は、自動車パワートレインの水晶タイミングに取って代わり、電動化が加速するにつれて装着率が上昇することが予想されます。

マイクロ流体チップはCAGR 9.8%で、技術のフロンティアとなります。ラボ・オン・ア・チップ・カートリッジは、キャピラリーフローコントロール、電気化学センシング、オンボード試薬を組み合わせ、診断サイクルタイムを数日から数分に短縮します。病院の調達担当者は、簡素化されたサンプル前処理と最小限の操作トレーニングを重視し、機器メーカーをポリマーベースのMEMS流路に依存する完全使い捨てユニットへと向かわせる。製薬会社は、ヒトの組織反応をモデル化するために臓器オンチップ・プラットフォームを探求し、高精度マイクロ流体製造へのさらなる牽引力を生み出しています。この新たなバスケットは、持続的な差別化をサポートし、表面化学に精通したサプライヤーをプレミアム・パートナーとして位置づけ、MEMS市場を従来の電気機械式球体の枠を超えて拡大します。

慣性センサーは2024年の売上高の24.5%を占め、スマートフォンの方向検出、自動車の横転防止、産業用追跡モジュールを支えています。振動や極端な温度環境下での信頼性が実証されたことで、MEMS市場におけるこのカテゴリーの重要性が確固たるものとなりました。バイアス・ドリフトを1°/h以下に抑えるなど、継続的な性能向上により、使用事例が精密農業や倉庫自動化ロボットにまで広がっています。一方、RF MEMSコンポーネントのCAGRは10.4%であり、5Gの展開では固定セラミックフィルターでは実現できない俊敏なスペクトラムチューニングが求められています。鋳造は、高Qキャビティを湿気の浸入から保護するためにウエハーレベルのハーメチックパッケージングに投資し、歩留まりを守り、平均販売価格を上昇させています。

MEMSマイクロフォン、圧力センサ、環境検出器は着実な数量成長を維持しています。STMicroelectronicsが2024年にリリースする有限ステートマシン・ロジックを統合した自律型産業用IMUは、小さなコード・スニペットで伝送前にイベントをフィルタリングするエッジ・インテリジェンスへの軸足を強調しています。光学式MEMSミラーは、最小限の可動質量と機械的耐疲労性により、ソリッドステートLiDARを進化させる。

地域分析

アジア太平洋は2024年に45%の売上シェアを維持し、2030年までのCAGRは10.7%。中国国内ベンダーがRFフロントエンドの特許出願を加速、5Gと衛星通信向け供給の現地化を目指します。日本のTDKと村田製作所、世界の電動化需要を取り込むため車載用慣性センサーの生産能力を増強。韓国は先進的なメモリー・クリーンルームを活用してMEMSタイミング・デバイスに多角化し、シンガポールとマレーシアはより低い人件費構造を提供するテスト・組立クラスターを拡大します。

北米は、強力な航空宇宙・防衛プログラムと医療機器イノベーション・パイプラインの恩恵を受けています。CHIPSプログラムオフィスは、MEMSパイロットラインを組み込んだファブに数十億米ドル規模の助成金交渉を行い、国内サプライチェーンの短縮を促しました。2025年第1四半期のシリコンウエハー出荷量は前年同期比2.2%増となり、300mm級の需要は大量生産の準備を示唆しました。フロリダ州の新しいMEMS鋳造工場が2025年に量産を開始すれば、地域的な回復力が高まる。

欧州は自動車安全、産業用オートメーション、医療用ウェアラブルに注力しています。先進運転支援機能を義務付ける規制の枠組みがセンサーの普及を加速させ、MEMS市場への同地域の貢献を後押しします。STマイクロエレクトロニクスの自律型産業用IMUは、ドイツやイタリアの機器メーカーからのライフサイクルの長い厳しい要求に応えています。中東とアフリカはまだ発展途上であるが、湾岸諸国におけるスマートシティの試験運用が、分散型大気質センシングとインテリジェント照明の灯台となります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- IoTとエッジ・デバイスの導入拡大

- EVとADASにおけるセンサー・コンテンツの拡大

- 5Gの普及がRF MEMSフィルターを牽引

- 300mmウエハー製造へのシフトMEMS

- 異種集積とチップレット・パッケージング

- PoC診断のためのマイクロ流体MEMSの急増

- 市場抑制要因

- 複雑で資本集約的な製造

- 設計とプロセスの標準化のギャップ

- 特殊素材へのサプライチェーン依存度

- RF MEMS特許の藪がライセンシング・コストを引き上げる

- バリュー/サプライチェーン分析

- テクノロジーの展望

- 規制情勢

- ポーターのファイブフォース

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- デバイスクラス別

- センサー

- アクチュエータ

- 発振器とタイミング

- マイクロ流体チップ

- パワー/モーション・マイクロジェネレータ

- センサー/アクチュエータタイプ別

- 慣性センサ

- 圧力センサー

- RF MEMS

- 光学MEMS

- 環境センサー

- MEMSマイクロフォン

- マイクロボロメーターと赤外線検出器

- インクジェットヘッド

- その他

- 用途別

- コンシューマー・エレクトロニクス

- 自動車

- 産業用およびロボット

- ヘルスケアと医療機器

- 通信インフラ

- 航空宇宙・防衛

- その他

- 製造プロセス別

- バルクマイクロマシニング

- 表面微細加工

- HARシリコンエッチング/DRIE

- シリコンオンインシュレータ(SOI)MEMS

- LIGAとX線リソグラフィ

- 先進の3DプリントMEMS

- 材料別

- シリコン

- ポリマー

- 圧電(AlN, PZT)

- 金属

- 化合物半導体

- 石英・ガラス

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 東南アジア

- オーストラリア、ニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Robert Bosch GmbH

- Broadcom Inc.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- TDK Corporation(InvenSense)

- Qorvo Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Knowles Electronics LLC

- Panasonic Corporation

- GoerTek Inc.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices Inc.

- Alps Alpine Co., Ltd.

- Omron Corporation

- Sensata Technologies

- Silex Microsystems AB

- Teledyne MEMS

- Rogue Valley Microdevices Inc.