|

市場調査レポート

商品コード

1403909

電動油圧式パワーステアリング - 市場シェア分析、産業動向・統計、2024年~2029年、成長予測Electro Hydraulic Power Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電動油圧式パワーステアリング - 市場シェア分析、産業動向・統計、2024年~2029年、成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

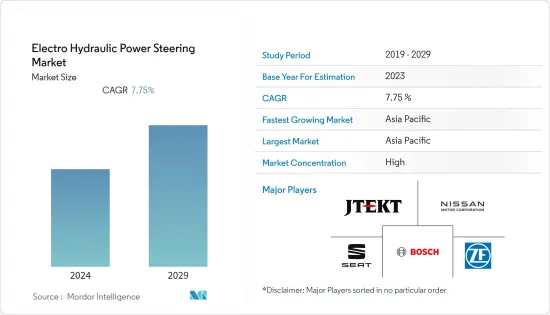

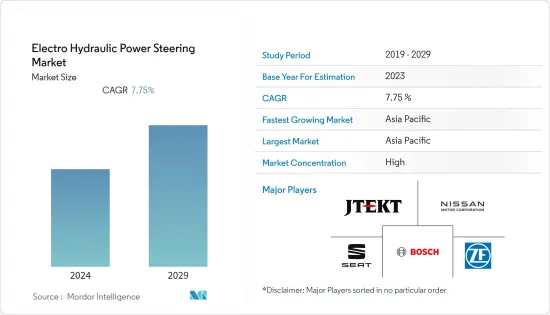

自動車用電動油圧式パワーステアリングシステム市場の現在の市場規模は28億4,000万米ドルで、今後5年間で41億2,000万米ドルに達すると予測され、予測期間中のCAGR成長率は7.75%です。

長期的には、業界大手による研究開発投資の増加、電気自動車やハイブリッド車の販売増、商用車需要の高まりなどがeコマース分野の成長に寄与しています。これは、自動車および輸送業界における需要を創出するのに役立っており、自動車用電動油圧式パワーステアリングシステム市場の急成長にプラスの影響を与えています。電動油圧式パワーステアリング・システムのコストが高いことや、主要商用車メーカーがコスト削減に力を入れていることなど、いくつかの要因が自動車用電動油圧式パワーステアリング・システム業界の成長見通しを妨げる可能性があります。

市場の主要企業は、電動油圧式パワーステアリング・システムの需要増に対応するために生産能力を拡大し、ポートフォリオを強化するためにM&Aにも取り組んでいます。例えば、コングスベルグ・オートモーティブは2022年8月、カナダのシャウィニガン事業を1億400万ユーロ(1億1,000万米ドル)でボンバルディア・レクリエーショナル・プロダクツ社(BRP社)に売却すると発表しました。シャウィニガンの製造施設では、パワースポーツおよびレクリエーショナル車用のセンサー、アクチュエーター、電子パワーステアリング、ワイヤーハーネス、ダッシュボードアセンブリを生産しています。さらに、ADAS(先進運転支援システム)、自動運転、コネクテッドカーの急速な変革に伴い、燃費性能を向上させるために新時代のコンポーネントを導入する需要が高まっており、これが電動油圧式パワーステアリングシステム市場の急成長にプラスの影響を与えています。

アジア太平洋は世界最大の自動車用電動油圧式パワーステアリングシステム市場であるが、これは様々な電気自動車メーカーの存在、商用車の販売台数の多さ、自動車部品産業の発達によるものです。北米と欧州は、ZF Friedrichshafen AGのような大手部品・コンポーネントメーカーの存在と、長距離観光バスや多軸トラックを含む商用車販売の好調な見通しにより、次いで大きな市場となっています。

電動油圧式パワーステアリングシステム市場動向

予測期間中、ステアリングモーターセグメントが牽引役に

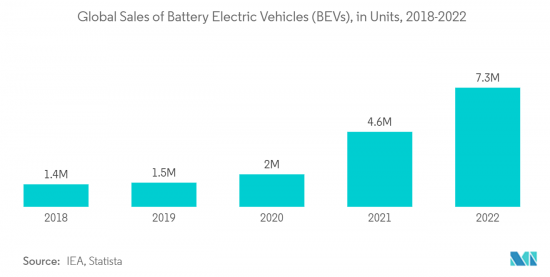

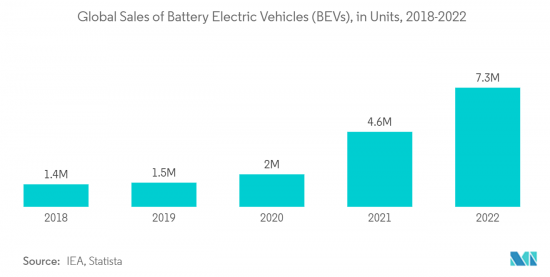

環境問題に対する消費者の意識の高まりと、二酸化炭素排出量削減を推進する政府の積極的な戦略が相まって、世界中で電気自動車市場の成長に寄与しています。その結果、電動油圧式パワーステアリングシステムシステムに必要なステアリングモーターの需要にプラスの影響を与えています。例えば

- 2023年7月、欧州地域における電気自動車の販売台数は、2021年の同月と比較して50%の伸びを記録しました。さらに、2023年7月の欧州におけるバッテリー電気自動車の販売台数は、サプライチェーンの制限が緩和されたことにより、2022年の同時期と比較して54.7%急増しました。

電動油圧式ステアリング・システムを車両モデルに組み込むには、電気モーターによって油圧動力を生成する必要があります。 促進要因のステアリング操作感を効率的に向上させることができる先進的なステアリングモーターに対するニーズは依然として高いです。

ステアリングモーターの改良と進歩によって電動油圧式パワーステアリングシステム技術が大きく変化したことも、電動油圧式パワーステアリングシステム・システムの販売に大きな弾みをつけています。日産自動車、ボッシュ、ZFなど、その他の自動車メーカーや部品メーカーは、電動油圧式パワーステアリング・システムに利用できる先進的なステアリング・モーターの開発に積極的に取り組んでいます。さらに、これらのOEMは、自律走行車専用に設計された電動油圧式パワーステアリングモーターも発売しています。市場において自律走行車の採用が進むにつれて、ステアリングモーターセグメントは予測期間中に急成長が見込まれます。

ステアリングモーターは、センサーのような他のコンポーネントよりもコスト効率が高く、メンテナンスも容易であるため、ステアリングモーターのサブセグメントは、コンポーネントタイプ別の自動車用電動油圧式パワーステアリング市場全体の大半の収益シェアに貢献すると予想されます。先進的なステアリングモーターのイントロダクションは、構造を簡素化し、駆動回路を少なくすることで軽量化を実現します。これらの新世代電動油圧式パワーステアリングシステムモーターは、コンポーネントセグメントにおけるステアリングモーターサブセグメントの市場シェアをさらに強化すると予想されます。

予測期間中、アジア太平洋が最大市場であり続ける

都市化率の上昇、自動車保有台数の増加、消費者の一人当たり可処分所得の増加が、アジア太平洋の自動車市場を牽引しています。その結果、この地域の自動車用電動油圧式パワーステアリングシステム・システムの需要にプラスの影響を与えています。より良い雇用と経済的機会を求めて都市部に移住する消費者が増えるにつれ、自家用交通機関を利用することへの嗜好が高まっています。これは、この地域の乗用車市場にプラスの影響を与えます。それに加えて、新エネルギー車の採用に政府が力を入れるようになったため、電気自動車が統合され、電気自動車市場の成長に貢献し、その結果、電動油圧式パワーステアリング・システムなどの新時代のコンポーネントの需要に影響を与えています。

- 2023年度のインドにおける電動四輪車の新車販売台数は48,105台に達し、2022年度と比較して前年比143.2%の伸びを示しました。

- 国際エネルギー機関(IEA)によると、中国における電気自動車の新車販売台数は、2021年には330万台に過ぎなかったが、2022年には600万台に達します。

乗用車の成長とは別に、アジア太平洋の商用車産業もこのセグメントの成長の主要な触媒として機能しています。これは、eコマース分野の進歩、ラスト・マイル・デリバリー分野の成長、建設活動の増加によるものです。商用車は重量が重いため、先進的なパワーステアリングシステムの開発は不可欠です。最適なトルクを維持するためには、スムーズなステアリング・システムが必要です。したがって、アジア太平洋における商用車の販売台数の増加に伴い、高度なステアリング・システムに対する需要も高まると思われます。ひいては、この地域の自動車用電動油圧式パワーステアリングシステム市場の成長にプラスに寄与すると思われます。

- 2022年のインドの商用車新規販売台数は93万3,000台で、2021年の67万7,000台と比べ、前年比37.8%の成長を記録しました。

欧州と北米も、自動車用ステアリングOEMの存在感が大きく、主要な輸送産業として道路輸送が普及しているため、主要市場となっており、これらの地域では商用車の販売台数が多いです。このように、各社がこの分野で技術革新や能力拡張を行うことで、電動油圧式パワーステアリング・システムの市場は、商用車セグメントの予測期間中に成長すると予想されます。

電動油圧式パワーステアリングシステム業界の概要

自動車用電動油圧式パワーステアリングシステム市場は、高度に統合され競争しています。この市場の特徴は、大手自動車メーカーと長期供給契約を結んでいるかなり大きなプレーヤーが存在することです。これらのプレーヤーはまた、ブランドポートフォリオを強化するために、合弁事業、M&A、製品開発に取り組んでいます。

世界市場を独占している主な企業には、株式会社ジェイテクト、日産自動車株式会社、SEAT、Robert Bosch GmbH、ZF Friedrichshafen、Danfoss A/S、三菱重工業、Evamoなどがあります。主要企業は、市場での地位を確保し、市場のカーブを先取りするために新製品を発表しています。例えば

- 2023年6月、ロバート・ボッシュはArnold NextG社との提携を発表し、ステア・バイ・ワイヤ・ステアリング・システムを自動車市場に大規模生産で導入すると発表しました。この提携により、ロバート・ボッシュは電動油圧式パワーステアリング・システムなどの先進ステアリング・システムを顧客に提供することを約束しました。この提携は、自動車メーカーに不可欠な新時代の部品やコンポーネントを供給することで、自動運転分野の活発な開発を支援することを目的としています。

これらの企業は、製品ポートフォリオの多様化によって競争力を得ようとしているため、市場では今後数年間、さまざまな先進的な電動油圧式パワー・ステアリング・システムが発売されると予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 電気自動車の普及拡大

- 市場抑制要因

- 電動油圧式パワーステアリングシステムの初期コストの高さ

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模-米ドル)

- 自動車タイプ別

- 乗用車

- 商用車

- コンポーネントタイプ別

- ステアリング・モーター

- センサー

- その他(ポンプ、ホースなど)

- 販売チャネル別

- 相手先ブランド製造(OEM)

- アフターマーケット

- 地域別

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- 世界のその他の地域

- アラブ首長国連邦

- ブラジル

- 南アフリカ

- その他の国

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- JTEKT Corporation

- Nissan Motor Corporation

- SEAT

- Robert Bosch GmbH

- ZF Friedrichshafen

- Danfoss A/S

- Eaton

- Danotek Motion Technologies

- Allied Motion Inc

- Mitsubishi Heavy Industries

- Dana TM4

- Evamo

第7章 市場機会と今後の動向

- ADAS(先進運転支援システム)技術の強化

The Automotive Electro-Hydraulic Power Steering Market is valued at USD 2.84 billion in the current year and is anticipated to reach a net valuation of USD 4.12 billion within the next five years, registering a CAGR growth of 7.75% over the forecast period.

Over the long term, increasing investments in R&D by major industry players, a rise in sales of electric and hybrid vehicles coupled with rising demand for commercial vehicles, attributed to the growth in the e-commerce sector. It is assisting in creating demand in the automotive and transportation industry, thereby positively impacting the surging growth of the automotive electro-hydraulic power steering market. Some factors like the high cost of electro-hydraulic power steering systems and the strong focus of major commercial vehicle manufacturers on cost-cutting may hamper the growth outlook of the automotive electro-hydraulic power steering systems industry.

Major players in the market are expanding their production capacity to cater to the increased demand for electro-hydraulic power steering systems and also engaging in mergers and acquisitions to bolster their portfolio. For instance, in August 2022, Kongsberg Automotive announced the divestiture of its Shawinigan operations in Canada to Bombardier Recreational Products, Inc.(BRP Inc.) for EUR 104 million (USD 110 million). The Shawinigan manufacturing facility produces sensors, actuators, electronic power steering, wire harnesses, and dashboard assemblies for power sports and recreational vehicles. Further, with rapid transformation in advanced driver assistance systems (ADAS), automated driving, and connected cars, there exists a greater demand for introducing new-age components to improve fuel consumption capability, which in turn is positively impacting the surging growth of the electro-hydraulic power steering market.

Asia-Pacific is the largest automotive electro-hydraulic power steering market in the world, owing to the presence of various electric vehicle manufacturers, high sales of commercial vehicles, and a well-developed automotive components industry. North America and Europe are the next biggest markets due to the presence of major parts and components manufacturers like ZF Friedrichshafen AG and the strong prospect of commercial vehicle sales, including long-distance touring coaches and multi-axle trucks.

Electro Hydraulic Power Steering Market Trends

Steering Motors Segment to gain Traction during the Forecast Period

Consumers' growing awareness of environmental hazards, coupled with the government's aggressive strategy to promote the reduction of carbon emissions, is contributing to the growth of the electric vehicle market across the world. It, in turn, positively impacts the demand for steering motors required for electro-hydraulic power steering systems. For instance,

- In July 2023, sales of electric vehicles in the European region recorded a growth of 50% compared to the same month in 2021. Further, battery electric vehicle sales in Europe surged 54.7% in July 2023, compared to the same period in 2022, owing to the easing supply chain restriction.

The integration of an electro-hydraulic steering system in vehicle models requires hydraulic power to be generated by an electric motor. There remains a greater need for advanced steering motors, which can efficiently improve the driver's steering experience.

The significant changes in electo-hydro power steering technologies that are driven by the improvements and advancements in steering motors are also providing a big impetus to the sales of electro-hydraulic power steering systems. Many vehicle and parts manufacturers, such as Nissan Motor, Bosch, and ZF, among others, are actively engaging in the development of advanced steering motors that can be utilized in an electro-hydraulic power steering system. Further, these OEMs are also launching electro-hydraulic power steering motors designed specifically for autonomous vehicles. With the greater adoption of autonomous vehicles in the market, the steering motors segment is anticipated to witness a rapid surge during the forecast period.

The steering motor sub-segment is expected to contribute the majority revenue share to the overall automotive elector-hydraulic power steering market by component type, as steering motors are more cost-effective and easy to maintain than other components like sensors. The introduction of advanced steering motors will assist in simplifying the structure and offer good weight reduction by maintaining fewer drive circuits. These new generation electro-hydraulic power steering motors are expected to further strengthen the market share of the steering motor sub-segment in the component segment.

Asia-Pacific to Remain the Largest Market during the forecast period

The increasing urbanization rate, growing vehicle parc, and the rising per capita disposable income of consumers are driving the automotive market in the Asia-Pacific region. It, in turn, is positively impacting the demand for automotive electro-hydraulic power steering systems in this region. As more consumers migrate to urban for better employment and financial opportunities, the preference towards availing private transportation shoots up. It positively impacts the passenger car market in the region. Coupled with that, the integration of electric vehicles owing to the increasing government's focus on the adoption of new-energy vehicles contributes to the growth electric vehicle market, subsequently impacting the demand for new-age components such as electro-hydraulic power steering systems.

- In FY 2023, new electric four-wheeler sales in India touched 48,105 units, representing a 143.2% Y-o-Y growth compared to FY 2022.

- According to the International Energy Agency, new sales of electric cars in China touched 6 million units in 2022, compared to only 3.3 million units in 2021.

Apart from the growth in passenger vehicles, the commercial vehicles industry in the Asia-Pacific region also acts as a major catalyst for the growth of this segment. It is owing to the advancement in the e-commerce sector, growth in the last-mile delivery sector, and increasing construction activity. The development of advanced power steering systems is essential for the commercial vehicle industry due to the higher weight of these vehicles. It requires a smooth steering system to maintain optimal torque. Therefore, with the increasing sales of commercial vehicles in the Asia-Pacific region, there will exist a greater demand for advanced steering systems. It, in turn, will positively contribute to the growth of the automotive electro-hydraulic power steering market in this region.

- In 2022, new sales of commercial vehicles in India touched 933 thousand units, compared to 677 thousand units in 2021, recording a Y-o-Y growth of 37.8%.

Europe and North America are also major markets due to the large presence of automotive steering OEMs and the prevalence of road transport as a major transport industry, which leads to high commercial vehicle sales in these geographies. Thus, with companies coming up with innovations and capacity expansions in this segment, the market for electro-hydraulic power steering systems is expected to grow over the forecast period for the commercial vehicles segment.

Electro Hydraulic Power Steering Industry Overview

The automotive electro-hydraulic power steering market is highly consolidated and competitive. The market is characterized by the presence of considerably large players who secured long-term supply contracts with major automotive OEMs. These players also engage in joint ventures, mergers and acquisitions, and product development to enhance their brand portfolio.

Some of the major players dominating the global market are JTEKT Corporation, Nissan Motor Corporation, SEAT, Robert Bosch GmbH, ZF Friedrichshafen, Danfoss A/S, Mitsubishi Heavy Industries, and Evamo, among others. Key players are launching new products to secure their market position and stay ahead of the market curve. For instance,

- In June 2023, Robert Bosch announced its partnership with Arnold NextG to introduce steer-by-wire steering systems to the automotive market in large-scale production. This partnership ensured its commitment to offering advanced steering systems, such as electro-hydraulic power steering systems, to its customers. The partnership aims to support the active development in the automated driving space by supplying automakers with essential new-age parts and components.

The market is anticipated to witness the launch of various advanced electro-hydraulic power steering systems in the coming years as these players try to gain a competitive edge with the diversification of their product portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of Electric Vehicles

- 4.2 Market Restraints

- 4.2.1 High Upfront Cost of Electro-Hydraulic Power Steering Systems

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Component Type

- 5.2.1 Steering Motors

- 5.2.2 Sensors

- 5.2.3 Others (Pumps, Hoses, etc.)

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturer (OEM)

- 5.3.2 Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 United Arab Emirates

- 5.4.4.2 Brazil

- 5.4.4.3 South Africa

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 JTEKT Corporation

- 6.2.2 Nissan Motor Corporation

- 6.2.3 SEAT

- 6.2.4 Robert Bosch GmbH

- 6.2.5 ZF Friedrichshafen

- 6.2.6 Danfoss A/S

- 6.2.7 Eaton

- 6.2.8 Danotek Motion Technologies

- 6.2.9 Allied Motion Inc

- 6.2.10 Mitsubishi Heavy Industries

- 6.2.11 Dana TM4

- 6.2.12 Evamo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Enhancement in Advanced Driver Assistance Systems (ADAS) Technology