|

市場調査レポート

商品コード

1910476

ハイパフォーマンスデータアナリティクス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)High-Performance Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ハイパフォーマンスデータアナリティクス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

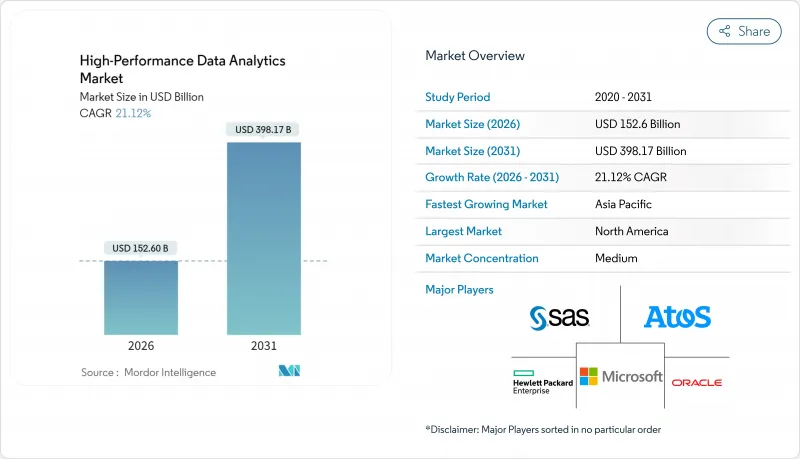

ハイパフォーマンスデータアナリティクス市場は、2025年の1,259億9,000万米ドルから2026年には1,526億米ドルへ成長し、2026年から2031年にかけてCAGR21.12%で推移し、2031年までに3,981億7,000万米ドルに達すると予測されています。

この成長の勢いは、AI、クラウドコンピューティング、そして膨れ上がる企業データの量という要素が融合した結果です。金融サービスは、安全な取引銀行業務にリアルタイムの不正分析が不可欠となる中、主要な導入分野であり続けています。ソフトウェアが収益の46.2%を占めていますが、専門的なAIコンサルティングを背景に、サービス分野が最も急速に拡大しています。導入形態ではオンプレミスが57.8%のシェアで現在主導していますが、プロバイダーが世界のGPU容量を拡大する中、クラウドベースソリューションが30.1%のCAGRで明らかな成長エンジンとなっています。地域別では北米が35.4%のシェアを占めますが、アジア太平洋地域は広範なデジタルトランスフォーメーション計画により、最も急速な成長が見込まれています。導入は大手企業が主導していますが、GPUレンタル料金の急落により中小企業との差が縮まりつつあります。例えば、H100インスタンスの1時間あたり3.35米ドルという料金は、ハイパースケーラーの定価を90%以上下回っています。

世界のハイパフォーマンスデータアナリティクス市場の動向と洞察

BFSI分野における不正検知のためのリアルタイム分析導入の加速

金融機関ではソーシャルエンジニアリング詐欺が10倍に増加し、デジタルバンキング詐欺の23%を占めるに至ったため、高性能詐欺検知エンジンの迅速な導入が進んでいます。TDバンクは2024年FICOデシジョンズアワード受賞後、全社的なリアルタイム監視を実現しました。AI搭載プラットフォームは1Gbpsのデータストリームを遅延なく処理しつつ、98.5%の検知精度を達成しています。この結果、BFSI機関は、評判と財務資本を保護するため、低遅延分析を決済システム、信用リスクスコアリング、顧客確認(KYC)に組み込んでいます。これらの導入は、ハイパフォーマンスデータアナリティクス市場全体のCAGRを5.2%押し上げる基盤となっています。

ペタバイト規模のデータ処理を必要とするAI/MLモデルトレーニングの急増

生成AIモデルのパラメータ数は半年ごとに倍増しており、ペタバイト規模のデータ取り込みとエクサスケール計算クラスターが求められています。AIワークロードに関連するハイパースケールデータセンターへの投資額は、2024年の1,627億9,000万米ドルから2030年までに6,085億4,000万米ドルへ増加する見込みです。マイクロソフトやグーグルなどのプロバイダーは、次世代AI施設向けに合計1,550億米ドルを予算化しています。この資本支出は、分散ファイルシステム、高スループット相互接続、高度なスケジューリングソフトウェアへの需要を高め、市場成長に6.8%のプラス効果をもたらします。

専用HPCクラスターの高い総所有コスト

データセンター建設への資本支出は2025年に2,500億米ドルを超えると予測され、電力需要の拡大により2030年までにさらに5,000億米ドルが追加されます。多くの発展途上国では電力不足に直面しており、これが現地HPC施設の立ち上げを妨げています。設備、冷却、熟練スタッフの人件費などを考慮すると、組織はオンプレミスクラスターの導入を正当化することが難しく、資源が限られている地域での導入が抑制され、全体のCAGRが2.1%低下しています。

セグメント分析

ソフトウェアセグメントは2025年に収益の45.78%を占め、ユーザーフレンドリーな分析エンジン、データファブリック層、AIオーケストレーションツールへの需要を反映しています。ベンダー各社は、ワークフロー自動化やフィーチャーストア機能を組み込み、事業部門横断でのモデル展開を加速させております。DevOps統合によりフィードバックサイクルが短縮され、ライセンス構造も価値創出に連動した従量課金制へと移行しつつあります。ハードウェア販売は基盤的役割を維持しており、NVIDIA Blackwell Ultra GPUなど、トランスフォーマーワークロード向けに高密度テンソルコアを実現するシリコン技術の進歩が牽引しております。

サービス分野は最も急速に拡大しており、2031年までCAGR25.05%が見込まれています。コンサルティングチームは現在、データ戦略設計、MLOps実装、継続的モデルチューニングサービスをパッケージ化し、複雑なハイブリッドスタックにおける専門知識のギャップを埋めています。プロバイダーは、マネージド機能エンジニアリング、バイアス監査、フェデレーテッドラーニングのオーケストレーションを含むAI-as-a-Serviceの提供を開始しています。これらの変化は対応可能な需要を拡大し、特に初めての企業導入者層において、サービス契約向けのハイパフォーマンスデータアナリティクス市場規模を押し上げています。

2025年時点ではオンプレミス導入が57.05%のシェアを占めており、政府機関や銀行など、レイテンシーや主権保護を重視するセクターが基盤となっています。組織側は、ハードウェアの直接制御や厳格なデータ居住地規制への準拠を主な動機として挙げています。多くの企業は既存データセンターの沈没コストを活用し、クラウドへの全面移行ではなくノード更新による稼働率最適化を図っています。

クラウドプラットフォームは、弾力的なスケーリング、従量課金制、世界のエッジゾーン展開により、29.25%のCAGRで成長しています。プロバイダーは、規制上の懸念を和らげるため、機密コンピューティングインスタンスと主権クラウドリージョンの拡充を進めています。ハイブリッドおよびマルチクラウドのパターンが新規プロジェクトを支配するようになっており、ローカルアクセラレータとAIトレーニング用のバースト容量を組み合わせています。この移行により、消費モデルに紐づくハイパフォーマンスデータアナリティクス市場の規模が拡大すると同時に、リソース制約のある企業の参入障壁が緩和されています。

地域別分析

北米は2025年、ハイパースケーラーの深い足跡と企業向けAIの早期導入に支えられ、34.85%の収益シェアを維持しました。米国データセンターの供給量は前年比26%増の5.2GWに達し、急増するAI推論需要に対応しました。TD銀行などの金融機関は全国的な決済テレメトリーを活用した即時不正スコアリングを導入し、業界の成熟度を裏付けています。北バージニア州のレンタル料金は2024年に41.6%上昇し、逼迫した容量が継続的な拡張を促していることを示しています。

アジア太平洋地域はCAGR27.2%の見通しで最も急速に成長する地域です。インドは2026年までに設置済みデータセンター容量を約1.8GWへ倍増させる計画であり、国内外の投資家による数十億米ドル規模の資金投入がこれを支えています。台湾ではチップ設計シミュレーションや大規模言語モデル(LLM)のトレーニング需要に対応するため、2028年までに施設建設費が30億米ドルを超えると予測されています。中国はモデル品質において米国との差を縮めており、各省の助成金が次世代AIフレームワークの開発を促進しています。しかしながら、厳格なデータ現地化規制により、企業は統一された世界の基盤ではなく、国別の分析スタックを構築せざるを得ない状況です。

欧州では、製造業と重要インフラの近代化に向け、エッジからクラウドまでの取り組みを拡大しています。EUは2030年までに企業のクラウド採用率75%達成と、1万基の気候中立型エッジノードの展開を目標としています。各国プログラムでは、低遅延分析を必要とする6Gテストベッド、通信事業者向けエッジクラウドパイロット、産業用メタバース実証プロジェクトへ資金を投入しています。2024年に欧州初のAIファクトリーが開設され、データ輸出を伴わずにモデルをトレーニングしたい自動車、航空宇宙、エネルギー企業向けに、主権的なコンピューティング環境を提供します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3か月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 北米における金融サービス業界(BFSI)での不正検知向けリアルタイム分析導入の加速

- アジアにおけるペタバイト規模のデータ処理を必要とするAI/MLモデルトレーニングの急増

- 欧州におけるスマート製造向けエッジからクラウドへのHPCの成長

- 中東諸国政府における国防ビッグデータ近代化プログラム

- 再生可能エネルギー網最適化イニシアチブが南米におけるHPC分析を推進

- GPU/CPUクラスターのコア単価低下により、世界中の中小企業向けHPCが手頃な価格に

- 市場抑制要因

- カリブ海地域およびアフリカにおける専用HPCクラスターの高い総所有コスト

- 欧州およびオセアニア地域における熟練HPC・並列プログラミング専門家の不足

- アジアにおける越境クラウド分析を制限するデータ主権規制

- 新興市場におけるインフラ信頼性の問題が継続的なデータストリームを阻害

- 規制の見通し

- テクノロジーの展望

- ハイパフォーマンスクラスタコンピューティングの進化

- グリッドコンピューティング

- インメモリ分析

- データベース内分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

第5章 市場規模と成長予測

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- 展開モデル別

- オンプレミス

- オンデマンド/クラウド

- 組織規模別

- 中小企業

- 大企業

- エンドユーザー業界別

- 銀行・金融サービス・保険(BFSI)

- 政府・防衛機関

- エネルギー・ユーティリティ

- 小売業・電子商取引

- ヘルスケア・ライフサイエンス

- 通信・ITサービス

- 製造業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- ペルー

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 戦略的開発

- ベンダーポジショニング分析

- 企業プロファイル

- Amazon Web Services, Inc.(AWS)

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Hewlett Packard Enterprise(HPE)

- Dell Technologies Inc.

- SAS Institute Inc.

- Oracle Corporation

- Fujitsu Limited

- Intel Corporation

- ATOS SE

- Juniper Networks Inc.

- NEC Corporation

- Cisco Systems, Inc.

- Teradata Corporation

- Cray Inc.(HPE Cray)

- Altair Engineering Inc.

- Cloudera, Inc.

- Huawei Technologies Co., Ltd.

- Hitachi Vantara LLC

- Super Micro Computer, Inc.