|

市場調査レポート

商品コード

1687386

ラップフィルム:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Cling Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ラップフィルム:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

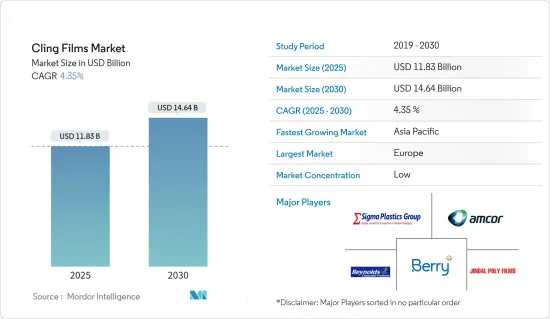

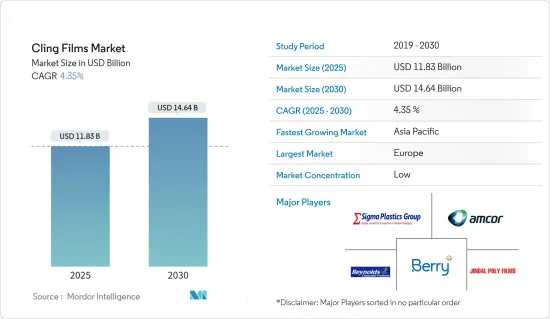

ラップフィルム市場規模は2025年に118億3,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは4.35%で、2030年には146億4,000万米ドルに達すると予測されています。

COVID-19は、いくつかのセクターが製造拠点の閉鎖を余儀なくされた世界の閉鎖と厳しい規則により、2020年の市場にマイナスの影響を与えました。しかし、市場はパンデミック以前の水準に達すると推定され、安定した成長が見込まれます。

衛生的な食品包装や包装食品への嗜好が、予測期間中の需要を押し上げると思われます。ヘルスケア分野からの需要の増加も市場成長の原動力になると予想されます。

しかし、極端な気象条件に対する耐性の低さや、ラップフィルムの使用に関する世界の規制の高まりが市場成長を抑制すると予想されます。

持続可能な食品包装へのバイオベースのクリンフィルムの応用は、今後の市場成長の機会として機能すると予想されます。

予測期間中、アジア太平洋が最も高い成長率を示すと予測されています。

ラップフィルム市場動向

市場を独占する食品セグメント

- ラップフィルムは主に食品の包装に使用され、虫やその他の微生物による汚染を防ぐ。さらに、ラップフィルムを使用することで、食品の保存性を向上させ、鮮度を長時間保つことができるため、食品廃棄物を効果的に削減することができます。

- 天然ポリマーベースの食品包装用クリンフィルムは、非生分解性の石油系合成ポリマーを低コストで置き換えることができ、環境面でも経済面でもプラスの効果をもたらします。

- 中国は最大の飲食品消費国のひとつであり、人口の増加と健康的でおいしい包装食品への需要の高まりを背景に、食品加工産業は拡大を続けています。同国で人気のある食品には、ベーカリー製品、飲食品、その他栄養価の高い食品などがあります。

- 米国の食品産業は世界最大級の規模を誇っています。北米における研究市場の需要は、主に米国からもたらされます。さらに米国では、食品市場の成長が同国の市場を押し上げています。

- 人気が高まっているインドは、同国経済の拡大と人々のライフスタイルの変化により、2025年までに世界の包装食品市場を独占することになると思われます。インドは現在、世界第2位の食品生産国であり、このことは調査対象市場の大きな成長機会を反映しています。

- 近年、特に都市部の消費者の間で、包装食品や調理済み食品の人気が高まっています。大都市では生活のペースが速いため、消費者は普段の食事に調理済みの食事を好みます。所得、生活水準、利便性の急速な向上が、都市部で包装食品の利用が増加している理由です。

- 世界最大の産業のひとつである食品加工部門は、年間約7兆米ドルを生産しています。グローバリゼーションにより、以前は地元でしか手に入らなかった食品が、今では世界中で手に入るようになりました。人々はまた、世界規模で入手可能な幅広い食品をより意識するようになっています。2030年までに、世界の食品加工市場は年率7.6%の成長が見込まれます。

- 飲食品産業は、雇用と付加価値の面でEU最大の製造業です。EUは食品貿易においてかなりの貿易黒字を誇っており、EUの特産品は海外で高く評価されています。過去10年間で、EUの飲食品輸出は倍増して900億ユーロ(~950億米ドル)以上に達し、約300億ユーロ(~320億米ドル)の黒字に貢献しています。

- 2022年12月に発表されたFoodDrink Europeの報告書によると、EUの食品・飲料産業は460万人を雇用し、売上高は1兆1,000億ユーロ(~1兆2,000億米ドル)、付加価値は2,300億ユーロ(~2,440億米ドル)で、EU最大の加工産業の1つとなっています。同時に、EUは世界最大の飲食品輸出国であり、EU域外への輸出は1,560億ユーロ(~1,650億米ドル)、貿易黒字は730億ユーロ(~770億米ドル)です。

- したがって、上記の要因は、予測期間中、飲食品用途におけるフュームドシリカの需要に影響を与えると考えられます。

アジア太平洋が高い市場成長をする

アジア太平洋は、中国、インド、日本を含む新興国の食品包装、ヘルスケア、消費財分野での使用が増加しているため、ラップフィルムの需要が高成長を遂げる可能性が高いです。

世界最大の食品産業のひとつが中国です。同国の食品市場は、人口の増加と一人当たりの平均消費量の増加によって拡大しています。中国国家統計局によると、2021年の中国食品事業の総利益は約6,187億人民元(~959億米ドル)で、前年の6,210億人民元(~900億米ドル)から減少しました。また、食品製造業は全体の利益にほぼ1,654億人民元(~256億米ドル)貢献しています。

インド・ブランド・エクイティ財団はさらに、2025年までにインドの加工食品部門は4,700億米ドルに達すると予測していると述べた。2022-23年度の連邦予算によると、飲食品部門は拡大する食品・飲料部門を考慮し、215,960カロールインドルピー(278億2,000万米ドル)の予算を受けています。

中国国家統計局によると、2021年の44兆1,000億人民元(~6兆8,000億米ドル)から、2022年の中国の消費財産業の小売総売上高は約44兆人民元(~6兆5,000億米ドル)に達しました。さらに、中国の都市部での小売売上高は38兆人民元(約5兆6,000億米ドル)、農村部での売上高は5兆9,000億人民元(約8,770億米ドル)となります。

世界の医薬品セクターでは、インドが突出した拡大企業です。インドは世界有数のジェネリック医薬品供給国であり、世界供給量の20%を占めています。インドの医薬品は200カ国以上に輸出されており、中でも米国が主要市場となっています。さらに、インドのジェネリック医薬品は米国のジェネリック医薬品需要の40%、英国の30%を満たしています。国内の医薬品メーカーは約10,500社のチェーンで構成されています。

さらに、中華人民共和国財政部によると、2022年の医療・衛生に対する公的支出総額は2021年比で約17%増加し、約2兆2,500億人民元(~3,300億米ドル)に達しました。

したがって、上記の理由から、アジア太平洋が予測期間中に調査された市場を独占すると予想されます。

ラップフィルム産業の概要

ラップフィルム市場は細分化されています。同市場の主要企業(順不同)には、Berry Global Inc.、Amcor plc、Sigma Plastics Group、Reynolds Consumer Products、Jindal Poly Films Limitedなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 食品産業の成長と食品包装の需要増加

- ヘルスケア分野からの需要増加

- 抑制要因

- 極端な気象条件に対する耐性の低さ

- 使用に関する世界の規制の高まり

- 業界バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション

- 材料タイプ

- ポリエチレン

- 二軸延伸ポリプロピレン

- ポリ塩化ビニル

- ポリ塩化ビニリデン

- その他の材料タイプ

- 形状

- キャストラップフィルム

- ブローラップフィルム

- エンドユーザー産業

- 食品

- ヘルスケア

- 消費財

- 工業用

- その他のエンドユーザー産業

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- ASEAN諸国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場ランキング分析

- 主要企業の戦略

- 企業プロファイル

- 3M

- ADEX SRL

- Alliance Plastics

- All American Poly

- Amcor plc

- Anchor Packaging LLC

- Berry Global Inc.

- Deriblok SpA

- Hipac SPA

- Inteplast Group

- Intertape Polymer Group

- Jindal Poly Films Limited

- Malpack

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Novamont SPA

- Paragon Films

- Reynolds Consumer Products

- Sigma Plastics Group

- Technovaa Plastic Industries Pvt. Ltd.

第7章 市場機会と今後の動向

- バイオベースラップフィルムの新たな用途

The Cling Films Market size is estimated at USD 11.83 billion in 2025, and is expected to reach USD 14.64 billion by 2030, at a CAGR of 4.35% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020 due to the global lockdowns and strict rules that forced several sectors to close their manufacturing hubs. However, the market was estimated to reach pre-pandemic levels and was expected to grow steadily.

The preference for hygienic food packaging and packaged food will boost demand during the forecast period. The increasing demand from healthcare sector is also expected to drive the market growth.

However, low resistance to extreme weather conditions and rising global regulations on cling film usage are anticipated to restrain the market growth.

The application of bio-based cling films for sustainable food packaging is expected to act as an opportunity for market growth in the future.

The Asia-Pacific region is anticipated to witness the highest growth rate during the forecast period.

Cling Films Market Trends

Food Segment to Dominate the Market

- Cling films are primarily used in the packaging of food products to prevent contamination by insects or other microbial contamination. Additionally, using cling films helps improve the shelf life of the food and keeps it fresh for longer durations, thus effectively reducing food waste.

- Natural polymer-based cling films for food packaging can replace non-biodegradable petroleum-based synthetic polymers at a low cost, producing a positive, environmental, and economic effect.

- China is one of the largest consumers of food and beverages, with the food processing industry continuing to expand, given the growing population and rising demand for healthy and tasty packaged foods. Some of the popular food products in the country include bakery products, beverages, and other nutritious food items, among others.

- The food industry in the United States is one of the largest in the world. The demand for the studied market in North America mainly comes from the United States. Furthermore, in the United States, the growing food market is boosting the market in the country.

- With its growing popularity, India is set to dominate the global packaged food market by 2025 due to the expansion of the country's economy and changes in people's lifestyles. India currently operates as the world's second-largest food producer, thus reflecting significant growth opportunities for the market studied.

- In recent years, packaged and ready-to-eat foods have become increasingly popular, especially among urban consumers. Due to the fast pace of life in big cities, consumers prefer cooked meals in their regular diet. Rapidly rising incomes, living standards, and convenience are the reasons for the increased use of packaged foods in urban areas.

- One of the largest global industries, the food processing sector, produces approximately USD 7 trillion annually. Due to globalization, foods previously available locally are now accessible worldwide. People are also becoming more aware of the wide range of foods that are available on a worldwide scale. By 2030, a 7.6% annual growth rate in the global food processing market is expected.

- The food and beverage industry is the EU's largest manufacturing sector in terms of employment and value-added. The EU boasts a sizeable trade surplus in the food trade, and EU specialties are highly valued abroad. Over the past decade, EU food and beverage exports have doubled to reach more than EUR 90 billion (~USD 95 billion), contributing to a surplus of around EUR 30 billion (~USD 32 billion).

- According to the FoodDrink Europe report published in December 2022, the EU food and beverage industry employs 4.6 million people, has a turnover of EUR 1.1 trillion (~USD 1.2 trillion), and a value-added of EUR 230 billion (~USD 244 billion), making it one of the largest processing industries in the EU. At the same time, the European Union is the world's largest exporter of food and beverage, with exports outside the European Union of EUR 156 billion (~USD 165 billion) and a trade surplus of EUR 73 billion (~USD 77 billion).

- Thus, the abovementioned factors are likely to influence the demand for fumed silica in food and beverage applications during the forecast period.

Asia-Pacific Region to Witness High Market Growth

Asia-Pacific is likely to witness the high growth demand for cling films, owing to their increasing usage in the food packaging, healthcare, and consumer goods sector of emerging economies, including China, India, and Japan.

One of the world's largest food industries is found in China. The country's food market is expanding mostly due to the expanding population and average per capita consumption. The total profit of the Chinese food business was approximately CNY 618.7 billion (~USD 95.9 billion) in 2021, down from CNY 621 billion (~USD 90 billion) the year before, according to the National Bureau of Statistics of China. Also, food manufacturing contributed almost CNY 165.4 billion (~USD 25.6 billion) to the overall profits.

The India Brand Equity Foundation further stated that by 2025, India's processed food sector is anticipated to reach USD 470 billion. According to the Union Budget for FY 2022-23, the Department of Food and Public Distribution has received a budget of INR 215,960 crore (USD 27.82 billion) considering the expanding food and beverage sector.

According to the National Bureau of Statistics of China, the total retail sales of China's consumer goods industry in 2022 amounted to around CNY 44 trillion (~USD 6.5 trillion) from CNY 44.1 trillion (~USD 6.8 trillion) in 2021. Furthermore, Retail sales in China's cities totaled CNY 38 trillion (~USD 5.6 trillion), while sales in rural China totaled CNY 5.9 trillion (~USD 877 billion) in 2022.

In the global pharmaceuticals sector, India is a prominent and expanding player. India is one of the world's major suppliers of generic medicines, accounting for 20% of the global supply by volume. Indian drugs are exported to more than 200 countries, with the United States being the key market. Furthermore, India's generic drugs satisfy 40% of the generic drug demand of the United States and 30% of the United Kingdom. The domestic drug manufacturers consist of a chain of around 10,500 companies.

Furthermore, according to the Ministry of Finance of the People's Republic of China, total public expenditure on health care and hygiene increased by about 17% in 2022 compared to 2021, amounting to about CNY 2.25 trillion (~USD 0.33 trillion).

Hence, for the above reasons, the Asia-Pacific region is anticipated to dominate the market studied during the forecast period.

Cling Films Industry Overview

The Cling Films Market is fragmented in nature. Some of the major players in the market (not in any particular order) include Berry Global Inc., Amcor plc, Sigma Plastics Group, Reynolds Consumer Products, and Jindal Poly Films Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Food Industry and Increasing Demand For Food Packaging

- 4.1.2 Increase in Demand from the Healthcare Sector

- 4.2 Restraints

- 4.2.1 Low Resistance to Extreme Weather Conditions

- 4.2.2 Rising Global Regulations on its Usage

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyethylene

- 5.1.2 Biaxially Oriented Polypropylene

- 5.1.3 Polyvinyl Chloride

- 5.1.4 Polyvinylidene Chloride

- 5.1.5 Other Material Types

- 5.2 Form

- 5.2.1 Cast Cling Film

- 5.2.2 Blow Cling Film

- 5.3 End-user Industry

- 5.3.1 Food

- 5.3.2 Healthcare

- 5.3.3 Consumer Goods

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ADEX SRL

- 6.4.3 Alliance Plastics

- 6.4.4 All American Poly

- 6.4.5 Amcor plc

- 6.4.6 Anchor Packaging LLC

- 6.4.7 Berry Global Inc.

- 6.4.8 Deriblok SpA

- 6.4.9 Hipac SPA

- 6.4.10 Inteplast Group

- 6.4.11 Intertape Polymer Group

- 6.4.12 Jindal Poly Films Limited

- 6.4.13 Malpack

- 6.4.14 Mitsubishi Chemical Corporation

- 6.4.15 Nan Ya Plastics Corporation

- 6.4.16 Novamont SPA

- 6.4.17 Paragon Films

- 6.4.18 Reynolds Consumer Products

- 6.4.19 Sigma Plastics Group

- 6.4.20 Technovaa Plastic Industries Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications Of Bio-based Cling Films