|

市場調査レポート

商品コード

1851082

アンチドローン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Anti-Drone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アンチドローン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月21日

発行: Mordor Intelligence

ページ情報: 英文 155 Pages

納期: 2~3営業日

|

概要

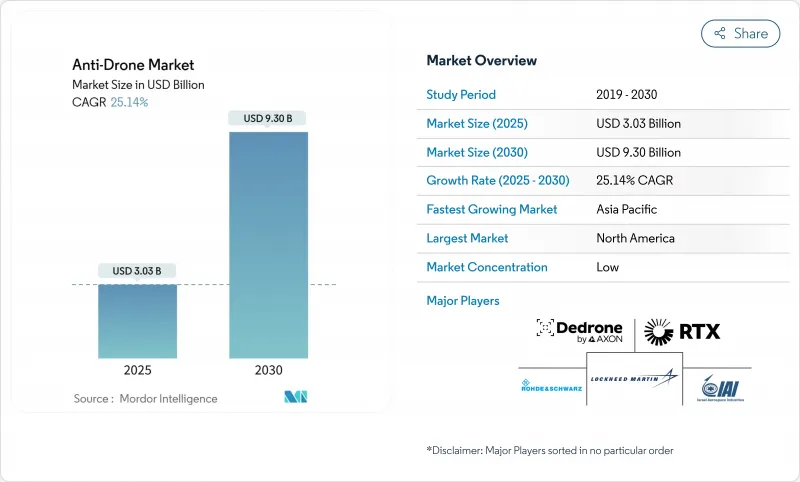

アンチドローンの市場規模は2025年に30億3,000万米ドルに達し、2030年には93億米ドルに達すると予測され、CAGRは25.14%で推移します。

急速な拡大は、ニッチな境界セキュリティから不可欠なレイヤー型防空へのシフトを反映しており、活発な紛争地帯における兵器化ドローンの拡散や国家エネルギーグリッドへの脅威の高まりが拍車をかけています。北米は、連邦航空規則が空港でのUAS検知を義務付けており、国防総省がUAS対策プログラムに500億米ドルを振り向けたことから、2024年の売上高の41.25%で最大のスライスを占めています。アジア太平洋は2030年までCAGR 25.66%で最速の成長を記録しているが、これは日米共同のマイクロ波プロジェクトと中国のドローン生産ブームが地域の戦力均衡を変化させるためです。現在の需要は、探知システムが55.43%のシェアで圧倒的に多いが、中和ソリューションが最も急速に伸びており、調達の優先順位が状況認識から強殺効果へと移行していることを裏付けています。プラットフォームの嗜好はこの進化を反映しています。地上固定型アレイは依然としてリードしているが、ドローン・オン・ドローンによる交戦が現代の戦場で一般的になるにつれて、ドローン搭載型迎撃ミサイルが急速に拡大しています。

世界のアンチドローン市場の動向と洞察

非対称の脅威を可能にする低コストの商用ドローンの普及

ウクライナだけで、76の国内企業にまたがる契約のもと、年間250万ユニットを調達しています。数百万米ドルの装甲を無効化する500米ドルのホビー用ドローンの能力は、従来のコスト交換比率を根底から覆し、従来は通常の防空に頼っていた軍隊の間でアンチドローン市場の需要を加速させています。NORADは、米国軍事施設において1年間に350件の無許可UAVイベントを記録しました。パイプライン、デポ、輸送ハブを標的とした同様の事件は、重要なインフラが同様に危険にさらされていることを証明しています。調達機関は、この拡散する脅威プロファイルに対抗するため、固定センサーとモバイルエフェクターを組み合わせたスケーラブルな対UASネットワークを好んでいます。新興の国内ドローンメーカーによる供給の後押しと、オンラインでの安価な部品の入手可能性により、拡散圧力は10年を通じて高止まりすることが確実です。

厳しい空域安全保障の義務化

FAAがニュージャージー、ニューメキシコ、ノースダコタ、ミシシッピで実施した段階的評価では、ドローン探知・軽減ツールを国家空域システムに統合するための46の実行可能な指令が出された[1]。EASAの更新されたリモートIDおよびサイバーセキュリティ規則を通じて、並行して欧州の規制強化が進み、空港、ヘリポート、重要インフラは認定された対UASスイートの導入を余儀なくされています。運航ライセンスを維持するためには、運航会社はリアルタイムの状況認識と対応能力を証明する必要があるため、コンプライアンスは即座に資本支出サイクルの引き金となります。保険会社は、3万人以上の観衆を収容する会場での承認された技術の存在と補償を関連付けることで、緊急性を高めています。これらの絡み合った義務付けは、対ドローン採用を裁量的支出から規制された必要性へと変化させ、軍事契約以外のアンチドローン市場を拡大します。

RFジャミングとキネティック・インターディクションの曖昧な合法性

ドローンを能動的に無力化するための法的権限は、米国では連邦政府の一握りの部局に限られており、スタジアムや化学工場にUAVの脅威が及んだ場合、州や地域の法執行機関には足かせとなります。国際的にも、同様の法的グレーゾーンが、軍事領域以外でのRFジャマーや指向性エネルギー迎撃ミサイルの市場導入を制限しています。提案されている国防法は、公共安全機関が承認された対ドローンツールにアクセスできるようにするものだが、その成立時期はまだ不透明です。欧州では、電子戦の放射は厳しい周波数管理規則に直面し、高出力デバイスの急速な展開を抑制しています。世界の規制当局が民間の空における武力行使の比例に関する規則を調和させるまでは、多くのオペレータが検知のみのソリューションを展開し、アンチドローン市場内のエフェクタの収益成長を抑制すると思われます。

セグメント分析

検知プラットフォームは2024年の売上高の55.43%を占め、アンチドローン市場への入口としての役割を明確にしました。初期の配備は、滑走路、前方作戦基地、エネルギーハブにおけるスタンドアローンレーダーやRFファインダーが中心でした。現在では、ソフトウェア定義のアップグレードにより、追加のハードウェア交換なしでマルチモーダル精度を向上させるセンサー・フュージョン・オーバーレイが可能になりました。AIを活用した分類は、オペレーターの作業負担をさらに軽減します。これは、脅威の量が増大する中で非常に重要なメリットです。今後、調達予算は、民間および軍の利害関係者がリアルタイムでアクセス可能な共通の操作画像上で空域を視覚化するコマンド・アンド・コントロール・ソフトウェアと検知ノードをバンドルする傾向が強まっています。

中和技術は、現在では小規模だが、オペレーターが「見る」から「止める」に移行するにつれて、CAGR 29.52%で拡大しつつあります。ロッキード・マーチンのHELIOSレーザーのような指向性エネルギー・システムは、ミサイルと比較して一発あたり小銭のコストで海上での迎撃を記録しています。高周波ハイパワーマイクロウェーブガンは、運動破片なしでドローンの電子機器を破壊するショートバーストパルスを提供し、連続生産を開始しています。ネットワーク化された40mmスマート弾から超小型UAVドッグファイターまで、キネティック・インターセプターは、指揮官に交戦範囲全体にわたる重層的な選択肢を与えます。これらの進歩は、人口密集地上空への破片落下を禁止する安全規則を遵守しなければならないエンドユーザーの間で、アンチドローン市場の魅力を大きく広げています。技術競争の中心は、高価な交換サイクルを強いることなく将来のエフェクターを受け入れることができるオープンアーキテクチャのコマンドソフトウェアであり、早期参入ベンダーのロックインを強化しています。

空港、刑務所、石油化学施設がマスト型レーダー、パノラマカメラ、電子戦用エミッターを設置したため、地上固定型アレイが2024年の支出額の42.12%を占めました。その広範なカバー範囲と継続的な電力供給は、24時間体制で定められた境界線を確保しなければならない静的施設に適しています。入退室管理や緊急対応ネットワークとの統合により、オペレーターは規制当局が要求するダッシュボードのコンプライアンスを維持することができます。コンテナ型シェルターの進歩により、固定システムは数時間以内に移転できるようになり、半永久的なカバレッジを必要とする遠征基地をサポートします。

UAV搭載型対UASプラットフォームは26.32%のCAGRを記録しているが、これはドローン・オン・ドローンによる交戦が、地上からの視線が遮られるようなダイナミックな戦場で優れているためです。MARSS Interceptor-MRのような自律型迎撃ミサイルは、5km以上離れた敵対的なドローンを追跡し、爆発物を使用せずに脅威を排除し、巻き添えリスクを低減します。MRAPに搭載された地上移動システムは、静止サイトと空中ハンターの間のギャップを埋め、機動部隊が輸送隊を保護することを可能にします。ハンドヘルドのジャマーやライフル型のディスラプターは、1km圏内では個々の兵士に最後の手段を与えます。海兵隊は、無人の脅威が沖合に移動するにつれて、甲板搭載型レーザーとRFディスラプターを採用し、拡大するアンチドローン市場からどの作戦領域も除外されないことを示しています。

地域分析

北米が2024年の売上高の41.25%を占め、首位を維持。国防総省の500億米ドルの再編は多層対UASアーキテクチャに資金を提供します。RTXやノースロップ・グラマンのような国内プライムは連続生産ロットを確保し、Andurilのようなベンチャー支援の課題は海兵隊からAI中心の契約を獲得します。統合は続いている:AxonのDedrone買収やAeroVironmentのBlueHalo買収は、ニッチな機能をより広範なコマンド・アンド・コントロール・スタックに組み込むことを目的としています。保険会社が、スタジアムや都市フェスティバルが補償を発行する前に承認されたギアを統合するよう主張し、アンチドローン市場全体で民間人の取り込みを深めているため、自治体の需要が加速しています。

アジア太平洋地域はCAGR 25.66%で最も急速に成長しています。東京とワシントンは高出力マイクロ波兵器を共同開発し、北京はCASICの下でレーザーベースの対UAS生産ラインを拡張しています。ソウルの海軍ドローンキャリア構想は、地域勢力が統合された無人脅威エンベロープを中心にブルーウォータープラットフォームを設計する方法を強調しています。オーストラリア、インド、台湾の国防近代化資金は、最近の紛争で観察された大量群戦術を鈍らせることを期待して、対ドローンに記録的な割合を割り当てています。デュアルユース産業プログラムは政府補助金を受け、輸出規制が強化される中、国内供給の回復力を確保しています。このような軍事的緊急性と産業政策の融合が、この地域全体の持続的なアンチドローン市場の拡大を後押ししています。

欧州では、欧州防衛基金の下での協調調達を背景に、着実な導入が進んでいます。タレスが主導するEISNETコンソーシアムのようなプロジェクトは、ドローンの群れに対する空とミサイルの統合防衛のためのロードマップを共有するために23の企業を結びつけた。英国はDragonFireレーザーを、ドイツはCICADA迎撃システムを、フランスはPARADEシステムを国家イベント用に調達しています。EASAによる規制の調和は国境を越えるハードルを取り除き、空港が共通のリモートIDやサイバーセキュリティ・ベースラインを導入できるようにします。国内の覇者は、輸入窒化ガリウム・パワーアンプにさらされる機会を減らすため、主権サプライチェーンを推進します。これらの取り組みにより、欧州は世界のアンチドローン市場において技術革新者であり、重要な消費者であることが証明されました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 非対称的脅威を可能にする低価格商用ドローンの普及

- 厳しい空域セキュリティ義務化(FAA空港UAS検知、EU Uスペース)

- 重要エネルギー資産周辺へのドローン侵入

- AIを活用したセンサーフュージョンが都市部のRFクラッターの検知精度を高める

- ウクライナ紛争後の国防予算の再配分はレイヤー型C-UASに向かう

- スタジアムとイベントに関する保険主導の賠償責任条項

- 市場抑制要因

- 民間空域におけるRFジャミングとキネティック・インターディクションの曖昧な合法性

- 5Gが密集する都市部における高い誤警報率

- モバイル/戦術プラットフォームのSWaP制約条件

- 高エネルギーレーザー用GaNパワーアンプ供給のボトルネック

- バリューチェーン分析

- 規制とテクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 技術別

- 検出システム

- 中和/対策システム

- プラットフォームタイプ別

- 地上固定

- 地上移動型(車両搭載型)

- ハンドヘルド

- UAVベースの対UAS

- 海軍ベース

- 業界別

- 軍事・防衛

- 国土安全保障と法執行

- 重要インフラ

- 商業・公共施設(スタジアム、テーマパーク)

- VIPプロテクション

- 動作範囲別

- 近距離(1 km未満)

- 中距離(1~5km)

- 長距離(5km以上)

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

第6章 競合情勢

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Dedrone Holdings, Inc.

- RTX Corporation

- Rohde & Schwarz India Pvt. Ltd.

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Saab AB

- Thales Group

- QinetiQ Group

- Anduril Industries, Inc.

- Leonardo S.p.A

- Northrop Grumman Corporation

- Rheinmetall AG

- CACI International Inc

- Honeywell International, Inc.

- Meteksan Defence Industry Inc.

- Drone Defence Services Ltd.

- DeTect, Inc

- Chess Technologies Ltd.

- OpenWorks Engineering Ltd.