|

市場調査レポート

商品コード

1851767

工業用水処理薬品:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Industrial Water Treatment Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 工業用水処理薬品:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月11日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

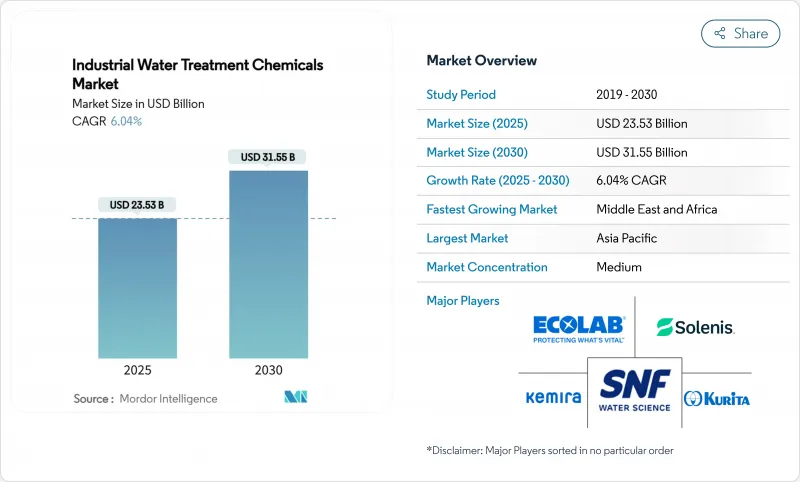

工業用水処理薬品市場規模は、2025年に235億3,000万米ドルと推計され、予測期間中(2025-2030年)のCAGRは6.04%で、2030年には315億5,000万米ドルに達すると予測されます。

成長は、PFAS除去義務の強化、随伴水量を増大させるシェールガス事業の拡大、乾燥地域における工業用水再利用目標の上昇から力強いものとなります。サプライヤーは、廃棄指向のソリューションから、高度な化学物質とAI対応投与プラットフォームを組み合わせた資源回収モデルへと軸足を移しつつあります。電力セクターが引き続き需要を支える一方で、工業用微生物の制御がミッションクリティカルになるにつれて、殺生物剤と殺菌剤はより広範な工業用水処理薬品市場を上回っています。デジタルモニタリング、特殊化学薬品、機器を組み合わせたフルサービスモデルが汎用化学薬品契約に取って代わるにつれて、競合勢力は激化しています。

世界の工業用水処理薬品市場の動向と洞察

シェールガス生産水量の増加

パーミアン・ベースンにおけるシェールオペレーションでは現在、毎日数百万バレルの随伴水が発生し、安全なリサイクルや廃棄のために高度な酸化剤、殺生物剤、高温凝固剤が必要とされています。その結果、化学薬品の需要は、淡水の取水量と処分費用を削減するため、オペレーターが逆流水の最大90%をリサイクルすることを目標としているため、さらに増大しています。140 °Cの温度と150,000 mg/Lを超える総溶解固形分に対応できる耐腐食性ブレンドを調合するサプライヤーは、プレミアム価格を確保しています。現場では、AI投与プラットフォームを処理スキッドに重ねることで、過剰投与を削減し、性能を維持しながら化学薬品使用量を15~25%削減する事例が増えています。このような利益は、工業用水処理薬品市場の販売量を増加させる経済的インセンティブとなります。

重金属とCODの排出規制強化

EUの工業排出指令と米国のNPDES許可は、カドミウム、水銀、化学的酸素要求量の基準値を引き下げており、工場は処理設備のアップグレードを余儀なくされています。第二鉄ベースの凝集剤と組み合わせた高度な有機バインダーは、従来のミョウバン溶液よりも効果的に微粒子と溶存金属を捕捉します。リアルタイムの濁度センサーと組み合わせることで、工場はコンプライアンスを損なうことなく、汚泥発生量を35%削減し、凝集剤消費量を20%削減することができると報告しています。この規制への対応と、測定可能なオペックスの節約とが相まって、繊維、金属仕上げ、エレクトロニクスの各分野での採用が加速しています。

メンブレンとUVシステムによる代替

限外ろ過モジュールとUV-LED消毒の組み合わせは、従来のセットアップよりも22%少ない凝集剤需要で93%の濁度除去を達成します。中国の自治体では、すでに670万m3/日の膜利用設備が稼動しており、ミョウバンやポリマーの使用量は減少しています。化学サプライヤーは、ポートフォリオを防汚クリーナーや膜の防腐剤にシフトすることで対応しています。試薬全体のトン数は減少するかもしれないが、サプライヤーがこれらの利益率の高い補助剤に軸足を移せば、収益の可能性は残る。

セグメント分析

腐食防止剤は2024年に工業用水処理薬品市場シェアの24.16%を占め、高圧ボイラー、復水器、パイプラインの保護において中心的な役割を果たすことが明らかになりました。プラント事業者は、1立方メートル当たり0.10米ドルの処理コストを、数百万米ドルの停電に対する安価な保険と見なしているため、需要は堅調です。有機リン酸塩混合物は現在、熱交換面に析出することなく150℃以上の温度スパイクに耐える皮膜形成アミノ酸を配合し、検査サイクルを長くしています。殺生物剤と殺菌剤は、現在の規模は小さいもの、CAGR 6.83%と工業用水処理薬品市場で最も高い伸びを示しています。微生物の影響による腐食は、石油・ガス・電力セクターで毎年数十億米ドルのコストがかかっており、毒性規制の強化に対応したDBNPAやグルタルアルデヒドなどの即効性のある酸化殺生物剤の普及を後押ししています。AI投与ツールは、ppmレベルを微調整し、廃棄物を削減し、プラントが残留酸化剤の排出制限を下回るのを助けます。

スケール防止剤、凝集剤、凝集剤は、引き続き大量のベースロードをサポートします。バイオ由来のタンニン凝集剤は、ミョウバンに匹敵するPFAS捕捉効率を達成するが、購入価格が高いため、持続可能性を重視する顧客に限られています。酸化剤、消泡剤、脱酸素剤、汚泥コンディショナーはニッチな用途に使用されるが、現場によって性能仕様が異なり、切り替えコストが高いため、安定した粗利率を実現しています。コンプライアンス基準値や再利用率の上昇に伴い、単機能試薬よりも特殊な混合試薬が、予測期間中に工業用水処理薬品市場規模を押し上げると思われます。

地域分析

アジア太平洋地域は、急速な工業化と自治体インフラの拡大に牽引され、2024年の売上高シェア37.58%で工業用水処理薬品市場をリードしました。中国では、毎日670万m3を処理する580以上の膜ベースの廃水プラントが稼動しており、浸透流束を維持するアンチスキャラント、殺生物剤、洗浄用化学薬品の需要を引き上げています。インドでは、Jal Jeevan Missionを含む水道事業が2025年まで年間9.7%の成長を維持し、従来型化学物質と先進型化学物質の両方を指定する新しい自治体の入札ラウンドを開始します。

北米は、依然として技術革新の中心地です。EPAのPFAS規制は、プラントの改修を一掃することを要求しており、ユーティリティ企業は界面活性剤強化凝集剤、粒状活性炭代替化学物質、酸化洗浄剤を大規模に調達する必要に迫られています。シェール盆地では、150,000mg/L TDSを超える塩水用に調合された特殊酸化剤、殺生物剤、腐食防止剤の大量需要が加わる。欧州は成熟しているが技術革新に熱心なユーザー基盤があり、バイオベースポリマーとグリーンディールの目標に沿った低リン配合が好まれます。

中東・アフリカ地域はCAGR 7.12%を記録すると予測され、これは世界最速です。サウジアラビアの水事業と湾岸海水淡水化事業の拡大には800億米ドルが投じられ、高塩分濃度のROプラント用に設計されたアンチスキャラントと膜洗浄剤の採用を下支えします。アラブ首長国連邦とエジプトの産業クラスターは、ゼロ液体排出システムを追求し、蒸発を制御するアンチスキャラントとマルチサイクル腐食防止剤の採用を強化しています。ラテンアメリカは、鉱滓水のリサイクルやヒ素除去のための試薬を必要とするチリやペルーの鉱業ホットスポットに牽引され、着実な成長を遂げています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- シェールガス生成随伴水量の増加(米国)

- 化学・紙パルプ廃水発生量の伸び

- 重金属とCODの排出規制強化

- 水不足地域における工業用水の再利用義務化

- 産業排水中のPFAS除去要件

- 市場抑制要因

- メンブレン&UVシステムによる代替

- 変動する特殊化学品原料価格

- 化学薬品を使わない治療を支持するネットゼロのロードマップ

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 製品タイプ別

- スケール抑制剤

- 腐食防止剤

- 殺生物剤と殺菌剤

- 凝固剤と凝集剤

- pHコンディショナー

- 消泡剤

- 脱酸素剤

- スラッジコンディショナー

- 酸化剤

- その他

- エンドユーザー業界別

- 石油・ガス

- 電力

- 紙

- 金属・鉱業

- 化学

- その他のエンドユーザー業界

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- 3M

- Accepta Water Treatment

- BASF

- Buckman

- Chemifloc

- Clariant

- DuPont

- Ecolab Inc.

- Feralco AB

- Italmatch AWS

- IXOM

- Kemira

- Kurita Water Industries Ltd

- Lenntech B.V.

- SNF Group

- Solenis LLC

- Thermax Limited

- Veolia Water Technololgies, Inc.