|

市場調査レポート

商品コード

1851788

炭素回収および貯留(CCS):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Carbon Capture And Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 炭素回収および貯留(CCS):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月21日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

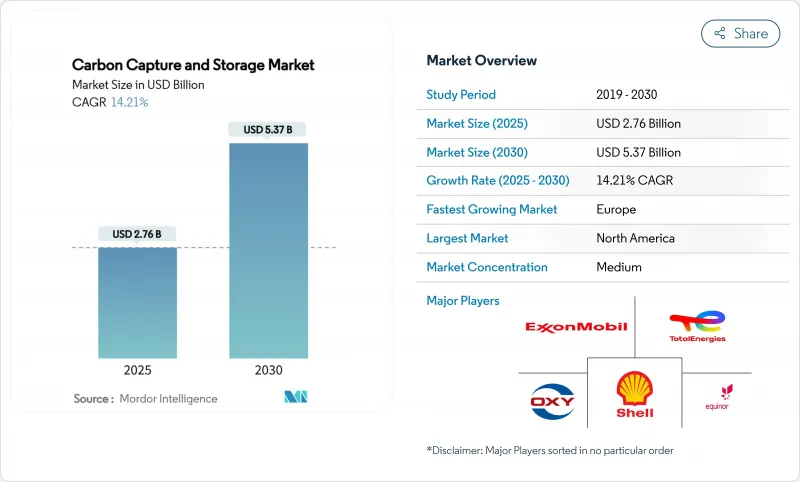

炭素回収および貯留(CCS)市場規模は2025年に27億6,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは14.21%で、2030年には53億7,000万米ドルに達すると予測されます。

規制圧力の高まり、捕捉技術の成熟化、専用の削減ソリューションなしでは重工業がネットゼロ義務を果たせないという認識が、この拡大を支えています。各国政府は、排出量規制の強化、炭素価格制度の拡大、税制優遇措置の引き上げを進めており、CCSをパイロット・スケールの実験から商業展開へとシフトさせる価格シグナルを生み出しています。支持的な政策と技術コスト低下の収束は、CCSを将来の炭素負債に対するヘッジとみなす石油メジャーや産業コングロマリットからの民間資本をも惹きつけています。しかし、セメント、鉄鋼、化学、製油所などの分野では、CCSに代わる実用的な選択肢はほとんどなく、CCSは過渡的なオプションではなく、構造的な要件となっています。

世界の炭素回収および貯留(CCS)市場動向と洞察

CO2-EORプロジェクトに対する新たな需要

石油増進回収法(EOR)は、成熟した貯留層からの生産を延長しながら、回収した炭素を収益化するという2つの収益の流れを生み出すため、再び注目を集めています。石油メジャーは、枯渇した油田に肥料、鉄鋼、石油化学の排出事業者を組み合わせ、初期導入段階で回収拠点を利益を生む資産に変えています。このアプローチは、投資回収期間を短縮し、固定客を確保し、すでに広範なパイプライン網を持つ地域でのインフラ整備を加速させる。また、大容量のCO2を処理する実践的な経験を提供し、EORの需要が時間の経過とともに減少していく中で、純粋な貯留プロジェクトへの橋渡しを確立します。増加するバレルからの収益の可視性は、投資家が分離回収プラントや圧入井戸に必要な高額な初期資本を正当化するのに役立ち、独立型隔離サービスへの移行をスムーズにします。

炭素価格決定と排出権取引制度の拡大

炭素市場は現在、キャップ・アンド・トレードの枠を超え、国境調整やセクター別賦課金を含むまでに拡大しており、規制地域に輸出する製造業者の経済計算を変えています。EUの炭素国境調整メカニズムは、輸入された排出集約型商品にシャドープライスを適用し、海外の生産者にCCSへの投資を強制し、市場シェアを失うリスクを回避しています。カリフォルニア州は、キャップ・アンド・トレードを2030年まで延長し、排出枠の割り当てを厳格化することで、CCSを企業の社会的責任というよりも、むしろコンプライアンス・コスト回避の手段にしています。自主的な炭素市場は成熟しつつあり、追加性についての疑問は残るもの、検証された貯蔵トン数に対する二次的な収益化ルートはまだ形成されています。これらの政策手段はいずれも、削減のためのフロアプライスを引き上げ、削減コストと市場インセンティブとの間の経済的ギャップを縮めるものです。

CCSプラントの高いCAPEXとOPEX

産業規模の設備には、通常5億米ドル~8億米ドルの先行投資が必要であり、政策の確実性が低い場合、エクイティファイナンシングは困難です。カーボン・クリーンのサイクロンCC(CycloneCC)のような革新的な溶媒システムでさえ、回収コストを1トン当たり30米ドルまで下げているが、商業規模でのスケールメリットを実証するには至っていないです。運転コストは、ベースライン・プラントの効率を15~30%低下させるエネルギー罰則によってさらに重荷となり、事業者は電力を追加購入するか、生産量の低下を受け入れざるを得ないです。発展途上国では、譲許的資金へのアクセスが依然として限られているため、排出削減のニーズが大きいにもかかわらず、導入が遅れています。そのため、資本集約度は投資回収期間を長期化させ、早期導入者をリスクを吸収できる大企業や国営企業に絞り込みます。

セグメント分析

2024年の炭素回収および貯留(CCS)市場シェアの82.19%を占める燃焼前捕捉は、製油所や化学コンビナートですでに一般的なスチームメタン改質装置やバイオマスガス化炉と連携しています。この分野には、数十年にわたる運転データが蓄積されており、グリーンフィールド建設時に設置した場合の追加コストが低いという利点があります。しかし、このプロセスは20~25%のエネルギー・ペナルティーを課し、溶媒再生は依然として資本集約的です。オキシ燃料燃焼は、2030年までCAGR 18.51%の成長が予測され、Brevikセメントプラントのような、大規模な排ガス分離を行わずにプロセス排ガスを回収するプロジェクトに後押しされます。純粋な酸素の中で燃料を燃焼させることで、排気流はほぼ純粋なCO2となり、下流の圧縮が簡素化されます。技術プロバイダーは、改修に適したモジュール式の酸素燃料ユニットを導入しており、空気分離の経済性が改善されたことで、燃焼後の代替燃料に対する競争力が強化されています。重工業が最小限の効率損失で深いカットを求めるにつれて、オキシ燃料の市場シェアは急速に拡大し、炭素回収および貯留(CCS)市場で長年リードしてきた予備燃焼に課題すると予想されます。

地域分析

2024年の炭素回収および貯留(CCS)市場シェアは北米が51.24%で首位に立ち、直接空気捕集には1トン当たり85米ドル、点源捕集には60米ドルの45Q税額控除が適用されます。米国メキシコ湾岸には、排出事業者、パイプライン回廊、塩水帯水層が集中しており、エクソンモービルが提案する1,000億米ドルのヒューストンシップチャネルネットワークのようなハブ構想が可能です。カナダは、DAC設備には60%、その他の回収システムには50%の投資税額控除を適用してこの地域を補完し、ストラスコナ・リソーシズとカナダ成長基金(Canada Growth Fund)による20億米ドルのパートナーシップのような合弁事業に拍車をかけています。メキシコは国境を越えた輸送パートナーとして位置づけられ、枯渇した沖合油田での共有貯蔵ソリューションを模索しています。

欧州は、2025~2030年のCAGRが26.64%と最も速いと予測され、イノベーション基金、EU ETS、2025年にオーロラでのCO2注入を開始したノルウェーの先駆的なロングシップ・プロジェクトに支えられています。ドイツのCCS法草案は、陸上貯留の禁止を撤廃し、北ドイツ海盆のロックを解除する一方、オランダはPorthosハブを推進し、英国はHyNetとTeesideクラスターを推進しています。国境を越えた輸送協定は成熟しつつあり、インフラを共有することで、小規模な産業排出者にとっては単価が下がります。カーボンプライシング、国境関税、専用公的助成金の組み合わせが民間投資を加速させ、欧州は早くから動き出している北米との差を確実に縮める。

アジア太平洋は、中国の2060年中立化公約と、2025年の最初の酸素燃料セメント実証試験により、地域のプロセス産業に適合する技術が実証されたことで、長期的には最大の上昇要因となります。日本はオーストラリアと液化CO2の輸送ルートを共同開発し、重工業地帯とボナパルト海盆の海洋貯留を結んでいます。インドネシアは、豊富な深海帯水層を活用し、2030年までに15のCCSプロジェクトを目標としています。しかし、この地域は断片的な規制と手頃な資金へのアクセスに悩まされており、本格的な離陸は2030年以降にずれ込む可能性があります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- CO2-EORプロジェクトに対する新たな需要

- カーボンプライス制度とETS制度の拡大

- 国のネット・ゼロ法制の強化

- 低炭素合成燃料プロジェクトのスケールアップ

- 貯蔵を必要とする直接空気捕捉(DAC)ビルドアウト

- 市場抑制要因

- CCSプラントの高いCAPEXとOPEX

- より安価な再生可能エネルギーの魅力の高まり

- 陸上CO2パイプラインに対する世論の反対

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 技術別

- 予備燃焼

- 燃焼後回収

- 酸素燃焼キャプチャ

- エンドユーザー業界別

- 石油・ガス

- 石炭・バイオマス発電所

- 鉄鋼

- セメント

- 化学品

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ノルウェー

- オランダ

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/ランキング分析

- 企業プロファイル

- Air Liquide

- Aker Solutions

- Baker Hughes

- Carbon Clean

- CF Industries Holdings, Inc.

- Climeworks

- Dakota Gasification Company

- ENEOS Xplora Inc.

- Equinor ASA

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Halliburton

- Honeywell International LLC

- Linde plc

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Occidental Petroleum Corporation

- Shell plc

- Siemens Energy

- SLB Capturi

- Svante Technologies Inc

- TotalEnergies