|

市場調査レポート

商品コード

1641992

決済セキュリティ:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Payment Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 決済セキュリティ:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

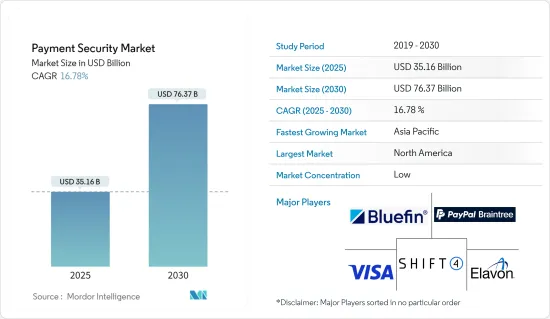

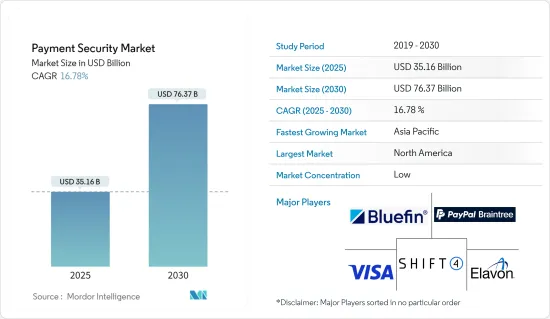

決済セキュリティの市場規模は2025年に351億6,000万米ドルと推計され、予測期間(2025~2030年)のCAGRは16.78%で、2030年には763億7,000万米ドルに達すると予測されます。

決済セキュリティ市場は、オンライン決済やモバイル決済への世界の移行が加速する中、デジタル取引を保護する上で極めて重要な役割を果たしています。決済セキュリティ・ソリューションの採用が増加している背景には、デジタル決済手段の増加があり、機密性の高い金融データを保護する強固な仕組みが必要となっています。この市場には、決済の暗号化、安全なトランザクション処理、PCI DSS(Payment Card Industry Data Security Standard)などのコンプライアンス基準の遵守など、さまざまなソリューションが含まれています。eコマースの拡大に伴い、不正行為を防止し、消費者の信頼を維持するために、決済セキュリティはますます重要になっています。

決済セキュリティの重要な基礎知識

主なハイライト

- プラットフォームと業界を超えた統合:決済セキュリティ市場はさまざまなプラットフォームや業界にまたがって統合されており、それぞれに独自の課題と機会が存在します。モバイルベースとウェブベースのプラットフォームが最前線で、小売、ヘルスケア、ITなどの分野に対応しています。オンライン決済システムの普及により、安全な決済ゲートウェイ、決済認証、決済詐欺防止ツールの需要が高まっています。このような信頼の高まりは、決済セキュリティ・ソリューションの強化の必要性を浮き彫りにし、ペイメントカードのセキュリティを保護し、安全なトランザクション処理を確保することの重要性を強調しています。

- 競合市場の情勢:決済セキュリティ市場は競争が激しく、CyberSource Corporation(Visa Inc.)、Bluefin Payment Systems LLC、Braintree Payment Solutions LLCなどの主要企業が技術革新をリードしています。これらの企業は、決済データ保護、安全な決済ゲートウェイ・サービス、業界規制への準拠に焦点を当てたソリューションを提供しています。これらの企業の役割は、業界の見通しを形成する上で極めて重要であり、決済方法が進化し続ける中で必要な保護措置が確実に講じられるようにすることで、市場動向や業界全体の成長に影響を与えています。

拡大するデジタル決済手段とeコマース詐欺

主なハイライト

- デジタル決済の普及とセキュリティニーズ:デジタル決済の急速な普及により、世界の金融情勢は大きく変化しています。スマートフォンの普及とインターネット普及率の向上により、モバイル決済やオンライン決済を利用する消費者が増えています。この動向は、デジタルインフラが整備されつつある新興国で特に顕著です。デジタル決済が普及するにつれて、強固な決済セキュリティ・ソリューションへの需要が高まっています。決済の暗号化、安全なトランザクション処理、決済認証といった不可欠な機能は、決済セキュリティ・ソリューションの重要な構成要素となりつつあり、決済プロセス全体を通じて消費者データが確実に保護されるようになっています。

- eコマース詐欺とセキュリティ・ソリューション:eコマースの台頭は詐欺行為の増加につながり、決済詐欺防止は企業にとって最優先事項となっています。オンラインショッピングの増加に伴い、特にペイメントカードのセキュリティ侵害や不正取引など、不正行為のリスクが急増しています。その結果、不正行為をリアルタイムで検知・防止するよう設計されたeコマース決済セキュリティ・ソリューションが広く採用されるようになりました。企業は、人工知能と機械学習を活用して取引パターンを分析し、疑わしい行為にフラグを立てる高度な決済セキュリティ・ソフトウェアを導入しています。さらに、安全な決済ゲートウェイにより、すべての取引が安全に処理され、データ漏洩や不正行為のリスクを最小限に抑えることができます。

オンライン決済における信用問題への取り組み

主なハイライト

- デジタル取引における消費者の信頼構築デジタル決済の利点にもかかわらず、オンライン決済に対する消費者の信頼構築は依然として大きな課題となっています。決済セキュリティのコンプライアンス、データ漏えい、不正行為に対する懸念から、一部の消費者はデジタル決済の導入をためらっています。このため、企業は決済データ保護の強化やPCI DSSのような業界基準への準拠に注力し、より透明で安全な決済プロセスを推進するようになっています。安全対策について消費者を教育し、安全な決済ゲートウェイや決済認証プロセスを通じて保証を提供することは、こうした信頼の障壁を克服する上で不可欠なステップです。

- COVID-19の決済セキュリティへの影響:COVID-19の大流行により、消費者や企業は非接触型や遠隔型の決済ソリューションを求めるようになり、デジタル決済手段の採用が加速しています。しかし、この急速な変化は、既存の決済セキュリティ基盤の脆弱性を露呈することにもなった。その結果、デジタル取引の急増に対応するため、決済の暗号化と安全なトランザクション処理の強化にますます焦点が当てられています。企業が新たな常態に適応し、デジタル化が進む世界で顧客の金融データを保護しようと努める中で、信頼性が高く安全な決済セキュリティソフトウェアの必要性はかつてないほど高まっています。

決済セキュリティ市場の動向

小売セクターが高成長を遂げる

- 大幅な拡大を遂げる小売セクター:決済セキュリティ市場における小売セクターの拡大は、主にeコマースの急成長によってもたらされています。オンラインショッピングが普及するにつれ、小売業者は決済詐欺の脅威の増大に直面し、高度な決済セキュリティ対策の導入が必要となっています。このようなデジタル取引の急増により、オンライン決済セキュリティは小売業者にとって最優先事項となっており、小売業者は決済の暗号化、認証、安全なトランザクション処理などの技術を導入して顧客データを保護し、PCI DSS準拠を確実にしています。

- モバイル決済のセキュリティ強化:モバイル決済の普及は、決済セキュリティ・ソリューションに対する小売業界の需要に大きく貢献しています。消費者によるスマートフォンでの取引が増加する中、小売業者は安全な決済アプリや生体認証など、モバイルプラットフォームに合わせたデジタルセキュリティ対策を採用しつつあります。これらの技術は決済セキュリティを強化し、デジタルショッピングに対する顧客の信頼を高めるため、市場の成長をさらに促進し、モバイル決済セキュリティの重要性を強化しています。

- コンプライアンスと不正防止:小売業者にとって、PCI DSSなどの決済セキュリティ基準への準拠は、決済詐欺を防止し、取引の安全な処理を確保する上で極めて重要です。安全な決済ゲートウェイを小売業務に統合することは、顧客の信頼を維持し、業界規制を遵守するために不可欠です。小売企業は、リスクを軽減し市場競争力を維持するため、これらのテクノロジーに積極的に投資しており、決済セキュリティ・ソリューションを最新の業界動向に対応させています。

- 今後の成長見通し:業界レポートによると、企業が安全な決済システムの重要性を認識していることから、小売業界の決済セキュリティソリューションに対する需要は今後も伸び続けると見られています。高度なセキュリティ対策の継続的な統合が市場の持続的成長を支え、小売業者がリスクを軽減し、進化するセキュリティ基準へのコンプライアンスを維持できるようにすることで、市場規模全体と業界動向にさらに貢献すると予想されます。

北米が最大の市場シェアを占める

- 高度なインフラと規制環境:北米は、先進的な技術インフラと厳格な規制環境に牽引され、世界の決済セキュリティ市場をリードしています。同地域が決済データ保護を重視しているのは、決済詐欺事件の増加に対応するためです。北米の企業はPCI DSSのような基準への準拠を優先し、安全な決済ゲートウェイ、暗号化技術、認証システムを導入して顧客情報を保護し、安全なデジタル決済取引を行っています。

- 決済セキュリティ技術の革新:北米が決済セキュリティ市場でリーダーシップを発揮しているのは、技術革新に重点を置いているからでもあります。同地域は、AIを活用した不正防止ツールやブロックチェーンを活用した認証システムなど、最先端の決済セキュリティ技術の開発で最先端を走っています。こうした進歩は、デジタル決済の安全性を高めるだけでなく、北米を決済セキュリティ市場の世界的リーダーとして位置づけ、業界の市場価値を押し上げ、将来の市場予測に影響を与えています。

- eコマースのエコシステムが市場の地位を強化:この地域のダイナミックなeコマースエコシステムは、市場シェアをさらに強化します。オンラインショッピングやモバイル決済アプリケーションの普及に伴い、安全な決済ソリューションへの需要が高まっています。デジタル決済のセキュリティ対策の導入は、北米における消費者の信頼とビジネスの成長を維持するために不可欠であり、引き続き市場価値の主要な促進要因として、市場セグメンテーションと市場全体の概観に積極的に反映されています。

- 市場成長の見通し:決済セキュリティ研究と次世代セキュリティ・ソリューション開発への継続的な投資により、北米の市場価値は着実に成長すると予想されます。同地域の強固なインフラ、技術革新への取り組み、規制の先見性により、同地域は世界の決済セキュリティ業界の最前線に位置し、デジタル取引の保護を確保し、当面の市場予測に影響を与え続けるでしょう。

決済セキュリティ業界の概要

多様なプレーヤーによる高度に細分化された市場:ペイメント・セキュリティ市場は、世界の大手企業と地域に特化した専門企業が混在して市場シェアを争っており、高度に細分化されているのが特徴です。単一の企業が市場を独占することはなく、さまざまなベンダーが独自のソリューションを提供しています。多国籍の大企業からニッチ・プロバイダーまで、さまざまな企業がこの市場を非常に競争的なものにしています。細分化された市場には技術革新と専門化の機会が数多くあり、中小企業は独自のセキュリティ・ソリューションを提供することでニッチを切り開くことができます。

市場リーダーは多様な戦略を展開:決済セキュリティ市場の主要企業であるBraintree Payment Solutions、Bluefin Payment Systems、Elavon、SecurionPay、CyberSource(Visa Inc.)これらのプレーヤーは、戦略的パートナーシップ、買収、広範な製品ポートフォリオを通じて地位を確立してきました。これらの企業は、セキュアなトランザクション処理、暗号化技術、世界なセキュリティ基準への準拠に注力することで差別化を図っています。規制の変化に適応し、さまざまな地域で拡張性のあるソリューションを提供する能力は、リーダーシップを維持し、業界の市場見通しに影響を与える重要な要因となっています。

主要成功要因としてのイノベーションと規制への適応:決済セキュリティ市場は、急速な技術の進歩と規制状況の進化に牽引されています。不正検知のためのAIや機械学習の統合、クラウドベースのセキュリティソリューションの開発など、技術革新に成功した企業は競争優位に立つことができます。さらに、複雑な規制環境を乗り切り、PCI DSSのような基準へのコンプライアンスを確保することも、成功には欠かせないです。シームレスでコンプライアンスに対応し、コスト効率の高いセキュリティ・ソリューションを提供できる企業は、このダイナミックな市場において有利な立場にあり、業界動向や市場全体の見直しに影響を与えると思われます。

競合市場の戦略と今後の動向:決済セキュリティ市場が進化を続ける中、企業は消費者データを保護し、安全で信頼性の高いデジタル取引を実現する技術の開発と導入に、常に用心深く積極的に取り組む必要があります。そのためには、新たな脅威を先取りし、市場での競争力を維持するための技術革新、規制遵守、市場調査への継続的な投資が必要となります。その結果、決済セキュリティ市場の将来見通しは有望であり、さまざまな業界や地域で安全な決済ソリューションに対する需要が高まっていることから、継続的な成長が期待されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- 市場促進要因

- デジタル決済の導入拡大

- eコマースにおける不正行為の増加

- 市場の課題

- オンライン決済手段に対する信頼の欠如

- COVID-19の業界への影響

第5章 市場セグメンテーション

- プラットフォーム別

- モバイルベース

- ウェブベース

- その他のプラットフォーム

- エンドユーザー産業別

- 小売

- ヘルスケア

- ITおよびテレコム

- 旅行・ホスピタリティ

- その他エンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- アジア

- インド

- 中国

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第6章 競合情勢

- 企業プロファイル

- CyberSource Corporation(Visa Inc.)

- Bluefin Payment Systems LLC

- Braintree Payment Solutions LLC

- Elavon Inc.

- SecurionPay

- Broadcom Inc.

- Signified Inc.

- TokenEx Inc.

- TNS Inc.

- Shift4 Corporation

第7章 投資分析

第8章 市場機会と今後の動向

The Payment Security Market size is estimated at USD 35.16 billion in 2025, and is expected to reach USD 76.37 billion by 2030, at a CAGR of 16.78% during the forecast period (2025-2030).

The payment security market plays a pivotal role in safeguarding digital transactions as the global shift towards online and mobile payments accelerates. The rising adoption of payment security solutions is driven by the increasing number of digital payment modes, necessitating robust mechanisms to protect sensitive financial data. This market encompasses a wide array of solutions such as payment encryption, secure transaction processing, and adherence to compliance standards like PCI DSS (Payment Card Industry Data Security Standard). As e-commerce expands, payment security becomes increasingly critical to prevent fraud and maintain consumer trust.

Significant Fundamentals in Payment Security

Key Highlights

- Integration Across Platforms and Industries: The payment security market integrates across various platforms and industries, each presenting unique challenges and opportunities. Mobile-based and web-based platforms are at the forefront, catering to sectors such as retail, healthcare, and IT. The demand for secure payment gateways, payment authentication, and payment fraud prevention tools is escalating due to the widespread use of online payment systems. This growing reliance highlights the need for enhanced payment security solutions, emphasizing the importance of protecting payment card security and ensuring secure transaction processing.

- Competitive Market Landscape: The payment security market is highly competitive, with key players like CyberSource Corporation (Visa Inc.), Bluefin Payment Systems LLC, and Braintree Payment Solutions LLC leading innovation. These companies offer solutions focused on payment data protection, secure payment gateway services, and compliance with industry regulations. Their role is crucial in shaping the industry outlook, ensuring that necessary safeguards are in place as payment methods continue to evolve, thereby influencing market trends and overall industry growth.

Expanding Digital Payment Modes and E-commerce Frauds

Key Highlights

- Digital Payment Adoption and Security Needs: The rapid adoption of digital payment modes is transforming the global financial landscape. The proliferation of smartphones and increasing internet penetration is driving more consumers toward mobile and online payment systems. This trend is particularly prominent in emerging economies with growing digital infrastructures. As digital payments become more prevalent, the demand for robust payment security solutions intensifies. Essential features such as payment encryption, secure transaction processing, and payment authentication are becoming crucial components of any payment security solution, ensuring that consumer data is protected throughout the payment process.

- E-commerce Fraud and Security Solutions: The rise of e-commerce has led to an increase in fraudulent activities, making payment fraud prevention a top priority for businesses. With the growth of online shopping, the risk of fraud, particularly in payment card security breaches and unauthorized transactions, has surged. This has resulted in the widespread adoption of e-commerce payment security solutions designed to detect and prevent fraudulent activities in real-time. Companies are implementing advanced payment security software that utilizes artificial intelligence and machine learning to analyze transaction patterns and flag suspicious activities. Additionally, secure payment gateways ensure that all transactions are processed securely, minimizing the risk of data breaches and fraud.

Addressing Trust Issues in Online Payments

Key Highlights

- Building Consumer Trust in Digital Transactions: Despite the advantages of digital payments, building consumer trust in online payment modes remains a significant challenge. Concerns about payment security compliance, data breaches, and fraud have made some consumers hesitant to adopt digital payment methods. This has led to a push for more transparent and secure payment processes, with companies focusing on enhancing payment data protection and compliance with industry standards like PCI DSS. Educating consumers about the safety measures in place and providing assurance through secure payment gateways and payment authentication processes are essential steps in overcoming these trust barriers.

- COVID-19's Impact on Payment Security: The COVID-19 pandemic has accelerated the adoption of digital payment methods as consumers and businesses seek contactless and remote payment solutions. However, this rapid shift has also exposed vulnerabilities in existing payment security infrastructures. As a result, there has been an increased focus on strengthening payment encryption and secure transaction processing to handle the surge in digital transactions. The need for reliable and secure payment security software has never been more critical, as businesses adapt to the new normal and strive to protect their customers' financial data in an increasingly digital world.

Payment Security Market Trends

Retail Sector to Witness High Growth

- Retail Sector Experiencing Significant Expansion: The retail sector's expansion within the payment security market is primarily driven by the exponential growth of e-commerce. As online shopping becomes more prevalent, retailers face increasing threats of payment fraud, necessitating the adoption of advanced payment security measures. This surge in digital transactions has made online payment security a top priority for retailers, who are implementing technologies such as payment encryption, authentication, and secure transaction processing to safeguard customer data and ensure PCI DSS compliance.

- Mobile Payment Security Gains Traction: The proliferation of mobile payments is significantly contributing to the retail sector's demand for payment security solutions. As consumers increasingly use smartphones for transactions, retailers are adopting digital security measures tailored for mobile platforms, including secure payment apps and biometric authentication. These technologies enhance payment security and build customer confidence in digital shopping, further driving market growth and reinforcing the importance of mobile payment security.

- Compliance and Fraud Prevention: Compliance with payment security standards, such as PCI DSS, is crucial for retailers to prevent payment fraud and ensure the secure processing of transactions. The integration of secure payment gateways into retail operations is essential for maintaining customer trust and adhering to industry regulations. Retailers are heavily investing in these technologies to mitigate risks and maintain a competitive edge in the market, ensuring that their payment security solutions are up to date with the latest industry trends.

- Future Growth Outlook: Industry reports indicate that the retail sector's demand for payment security solutions will continue to grow as businesses recognize the importance of secure payment systems. The ongoing integration of advanced security measures is expected to support sustained market growth, ensuring that retailers can mitigate risks and maintain compliance with evolving security standards, further contributing to the overall market size and industry trends.

North America occupies the Largest Market Share

- Advanced Infrastructure and Regulatory Environment: North America leads the global payment security market, driven by its advanced technological infrastructure and strict regulatory environment. The region's strong emphasis on payment data protection is a response to the increasing incidents of payment fraud. Businesses in North America prioritize compliance with standards like PCI DSS, implementing secure payment gateways, encryption technologies, and authentication systems to protect customer information and secure digital payment transactions.

- Innovation in Payment Security Technologies: North America's leadership in the payment security market is also due to its focus on innovation. The region is at the forefront of developing cutting-edge payment security technologies, including AI-driven fraud prevention tools and blockchain-based authentication systems. These advancements not only enhance the security of digital payments but also position North America as a global leader in the payment security market, driving the industry's market value and influencing future market predictions.

- E-commerce Ecosystem Strengthens Market Position: The region's dynamic e-commerce ecosystem further bolsters its market share. As online shopping and mobile payment applications proliferate, the demand for secure payment solutions has intensified. The adoption of digital payment security measures is essential for sustaining consumer trust and business growth in North America, which continues to be a major driver of market value, reflecting positively in market segmentation and overall market overview.

- Market Growth Forecast: With continuous investments in payment security research and the development of next-generation security solutions, North America's market value is expected to grow steadily. The region's robust infrastructure, commitment to innovation, and regulatory foresight will likely keep it at the forefront of the global payment security industry, ensuring the protection of digital transactions and influencing market predictions for the foreseeable future.

Payment Security Industry Overview

Highly Fragmented Market with Diverse Players: The payment security market is characterized by a high degree of fragmentation, with a mix of global giants and specialized regional firms competing for market share. No single company dominates, and the market is populated by a variety of vendors offering distinct solutions. Companies ranging from large multinational corporations to niche providers make this market highly competitive. The fragmentation indicates numerous opportunities for innovation and specialization, allowing smaller players to carve out niches by offering unique security solutions.

Market Leaders Exhibit Diverse Strategies: The leading companies in the payment security market, such as Braintree Payment Solutions, Bluefin Payment Systems, Elavon, SecurionPay, and CyberSource (Visa Inc.), represent a broad spectrum of services and technologies. These players have established themselves through strategic partnerships, acquisitions, and extensive product portfolios. They differentiate themselves by focusing on secure transaction processing, encryption technologies, and compliance with global security standards. Their ability to adapt to regulatory changes and provide scalable solutions across different regions is a key factor in maintaining their leadership and influencing the industry's market outlook.

Innovation and Regulatory Adaptation as Key Success Factors: The payment security market is driven by rapid technological advancements and evolving regulatory landscapes. Companies that can successfully innovate, such as by integrating AI and machine learning for fraud detection or developing cloud-based security solutions, are poised to gain a competitive edge. Additionally, navigating the complex regulatory environment and ensuring compliance with standards like PCI DSS is crucial for success. Players who can offer seamless, compliant, and cost-effective security solutions will be well-positioned in this dynamic market, influencing industry trends and overall market review.

Competitive Market Strategies and Future Trends: As the payment security market continues to evolve, companies must remain vigilant and proactive in developing and implementing technologies that protect consumer data and ensure secure, trustworthy digital transactions. This will require ongoing investment in innovation, regulatory compliance, and market research to stay ahead of emerging threats and maintain a competitive edge in the market. As a result, the future outlook for the payment security market is promising, with continued growth expected in response to the increasing demand for secure payment solutions across various industries and regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Growing Adoption of Digital Payment Modes

- 4.4.2 Increase in Fraudulent Activities in E-commerce

- 4.5 Market Challenges

- 4.5.1 Lack of Trust in Online Payment Modes

- 4.6 Impact of COVID-19 on the industry

5 MARKET SEGMENTATION

- 5.1 By Platform

- 5.1.1 Mobile Based

- 5.1.2 Web Based

- 5.1.3 Other Platforms

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 Healthcare

- 5.2.3 IT and Telecom

- 5.2.4 Travel and Hospitality

- 5.2.5 Other End-user Industry

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.3 Asia

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 CyberSource Corporation (Visa Inc.)

- 6.1.2 Bluefin Payment Systems LLC

- 6.1.3 Braintree Payment Solutions LLC

- 6.1.4 Elavon Inc.

- 6.1.5 SecurionPay

- 6.1.6 Broadcom Inc.

- 6.1.7 Signified Inc.

- 6.1.8 TokenEx Inc.

- 6.1.9 TNS Inc.

- 6.1.10 Shift4 Corporation