|

市場調査レポート

商品コード

1910546

LED照明:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| LED照明:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 161 Pages

納期: 2~3営業日

|

概要

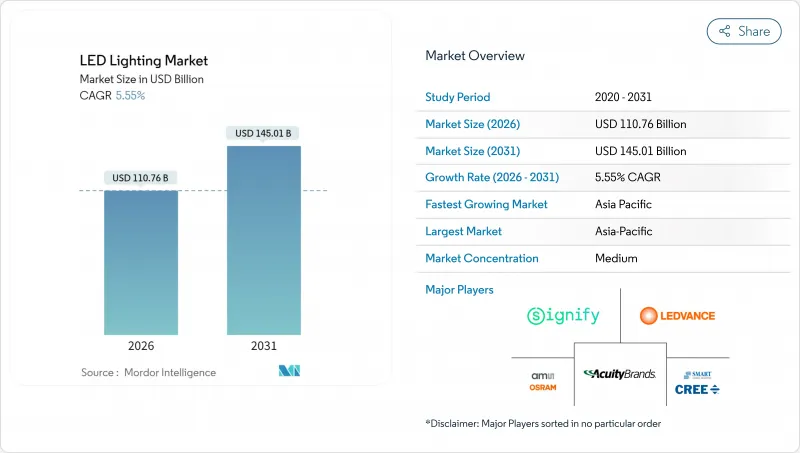

LED照明市場は、2025年の1,049億3,000万米ドルから2026年には1,107億6,000万米ドルへ成長し、2026年から2031年にかけてCAGR5.55%で推移し、2031年までに1,450億1,000万米ドルに達すると予測されています。

この推移は、業界が急速な初期導入段階から、品質の差別化と統合制御が競合優位性を左右する、安定した置換主導の段階へ移行していることを示しています。非効率な照明器具に対する政府による段階的廃止、2014年から2016年に設置された設備の二次的な置換需要、そしてスマートシティ計画の加速が、主要な需要の牽引役となっています。LEDハードウェアにセンサー、ネットワークインターフェース、付加価値サービスを統合するメーカーは、より大規模な契約と長期的な顧客関係の確保に有利です。一方、サムスンの撤退計画に象徴される供給側の統合が進む中、残存サプライヤー間の競争は激化しており、販売チャネルの確保と利益率の維持に向けた競争が加速しています。

世界のLED照明市場の動向と洞察

政府のインセンティブと段階的廃止が市場変革を推進

政策介入は依然としてLED照明市場における最強の推進力です。オーストラリアの「温室効果ガス・エネルギー最低基準規制」(2026年3月施行)は最低効率基準を引き上げ、白熱灯の禁止を2030年まで延長することで、メーカーに明確なコンプライアンススケジュールを提供し、滞留在庫リスクを軽減します。連邦基準が州・自治体調達を導く米国でも同様の動きが見られ、予測可能な大量購入パイプラインが形成されています。フィラデルフィア市が実施した13万1千基の照明器具更新プログラム(エネルギー消費量50%削減、年間240万米ドルの節約効果)のような都市規模の転換事例は、他の自治体に対しても経済的合理性を証明しています。こうした政策により、適合性が高く高品質なランプや照明器具のみが市場で生き残るようになり、平均販売価格が上昇。強力な認証ポートフォリオを有するブランドが恩恵を受ける構造となっています。

スマートシティインフラがLED導入を加速

スマートシティへの投資は、照明を都市管理のためのデータ基盤へと転換し、各照明器具の戦略的価値を高めます。ミルトン・キーンズでは2万基のセンサー搭載LED街路灯を導入し、エネルギー使用量を40%削減するとともに、交通量や大気質のモニタリング機能を追加しました。パラマッタでは65%の省エネルギーを達成し、照明ノードを市全体のIoTネットワークに統合。照明機能を超えた収益創出サービスを支えています。これらの事例は、LED照明市場がコモディティ製品の販売から、長期サービス契約とデータプラットフォーム収益源を伴う多分野にわたるインフラプロジェクトへと移行していることを示しています。

初期費用の高さがプレミアムセグメントの普及を制限

エントリーモデルとプレミアム接続型照明器具の価格差は依然として大きく、コスト重視地域での導入を阻んでいます。部品コストは年々低下しているもの、可変スペクトル、統合センサー、堅牢な熱管理といった先進機能は部品原価の圧迫要因となります。その結果、LED照明市場は二極化しており、基本モデルは純粋な価格競争に、プレミアム製品はライフサイクルコスト削減を訴求するもの、一部の購入者は依然としてその価値を過小評価しています。新興市場、中小企業、限られた資本を持つ自治体予算は最も厳しい制約に直面しており、高利益率のスマート製品や人間中心設計製品の普及が遅れています。

セグメント分析

2025年の売上高の61.45%を照明器具が占め、光学系・放熱器・制御機能を統合した一体型設計が買い手から支持されていることが示されました。この優位性により、特定の建築・産業仕様に合わせた製品開発が可能なフルフィクスチャベンダーのLED照明市場におけるシェアが拡大しています。照明器具カテゴリーは平均販売価格が高く、交換サイクルも長いため、メーカーのキャッシュフローを安定させます。一方、ランプセグメントは住宅用・軽商用ソケットにおける二次交換需要の波に牽引され、8.29%のCAGRで拡大が見込まれます。Cree LEDのXLamp XFLはコンパクトな筐体で最大20,000ルーメンを実現し、携帯照明向けに特定の性能向上をもたらすランプ技術革新の好例です。

二次的な交換動向の高まりにより、配線工事や天井工事を必要とせず、迅速な性能向上を求める所有者層においてランプの重要性が増しています。しかしながら、LED照明市場では、ネットワーク制御機能を統合し、電力会社の補助金申請手続きをサポートする照明器具メーカーが顧客の囲い込みを強化し、引き続き優位性を保っています。企業が改修用ランプと新規接続型器具を併せて提供するハイブリッド戦略は、予算重視層と機能重視層の双方に対応する上で有効です。

卸売・小売チャネルは2025年に53.55%のシェアを占めました。これは請負業者や施設管理者が、製品の即時入手性、技術指導、アフターサポートを重視しているためです。このチャネルはプロジェクトのスケジュール確保や地域規制・仕様への準拠を保証することで、LED照明市場の基盤を支えています。しかし、住宅消費者や中小企業による直接配送の採用が増加しているため、Eコマースは2031年まで6.62%のCAGRで最速の成長が見込まれています。Havellsなどのメーカーは、サウスカロライナ州アンダーソンに在庫を完備した倉庫を開設すると同時に、独立した照明代理店との関係を維持することで、デュアルチャネルモデルを活用しています。

デジタル購入の過程では、カタログの標準化と、製品選択プロセスをわかりやすく説明するリッチメディアコンテンツが活用されています。しかし、複雑な商業施設の改修工事では、測光レイアウト、リベートの調整、現場でのトラブルシューティングを提供する卸売業者が依然として有利です。その結果、オンラインのコンフィギュレータと現地での受け取りまたは迅速な配送を組み合わせたオムニチャネル戦略が、最も幅広い顧客層に対応しています。

地域別分析

アジア太平洋地域は、中国の大規模な製造とインドのインフラ開発に牽引され、2025年にはLED照明市場で42.10%の収益シェアを占め、市場をリードしました。インドのUJALA電球配布や広範なスマートシティプログラムなどの政府計画が継続的な需要を推進する一方、国内メーカーはコスト優位性を活用して海外プロジェクトに供給しています。同地域は2031年までにCAGR7.58%と最も高い成長率を示すと予測されており、加速する都市化、景気刺激策による建設需要、接続型照明エコシステムへの選好の高まりがこれを支えています。韓国および日本の部品メーカーが高効率チップを供給することで、地域の照明器具ブランドは性能と価格の両面で世界の競争力を獲得しています。

北米地域は、厳格な省エネ基準、ESCO契約、LED転換を優先する連邦インフラ支出により堅調な地位を維持しています。州レベルの優遇措置と自治体の持続可能性目標が相まって、街路灯や公共施設での高い普及率を牽引しています。商業用新築プロジェクトでは、居住者ウェルネス基準を満たすためネットワーク対応照明器具が導入され、倉庫・物流施設では運用コスト削減のためハイベイLEDへの移行が進んでいます。ただし、サプライチェーンの混乱によりプロジェクト遅延が発生するケースもあり、多くの購入者がドライバとチップパッケージの二重調達を進めています。

欧州では「建築物のエネルギー性能指令」と「改修波」が加盟国全体で大規模改修を義務付け、恩恵をもたらしています。公共料金や炭素税がLED更新の経済的合理性を強化し、公共調達における現地調達規則が欧州ブランドを優遇しています。スカンジナビアの都市では人間中心照明のパイロット事業が先行し、調光可能な白色照明器具の普及を推進中です。一方、中東・アフリカ地域では発展にばらつきが見られます。石油資源に恵まれた湾岸諸国はスマートシティのモデル事業に投資する一方、多くのアフリカ諸国では基礎的な電化事業に注力し、ドナー資金によるLED導入に依存しています。ラテンアメリカでは、エネルギー補助金の削減と公共照明事業のコンセッション方式が、成果連動型契約の導入を促進し、漸進的な進展が見られます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 白熱灯・CFL照明に対する政府の優遇措置および段階的廃止

- LED価格の下落と効率性の向上

- スマートシティインフラの展開

- 商業建築および改修ブーム

- 2014-2016年に設置されたLED照明の二次的交換サイクル

- 人間中心(サーカディアン)照明ソリューションの台頭

- 市場抑制要因

- 高品質LED照明器具の高額な初期費用

- 過酷な環境下における温度・電圧への感度

- 規格外低価格輸入品の流入

- 主要ベンダーの撤退やM&A後のサプライチェーンの変動性;

- 業界バリューチェーン分析

- マクロ経済要因の影響

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- ランプ

- 照明器具/照明装置

- 流通チャネル別

- 直販

- 卸売/小売

- 電子商取引

- 設置タイプ別

- 新規導入

- 改修工事

- 用途別

- 営業事務所

- 小売店舗

- ホスピタリティ

- 産業

- 高速道路および一般道路

- 建築

- 公共の場所

- 病院

- 園芸庭園

- 住宅用

- 自動車

- その他(化学、石油・ガス、農業)

- エンドユーザー別

- 屋内

- 屋外

- 自動車

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Signify N.V.

- ams OSRAM AG

- Acuity Brands Lighting Inc.

- Cree LED(SMART Global Holdings)

- LEDVANCE GmbH

- Zumtobel Group AG

- Nichia Corporation

- Seoul Semiconductor Co. Ltd.

- Everlight Electronics Co. Ltd.

- Dialight plc

- LSI Industries Inc.

- Havells India Ltd.

- Syska LED Lights Pvt. Ltd.

- Opple Lighting Co. Ltd.

- Yankon Group Co. Ltd.

- Fagerhult Group

- Current Lighting Solutions LLC

- Leedarson Lighting Co. Ltd.

- TOSPO Lighting Co. Ltd.

- MLS Co. Ltd.

- Hubbell Lighting Inc.

- Panasonic Corporation(Lighting)

- Bridgelux Inc.

- Valmont Industries(Lighting)