|

市場調査レポート

商品コード

1273424

パラフィン市場- 成長、動向、予測(2023年-2028年)Paraffin Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

価格

| パラフィン市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年04月14日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

ご注意事項 :

本レポートは最新情報反映のため適宜更新し、内容構成変更を行う場合があります。ご検討の際はお問い合わせください。

- 全表示

- 概要

- 目次

概要

パラフィン市場は予測期間中に3%以上のCAGRで推移すると予測されます。

主なハイライト

- COVID-19は2020年の市場にマイナスの影響を与えました。Organisation Internationale des Constructeurs d'Automobiles(OICA)によると、2019年に世界で販売された自動車は約9,042万台で、2020年には約7,797万台に達し、減少率は13.8%です。しかし、食品用途やeコマース用途でパラフィンをベースとした紙製パッケージの使用が増加しており、パンデミック後のパラフィン需要が増加しています。

- 短期的には、キャンドルやパッケージの需要増とアジア太平洋地域のパーソナルケア産業の成長が市場成長を牽引しています。オンライン美容支出の継続的な増加、ソーシャルネットワークの利用拡大、新製品やプレミアム製品に対する消費者の関心の高まり、都市化の加速、アッパーミドル層の人口増加が、アジア太平洋地域のパーソナルケア産業におけるパラフィン市場を牽引する主要因となっています。

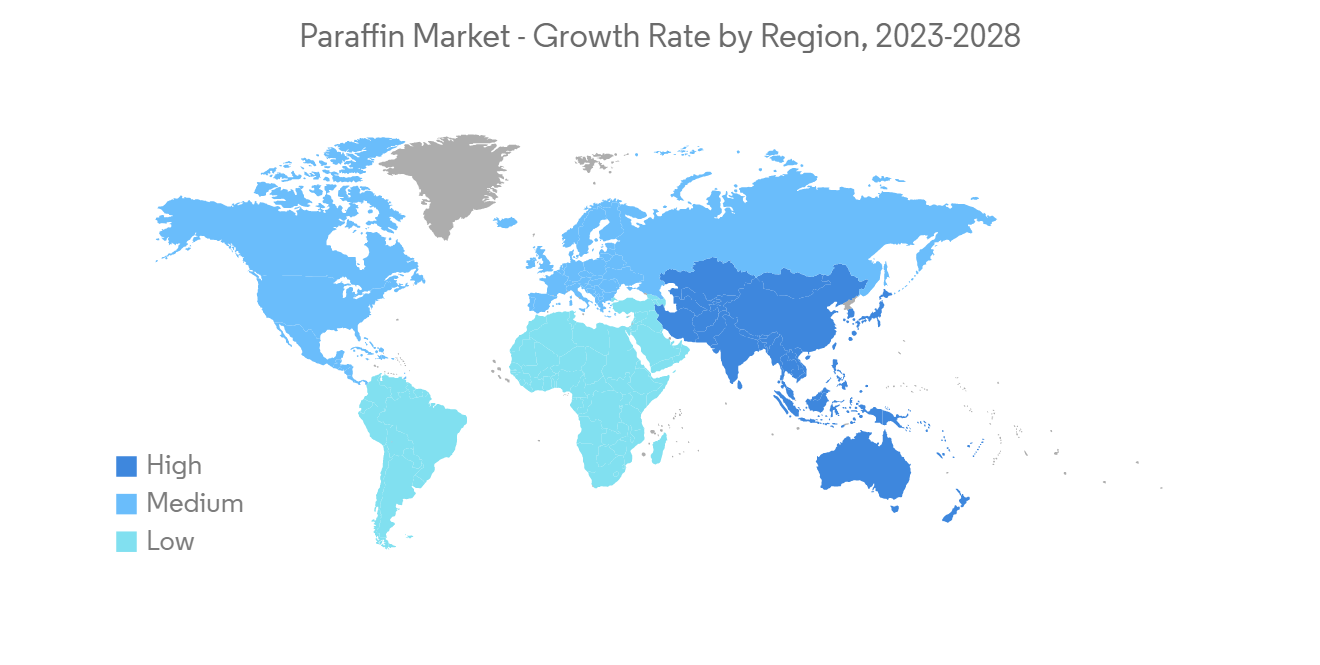

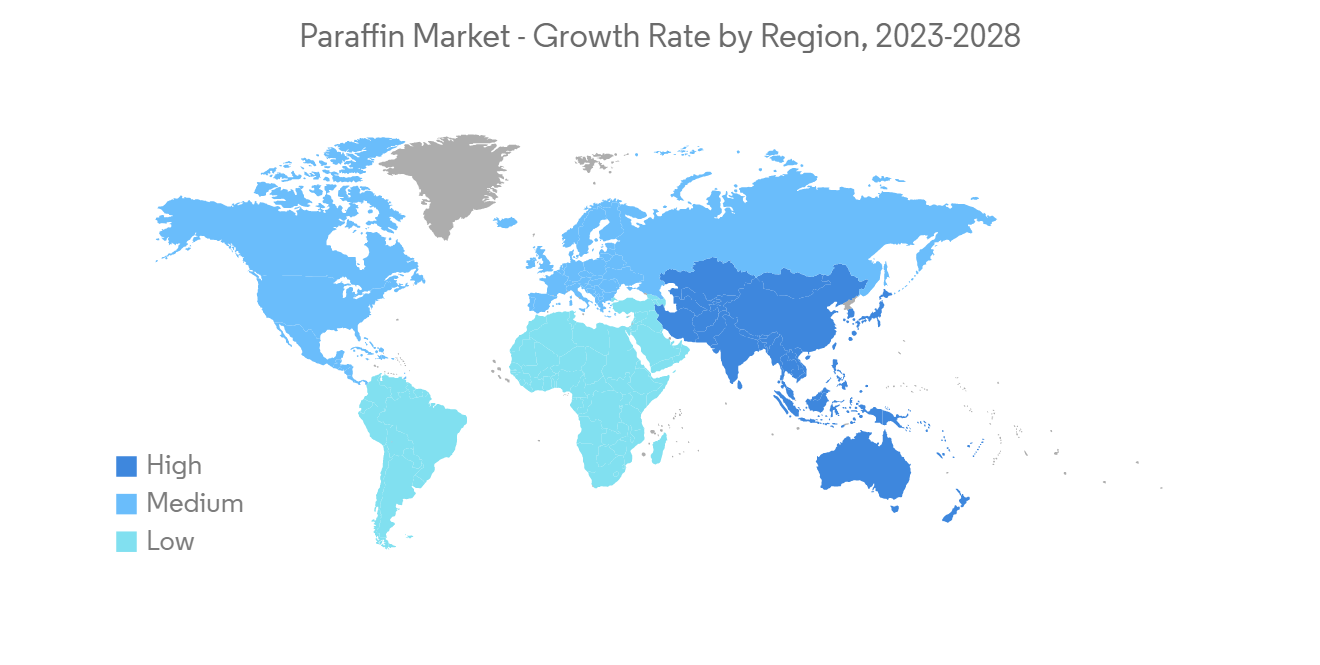

- バイオベース製品の開拓が市場の成長を阻害しています。投資用キャスティングの増加により、今後数年間は市場機会が生まれると思われます。アジア太平洋地域が市場を独占し、予測期間中に最も高いCAGRで推移すると予想されます。

パラフィンの市場動向

板紙・包装用途の需要拡大

- パラフィンワックスは、パラフィンやパラフィンブレンドが、光沢や鮮度シールとともに、湿気や油脂のバリアを提供するため、フレキシブルパッケージの用途に適しています。この製品を使用する主な利点としては、ガスや臭いのバリア(風味の低下や汚染を防ぐ)、プロセス効率の向上、水や水蒸気に対する耐性が挙げられます。また、石油由来の製品はコスト効率が高く、低粘度です。また、高速で塗布するために、比較的安価な機械が必要です。

- 保管や輸送時の安定性や美観への配慮から、工業製品のかなりの割合がパッケージングで提供されています。クラウンコルク、ラグキャップ、プラスチックフィルムラミネート、クラフト紙、板紙、包装機械は、平打ち缶、印刷シート、部品と並んで、インドの上位輸出品目です。インドで最も成長しているパッケージングカテゴリは、ラミネートとフレキシブルパッケージング、特にPETと織物サックです。

- インドの紙・板紙パッケージング市場は、2021年に107億7,000万米ドルと評価され、2027年には約156億9,000万米ドルに達すると予想されています。インドからの包装材の輸出は、2018-19年の8億4,400万米ドルから2021-22年には11億1,900万米ドルに、9.9%の年間複合成長率(CAGR)で成長しました。米国は依然として包装業界の主要な輸出先であり、英国、UAE、オランダ、ドイツがそれに続く。

- 特に東欧や北米諸国では、生活水準の向上と購買所得の増加により、幅広い製品への需要が高まっており、そのすべてに包装が必要とされています。そのため、包装の需要が増加し、結果としてパラフィンの消費量が増加しています。

- 包装分野の需要の多くは、飲食品業界からのものです。一方、ヘルスケア製品は、フォールディングカートンの最大のユーザーです。前述のエンドユーザーセグメントは、予測期間中にパラフィンの需要を押し上げると思われます。

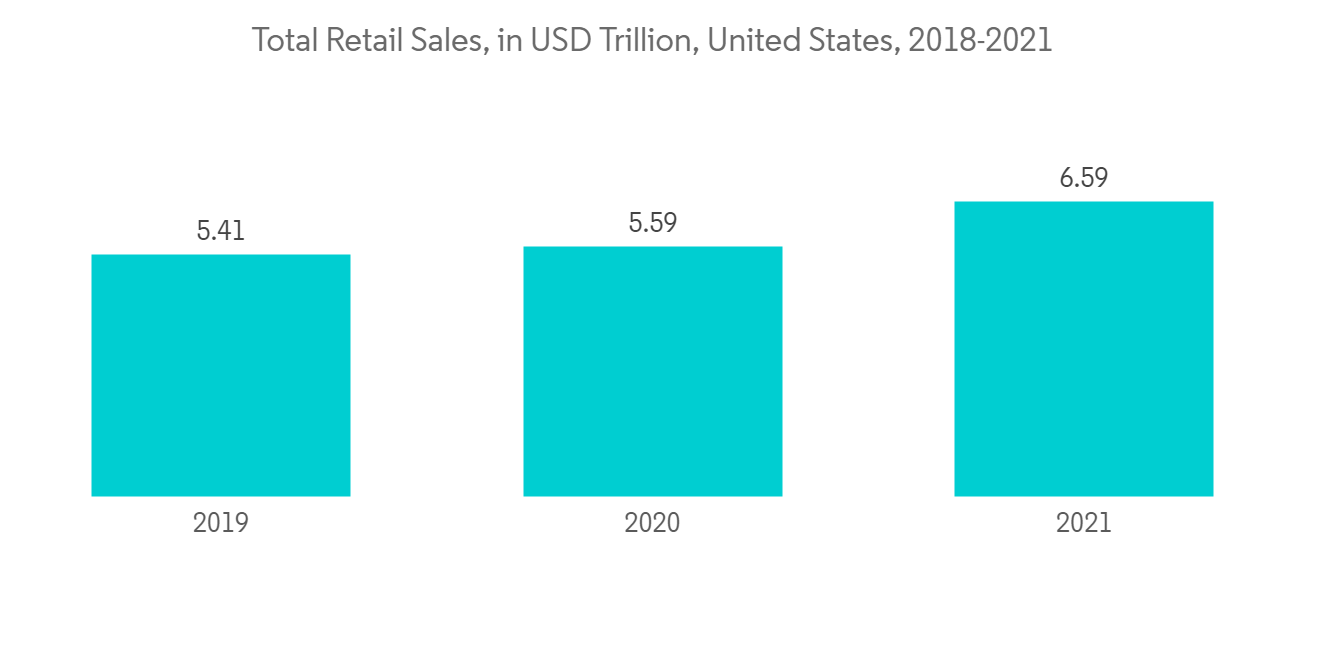

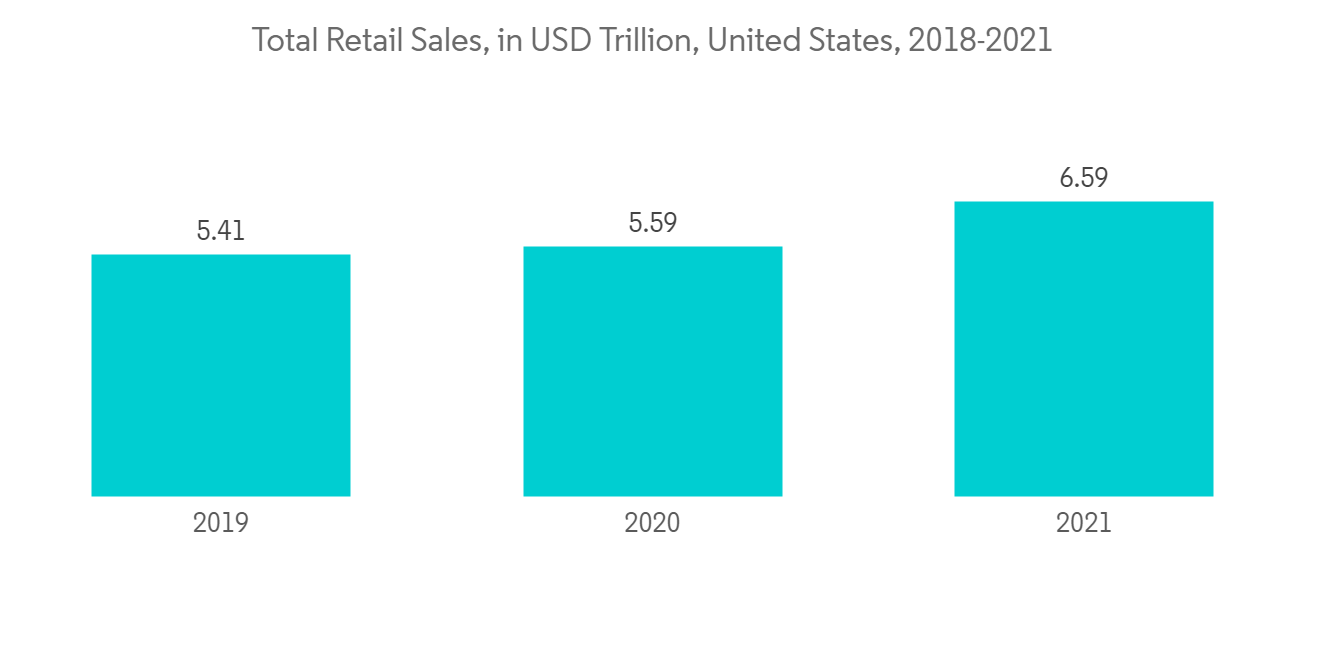

- さらに、北米は板紙・パッケージの最大消費国の一つです。Packaging Machinery Manufacturers Institute(PMMI)のBeverage Reportによると、北米の飲料産業は2018年から2028年にかけて4.5%の成長が見込まれます。さらに、全米小売業協会(NRF)によると、小売売上高は2020年に7%、2021年には14%超の成長を遂げました。2021年末には、米国における小売総売上高は約6兆6,000億米ドルに達します。

- これらの要因から、パラフィン市場は予測期間中に世界的に成長すると思われます。

アジア太平洋地域が市場を独占する

- パーソナルケアや生活の質への関心の高まりに伴い、キャンドル、板紙、包装、化粧品などパラフィンベースの製品の需要が増加していることから、アジア太平洋地域が世界のパラフィン市場を独占しました。

- 2021年、アジア太平洋地域は潤滑油の最大の需要を占めました。2021年、中国では2020年の2,522万台に対し、約2,608万台の自動車が販売され、約3%の増加率をあげました。このため、燃料や潤滑油の需要が増加し、パラフィンの市場需要にプラスの影響を与えました。

- 中国の美容・パーソナルケア産業は、2021年に510億米ドルと評価され、2027年には729億米ドルに達すると推定されています。この収益のうち、パーソナルケア製品が最も大きな割合を占め(240億米ドル超)、次いでスキンケア製品(140億米ドル)です。

- インド包装産業協会(PIAI)によると、この分野は年率約22~25%で急成長しています。インドのパッケージング産業は、輸出入で実績を上げているため、技術やイノベーションの成長を促進し、さまざまな製造部門に付加価値を与えています。予測期間中、パッケージング産業の成長がインドのパラフィン市場を牽引することが期待されます。

- 韓国は、世界で最も優れた美容市場の一つです。洗練された成分と審美的に魅力的なパッケージを特徴とする新しい美容動向とイノベーションが常に展示されています。韓国の美容・パーソナルケア製品市場は、2021年に119億米ドルと評価され、2027年には1,390万米ドルに達すると予想され、市場の需要を高めると考えられます。

- したがって、上記のすべての要因が、予測期間中にパラフィン市場を押し上げると予想されます。

パラフィン産業の概要

世界のパラフィン市場は、その性質上、断片化されています。主な企業は、Sasol、Exxon Mobil Corporation、Lanxess、Eneos Corporation、China Petroleum &Chemical Corporationなどです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 本調査の対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- キャンドルやパッケージの需要拡大

- アジア太平洋地域におけるパーソナルケア産業の成長

- 抑制要因

- バイオベース製品の開発

- 業界のバリューチェーン分析

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- タイプ別

- パラフィンワックス

- 流動パラフィン

- ケロシン

- 石油ゼリー

- 用途別

- 化粧品・パーソナルケア

- 板紙・パッケージ

- 燃料

- ゴム

- 潤滑油

- その他の用途

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- 中東およびアフリカ

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- アジア太平洋地域

第6章 競合情勢

- M&A、ジョイントベンチャー、コラボレーション、契約など

- 市場シェア(%)**/ランキング分析

- 主要企業が採用した戦略

- 企業プロファイル

- Aromachimie Ltd

- Calumet Specialty Products Partners LP

- Cepsa

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- H&R GROUP

- HollyFrontier Refining & Marketing LLC

- Indian Oil Corporation Ltd

- Kemipex

- LANXESS

- NIPPON SEIRO CO. LTD

- PersiaParaffin

- Petrobras

- Repsol

- Sasol

- The International Group Inc.

第7章 市場機会および将来動向

- インベストメント鋳造の利用拡大

目次

Product Code: 64764

The paraffin market is projected to register a CAGR of over 3% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. According to Organisation Internationale des Constructeurs d'Automobiles (OICA), about 90.42 million vehicles were sold globally in 2019 and reached about 77.97 million in 2020, with a decline rate of 13.8%. However, the use of paper packaging based on paraffin has increased for food and e-commerce uses, which has increased the demand for paraffin post-pandemic.

- Over the short term, increasing demand for candles and packaging and the growing personal care industry in Asia-Pacific is driving the market growth. Continuous growth in online beauty spending, expanding use of social networks, increasing consumer interest in new and premium products, accelerating urbanization, and the growth of the upper-middle-class population are the major factors driving the paraffin market in the personal care industry in the Asia-Pacific region.

- The development of bio-based products is hindering the market's growth. Increasing investment casting will likely create market opportunities in the coming years. Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Paraffin Market Trends

Increasing Demand for the Paperboard and Packaging Application

- Paraffin wax finds applications in flexible packaging as paraffin and paraffin blends provide moisture and grease barriers along with gloss and freshness seals. The key benefits of using the product include its ability to provide a gas and odor barrier (preventing loss of flavor or contamination), improved process efficiency, and water and water vapor resistance. Besides, a product derived from petroleum is highly cost-effective and possesses low viscosity. It also needs relatively low-cost machinery for the application at high speeds.

- Due to the need for stability during storage and transportation and aesthetic considerations, a significant share of industrial products is offered in packaging. Crown corks, lug caps, plastic film laminates, craft paper, paper board, and packaging machinery are among India's top exports, along with flattened cans, printed sheets, and components. The fastest-growing packaging categories in India include laminates and flexible packaging, particularly PET and woven sacks.

- India's paper and paperboard packaging market was valued at USD 10.77 billion in 2021 and is expected to reach around USD 15.69 billion by 2027. The export of packaging materials from India grew at a compound annual growth rate (CAGR) of 9.9% to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. The United States remains the major export destination for the packaging industry, followed by the United Kingdom, the UAE, the Netherlands, and Germany.

- The improvement in living standards and higher purchasing incomes, especially in eastern European and North American countries, has increased the demand for a broad range of products, all of which require packaging. Therefore, the demand for packaging is increasing, resulting in the increased consumption of paraffin.

- Most of the demand from the packaging segment is from the food and beverage industry. On the other hand, healthcare products are the largest users of folding cartons. The aforementioned end-user segments will likely boost the demand for paraffin during the forecast period.

- Furthermore, North America is one of the largest consumers of paperboard and packaging. According to Packaging Machinery Manufacturers Institute's (PMMI) Beverage Report, the North American beverage industry is expected to grow by 4.5% from 2018 to 2028. Additionally, according to the National Retail Federation (NRF), retail sales grew by 7% in 2020 and over 14% in 2021. By the end of 2021, total retail sales reached approximately USD 6.6 trillion in the United States.

- Due to all these factors, the paraffin market will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global paraffin market as the demand for paraffin-based products, like candles, paperboard, packaging, and cosmetics, is increasing with an increasing focus on personal care and quality of life.

- In 2021, the Asia-Pacific region accounted for the largest demand for lubricants. In 2021, around 26.08 million vehicles were sold in China compared to 25.22 million in 2020, witnessing an increasing growth rate of about 3%. This led to increased demand for fuel and lubricants, positively affecting the market demand for paraffin.

- The Chinese beauty and personal care industry was valued at USD 51 billion in 2021 and is estimated to reach USD 72.9 billion by 2027. Personal care products held the largest portion of this revenue (over USD 24 billion), followed by skin care products (USD 14 billion).

- According to the Packaging Industry Association of India (PIAI), the sector is growing rapidly at about 22-25% per annum. The Indian packaging industry has made a mark with its exports and imports, thus, driving technology and innovation growth and adding value to various manufacturing sectors. During the forecast period, growth in the packaging industry is expected to drive the paraffin market in India.

- South Korea has one of the world's most exceptional beauty markets. New beauty trends and innovations featuring sophisticated ingredients and aesthetically appealing packaging are constantly displayed. The South Korean beauty and personal care products market was valued at USD 11.9 billion in 2021, and it is expected to reach USD 13.9 million by 2027, which is likely to enhance the market demand.

- Therefore, all the above factors are expected to boost the paraffin market during the forecast period.

Paraffin Industry Overview

The global paraffin market is fragmented in nature. The major companies include Sasol, Exxon Mobil Corporation, Lanxess, Eneos Corporation, and China Petroleum & Chemical Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Candles and Packaging

- 4.1.2 Growing Personal Care Industry in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Development of Bio-based Products

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Paraffin Wax

- 5.1.2 Liquid Paraffin

- 5.1.3 Kerosene

- 5.1.4 Petroleum Jelly

- 5.2 By Application

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Paperboard and Packaging

- 5.2.3 Fuel

- 5.2.4 Rubber

- 5.2.5 Lubricants

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aromachimie Ltd

- 6.4.2 Calumet Specialty Products Partners LP

- 6.4.3 Cepsa

- 6.4.4 China National Petroleum Corporation

- 6.4.5 China Petroleum & Chemical Corporation

- 6.4.6 ENEOS Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 H&R GROUP

- 6.4.9 HollyFrontier Refining & Marketing LLC

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 Kemipex

- 6.4.12 LANXESS

- 6.4.13 NIPPON SEIRO CO. LTD

- 6.4.14 PersiaParaffin

- 6.4.15 Petrobras

- 6.4.16 Repsol

- 6.4.17 Sasol

- 6.4.18 The International Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Investment Casting

お電話でのお問い合わせ

044-952-0102

( 土日・祝日を除く )