|

市場調査レポート

商品コード

1687827

選択的レーザー焼結:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Selective Laser Sintering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 選択的レーザー焼結:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

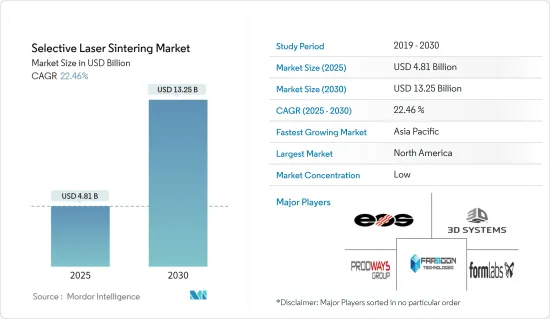

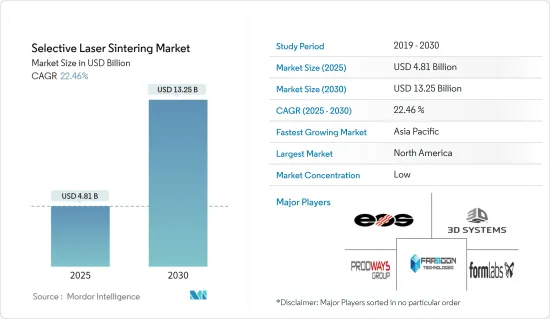

選択的レーザー焼結市場規模は、2025年に48億1,000万米ドルと推定され、予測期間中(2025年~2030年)のCAGRは22.46%で、2030年には132億5,000万米ドルに達すると予測されています。

付加製造(AM)技術の一つである選択的レーザー焼結(SLS)は、高出力のレーザービームを粉末材料(通常はナイロンまたはポリアミド)ベッドに向けて照射し、目的の物体の層を焼結するプロセスです。その層の完成後、対象物は新しい粉末の層で覆われ、さらに別の層が焼結されます。

主なハイライト

- SLS装置市場は、先進国の研究開発施設の存在による需要の高まりによって牽引されると予測されます。プロトタイプモデルや部品を作成するための非金属粉末の入手が容易なため、レーザー焼結プリンターの採用が増加しています。また、レーザー焼結プリンターは金属部品を印刷する際に最も精度が高いです。

- 選択的レーザー焼結(SLS)は、印刷用途に使用される他の技術よりも様々な利点があるため、最も好まれる技術の1つとして特定されており、予測期間中に堅調な成長が見込まれています。

- SLSは、ステレオリソグラフィで使用される感光性樹脂の代用として、原料としてナイロン粉末を利用します。世界中の企業や研究機関が、太陽光にさらされると樹脂がもろくなるなどの懸念に対処するため、この材料と技術を活用することを確認しています。さらにSLSは、印刷後に専用の支持構造を必要としないため、コストと材料に優しいことも証明されています。さらに、SLSは耐久性が向上し、機能部品や試作品と同等の性能を発揮します。

- SLSはさらに、航空宇宙、防衛、自動車など、さまざまな垂直分野で幅広い用途を見出すことができます。宇宙開発がパラダイムシフトを迎えている中、人工衛星の打ち上げに備える国が増加しており、SLSプリンティングの需要は高まると予想されます。

- さまざまな航空宇宙企業が、効率的な生産を促進するためにこの技術を採用しています。例えば、航空宇宙の宇宙飛行分野では、NASAと非公開会社は、より少ない部品でロケットエンジン(Relativity Spaceの場合はロケット全体)を製造することに取り組んでいます。これは3Dプリンティングの重要な能力であり、製造時間とコストを削減する方法です。選択的レーザー焼結と、金属粉(例えば、高温に耐えるインコネル銅超合金パワー)の敷設と溶融を使用して、部品は層ごとに構築されます。SLS技術にはいくつかの利点があります。たとえば、複数の部品をわずか数日で1つの統一部品として印刷できます。試験中にロケットが不具合を起こした場合は、3Dモデリング・ソフトウェアに変更を加えて新しいロケットを作成し、別の試験を素早く設定することができます。

- さらに2021年12月、積層造形部品製造企業のPrimaeam Solutions Pvt Ltdは、インドのチェンナイに新しい積層造形カスタマー・エクスペリエンス・センター、ヘルスケア向けイノベーション&インキュベーション・センターを開設しました。この1万平方フィートのセンターでは、電子ビーム溶解(EBM)、選択的レーザー焼結(SLM)、溶融堆積モデリング(FDM)、ステレオリソグラフィ(SLA)、マルチジェット融合(MJF)、繊維強化連続フィラメント製造(CFF)などの技術を駆使し、積層造形サービスビューローの有力企業としての地位を確立します。

- COVID-19の大流行は、世界中の中小・大企業に経済的混乱をもたらしました。製造業の大部分には、生産性を向上させるために人々が密接に接触する工場現場での作業が含まれるためです。

選択的レーザー焼結(SLS)市場動向

航空宇宙・防衛産業が大きな市場シェアを占める見込み

- 航空宇宙産業は、現世代の技術のほとんどを早期に採用しています。航空機メーカーもエンジンメーカーも、効率を上げるために軽量部品を開発するために3Dプリンティング技術に依存しています。

- 3Dプリンティングは、米航空宇宙局(NASA)が数十年にわたり、プロトタイピングや機能部品の作成、そして最近では月や火星用の建設システムの構築の目的で使用してきました。

- ベル・テキストロン社は、アディティブ・マニュファクチャリングの実験を行った最初の航空宇宙企業のひとつです。SLSの最初の用途は、金型や実験部品の迅速な試作でした。しかし、アディティブ・マニュファクチャリング産業が進歩するにつれ、同社はアディティブ・マニュファクチャリング産業が成熟する必要性を理解しました。アディティブへの取り組みが始まって以来、ベル・テキストロンはSLSだけで、製品に広く散在する550を超える部品を生産してきました。生産された部品の大半は実験的なものだが、550個の部品のうち200個以上が生産目的であることは注目に値します。

- さらに、GKNエアロスペースは2022年7月、英国にある同社の世界・テクノロジー・センターにRenAM 500 Flexを導入し、金属積層造形機のラインアップを拡充しました。RenAM 500Q Flexは4レーザー積層造形機で、航空宇宙用途の積層造形を最適化することが期待されています。

- さらに、米国国勢調査局によると、米国における航空宇宙製品と部品製造の収益は、2024年までに約2,644億米ドルに達すると予想されています。さらに、カナダにおける航空宇宙製品と部品製造の売上は、2024年までに約193億米ドルに達すると思われます。こうした開発は、市場の成長を積極的に後押しすると思われます。

- ストックホルム国際平和研究所(SIPRI)によると、米国は2021年に軍事費が最大となった国のランキングで首位に立ち、軍事費は8,010億米ドルに上り、世界の軍事費2兆1,000億米ドルの38%を占めました。

北米が主要市場シェアを占める見込み

- 北米には、積層造形の開発、採用、投資を行う企業が多数存在します。同地域ではプロトタイピングの需要が伸びており、これが同地域の市場を大きく牽引しています。さらに、北米におけるSLSの需要は、研究開発と様々な産業における試験の増加に重点が置かれていることが要因となっています。

- カナダ統計局によると、カナダの企業は2021年に219億米ドルを社内の産業研究開発に費やす意向であり、2022年には224億米ドルを費やす見込みです。このような研究開発の成長は、北米の選択的レーザー焼結市場を押し上げると予想されます。

- 同地域の企業は、より幅広い顧客層にソリューションを提供するために戦略的提携を行っています。例えば、2022年5月、米国のEssentium Incは、青色レーザソリューションプロバイダのNuburuと提携し、青色レーザベースの金属積層造形プラットフォームを開発しました。

- その結果、製造業者は高解像度と高速スループットで生産グレードの金属部品を作成できるようになると期待されています。さらに、この契約の一環として、ヌブル社はアディティブ・マニュファクチャリング応用特許のライセンス供与を行う。

- 3Dプリンティングのような新技術の利用が増加していることも、同地域のSLS市場を牽引すると予想されます。例えば、世界経済フォーラムによると、2022年までに米国の調査対象企業の47%が3Dプリンティング技術を使用すると予想されています。

選択的レーザー焼結(SLS)産業概要

選択的レーザー焼結市場は、世界的に事業を展開する既存企業と、統合された市場空間で注目を集めるために争う少数の地域企業で主に構成されています。3D Systems Inc.、EOS GmbH Electro Optical Systems、Ricoh Company Ltd.、Fathom Manufacturingなど、この分野で豊富な専門知識を持つ企業が複数存在することで、競争企業間の敵対関係がさらに激化することが予想されます。

- 2022年6月-3D SystemsとEMS GRILTECHは、積層造形材料開発を強化するための戦略的提携を発表。両社は、市販の選択的レーザー焼結(SLS)プリンターで使用できるよう設計された、新しいナイロン共重合体デュラフォームPAxナチュラルを発表します。

- 2021年11月-Evonik Industries AGは、パーソナライズされた移植可能な医療機器の3Dプリントを可能にするため、RESOMER PrintPowderポリマーをより幅広く提供することを発表しました。この新しいパウダーは、選択的レーザー焼結法(SLS)による3Dプリント用として世界中で利用できます。この新しいパウダーは、カスタマイズ可能な機械的特性と劣化速度の範囲が広いため、多様な整形外科、歯科、軟組織用途など、より複雑でカスタマイズされた医療機器に使用することができます。

- 2021年2月-3D Systemsは、サウスカロライナ州ロックヒルの拡張計画を発表し、既存の本社キャンパスに100,000平方フィートを追加しました。この拡張により、材料製造、品質、ロジスティクス業務を統合し、材料開発ラボを新設・拡張することで、業務効率の向上、ソリューション開発の迅速化、市場投入期間の短縮を図る。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

- 3Dプリンティング技術の分析(FDM、SLA、SLS;材料と技術に関する定性分析;ベンチトップ工業用SLSと従来の工業用SLSプリンターの比較)

第5章 市場力学

- 市場促進要因

- 最終製品が市場に届くまでの時間の短縮

- 各地域における政府の取り組み強化

- 市場の課題

- 追加資本支出と大量生産における制約

第6章 市場セグメンテーション

- 素材別

- 金属

- プラスチック

- 部品別

- ハードウェア

- ソフトウェア

- サービス

- エンドユーザー産業別

- 自動車

- 航空宇宙・防衛

- ヘルスケア

- エレクトロニクス

- その他エンドユーザー産業

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第7章 競合情勢

- 企業プロファイル

- 3D Systems Inc.

- EOS GmbH Electro Optical Systems

- Farsoon Technologies

- Prodways Group

- Formlabs Inc.

- Ricoh Company Ltd

- Concept Laser GmbH(General Electric)

- Renishaw PLC

- Sinterit Sp. Zoo

- Sintratec AG

- Sharebot SRL

- Red Rock SLS

第8章 投資分析

第9章 市場の将来

The Selective Laser Sintering Market size is estimated at USD 4.81 billion in 2025, and is expected to reach USD 13.25 billion by 2030, at a CAGR of 22.46% during the forecast period (2025-2030).

Selective Laser Sintering (SLS), an additive manufacturing (AM) technique, is a process in which a high-powered laser beam is aimed into powdered material (typically nylon or polyamide) bed to sinter a layer of the desired object. Following the completion of that layer, the object is covered with a new layer of powder, and another layer is sintered.

Key Highlights

- The market for SLS equipment is anticipated to be driven by the rising demand from developed countries, owing to the presence of research and development facilities in the countries. The adoption of laser sintering printers has increased due to the ease of availability of non-metal powders to create prototype models and parts. Also, laser sintering printers are the most precise when printing metal parts.

- Selective Laser Sintering (SLS) has been identified as one of the most-preferred technology and is expected to witness robust growth during the forecast period, owing to its various benefits over other technologies used for printing applications.

- SLS utilizes nylon powder as raw material as a substitute for the photosensitive resin used in Stereolithography. Companies and research organizations across the globe have been identified to take advantage of this material and technology to tackle concerns, such as the brittle nature of the resin when exposed to sunlight. In addition, SLS has also been proven to be cost and material friendly, as it does not require any dedicated support structure post-printing. In addition, SLS provides enhanced durability and can perform as well as either functional parts or prototypes.

- SLS further finds a wide array of applications across various verticals, such as aerospace, defense, and automotive, among others. With space exploration witnessing a paradigm shift, the demand for SLS printing is expected to mount, with an increasing number of countries gearing up to launch satellites.

- Various aerospace companies are adopting the technology to foster efficient production. For instance, in the space flight branch of aerospace, NASA and private companies are working to build rocket engines (and even entire rockets in the case of Relativity Space) with fewer parts, which is a crucial capability of 3D printing and a way to reduce production time and costs. Using selective laser sintering and the laying down and melting of metal powder (for example, Inconel copper super alloy power that can withstand high temperatures), parts are built up layer by layer. The SLS technique offers several benefits, like multiple parts can be printed as one unified part in just days; the rocket's weight can be reduced with fewer nuts, bolts, and welds. If the rocket proves faulty during a test, changes can be made to the 3D modeling software for a new rocket, and another test can be quickly set up.

- Further, in December 2021, Primaeam Solutions Pvt Ltd, an additive parts manufacturing company, inaugurated its new Additive Manufacturing Customer Experience Centre, Innovation & Incubation Centre for Healthcare, in Chennai, India. The 10,000 sq. ft. center would allow the company to develop its position as a prominent player in the additive manufacturing service bureau with technologies such as Electron Beam Melting (EBM), Selective Laser Sintering (SLM), Fused Deposition Modelling (FDM), Stereolithography (SLA), Multi Jet Fusion (MJF), and Continuous Filament Fabrication with Fiber reinforcement (CFF).

- The COVID-19 pandemic outbreak has created economic turmoil for small, medium, and large-scale industries worldwide. Adding to the woes, country-wise lockdown inflicted by the governments across the globe (to minimize the spread of the virus) has further resulted in industries taking a hit and disruption in supply chain and manufacturing operations across the world, as a large part of manufacturing includes work on the factory floor, where people are in close contact as they collaborate to boost the productivity.

Selective Laser Sintering (SLS) Market Trends

Aerospace and Defense Industry is Expected to Hold Significant Market Share

- The aerospace industry has an early rate of adoption of most of the technologies in the current generation. Both aircraft and engine manufacturers have been relying on 3D printing technology in order to develop lightweight parts to gain efficiency.

- 3D printing has been used by the National Aeronautics and Space Administration (NASA) for decades for the purposes of prototyping and creating functional parts and, most recently, for building construction systems for the Moon and Mars.

- Bell Textron Inc. was one of the first aerospace companies to experiment with additive manufacturing. The first use of SLS was for quick prototypes of tooling and experimental parts. However, as the additive manufacturing industry progressed, the company understood the need to allow the additive manufacturing industry to mature. Since the start of additive efforts, Bell Textron has produced over 550 parts widely spread among its products with just SLS. While a majority of parts produced are experimental, it is to be noted that over 200 of those 550 parts are for production purposes.

- Moreover, in July 2022, GKN Aerospace expanded its range of metal additive manufacturing machines at the company's global technology center in the United Kingdom by installing RenAM 500 Flex. The RenAM 500Q Flex is a four-laser Additive Manufacturing machine that is expected to optimize Additive Manufacturing for aerospace applications.

- Furthermore, according to the US Census Bureau, it is expected that the revenue of aerospace products and parts manufacturing in the United States will amount to about USD 264.4 billion by 2024. Moreover, It is likely that the revenue of aerospace products and parts manufacturing in Canada will amount to approximately USD 19.3 billion by 2024. Such developments would drive the market's growth positively.

- According to Stockholm International Peace Research Institute (SIPRI), the United States led the ranking of countries with maximum military spending in 2021, with 801 USD billion dedicated to the military, which was 38 percent of the global military expenditure of USD 2.1 trillion.

North America is Expected to Hold Major Market Share

- North America is home to many companies developing, adopting, or investing in additive manufacturing. There has been a growth in the demand for prototyping in the region which has been majorly driving the market in the region. Further, the demand for SLS in North America is driven by a higher focus on research and development and increased testing in various industries.

- According to Statistics Canada, Canadian businesses intend to spend USD 21.9 billion on in-house industrial research and development in 2021, while USD 22.4 billion is expected to be spent in 2022. Such growth in research and development is expected to push the market for Selective Laser Sintering in North America.

- Companies in the region are doing strategic collaborations to provide their solutions to a broader customer base. For instance, in May 2022, Essentium Inc, a US-based company, partnered with Nuburu, a blue laser solution provider, to develop a blue laser-based metal Additive Manufacturing platform.

- The resulting machine is hoped to enable manufacturers to create production-grade metal parts with high resolution and fast throughput. Further, as a part of the contract, Nuburu will license its additive manufacturing application patents.

- The increase in the usage of new technologies, such as 3D printing, is also expected to drive the market of SLS in the region. For instance, according to World Economic Forum, it is expected that by 2022, 47% of the surveyed companies in the United States will use 3D printing technology.

Selective Laser Sintering (SLS) Industry Overview

The Selective Laser Sintering Market majorly comprises incumbents operating globally, along with a few regional players vying for attention in a consolidated market space. The presence of several players, such as 3D Systems Inc., EOS GmbH Electro Optical Systems, Ricoh Company Ltd., and Fathom Manufacturing, among others with considerable expertise in the field, is expected to intensify the competitive rivalry further.

- June 2022 - 3D Systems and EMS GRILTECH announced the strategic partnership to enhance additive manufacturing materials development. Both companies will introduce a novel nylon copolymer - DuraForm PAx Natural- designed to be used with any commercially-available selective laser sintering (SLS) printer.

- November 2021 - Evonik Industries AG announced that it offers a broader range of RESOMER PrintPowder polymers to enable the 3D printing of personalized implantable medical devices. The new powders are available globally for 3D printing through selective laser sintering (SLS). Due to a broader range of customizable mechanical properties and degradation rates, the new powders could be used for more complex and tailored medical devices, including diverse orthopedic, dental, or soft tissue applications.

- February 2021 - 3D Systems announced the expansion plan of its Rock Hill, South Carolina, location, adding 100,000 square feet to its existing headquarters campus. This expansion will enable the company to consolidate its materials manufacturing, quality, and logistics operations, with new and expanded materials development laboratories to improve operational efficiencies, accelerate solution development, and reduce time to market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Analysis of 3D Printing Technologies (FDM, SLA, SLS; Qualitative Analysis on Materials and Technologies; Benchtop Industrial SLS Vs Traditional Industrial SLS Printers)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduced Time for the End Product to Reach the Market

- 5.1.2 Increased Government Initiatives Across Various Regions

- 5.2 Market Challenges

- 5.2.1 Additional Capital Expenditure and Restrictions in Mass Production

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software

- 6.2.3 Services

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Aerospace and Defense

- 6.3.3 Healthcare

- 6.3.4 Electronics

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Inc.

- 7.1.2 EOS GmbH Electro Optical Systems

- 7.1.3 Farsoon Technologies

- 7.1.4 Prodways Group

- 7.1.5 Formlabs Inc.

- 7.1.6 Ricoh Company Ltd

- 7.1.7 Concept Laser GmbH (General Electric)

- 7.1.8 Renishaw PLC

- 7.1.9 Sinterit Sp. Zoo

- 7.1.10 Sintratec AG

- 7.1.11 Sharebot SRL

- 7.1.12 Red Rock SLS