|

|

市場調査レポート

商品コード

1642064

産業用オートメーションソフトウェア:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Industrial Automation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 産業用オートメーションソフトウェア:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

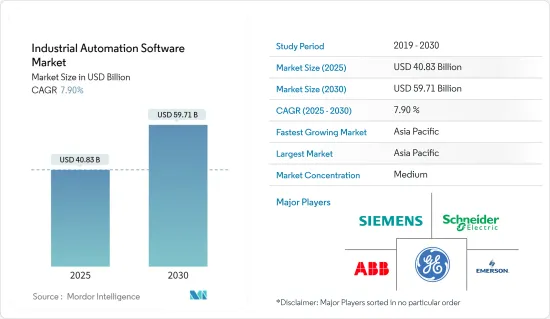

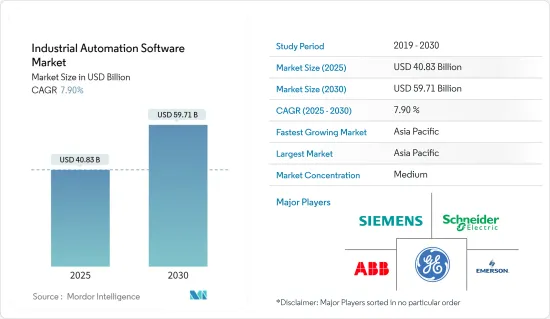

産業用オートメーションソフトウェアの市場規模は、2025年に408億3,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは7.9%で、2030年には597億1,000万米ドルに達すると予測されます。

産業オートメーションソフトウェアは、産業プロセス全体を制御するためのサポート・システムです。様々な産業におけるダイナミックなニーズの増加と複雑なオペレーションやプロセスが、産業用オートメーションソフトウェアの需要を促進しています。産業オートメーションは、操作に必要な機械時間を短縮するのに役立ち、これは堅牢なソフトウェアによってのみ可能となります。

主なハイライト

- 様々な産業の自動化は、容易なモニタリング、廃棄物の削減、生産速度の向上など、様々な利点を提供しています。オートメーションは、標準化による品質の向上と、信頼できる製品を納期通りに、より低コストで顧客に提供します。

- SCADA、HMI、PLCシステム、MES、APM、APC、PLM、OTSなどのソフトウェア、可視化を提供する制御システムソフトウェアなどの採用において、産業用機械や装置を接続し、リアルタイムのデータを取得することが重要な役割を果たしています。これらのシステムは、製品の故障を減らし、ダウンタイムを減らし、メンテナンスをスケジューリングし、反応的な状態から予測的な状態に切り替え、意思決定のための規定段階を作るのに役立ちます。

- インダストリアル・インターネット・オブ・シングス(IIoT)とインダストリー4.0は、スマート・ファクトリー・オートメーションとして知られるロジスティクス・チェーンの開発、生産、管理のための新しい技術的アプローチの中心にあります。これらは、機械やデバイスがインターネットを介して接続される、産業分野における主要な動向です。

- しかし、産業オートメーションソリューションの導入に伴う初期コストは高いです。さらに、ソリューションに対応できる従業員の雇用やトレーニングにかかるコストが総コストを押し上げ、市場成長の妨げとなる可能性があります。

- COVID以前の製造業界に存在した動向には、世界中でインダストリー4.0の採用が拡大していること、政府支援の増加に伴い製造プロセスで産業オートメーションが重視されるようになっていること、規制遵守が重視されるようになっていること、サプライチェーンの複雑化と統合が進んでいること、時間とコストを削減し、総合的な設備効率(OEE)を改善するソフトウェアシステムに対する需要が急増していること、MESとERP層、SCADAとMES層の融合が崩壊していることなどがあります。COVID-19の大流行はインダストリー5.0の引き金にはならなかったが、いくつかのスマート製造技術を利用するインダストリー4.0の導入をもたらしました。デジタルワークフローと自動化はもはや目標ではなく、必要要件になりつつあります。IoTデバイスは、このパンデミックの最中でも収益源を維持する道をメーカーに提供しています。

産業用オートメーションソフトウェア市場動向

SCADAが市場成長に大きな影響

- 監視制御・データ収集(SCADA)ソフトウェアは、過去10年間で急成長を遂げました。SCADAシステムは、エンドユーザー産業の従業員がデータを分析し、遠隔地から重要な意思決定を行うのに役立ちます。さらに、データを処理し、配信し、ヒューマン・マシン・インターフェース(HMI)上に表示するため、迅速な対応で問題を軽減するのに役立ちます。

- SCADAシステムは通常、ハードウェアとソフトウェアのコンポーネントが密接に連携して機能します。ハードウェアはデータを収集し、コンピュータの処理装置に送り込み、処理装置はさまざまな時間間隔でデータを処理します。SCADAシステムは、イベントを記録してハードディスク上のフォルダに記録するか、プリンタに送信します。

- SCADAシステムは、多くの産業アプリケーションで重要な役割を果たしています。日常業務でSCADAを使用している産業には、上下水道システム、発電、トランスミッション、配電システム、石油・ガスシステムなどがあります。例えば石油・ガス業界では、SCADAは配水ポンプ圧力やパイプライン流量とともに、井戸やポンプ場の監視に使用されます。

- 2022年2月、ゼネラル・エレクトリック(GE)デジタルは最新バージョンのCIMPLICITY 2022 HMI/SCADAソフトウェアの発売を発表しました。このソフトウェアは、あらゆる規模のアプリケーションに対して、迅速な対応、コスト削減、セキュリティの向上、収益性の向上を実現します。CIMPLICITYはまた、オンプレミス、クラウド、またはハイブリッドアーキテクチャでの導入オプションを提供し、インフラストラクチャとメンテナンスコストを削減します。

- 労働賃金は、あらゆるビジネスにとって最大の経費のひとつです。米国労働統計局によると、2021年第3四半期の米国労働者の人件費は1.3%上昇し、過去20年間で最大の上昇率となりました。SCADAなどの産業オートメーションソリューションは、タスクに必要な労働時間の削減を可能にし、それによって関連する人件費を削減します。

著しい成長を遂げる欧州市場

- ロボット工学とオートメーション産業は、ドイツの機械工学分野で最も革新的な産業のひとつです。ドイツのOEM企業は、世界有数のR&A企業です。人間とロボットの協働(HRC)とマシンビジョン(MV)技術は、あらゆる市場セグメントのロボット企業を抱える世界的ハブにおける主要な強みと考えられています。機械学習やディープラーニングを含む人工知能分野の技術開発は、従来の産業用ロボットや協働ロボットのさらなる応用につながると思われます。

- 最近、革新的な組込みシステム、モノのインターネット(IoT)、人工知能(AI)ソリューションの世界的プロバイダーであるSECOは、ドイツのニュルンベルクで開催されたembedded world 2022で、拡張されたヒューマン・マシン・インターフェース製品ポートフォリオを発表しました。同社の広範なFLEXY VISIONファミリーに加え、HMI製品ポートフォリオが拡張され、フラッシュマウント、リアマウント、パネルマウントの設置オプションを備えたGarz &Fricke社のモジュール型Proven Concept(PCT)HMIシリーズと、ディスプレイインテリジェンスとインターフェースを提供する付属のシングルボードコンピュータが追加されました。

- ドイツおよび欧州のマシンビジョン産業は、過去10年間、急速に成長してきました。自動車産業や電気・電子産業(半導体を含む)だけでなく、金属、食品、包装、非製造業(インテリジェント交通技術、医療診断機器、手術技術など)を含む他の分野でも、マシンビジョン技術の活用が進んでいます。

- 製造技術センター(MTC)とラフバラ大学産業政策研究センター(IPRC)が作成した最近の報告書によると、英国で産業オートメーションとロボット工学の導入を加速すれば、同国の製造業の生産性を大幅に改善できる可能性があります。また、障壁を取り除き、スマート協働ロボット技術の普及を加速することで、スマート・マニュファクチャリングを推進するため、新たな国立ロボット研究センターも設立される予定です。

- 多くのEUベースの研究・技術革新(R&I)プログラムは、欧州の製造部門がデジタルの機会を十分に活用できるようにするソリューションや技術の開発を常に支援してきました。プロジェクトの多くは、Factories of the Future官民パートナーシップによって資金提供されており、デジタルオートメーション、製造資産のプロセス最適化、シミュレーションと分析技術、製造業中小企業のためのICTイノベーションなどの分野をカバーしています。

産業用オートメーションソフトウェア業界の概要

産業用オートメーションソフトウェア市場は適度な競争があり、影響力のあるプレーヤーで構成されています。同市場で顕著なシェアを持つ主要企業は、海外における顧客基盤の拡大に注力しています。これらの企業は、市場シェアの向上と収益力強化のため、戦略的な協力体制を活用しています。

- 2022年2月-エマソンは、タミル・ナードゥ州チェンナイのマヒンドラ・ワールド・シティに統合製造施設を新設すると発表。14万5,000平方フィートの施設では、インドおよびアジア全域の産業顧客に生産性、安全性、環境持続可能性を向上させる技術を提供するオートメーションソリューション事業の主要製品を製造します。

- 2021年7月-ロックウェル・オートメーションは、産業用クラウドソフトウェアの提供を拡大するため、22億2,000万米ドルでプレックス・システムズを買収すると発表しました。プレックス・システムズは、純粋なSaaS(Software-as-a-Service)であり、クラウドネイティブなスマート・マニュファクチャリング・プラットフォームを大規模に運用しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- COVID-19の業界への影響

第5章 市場力学

- 市場促進要因

- 品質と信頼性の高い製造のための自動化需要の増加

- 運用コストを削減した大量生産へのニーズの高まり

- インダストリー4.0とそれを可能にする技術の採用急増

- 市場抑制要因

- 専門家の不足とセキュリティ意識の低下

- ファクトリーオートメーションソリューションの導入コストの高さ

第6章 市場セグメンテーション

- 製品別

- 監視制御およびデータ収集(SCADA)

- 分散型制御システム(DCS)

- 製造実行システム(MES)

- ヒューマン・マシン・インターフェース(HMI)

- プログラマブル・ロジック・コントローラー(PLC)

- エンドユーザー産業別

- 電力産業

- 自動車産業

- 石油・ガス産業

- その他のエンドユーザー産業

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Emerson Electric Company

- ABB Ltd

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Honeywell International Inc.

- Rockwell Automation Inc.

- HCL Technologies Limited

- Parsec Automation Corporation

- SAP SE

- Tata Consultancy Services Limited

- Hitachi Ltd

第8章 投資分析

第9章 市場の将来

The Industrial Automation Software Market size is estimated at USD 40.83 billion in 2025, and is expected to reach USD 59.71 billion by 2030, at a CAGR of 7.9% during the forecast period (2025-2030).

Industrial automation software is the support system in controlling the overall industrial process. The increasing dynamic needs of various industries and complex operations and processes are driving the demand for industrial automation software. Industrial automation helps in reducing the machine hours required for operations, which can be made possible only through robust software.

Key Highlights

- The automation of various industries has offered various benefits, such as effortless monitoring, waste reduction, and increased production speed. Automation offers customers improved quality with standardization and dependable products on time and at a much lower cost.

- Connecting industrial machinery and equipment and obtaining real-time data have played a key role in the adoption of SCADA, HMI, and PLC systems, software such as MES, APM, APC, PLM, and OTS, and control system software that offers visualization. These systems help in reducing the faults in the product, reducing downtime, scheduling maintenance, switching from a reactive state to a predictive state, and creating prescriptive stages for decision-making.

- The Industrial Internet of Things (IIoT) and Industry 4.0 are at the center of new technological approaches for the development, production, and management of the logistics chain, otherwise known as smart factory automation. These are dominating trends in the industrial sector, with machinery and devices being connected via the internet.

- However, the initial costs associated with the implementation of industrial automation solutions are high. Additionally, the costs involved in hiring and training employees who are capable of handling the solution add to the total cost, which can hinder market growth.

- The trends that existed in the pre-COVID manufacturing industry include growing adoption of Industry 4.0 throughout the world, increasing emphasis on industrial automation in manufacturing processes with increasing government support, the growing emphasis on regulatory compliance, increasing complexity and integration of supply chains, surging demand for software systems that reduce time and cost and improve overall equipment effectiveness (OEE) and the collapse of the convergence of MES and ERP layers and SCADA and MES layers. While the COVID-19 pandemic has not triggered Industry 5.0, it has brought about the adoption of Industry 4.0, which utilizes several smart manufacturing technologies. Digital workflows and automation are no longer goals; they are becoming necessary requirements. IoT devices have offered manufacturers a path toward preserving revenue streams during this pandemic.

Industrial Automation Software Market Trends

SCADA has a Significant Impact on the Market Growth

- The supervisory control and data acquisition (SCADA) software experienced rapid growth over the past decade. SCADA system helps the end-user industry employees to analyze the data and make crucial decisions from a remote location. It further assists in mitigating the issues with a quick response as it processes, distributes, and displays the data on the human-machine interface (HMI).

- SCADA systems usually function in close coordination with hardware and software components. The hardware collects and feeds data into the processing unit of a computer, which then processes it at varying time intervals. SCADA systems either record and log events into a folder on a hard disk or send them to a printer.

- SCADA systems play an important role in a number of industrial applications. Some of the industries that use SCADA in their daily operations include water and wastewater systems, electric generation, transmission and distribution systems and oil and gas systems. For instance, in the Oil and Gas industry, SCADA is used to monitor well and pumping sites along with distribution pumping pressure and pipeline flow.

- In February 2022, General Electric (GE) Digital announced the launch of its latest version of CIMPLICITY 2022 HMI/SCADA software. For applications of all sizes, the software can deliver fast response, reduced costs, improved security, and increased profitability. CIMPLICITY also provides options to deploy on-prem, in the cloud, or in a hybrid architecture to reduce infrastructure and maintenance costs.

- The labor wage is one of the largest expenses for any business. As per the US Bureau of Labor Statistics, labor costs for workers in the US rose by 1.3% for the third quarter of 2021, which was the largest hike in 20 years. Industrial automation solutions, such as SCADA, enables the reduction in required labor hours for the tasks, thereby reducing the associated labour costs.

Europe Market to Witness Significant Growth

- The robotics and automation industry is one of the most innovative in the German mechanical engineering sectors. German OEMs rank among the world's leading R&A companies. Human-robot collaboration (HRC) and machine vision (MV) technologies are considered the major strengths in a global hub that hosts robotics players from all market segments. Technological developments in the field of artificial intelligence, including machine learning and deep learning, will lead to further applications of conventional industrial robots and collaborative robots.

- Recently, SECO, a global provider of innovative embedded systems, Internet of Things (IoT), and Artificial Intelligence (AI) solutions, presented its expanded Human Machine Interface product portfolio at embedded world 2022 in Nuremberg, Germany. In addition to the company's wide-ranging FLEXY VISION family, the HMI product portfolio was expanded to include the modular Proven Concept (PCT) HMI series by Garz & Fricke with flush mount, rear mount, and panel mount installation options and an accompanying single board computer providing display intelligence and interfaces.

- The machine vision industry in Germany and Europe has been growing at a fast rate over the past decade. Beyond the automotive industry and the electrical and electronics industries (including semiconductors), other sectors - including the metal, food, and packaging, as well as non-manufacturing industries (e.g., intelligent traffic technology, medical diagnostic equipment, and surgical technologies) - are increasingly making use of machine vision technology.

- As per a recent report produced by the Manufacturing Technology Centre (MTC) and Loughborough University's Industrial Policy Research Centre (IPRC), speeding up the adoption of industrial automation and robotics in the United Kingdom could lead to significant improvements in the country's manufacturing productivity. A new national robotics research center is also being set up in the country to advance smart manufacturing by eliminating barriers and accelerating the widespread use of smart collaborative robotics technologies.

- Much EU-based research & innovation (R&I) programs have constantly supported the development of solutions and technologies that enable the European manufacturing sector to fully utilize digital opportunities. Many of the projects are financed by the Factories of the Future Public-Private Partnership as they cover areas such as digital automation, process optimization of manufacturing assets, simulation and analytics technologies, and ICT innovation for manufacturing SMEs.

Industrial Automation Software Industry Overview

The Industrial Automation Software Market is moderately competitive and consists of some influential players. The key players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. These businesses are leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- February 2022 - Emerson announced the opening of a new integrated manufacturing facility at Mahindra World City, in Chennai, Tamil Nadu. The 145,000-square-foot facility will manufacture major products of the company's Automation Solutions business which provides industrial customers in India and across Asia with technologies to improve productivity, safety, and environmental sustainability.

- July 2021 - Rockwell Automation announced the acquisition of Plex Systems for USD 2.22 billion to expand its industrial cloud software offering. Plex Systems is a pure software-as-a-service, cloud-native smart manufacturing platform operating at scale.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Automation for Qualitative and Reliable Manufacturing

- 5.1.2 Growing Need for Mass Production with Reduced Operation Cost

- 5.1.3 Surge in Adoption of Industry 4.0 and Enabling Technologies

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Professionals and Awareness of Security

- 5.2.2 High Implementation Costs for Factory Automation Solutions

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Supervisory Control and Data Acquisition (SCADA)

- 6.1.2 Distributed Control System (DCS)

- 6.1.3 Manufacturing Execution Systems (MES)

- 6.1.4 Human Machine Interface (HMI)

- 6.1.5 Programmable Logic Controller (PLC)

- 6.2 By End-user Industry

- 6.2.1 Power Industry

- 6.2.2 Automotive Industry

- 6.2.3 Oil and Gas Industry

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Company

- 7.1.2 ABB Ltd

- 7.1.3 Siemens AG

- 7.1.4 General Electric Company

- 7.1.5 Schneider Electric SE

- 7.1.6 Honeywell International Inc.

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 HCL Technologies Limited

- 7.1.9 Parsec Automation Corporation

- 7.1.10 SAP SE

- 7.1.11 Tata Consultancy Services Limited

- 7.1.12 Hitachi Ltd