|

市場調査レポート

商品コード

1851771

プロパン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Propane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プロパン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月03日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

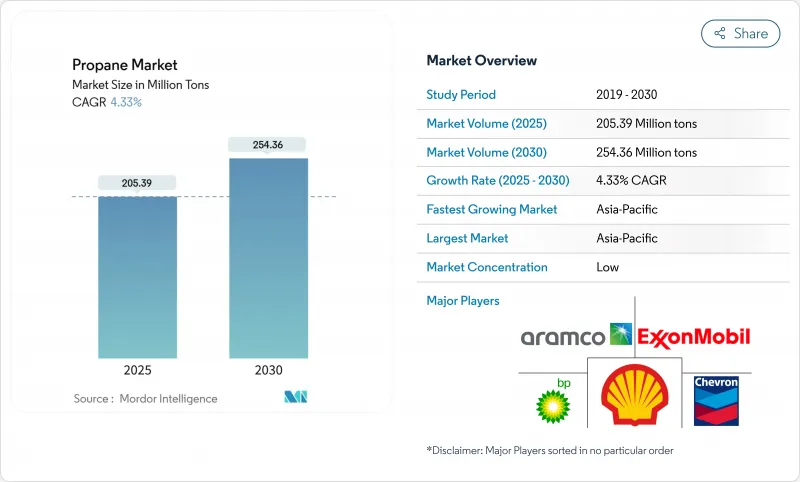

プロパンの市場規模は2025年に2億539万トンと推定され、2030年には2億5,436万トンに達すると予測され、予測期間(2025-2030年)のCAGRは4.33%です。

プロパン需要は、炭素原単位が比較的低いこと、地方や郊外の多くの場所で電気よりもコスト面で有利であること、石油化学原料としての役割が高まっていることなどの恩恵を受けています。シリンダーによる配給、ラストワンマイルネットワークの拡大、安全性の向上により、新興国での利用が拡大している一方、バイオプロパンへの投資は、生産者がライフサイクル排出量の大幅削減を目指していることから加速しています。オートガスプログラム、低排出ガス燃料の税額控除、スクールバス車両の転換が輸送需要を拡大する一方、堅調な農業消費が引き続き季節的な引取を下支えしています。供給面では、北米の堅調な天然ガス液生産とアジアの新規プロパン脱水素(PDH)生産能力が流動性を支えています。

世界のプロパン市場の動向と洞察

電化推進にもかかわらず住宅需要は底堅い

低炭素暖房の義務化は、2024年の世界オフテイクの40%を占める中核的な住宅消費を侵食しませんでした。米国の天然ガスまたはプロパン暖房住宅は、オール電化住宅に比べて年間平均1,132米ドル節約でき、プロパンのコスト提案を強化しています。特に中西部では、2,400万以上の米国世帯がプロパンに依存しています。マサチューセッツ州は2024年にほとんどの機器リベートを打ち切ったが、低所得者向けの高効率ユニットへのインセンティブは残っており、政策的現実主義を示しています。小売価格は全国的に軟化し、2024年5月には1ガロン当たり平均2.475米ドルとなり、需要維持に貢献しました。こうした力学は、ヒートポンプの採用が増加しても、成熟市場では緩やかな成長を維持すると予想されます。

高い成長率を牽引する産業用途

石油化学メーカーがプロパンをプロピレンに変換するための専用PDHプラントを増設するにつれて、産業用途の取り込みは全体の成長を上回り、CAGR 5.25%で進んでいます。アジアの新規プロジェクトが2024年のプロピレン生産量を加速させ、スプレッドは縮小しながらもプロパンのスループットは拡大しています。持続可能性の目標は、事業者に、プロセス効率を損なうことなくスコープ1排出を抑制するために、炭素捕捉ソリューションと再生可能プロパン混合を試すよう促しています。原料の信頼性とリスク回避された脱炭素化の道筋が組み合わさることで、業界の需要は予測期間を通じて持続的な成長の柱となります。

スポットNGL価格の変動

プロパン価格は、原油価格の変動や在庫サイクルの影響を受けやすく、独立系販売業者の販売マージンを圧迫しています。コンウェイ・インデックスによると、中西部ではシェールの生産量が豊富な時期に価格が下落し、その後、需要の多い冬に急騰するため、ヘッジ戦略が複雑になります。ボラティリティは、中小企業の貯蔵インフラへの設備投資を抑制し、オートガスステーションの展開を遅らせ、短期的な市場拡大をわずかに抑制する可能性があります。

セグメント分析

非関連ガスは2024年の世界供給量の52%を占め、シェールガスの開発と中流域の整備が盛んです。米国だけで、プロパンを含むNGLの2025年の生産量は前年比10%増の日量300万バレルとなります。パーミアン盆地とアパラチア地域における低温処理の増加により、原料の継続性が確保され、プロパン市場の安定した基盤が確保されました。製油所と関連ガスの流れは補完的な量を供給したが、製油所の稼働率上限とフレア削減イニシアチブに制約され、伸びは緩やかでした。

バイオプロパンのCAGRは9.20%であり、エネルギー転換の流れの中で極めて重要な役割を担っています。専用のHVO(水素化分解植物油)装置とコプロセシング・ラインの能力拡張により、再生可能プロパンの世界生産量は2023年の日量1万9,000バレルから2025年には日量5万1,000バレルに増加します。東南アジアやラテンアメリカの発展途上国でも、廃油の利用を試験的に導入しており、地理的な供給の多様性が広がっています。再生可能エネルギー認証制度が成熟するにつれて、トレーダーは価格プレミアムが圧縮され、住宅用混合燃料や工業炉の主流になることを期待しています。

プロパン市場レポートは、供給源(精製所、随伴ガス、非随伴ガス、バイオプロパン)、エンドユーザー産業(住宅、商業、工業、運輸、その他)、流通チャネル(バルク配送、シリンダー配送、その他)、地域(アジア太平洋、北米、欧州、南米、中東アフリカ)で区分されています。市場予測は数量(トン)で提供されます。

地域別分析

アジア太平洋地域は2024年にプロパン市場量の41%を占め、工業化、人口増加、LPG導入支援策に後押しされ、2030年までCAGR 6.18%で拡大すると予測されます。中国の消費量は2022年に7,390万トンに増加し、自動車内装や消費者包装のポリプロピレン需要を満たすためにPDHの生産能力が増強されているため、引き続き増加します。インドのPradhan Mantri Ujjwala Yojanaは農村部でのシリンダー普及率を維持し、家庭の燃料転換を促進しています。カナダの輸出業者であるAltaGas社は、2026年までにリドレー島のプロパン輸出量を倍増させる計画であり、北米とアジアのバイヤーを結ぶサプライチェーンのつながりを強調しています。

北米では生産と輸出の大幅な余剰が続いています。米国の輸出量は2024年に日量180万バレルに達し、17年連続で増加しました。豊富なシェールガス・リキッドとメキシコ湾岸のドック容量の拡大により、世界の需要家にとって信頼できる原料が確保されます。国内需要は堅調で、住宅暖房は横ばいだが、オートガスと再生可能プロパンの混合は増加傾向にあります。

欧州では、伝統的な暖房用途の需要は成熟しているが、再生可能プロパン混合は勢いがあります。再生可能エネルギー指令IIIとfit-for-55パッケージは、バルク・ポートフォリオと航空燃料のコプロダクト・ストリームを脱炭素化するようサプライヤーを刺激します。混合分子を扱うためのインフラの再利用により、この地域は2030年までの緩やかなサプライミックス移行に備えます。

中東とアフリカでは、豊富な随伴ガスストリームを活用し、国内の石油化学への意欲を高めています。一方、南米市場は、ブラジルのシリンダープログラムの拡張とアルゼンチンの農業乾燥のニーズを背景に、着実に進展しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 住宅部門の需要増加

- 石油化学産業における需要

- 欧州運輸セクターにおけるバイオプロパン混合目標(欧州)

- 農業における需要の高まり

- 運輸部門からの需要増加

- 市場抑制要因

- プロパンの高濃度における有害作用

- スポットNGL価格の変動が独立系市場業者のマージンを圧迫(グローバル)

- 保管と安全性リスク

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 供給減別

- 製油所

- 関連ガス

- 非関連ガス

- バイオプロパン

- エンドユーザー業界別

- 住宅

- 商業

- 工業

- 輸送機関

- その他のエンドユーザー業界

- 流通チャネル別

- バルク配送

- シリンダー配給

- オートガス給油ネットワーク

- 小売パッケージ(1ポンドおよびキャンプ用)

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- AltaGas Ltd.

- BP p.l.c.

- Chevron Corporation

- China Petrochemical Corporation

- DCC Plc

- Energy Transfer LP

- Eni SpA

- Enterprise Products Partners L.P.

- Equinor ASA

- Exxon Mobil Corporation

- GAIL(India)Limited

- Gazprom

- Linde PLC

- PDVSA

- PetroChina Company Limited(China National Petroleum Corp.)

- Phillips 66 Company

- Repsol

- Saudi Arabian Oil Co.

- Shell PLC

- SHV Energy

- Suburban Propane

- TotalEnergies

- UGI Corporation