|

市場調査レポート

商品コード

1438378

チョコレートミルク:市場シェア分析、業界動向と統計、成長予測(2024-2029)Chocolate Milk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| チョコレートミルク:市場シェア分析、業界動向と統計、成長予測(2024-2029) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 132 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

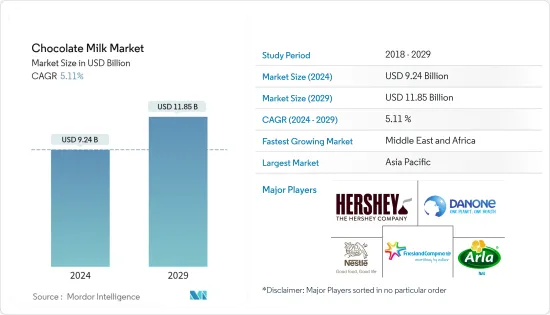

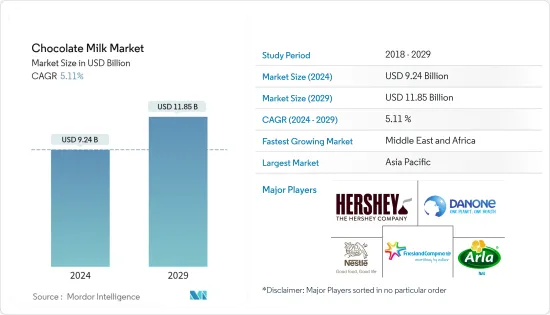

チョコレートミルク市場規模は、2024年に92億4,000万米ドルと推定され、2029年までに118億5,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.11%のCAGRで成長します。

消費者の可処分所得の増加、フレーバー乳製品の需要の高まり、小売店へのアクセスの容易さは、市場の成長を促進するいくつかの推進力です。世界中のさまざまなプレーヤーが発売した、さまざまな魅力的な包装オプションと、必須栄養素を追加した革新的で機能的な製品が、市場の成長を支える主要な要因です。さらに、世界中で調理時間が短い労働人口が増加しているため、チョコレートミルクは都市部の多くの人にとって簡単な食事の選択肢となっています。

さらに、チョコレートフレーバーは世界中で最も愛されているフレーバーの1つであることも、製品の売上を押し上げています。 BCZ(ベルギー乳業連盟)によると、2021年にベルギーでは平均して一人当たり約3.4リットルのチョコレートミルクが消費され、2018年の3.21リットルから増加しました。

さらに、乳製品を含まないチョコレートミルク業界の台頭は、ビーガン動向の高まりと、本物の乳製品の感触を提供する植物ベースの乳製品に対する消費者の欲求によって推進されています。乳糖不耐症の人は、カロリーが低いと考えられている乳製品を含まないチョコレート乳製品を楽しむことができます。ビーガン人口の増加とその味が、ビーガンミルクなどの乳製品を含まないチョコレートミルク製品の売上を押し上げています。乳製品を使わずに作られたチョコレートミルクは砂糖を減らし、タンパク質、ビタミン、ミネラルを強化しています。美味しくて健康に良い牛乳の代替品です。飽和脂肪とコレステロールが少なく、タンパク質とビタミンCが豊富です。

チョコレートミルク市場動向

「より良い」、「オーガニック」、「フリーフロム」製品への需要の増加

パンデミック後、人々の健康意識はさらに高まりました。彼らは化学物質や人工成分を含む製品を避けています。この消費者の健康意識の高まりと、それに伴う人工原材料の摂取のデメリットに対する認識の高まりにより、世界市場でオーガニックチョコレートミルクや無糖チョコレートミルクの売上が増加しています。たとえば、USDAによると、米国における有機液体ミルク製品の総売上高は2021年から2.0%増加し、2022年には23億8,500万米ドルに達しました。この需要と売上の増加が、米国におけるオーガニックチョコレートミルク市場の成長を支えています。

これに伴い、消費者の食品消費パターンの変化とチョコレートドリンクの需要の増加が、世界中でオーガニックチョコレートドリンクの成長を支えています。これらのオーガニックチョコレートミルクの動向は、チョコレートミルクメーカーにとって潜在市場を開拓する有利な機会を生み出し、新規参入者が新しく革新的なオーガニックフレーバーチョコレートドリンクで市場に参入し、利益を得ることで企業の収益を向上させる扉を開きます。他のものよりも優れています。たとえば、2021年3月、アメリカの元祖100%グラスフェッドオーガニック乳製品ブランドの1つであるメープルヒルは、国内初の減糖グラスフェッドオーガニックチョコレートミルクを発売しました。さらに、この製品は主要なチョコレートミルクブランドよりも砂糖が25パーセント少なく、タンパク質が8グラム含まれています。フェアトレードココアと再生農業を利用して生産された100%牧草で育てられたオーガニックミルクで作られています。

さらに、ビーガンおよび無糖のチョコレートミルクの需要の高まりもチョコレートミルク市場の成長を支えています。ビーガン主義の高まりと、天然成分を使用したビーガン製品の消費に対する人々の関心の高まりにより、市場の大手企業はビーガンベースのチョコレートミルク製品の発売を推進しています。たとえば、2021年10月、a2ミルク社とハーシー社は提携し、ほとんどの乳製品に含まれるA1タンパク質とA2タンパク質の組み合わせではなく、A2タンパク質を含む天然チョコレートミルクを発売しました。したがって、より良い健康とビーガンベースのチョコレートミルクに対する需要が、予測期間中の市場の成長を推進します。

アジア太平洋で世界のチョコレートミルク市場をリード

アジア太平洋地域はチョコレートミルク市場の主要地域です。便利で、自然で、栄養価が高く、健康的な持ち運び用スナックのオプションに対する消費者の需要が、アジア太平洋全体でのチョコレートミルクの売上の主な要因です。消費者のライフスタイルの変化、健康的なライフスタイルへの傾向、子供向けのチョコレートの風味や栄養価の高いものへの欲求の高まりが、この地域の産業の成長に貢献しています。したがって、より健康的で栄養価の高いチョコレートミルクの需要が高まっています。

これに加えて、乳製品ベースの飲料はもともとカルシウム含有量が高いため、栄養飲料の選択肢として認識されています。また、プロバイオティクスドリンクの健康上の利点、特に消化と免疫システムを改善する能力は、主に中国とインドであらゆる年齢層の消費者を魅了しています。消費者の食品消費パターンの変化とチョコレートドリンクの需要の増加が、アジア太平洋全体でのオーガニックチョコレートドリンクの成長を支えています。

さらに、インドは最大の牛乳生産国であるため、事業を拡大するためにチョコレートミルク企業が製造施設を設立し、さまざまな製品を発売するよう誘致しています。たとえば、インドの飲料業界で有名なプレーヤーであるパール・アグロは、2021年にSMOODHブランドでチョコレートミルク味とトフィーキャラメル味の新しいフレーバーミルク製品を発売しました。この立ち上げにより、同社は乳製品部門に事業を拡大しました。したがって、健康上の利点の増加と、この地域の市場の主要企業による新製品の発売により、この地域のチョコレートミルク製品の需要が増加しています。

チョコレートミルク業界の概要

チョコレートミルク市場は細分化されており、地域/地元のプレーヤーと国際的な競合企業で構成されています。 Arla Foods、Danone、Nestle SAなどの企業が市場を独占しています。チョコレートミルク市場の主要企業は、世界的に圧倒的な存在感を誇っています。 Hershey Company、Saputo Inc.、Mullerなどの他の主要企業は、ソーシャルメディアプラットフォームやオンライン流通チャネルで製品を宣伝し、オンラインマーケティングの売上とブランディングを増やし、より多くの顧客を引き付けています。したがって、彼らはエンターテイメント業界やスポーツ業界と協力して、特に子供たちに健康的な牛乳を飲む習慣を教え込んでいます。同様に、マースなどの大手企業は、各製品に機能的な利点を盛り込みながら、消費者に革新的でエキゾチックなフレーバーを提供することに重点を置いています。さらに、これらの企業は、地理的なプレゼンスと顧客ベースを拡大するための主要戦略としてイノベーションと拡大を採用しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- タイプ

- 乳製品ベースのチョコレートミルク

- 乳製品不使用のチョコレートミルク

- 流通チャネル

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア

- オンライン小売店

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 北米のその他の地域

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- 南アフリカ

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Nestle SA

- Arla Foods amba

- Dairy Farmers of America Inc.

- Saputo Inc.

- Royal FrieslandCampina NV

- Maryland &Virginia Milk Producers Cooperative Association, Inc.

- Inner Mongolia Yili Industrial Group Co. Ltd

- Danone SA

- The Hershey Company

- The Coca-Cola Company

第7章 市場機会と将来の動向

The Chocolate Milk Market size is estimated at USD 9.24 billion in 2024, and is expected to reach USD 11.85 billion by 2029, growing at a CAGR of 5.11% during the forecast period (2024-2029).

The increasing consumer disposable income, rising demand for flavored dairy products, and easy access to retail outlets are a few drivers aiding the market growth. Various attractive packing options and innovative and functional products with added essential nutrients launched by different players worldwide are major factors supporting the market's growth. Additionally, chocolate milk has been a quick meal option for many in urban areas as the working population with less time to cook worldwide is increasing.

Furthermore, the chocolate flavor is one of the most loved flavors globally, also boosting product sales. According to BCZ (Belgian Dairy Industry Confederation), in 2021, on average, roughly 3.4 liters of chocolate milk were consumed per capita, an increase from 3.21 liters in 2018 in Belgium.

Moreover, the rise of the non-dairy chocolate milk industry is being driven by rising vegan trends and consumer desire for plant-based milk products, which provide an authentic dairy feel. Lactose-intolerant people can enjoy non-dairy chocolate milk products, which are also frequently thought to have fewer calories. An increase in the vegan population coupled with its taste drives the sales of nondairy chocolate milk products like vegan milk. Chocolate milk made from a non-dairy basis is reduced in sugar and fortified with protein, vitamins, and minerals. It is a delectable and wholesome substitute for cow's milk. It is low in saturated fat and cholesterol and abundant in protein and vitamin C.

Furthermore, The growth of supermarkets/hypermarkets across most of the Tire 1 and Tire 2 cities worldwide is also aiding the Chocolate Milk Market to penetrate deeper, thus increasing the market size.

Chocolate Milk Market Trends

Increasing Demand for "Better-For-You", "Organic", and "Free-From" Products

Post-pandemic people became more health conscious. They are avoiding products containing chemicals and artificial ingredients. This rise in health consciousness among consumers and the resulting increase in awareness about the disadvantages of consuming artificial ingredients is fueling the sales of organic chocolate milk and sugar-free chocolate milk in the global market. For instance, according to USDA, the total sales of organic fluid milk products in the United States increased by 2.0%from 2021 and stood at USD 2,385 million in 2022. This increased demand and sales support the growth of the organic chocolate milk market in the forecast period.

Along with this, a shift in the food consumption pattern of consumers and increasing demand for chocolate drinks is supporting the growth of organic chocolate drinks across the globe. The trend of these organic chocolate milk is creating lucrative opportunities for the chocolate milk manufacturers to tap the potential markets and opening the doors for new entrants to enter the market with new and innovative organic, flavored chocolates drinks and enhance the revenue of the companies by gaining an advantage over the others. For instance, in March 2021, Maple Hill, one of America's original 100% grass-fed organic dairy brands launched the nation's first Reduced Sugar Grass-Fed Organic Chocolate Milk. Moreover, the product has 25 percent less sugar than leading chocolate milk brands and has 8 grams of protein. It is made with 100% grass-fed organic milk, which is produced using regenerative agriculture along with Fair Trade Cocoa.

Furthermore, the rising demand for vegan and sugar-free chocolate milk is also supporting the chocolate milk market growth. The increase in veganism and people's interest in consuming vegan products with natural ingredients is pushing the leading players in the market to launch vegan-based chocolate milk products. For instance, in October 2021, a2 Milk Co. and Hershey Co. partnered and launched natural chocolate milk containing A2 protein rather than the combination of A1 and A2 proteins contained in most dairy products. Therefore, the demand for better for you and vegan-based chocolate milk is driving the growth of the market during the forecast period.

Asia-Pacific Leading The Global Chocolate Milk Market

Asia Pacific is the leading region for the chocolate milk market. The consumer demand for convenient, natural, nutritious, and healthy on-the-go snack options is the primary attribute for the sales of chocolate milk across Asia-Pacific. The changing lifestyle of consumers, their inclination toward a healthy lifestyle, and the growing desire for chocolate flavor and high nutritional content for children aid in the growth of the region's industry. Hence, chocolate milk, the healthier and more nutritional option, is witnessing increasing demand.

Along with this, dairy-based beverages are naturally high in calcium content, and thus, they are perceived as a nutritional beverage option. Also, the health benefits of probiotic drinks, especially their ability to improve digestion and the immune system, attract consumers across all age groups mainly in China and India. A shift in the food consumption pattern of consumers and increasing demand for chocolate drinks are supporting the growth of organic chocolate drinks across Asia-Pacific.

Moreover, India is the largest milk producer, so it is attracting chocolate milk businesses to set up manufacturing facilities and launch different products to expand their businesses. For instance, in 2021, Parle Agro a well-known player in the Indian beverage industry launched a new flavored milk product under SMOODH brand that is available in chocolate milk and toffee caramel flavors. Through this launch, the company expanded its business into the dairy sector. Therefore, the increased health benefits coupled with new product launches from the major players in the region's market are increasing the demand for chocolate milk products in the region.

Chocolate Milk Industry Overview

The chocolate Milk Market is fragmented, comprising regional/local players and international competitors. Players like Arla Foods, Danone, and Nestle SA dominate the market. The leading players in the chocolate milk market enjoy a dominant presence globally. Other key players, such as the Hershey Company, Saputo Inc., and Muller, are promoting products on social media platforms and online distribution channels to increase online marketing sales and branding to attract more customers. Thus, they collaborate with the entertainment and sports industries to inculcate healthy milk-drinking habits, especially among children. Similarly, major players, such as Mars, extensively focus on providing consumers with innovative and exotic flavors while including functional benefits in each product. Moreover, these companies adopted innovation and expansion as key strategies to increase their geographical presence and customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dairy Based Chocolate Milk

- 5.1.2 Non-Dairy Based Chocolate Milk

- 5.2 Distribution Channel

- 5.2.1 Supermarket/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle S.A.

- 6.3.2 Arla Foods amba

- 6.3.3 Dairy Farmers of America Inc.

- 6.3.4 Saputo Inc.

- 6.3.5 Royal FrieslandCampina N.V.

- 6.3.6 Maryland & Virginia Milk Producers Cooperative Association, Inc.

- 6.3.7 Inner Mongolia Yili Industrial Group Co. Ltd

- 6.3.8 Danone S.A.

- 6.3.9 The Hershey Company

- 6.3.10 The Coca-Cola Company