|

市場調査レポート

商品コード

1403855

家畜ヘルスケア:市場シェア分析、産業動向と統計、2024~2029年の成長予測Farm Animal Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 家畜ヘルスケア:市場シェア分析、産業動向と統計、2024~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

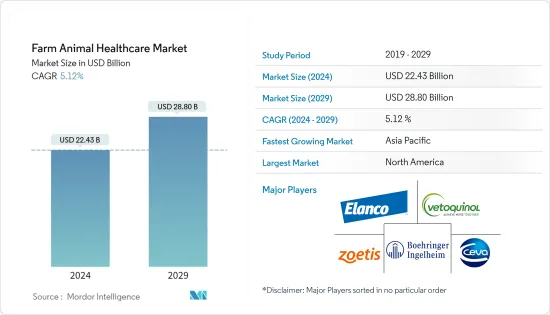

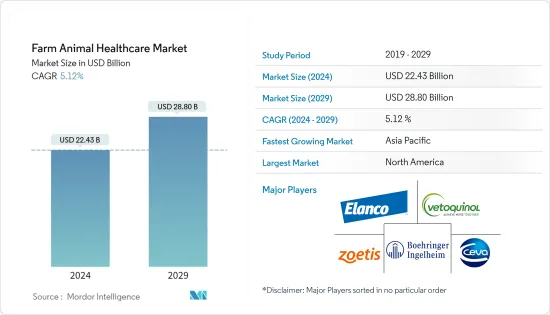

家畜医療市場規模は2024年に224億3,000万米ドルと推定され、2029年には288億米ドルに達すると予測され、予測期間中(2024~2029年)のCAGRは5.12%で成長する見込みです。

COVID-19は、動物医療サービスの停止につながった政府による封鎖措置のため、家畜医療市場の成長に影響を与えています。例えば、2022年7月にIndian Journal of Animal Sciencesに掲載された論文によると、パンデミックは、インドのカルナータカ州におけるワクチン接種、対処法、農家への経済的損失を含む動物医療サービスの提供の停止により、畜産部門に深刻な影響を与えたことが観察されています。また、『Translational Animal Science』に掲載された論文によると、2021年12月、COVID-19の大流行によりサプライチェーンが寸断され、米国のローワで動物のケアを維持する上で、生産者のストレスや不確実性、時間的な課題が増大しました。しかし、規制が解除されたことで、企業は臨床活動を再開し、製品開発も再開したため、市場開拓が進みました。したがって、市場は予測期間中に成長すると予想されます。

動物医療における技術革新につながる先端技術、各国の政府や動物愛護協会によるイニシアチブの高まり、新興人獣共通感染症のリスクにおける生産性の向上などの要因が、予測期間中の市場成長を押し上げると予想されます。

また、農作物へのワクチン接種のための様々なプログラムやキャンペーンを推進する政府の取り組みが増加していることも、市場の成長を後押しすると予想されます。例えば、2022年3月、米国大使は、牛の結核に対するワクチン接種のための新たな5カ年プロジェクトの開始を発表しました。

さらに、家畜の間で慢性疾患や感染症が新たに発生していることから、効果的な治療薬製品に対する需要が高まっており、これが予測期間中の市場成長を高めると予想されています。例えば、Health and Medicine誌に掲載された記事によると、2022年2月、シドニーで、馬に急性致死性の呼吸器と/または神経学的適応症を引き起こす可能性のあるウイルス、新型ヘンドラウイルスが発見されました。このウイルスはオーストラリア馬の致命的な病気の原因であり、人体への脅威であると考えられています。さらに、同じ情報源によれば、2021年10月、ニューサウスウェールズ州一次産業省がニューカッスル近郊で2例目の感染者を確認しました。

さらに、農畜産物に関連する製品の発売が増加することで、ワクチン、薬用飼料、その他の製品が市場に出回るようになり、農畜産物医療市場の成長に寄与しています。例えば、2022年4月、Boehringer Ingelheimは、ヘルペスウイルスによって引き起こされる鶏の非常に一般的な病気であるマレック病の予防接種「PREVEXXION RN+HVT+IBD」と「PREVEXXION RN」を英国やドイツを含む欧州で発売しました。また、Amlan Internationalは2022年4月、家禽・家畜用の抗生物質の代替となる2つの新しい天然抗生物質、Phylox FeedとNeutraPathを上市しました。この発売により、同社は動物用飼料添加物の幅広いポートフォリオを拡大し、抗コクシジウム薬やワクチンの天然代替品や、抗生物質を使用しない生産のための天然病原体制御製品を含むようになった。

したがって、前述の要因により、調査対象市場は予測期間中に成長すると予想されます。しかし、偽造医薬品の使用や、動物実験や獣医サービスのコスト増加が、予測期間中の家畜医療市場の成長を阻害する可能性が高いです。

家畜医療市場の動向

ワクチン分野は予測期間中に大幅な成長が見込まれる

ワクチンは、特定の疾病に対する獲得免疫を提供するために処方される生物学的製剤です。ワクチンは、クロストリジウム病、マレック病、ニューカッスル病、伝染性気管支炎、伝染性喉頭気管炎、家禽痘、家禽コレラ、豚コレラ、豚コレラ、口蹄疫、豚パルボウイルスなど、家畜の様々な疾病の治療に使用されます。さらに、これらの病原体に由来する遺伝子組み換え成分を含む新しい先進ワクチンが製造されており、様々な感染症から家畜を守り、その生産性を高めることができます。

ワクチン分野は、人獣共通感染症や慢性疾患の流行の増加、製品上市の増加、動物の健康に対する意識の高まり、政府機関や協会による投資の増加、農作物に対する医療費の増加などの要因により、予測期間中、農作物医療市場で大きな成長が見込まれています。例えば、2022年8月にFrontiers in Veterinary Scienceに掲載された論文によると、2021年から2022年にかけてタイで多数の塊状皮膚病(LSD)の発生が報告され、畜牛農場に影響を与えたことが確認されています。さらに、同じ情報源によると、タイでは2021年5月から7月にかけて、152の酪農場で133のLSDの発生が確認されました。このように、LSDの症例数が多いことから、企業は効果的なワクチンの開発に注力しており、予測期間中の同分野の成長を押し上げると予想されます。

さらに、市場参入企業は市場での存在感を高めるため、世界的に新しいワクチンを開発・発売しており、このセグメントの成長に貢献しています。例えば、ベーリンガーインゲルハイムは2022年5月、画期的な混合プラットフォームであるTwistPakを発売しました。これにより豚の生産者は、Ingelvac CircoFLEXとIngelvac MycoFLEXの2種類のワクチンを、便利で迅速かつ柔軟に組み合わせることができます。現在進行中のワクチン候補から良好な結果が得られれば、研究セグメントの成長にプラスの影響を与えることがさらに期待されます。同様に、2021年12月、Indian Immunologicals Ltd(IIL)は、ヤギ痘病の制圧に役立つヤギ痘ワクチン(Raksha Goat Pox)を発売しました。さらに、2022年8月には、インドの農業・農民福祉担当大臣がインド獣医研究所と共同で、ランピー・スキン病から家畜を守るための土着ワクチンLumpi-ProVacを発売しました。

従って、牛の間でランピー・スキン病の発生が増加していることと新製品の発売により、調査対象セグメントは予測期間中に成長すると予想されます。

北米が予測期間中に大きな市場シェアを占める見込み

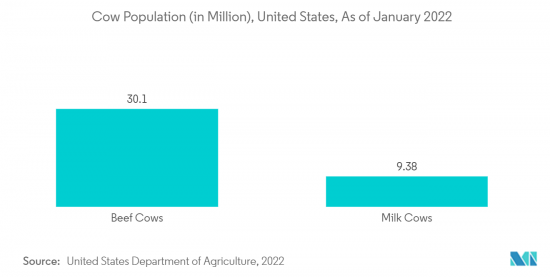

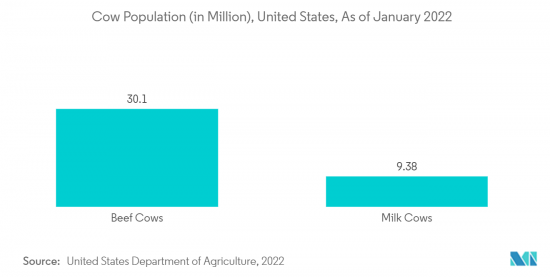

北米は、家畜の慢性疾患や感染症の負担の増加、技術の進歩、家畜医療の利点に対する認識などの要因により、予測期間中、家畜医療市場で大きなシェアを占めると予想されます。

さらに、政府のイニシアチブの高まりや、農作物用の効果的な医薬品や治療製品の開発のための様々なプロジェクトの立ち上げへの投資は、予測期間中に市場の成長を増加させると予想されます。例えば、2022年3月、米国農務省は、より効果的な豚インフルエンザワクチンを開発するため、コーネル大学に64万2,000米ドルを授与しました。同様に、2022年3月、米国農務省(USDA)の国立食品農業研究所(NIFA)は、動物疾病の新規治療と予防戦略の調査のために1,300万米ドル以上を投資しました。これらの資金は、家畜の健康状態を改善するため、子牛の感染症を治療する効果的な薬剤や医薬品の開発に使用されます。

さらに、この地域では家畜の間で様々な疾病の負担が大きいため、家畜を保護するための効果的なワクチンの需要が高まっています。例えば、2022年1月にカナダ政府が発表したデータによると、アフリカ豚熱(ASF)は豚にとって致命的です。これは養豚を破壊し、カナダ経済に影響を与えると予想されています。同じ情報源によると、Swine Innovation Porcは2021年、カナダ農業戦略優先プログラムのもと、アフリカ豚熱の発生が豚肉セクターに与える影響を緩和する戦略を開発するため、約44万6,135米ドルを受け取った。同様に、Poultry Science誌に掲載された論文によると、2022年10月、2021年までメキシコで病気の兆候を示したニワトリから約17の鳥伝染性気管支炎ウイルス株が得られました。メキシコの伝染性気管支炎ウイルス(IBV)の遺伝的多様性の高さは、異なる遺伝子型に属する分岐系統の共流行によるもので、これらの系統はマサチューセッツ州やコネチカット州のワクチン株とは大きく異なります。このことは、同地域で新規ワクチンに対する需要が高いことを示しており、予測期間中の市場成長を促進すると予想されます。

したがって、政府のイニシアチブの高まりや家畜の疾病負担の高さといった上記の要因から、調査対象市場は予測期間中に成長すると予想されます。

家畜医療産業概要

家畜医療市場は、国内外に多くの参入企業が存在するため競争が激しいです。各社は、製品の提供を拡大することによって市場での地位を保持するために、提携、パートナーシップ、契約、その他のイニシアティブなどの主要な戦略的イニシアティブを採用しています。市場の主要企業には、Zoetis、Merck、Boehringer Ingelheim、Elanco、Vetoquinol、Ceva Animal Healthなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場の促進要因と市場抑制要因のイントロダクション

- 市場促進要因

- 動物医療に革新をもたらす先端技術

- 各国政府と動物福祉協会による取り組みの増加

- 新興人獣共通感染症のリスク増加

- 市場抑制要因

- 偽造医薬品の使用

- 動物実験と獣医サービスのコスト増加

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模(100万米ドル))

- 製品別

- ワクチン

- 寄生虫駆除薬

- 抗感染症剤

- 医療用飼料添加物

- その他の製品

- 動物のタイプ別

- 牛

- 豚

- 家禽

- 羊

- その他の動物

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Boehringer Ingelheim International GmbH

- Ceva Animal Health Inc.

- Elanco

- Hester Biosciences Limited

- Merck & Co. Inc.

- Phibro Animal Health

- Vetoquinol

- Zoetis Inc.

- Intas Pharmaceuticals Ltd

- Norbrook

- Alivira Animal Health Limited

第7章 市場機会と今後の動向

The Farm Animal Healthcare Market size is estimated at USD 22.43 billion in 2024, and is expected to reach USD 28.80 billion by 2029, growing at a CAGR of 5.12% during the forecast period (2024-2029).

COVID-19 has impacted the growth of the farm animal healthcare market owing to the lockdown measures imposed by the government which led to the suspension of animal healthcare services. For instance, according to an article published in the Indian Journal of Animal Sciences, in July 2022, it has been observed that the pandemic has created a serious impact on the livestock sector owing to the lockdown on animal health services delivery including vaccination, coping practices, and financial loss to farmers in Karnataka, India. Also, as per an article published in Translational Animal Science, in December 2021, the COVID-19 pandemic caused supply chain disruptions that increased stress, uncertainty, and time-sensitive challenges for producers in maintaining animal care at Lowa, United States. However, with the released restrictions the companies have resumed their clinical activities as well as product developments which have increased the market growth. Thus, the market is expected to grow over the forecast period.

Factors such as advanced technology leading to innovations in animal healthcare, growing initiatives by government and animal welfare associations in different countries as well as the increased productivity at the risk of emerging zoonosis are expected to boost the market growth over the forecast period.

The increasing government initiatives to promote various programs and campaigns to vaccinate farm animals are also expected to fuel the market growth. For instance, in March 2022, the United States Ambassador announced the launch of a new five-year project to vaccinate cattle against bovine tuberculosis.

Additionally, the emerging chronic and infectious diseases among the farm animals raise the demand for effective therapeutics products which in turn is anticipated to increase the market growth over the forecast period. For instance, as per an article published in Health and Medicine, in February 2022, a novel Hendra virus, a virus that can cause acute lethal respiratory and/or neurologic indications in horses, was discovered in Sydney. This virus is thought to be the cause of the deadly disease in Australian horses and is a threat to human health. In addition, as per the same source, the second case of the variant was confirmed by the New South Wales Department of Primary Industries near Newcastle in October 2021.

Furthermore, the rising product launches related to farm animals increase the availability of vaccines, medicated feed, and other products in the market, hence, contributing to the growth of the farm animal healthcare market. For instance, in April 2022, Boehringer Ingelheim launched PREVEXXION RN+HVT+IBD and PREVEXXION RN vaccinations for Marek's disease, a very common disease of chickens caused by a herpes virus, in Europe, including the United Kingdom and Germany. Also, in April 2022, Amlan International launched two new natural alternatives to antibiotics for poultry and livestock, Phylox Feed and NeutraPath, that can reduce the negative health and production effects of enteric disease. This launch assists the company to expand its broad portfolio of animal health feed additives to include a natural alternative to anticoccidial drugs and vaccines and a natural pathogen control product for antibiotic-free production.

Therefore, owing to the aforementioned factors, the studied market is expected to grow over the forecast period. However, the use of counterfeit medicines and the increasing cost of animal testing and veterinary services are likely to impede the growth of the farm animal healthcare market over the forecast period.

Farm Animal Healthcare Market Trends

Vaccines Segment is Expected to Witness Significant Growth Over the Forecast Period

Vaccines are biological preparation formulated to provide acquired immunity for particular diseases. The vaccines are used to treat various diseases in farm animals, such as clostridial diseases, Marek's disease, Newcastle disease, infectious bronchitis, infectious laryngotracheitis, fowl pox, fowl cholera, classical swine fever, foot and mouth disease, porcine parvovirus and others. Furthermore, new advanced vaccines have been manufactured containing genetically engineered components derived from those disease agents, which can protect farm animals from various infectious diseases and enhances their productivity.

The vaccines segment is expected to witness significant growth in the farm animal healthcare market over the forecast period owing to factors such as the rising prevalence of zoonotic and chronic diseases, increasing product launches, growing awareness of animal health, rising investments by government bodies and associations, and increasing healthcare expenditure for farm animals. For instance, according to an article published in Frontiers in Veterinary Science in August 2022, it has been observed that numerous outbreaks of lumpy skin disease (LSD) were reported in Thailand in 2021-2022, affecting cattle farms. In addition, as per the same source, 133 LSD outbreaks were found in Thailand in 152 dairy farms from May to July 2021. Thus, the high number of LSD cases raises the company's focus on developing effective vaccines, which is anticipated to boost the segment growth over the forecast period.

Moreover, market players are developing and launching new vaccines globally to enhance their market presence, contributing to the segment's growth. For instance, in May 2022, Boehringer Ingelheim launched TwistPak, a revolutionary mixing platform. It enables swine producers to combine two vaccines, Ingelvac CircoFLEX and Ingelvac MycoFLEX, conveniently, quickly, and flexibly. The positive outcome from the undergoing vaccine candidates is further expected to impact the growth of the studied segment positively. Similarly, in December 2021, Indian Immunologicals Ltd (IIL) launched Goat Pox Vaccine (Raksha Goat Pox) to help control Goat Pox disease. Moreover, in August 2022, the Union Minister for Agriculture and Farmers Welfare, India, in collaboration with Indian Veterinary Research Institute, launched the indigenous vaccine Lumpi-ProVac to protect livestock from Lumpy Skin disease.

Therefore, owing to the rising incidences of lumpy skin disease among cattle and the new product launches, the studied segment is expected to grow over the forecast period.

North America is Expected to Have the Significant Market Share Over the Forecast Period

North America is expected to hold a significant share in the farm animal healthcare market over the forecast period owing to factors such as the rising burden of chronic and infectious diseases among farm animals, growing technological advancements, and the awareness of farm animal healthcare benefits.

Additionally, the growing government initiatives and investments in launching various projects for developing effective medicines and therapeutics products for farm animals are expected to increase market growth over the forecast period. For instance, in March 2022, the United States Department of Agriculture awarded USD 642,000 to Cornell University to develop more effective swine influenza vaccines. Similarly, in March 2022, the United States Department of Agriculture (USDA) National Institute of Food and Agriculture (NIFA) invested USD over 13 million to research novel therapies and prevention strategies for animal diseases. These funds are used to develop effective drugs and medicines to treat infectious diseases in calves to improve livestock health.

Furthermore, the high burden of various diseases among farm animals in the region raises the demand for effective vaccines for their protection. For instance, according to the data published by the government of Canada in January 2022, African swine fever (ASF) is deadly for pigs. It is expected to destroy swine farming, impacting the Canadian economy. As per the same source, Swine Innovation Porc received about USD 446,135 in 2021 under the Canadian Agricultural Strategic Priorities Program to develop strategies to mitigate the impact of an African swine fever outbreak on the pork sector. Similarly, per an article published in Poultry Science, in October 2022, about 17 avian infectious bronchitis virus strains were obtained from chickens showing signs of illness in Mexico until 2021. Mexico's high genetic contagious bronchitis virus (IBV) diversity results from the co-circulation of divergent lineages belonging to different genotypes, and these lineages differ significantly from Massachusetts and Connecticut vaccine strains. This indicates the high demand for novel vaccines in the region, which is expected to propel the market growth over the forecast period.

Therefore, owing to the factors above, such as growing government initiatives and the high burden of diseases among farm animals, the studied market is expected to grow over the forecast period.

Farm Animal Healthcare Industry Overview

The farm animal healthcare market is competitive owing to the presence of many local and domestic players. The companies are adopting key strategic initiatives such as collaboration, partnerships, agreements, and other initiatives to withhold their market position by expanding their product offerings. Some of the key players in the market are Zoetis, Merck, Boehringer Ingelheim, Elanco, Vetoquinol, and Ceva Animal Health.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Advanced Technology Leading to Innovations in Animal Healthcare

- 4.3.2 Increasing Initiatives by Governments and Animal Welfare Associations in Different Countries

- 4.3.3 Increasing Risk of Emerging Zoonosis

- 4.4 Market Restraints

- 4.4.1 Use of Counterfeit Medicines

- 4.4.2 Increasing Costs of Animal Testing and Veterinary Services

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Vaccines

- 5.1.2 Parasiticides

- 5.1.3 Anti-infectives

- 5.1.4 Medical Feed Additives

- 5.1.5 Other Products

- 5.2 By Animal Type

- 5.2.1 Cattle

- 5.2.2 Swine

- 5.2.3 Poultry

- 5.2.4 Sheep

- 5.2.5 Other Animal Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Boehringer Ingelheim International GmbH

- 6.1.2 Ceva Animal Health Inc.

- 6.1.3 Elanco

- 6.1.4 Hester Biosciences Limited

- 6.1.5 Merck & Co. Inc.

- 6.1.6 Phibro Animal Health

- 6.1.7 Vetoquinol

- 6.1.8 Zoetis Inc.

- 6.1.9 Intas Pharmaceuticals Ltd

- 6.1.10 Norbrook

- 6.1.11 Alivira Animal Health Limited