|

市場調査レポート

商品コード

1851634

無人地上車両:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Unmanned Ground Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 無人地上車両:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

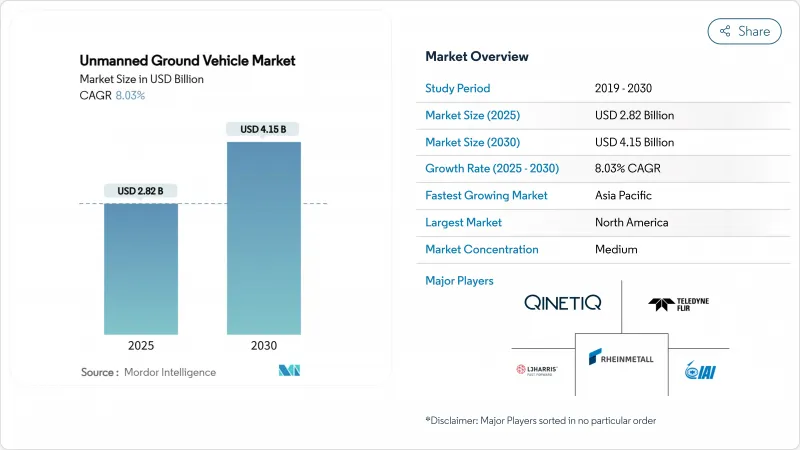

無人地上車両(UGV)市場の2025年の市場規模は34億4,000万米ドルで、2030年には47億4,000万米ドルに達し、CAGR 6.62%で成長すると予測されています。

国防近代化プログラムの増加、死傷者削減への鋭いフォーカス、ロジスティクスと採掘における自動化の加速が、共同で対応可能な需要を拡大しています。無人地上車両市場はまた、センサーとコンピューティングのコスト低下からも恩恵を受け、価格上昇に比例することなく高度な自律性を実現します。同時に、デュアルユース調達戦略により、防衛バイヤーが商業的イノベーションを活用する一方、倉庫や採掘オペレーターは実績のある軍事的信頼性を活用することができます。ソフトウェアによる差別化、モジュール式ペイロード・ベイ、安全な5Gリンクは、バイヤーが金属ではなくコードによってアップグレード可能なプラットフォームを求める中で、決定的な購入基準となってきています。地域別の支出パターンがこの状況を際立たせている:北米は絶対的な予算でリードを保っているが、アジア太平洋の資本支出は急上昇しており、無人地上車両市場に最も大きな増分を供給しています。

世界の無人地上車両市場の動向と洞察

戦闘環境における負傷者搬送用UGVに対する軍事需要

米国陸軍のTRV-150実証機がNATO訓練中に68kgの物資を70km以上輸送し、否定された空域での価値を証明。2024年12月のウクライナのUGV主導の攻撃は、銃撃下での自律的な地上作戦をさらに検証するものです。防衛機関は、地上ロボットがヘリコプターが対空の脅威に直面する都市のホットゾーンに到達し、最小限の変更で既存のロジスティクス・ネットワークに統合できることに注目しています。この推進力は、危険物の除去にこの技術を適応させる災害対応機関にも波及します。これらの要因が相まって、ミッションの範囲が拡大し、取得サイクルが短縮されることで、無人地上車両市場が活性化します。

ルート掃討任務への対IEDロボット・フリートの展開

ルート掃討のドクトリンは、単一のロボットから、ノースロップ・グラマンのANDROSやWheelbarrow Mk9のような連携したフリートへと移行しつつあります。マルチセンサーペイロードは、地中レーダーと化学スニッファーを組み合わせ、隠れた脅威を無力化すると同時に、IED攻撃による人的リスクと経済的損害を削減します。民間の爆弾処理班もこれに追随しており、最前線の軍隊以外の需要を強化し、汎用性の高いセキュリティ・ツールとして無人地上車両市場を確固たるものにしています。

独自のUGVコマンド・アンド・コントロール・プロトコル間の相互運用性のギャップ

断片化された無線リンクやソフトウェア・スタックが共同作戦の妨げとなり、防衛バイヤーはライフサイクル・コストを膨れ上がらせるミドルウェアに資金を投入することになります。AUVSIの「Trusted UGV」イニシアチブはセキュリティ認証に取り組んでいるが、世界共通言語には至っていないです。物流事業者は、異なるベンダーの倉庫ロボットを混在させる際に同様の頭痛の種に直面し、無人地上車両市場の短期的な拡大テンポを弱めています。

セグメント分析

軍事プログラムは2024年に22億米ドルを生み出し、総売上の64.10%を占め、無人地上車両市場を支えています。米国陸軍のS-MET Increment IIのような大型契約は需要を安定させるが、予算サイクルが長いため、年間数量の立ち上がりは遅いです。国防のバイヤーは、堅牢性、安全な通信、NATOグレードの相互運用性を重視し、プレミアム価格と高いマージンを支えています。

民間および商業用プラットフォームは、2024年に12億米ドルを出荷し、CAGR 9.84%で拡大し、その差は年々縮まっています。フルフィルメント・センターにおける労働力の制約、鉱山における無害化義務、自律型農業の試みは、無人地上車両市場の顧客基盤を拡大する多様な引き合いを生み出します。現在の動向が続けば、民間事業者は2028年までに国防量に匹敵するようになり、イノベーションの課題が倉庫グレードの安全システムと採掘対応の知覚ソフトウェアに傾く可能性があります。

遠隔操作ユニットは、指揮官や倉庫管理者が複雑な作業をループ内で行うため、2024年の売上を55.56%のシェアで牽引しました。同分野の成熟度と実証済みの信頼性が、無人地上車両市場の中核需要を支えています。しかし、人件費の高止まりや、帯域幅の制限により遠隔地での拡張性が制限されるため、成長は緩やかです。

自律型およびハイブリッド・プラットフォームはCAGR 10.58%で拡大しています。コマツのFrontRunnerシステムは、現在700台以上のトラックを人間の運転手なしで操縦しています。ソフトウェアが更新されるたびに、認識精度とフェイルセーフの冗長性が向上し、買い手の信頼を高めています。2027年までに、自律走行モードは遠隔操作の台数に匹敵する勢いであり、コントロールルームの人員配置モデルを再構築し、無人地上車両市場における車両1台当たりのソフトウェアコンテンツを増加させています。

地域分析

北米は2024年に13億5,000万米ドルを生産し、無人地上車両市場の39.34%を占める。政府のテストコリドー、FAAのBVLOS免除、成熟した防衛サプライチェーンがこのリーダーシップを支えています。S-METインクリメントIIプロトタイプ契約のような契約は、米国陸軍の継続的な意欲を示す一方、アマゾンの自動化支出は大規模な商業量を注入します。カナダはRPAS規則を整え、国境を越えたフリート運用を円滑化し、大陸規模の優位性を強化します。

欧州は、EUの協調的な資金援助が共通基準に拍車をかけ、およそ9億5,000万米ドルを拠出しました。Milrem率いるチームへの3,060万ユーロ(3,529万米ドル)のICUPS賞は、相互運用性を目標としており、市場の主要な抑制要因に直接対処しています。ドイツによるテレダイン社製フリアーシステムズの127台の発注とスウェーデンによるミッション・マスターの評価は、軍による具体的な導入の兆しを示しています。自動運転車のサイバーセキュリティに関する国連欧州委員会(UN ECE)の規制が明確化されたことで、サプライヤの投資が促進され、世界の無人地上車両市場における標準輸出国としての欧州の役割が強化されました。

アジア太平洋は2024年に6億7,500万米ドルを生み出すが、CAGRは最速の9.62%。中国のYiminプロジェクトは大量展開能力と5G-Aの拡張性を示し、オーストラリアの907自律採掘資産はファーウェイに輸出可能なオペレーション・モデルを提供します。韓国は歩兵旅団にロボット・ラバを投入し、日本は景気刺激策資金をスマート・ファクトリー・ロジスティクスに振り向ける。費用対効果の高い製造と大規模な調達プログラムにより、アジア太平洋は2028年までに無人地上車両市場シェアで北米を追い抜く明確な道筋が見えています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 紛争環境における死傷者救助用UGVの軍事需要

- 対IEDロボットフリートによるルート確保ミッションの展開

- eコマース倉庫における自律型物流カートの急速な導入

- 鉱業セクターの無害化への取り組みに向けた無人運搬へのシフト

- 固体LiDARの進歩がナビゲーション・センサーのコストを下げる

- 有人ー無人チーミング(MUM-T)コンセプトへの国防資金援助

- 市場抑制要因

- 独自のUGVコマンド・アンド・コントロール・プロトコル間の相互運用性のギャップ

- 長期耐久ミッションにおけるSWaP(サイズー重量ーパワー)トレードオフの課題

- 遠隔遠隔操作リンクにおけるサイバーセキュリティの脆弱性

- 公道における目視外(BVLOS)地上自律走行に対する規制の遅れ

- バリューチェーン分析

- 規制または技術的展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 用途別

- ミリタリー

- 民間および商業

- モビリティ別

- 装輪

- 装軌

- 脚

- サイズ別

- マイクロ(10 kg未満)

- 小型(10~200 kg)

- 中型(200~500 kg)

- 大型(500~1,000 kg)

- 重重量(1,000 kg以上)

- 運用モード別

- 遠隔操作

- 自律走行/ハイブリッド

- コンポーネント別

- ハードウェア(シャーシ、センサー、パワートレイン、ペイロード)

- ソフトウェアとAIスタック

- サービス(インテグレーション、MRO)

- 動力源別

- 電気電池

- ハイブリッド・電気

- 内燃機関

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Teledyne FLIR LLC

- General Dynamics Land Systems(General Dynamics Corporation)

- Rheinmetall AG

- Oshkosh Corporation

- Exail SAS

- Israel Aerospace Industries Ltd.

- Milrem AS

- QinetiQ Group plc

- Robo-Team Ltd.

- Textron Systems Corporation(Textron Inc.)

- Peraton Corp.

- Nexter Robotics(KNDS N.V.)

- Clearpath Robotics(Rockwell Automation, Inc.)

- AeroVironment, Inc.

- HORIBA MIRA Ltd.

- Aselsan AS

- Hyundai Rotem Company

- Leonardo S.p.A.

- L3Harris Technologies, Inc.