|

市場調査レポート

商品コード

1642006

5Gチップセット:世界の市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Global 5G Chipset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 5Gチップセット:世界の市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

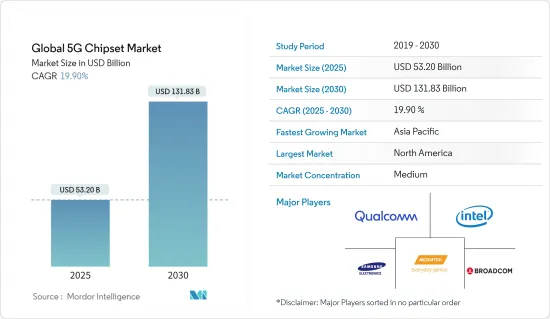

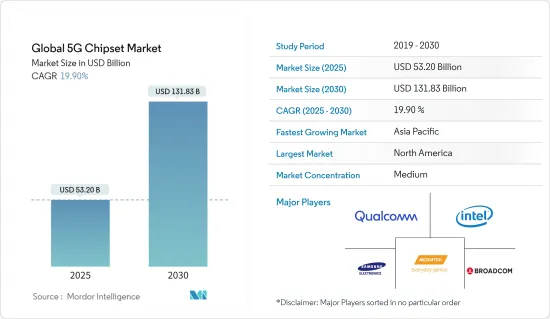

世界の5Gチップセット市場規模は、2025年に532億米ドルと推計され、2030年には1,318億3,000万米ドルに達すると予測され、市場推計・予測期間(2025-2030年)のCAGRは19.9%です。

5Gモデム・チップセットは、サービス・プロバイダーとの組み合わせにより、強化されたモバイル・ブロードバンド、超高信頼性・低遅延通信、大規模マシン型通信という3つの主要アプリケーションに大きく貢献し、その機能を強化します。この技術のアプリケーションは、予測期間中に5Gチップセットの需要を促進すると予想されます。

主なハイライト

- 5Gチップセットは、スマートフォンOEMや通信事業者向けに間もなく大規模に展開される5Gネットワークの重要な構成要素になると予想されます。超高速ネットワークスピードとデータレートを提供するため、世界中の大手通信サービスプロバイダーはネットワークを5Gにアップグレードしています。

- 5Gの登場は、すでに第4次産業革命(インダストリー4.0)に向かって突き進んでいる産業におけるコネクテッド・デバイスの利用を促進すると予想されます。インダストリー4.0は業界全体のセルラー接続を助長しており、IoTやマシン間接続の台頭も市場牽引に寄与しています。世界各地で複数のスマートシティプロジェクトやイニシアチブが進行中で、2025年までに世界全体で約30のスマートシティが誕生し、その半数は北米と欧州に立地すると予想されています。OECDによると、2010年から2030年にかけての都市インフラ・プロジェクトの総額は1兆8,000億米ドルに達すると予想されています。これは、主にスマートシティ接続アプリケーションでの使用によるもので、5Gチップセットの需要を促進する主な要因の1つとなっています。

- 複数の通信事業者が5G接続のカバレッジを拡大するために周波数帯を取得しています。例えば、2022年8月、インド初の5G周波数オークションで、エアテルは19,800MHzの周波数に43,084ルピーを支払った。過去20年間で、900 MHz、2100 MHz、1800 MHz、3300 MHz、26 GHzの周波数帯をオークションで取得しました。同社は、3.5GHz帯と26GHz帯でインド全土のフットプリントを獲得しました。同社によると、これは最高の5G体験を提供するための理想的な周波数バンクであり、100倍の容量拡張を最低コストで戦略的に行うことができます。

- 世界・ワークプレイス・アナリティクス(2020年)の調査では、回答者の80%以上が、WFHに必要な技術的スキルと知識があり、社内ネットワーク(おそらく固定回線とモバイルの両方)へのアクセスが容易で信頼できると回答しています。

- 3GPPは、5GはIMSに基づいて音声またはビデオ通信サービスを提供すべきであると規定しています。i.i.は、3GPPリリース 16の5G-to-3G SRVCC、または3GPPリリース 15のVoNR、EPS FB、VoeLTE、およびRAT FBに対してIMSを展開する必要があります。従って、このようなアップグレードはインフラ・コストを増加させ、市場の成長を困難にすることが予想されます。各アーキテクチャには固有の課題があるが、いずれも通信事業者のネットワーク内でIPマルチメディア・サブシステム(IMS)のネットワーク対応準備が必要です。

5Gチップセット市場動向

産業オートメーションが大きなシェアを占める

- Capgemini社によると、自動車工場の10件中3件が過去18~24カ月でスマート化したといいます。さらに、自動車メーカーの80%は、今後5年間のデジタルトランスフォーメーションには5Gが不可欠と考えています。例えば、エリクソンとアウディは、ドイツのガイマースハイムにあるアウディの生産ラボで、インゴルシュタットにある本社と同様のシミュレーション工程を使用して、ワイヤレス接続された生産ロボットが車体を製造するなどの実地試験を行っています。

- スマートな製造方法の重視は、市場に影響を与える重要な動向です。IBEFのデータによると、インド政府は、GDPに占める製造業の生産高寄与度を16%から2025年までに25%に引き上げるという野心的な目標を掲げています。Smart Advanced Manufacturing and Rapid Transformation Hub(SAMARTH)Udyog Bharat 4.0イニシアチブは、インドの製造業におけるインダストリー4.0の認知度を高め、利害関係者がスマート・マニュファクチャリングの課題に対処できるよう支援することを目的としています。

- インダストリー4.0革命、またはモノの産業インターネット(IIOT)は、スマートマシンとダムマシンが生成するデータのリアルタイム分析を活用することで、自動車、製造、倉庫、物流部門に食い込んでいます。しかし、自動化はこれらの分野でいくつかの課題を生み出しました。期待された業務改善は、必要なハードウェアとの統合が不十分なため、実現が難しいことが判明しました。例えば、インドの製造業GDPに占める自動化の割合は、先進国の約5%に対し、わずか1%に過ぎないです。これは、導入に適した技術にギャップがあることに起因しています。さらに、GSMAによると、2025年までに北米における消費者向けおよび産業向けのモノのインターネット(IoT)接続の総数は54億に増加すると予測されています。

- 5Gは、産業環境において約束された利点を考慮すると、大きな関心を集めています。3GPPのリリース16以降、企業向け5Gの主要機能(99.999%のネットワーク可用性と信頼性、10ミリ秒以下のレイテンシー、時間に敏感なネットワーキングのためのインターネット・サポートなど)は、インダストリー4.0の文脈におけるデジタル化のために、多くの産業プレーヤーを魅了しています。

- 例えば、ABBとエリクソンは、タイのインダストリー4.0の野望を実現し、自動化システムと無線通信によって将来の柔軟な生産を促進するために協力しました。重点分野には、ABBのロボティクス&ディスクリートオートメーション、インダストリアルオートメーション、モーションの各事業分野とABB Ability TM Platform Servicesが含まれます。この協業は、エリクソンの通信サービス・プロバイダー・パートナーとIoT-Acceleratorプラットフォームを通じて、製造環境での遠隔試運転のための5つのG対応と拡張現実レンズ、G対応と世界なNB-IoT接続モーターとドライブをカバーします。

北米が最大のシェアを占める

北米は最も重要な市場成長地域のひとつです。米国が同地域の市場シェアの大半を占めています。IoT、M2M通信、モバイルブロードバンド、その他の新興アプリケーションの需要が増加を牽引しています。

GSMA Intelligenceの「Mobile Economy North America 2020」レポートによると、北米では5G接続が全モバイル接続の半分以上を占めるようになります。2025年までに、同地域の4億2,600万件のモバイル接続の51%が5Gネットワークを利用することになります。同レポートによると、同地域のモバイル加入者数は2025年までに3億4,000万人になるといいます。

さらに、Cisco Annual Internet Reportによると、米国におけるスマートフォンの平均接続速度は、2018年の19.2Mbpsから2023年には81.1Mbpsとなり、4.2倍の成長(CAGR 33%)を遂げるといいます。5Gの展開と並行して、通信事業者は野心的なネットワーク変革戦略を推進しています。さらに、世界の通信機器メーカーおよび消費者機器メーカー18社が、5Gチップセットで米国のクアルコムと提携しました。

V2XまたはVehicle-to-Everythingと総称される安全性に敏感な新しいアプリケーションは、5Gの強化されたスループット、信頼性、可用性、および遅延の減少によって可能になります。都市部、郊外、高速道路を走行する状況での様々なアプリケーションの融合を促進するため、5GセルラーV2X(C-V2X)は共通の無線ネットワークを提供します。

5Gチップセット業界の概要

5Gチップセット市場は半固定的で、多くの地域および世界プレーヤーが存在します。イノベーションが製品提供において市場を牽引し、各ベンダーはイノベーションに投資しています。

- 2023年11月-MediaTekはgenAI機能を搭載したDimensity 8300 5Gチップセットを発表。このチップセットはTSMCの第2世代4nmプロセスに基づいており、Armのv9 CPUアーキテクチャに基づいて構築された4つのArm Cortex-A715コアと4つのCortex-A510コアで構成されるオクタコアCPUを搭載しています。GPUはMali-G615 MC6です。Dimensity 8300は、プレミアムスマートフォン・セグメントに新たな可能性をもたらし、ユーザーにインハンドAI、超リアルなエンターテインメントの機会、シームレスな接続性を提供します。

- 2023年11月-Viettel High Techが独自の5Gチップセットを開発。5G DFE(デジタル・フロント・エンド)チップは毎秒1兆回の計算が可能。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 技術スナップショット

- マクロ経済動向の業界への影響

第5章 市場力学

- 市場促進要因

- 遅延と消費電力を低減した高速インターネットと広範なネットワークカバレッジに対する需要の増加

- マシンツーマシン/IoT接続の増加

- モバイルデータサービス需要の増加

- 市場抑制要因

- 細分化されたスペクトル割り当て

第6章 市場セグメンテーション

- チップセットタイプ別

- 特定用途向け集積回路(ASIC)

- 無線周波数集積回路(RFIC)

- ミリ波技術チップ

- FPGA(フィールド・プログラマブル・ゲート・アレイ)

- 動作周波数別

- 6GHz未満

- 26~39 GHz

- 39 GHz以上

- エンドユーザー別

- コンシューマー・エレクトロニクス

- 産業オートメーション

- 自動車および輸送

- エネルギーおよび公益事業

- ヘルスケア

- 小売

- その他のエンドユーザー

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- MediaTek Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd

- Xilinx Inc.

- Nokia Corporation

- Broadcom Inc.

- Infineon Technologies AG

- Huawei Technologies Co. Ltd

- Renesas Electronics Corporation

- Anokiwave Inc.

- Qorvo Inc.

- NXP Semiconductors NV

- Cavium Inc.

- Analog Devices Inc.

- Texas Instruments Inc.

第8章 投資分析

第9章 市場の将来

The Global 5G Chipset Market size is estimated at USD 53.20 billion in 2025, and is expected to reach USD 131.83 billion by 2030, at a CAGR of 19.9% during the forecast period (2025-2030).

The 5G modem chipsets, in combination with service providers, largely serve and enhance the capabilities of three major applications - enhanced mobile broadband, ultra-reliable and low latency communications, and massive machine-type communications. The applications of this technology are expected to drive the demand for 5G chipsets during the forecast period.

Key Highlights

- The 5G chipsets are expected to be a critical component of 5G networks, which will soon be rolled out at a massive scale for smartphone OEMs and telecom players. In order to provide ultra-high network speeds and data rates, major telecom service providers across the globe are upgrading their networks to 5G.

- The emergence of 5G is expected to expedite the use of connected devices in industries that are already pushing toward the fourth industrial revolution (Industry 4.0). Industry 4.0 is aiding cellular connectivity throughout the industry; the rise of IoT and machine-to-machine connections is also instrumental in driving market traction. Several smart city projects and initiatives are underway around the world, and it is expected that by 2025, there will be around 30 global smart cities, with half of these located in North America and Europe. These steps are supported by global investments, which, according to the OECD, are expected to total USD 1.8 trillion in urban infrastructure projects between 2010 and 2030. This is one of the major factors driving demand for 5G chipsets, owing primarily to their use in smart city connectivity applications.

- Multiple telecom operators are acquiring spectrums to increase their 5G connection coverage. For instance, in August 2022, In India's first 5G spectrum auction, Airtel paid Rs 43,084 crore for 19,800 MHz spectrum. In the past 20 years, spectrum bands 900 MHz, 2100 MHz, 1800 MHz, 3300 MHz, and 26 GHz have been acquired through auctions. It obtained a pan-India footprint in the 3.5 GHz and 26 GHz bands. According to the company, this is the ideal spectrum bank for the best 5G experience, with 100x capacity enhancement done strategically at the lowest cost.

- During the pandemic, the WFH setting was prepared for the extra technological benefits of 5G: in the Global Workplace Analytics (2020) survey, more than 80% of respondents stated that they had the technical skills and knowledge required for WFH, as well as easy and reliable access to company networks (presumably by both fixed-line and mobile means).

- 3GPP has specified that 5G should offer voice or video communication services based on the IMS, i.e., the IMS must be deployed for 5G-to-3G SRVCC in 3GPP Release 16 or VoNR, EPS FB, VoeLTE, and RAT FB in 3GPP Release 15. Hence such upgrades are expected to increase the infrastructure cost, thereby challenging the market's growth. While every architecture has specific challenges, all of them need network readiness of the IP Multimedia Subsystem (IMS) within the carrier's network.

5G Chipset Market Trends

Industrial Automation to Account for a Significant Share

- According to Capgemini, three out of every ten automotive plants have become smart in the last 18-24 months. Furthermore, 80% of automakers believe 5G will be critical to their digital transformation over the next five years. For instance, Ericsson and Audi are conducting field trials, such as wirelessly connected production robots building a car body at the latter company's production lab in Gaimersheim, Germany, using simulated processes similar to those used at its headquarters in Ingolstadt.

- The emphasis on smart manufacturing practices is a significant trend influencing the market. According to IBEF data, the Government of India has set an ambitious target of increasing manufacturing output contribution to GDP to 25% by 2025, up from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to raise awareness of Industry 4.0 in the Indian manufacturing industry and assist stakeholders in addressing smart manufacturing challenges.

- The Industry 4.0 revolution, or industrial internet of things (IIOT) is making a dent in the automotive, manufacturing, warehousing, and logistics sectors by leveraging smart machines and real-time analytics on data produced by dumb machines. However, automation created several challenges in these sectors. Expected operational improvements proved hard to match due to a lack of integration with the required hardware. For instance, automation contributes to just 1% of manufacturing GDP in India, compared to around 5% in developed countries. This stems from a gap in suitable technology available for adoption. Further, According to GSMA By 2025 the total number of consumer and industrial Internet of Things (IoT) connections in North America is forecast to grow to 5.4 billion

- 5G has garnered significant interest considering the promised benefits within industrial environments. Since 3GPP's Release 16, key capabilities for enterprise 5G (such as 99.999% network availability and reliability, sub-10 milliseconds latencies, and Internet support for time-sensitive networking) has attracted ,industrial players for digitization in the context of Industry 4.0.

- For example, ABB and Ericsson collaborated to realize Thailand's Industry 4.0 ambition and facilitate future flexible production with automation systems and wireless communications. The focus areas include ABB's Robotics & Discrete Automation, Industrial Automation, and Motion business areas and ABB Ability TM Platform Services. The collaboration would cover 5 G-enabled andAugmented Reality Lenses for remote commissioning in manufacturing environments G-enabledand global NB-IoT connected motors and drives through Ericsson Communication Service Provider partners and its IoT-Accelerator platform.

North America to Account for the Largest Share

North America is one of the most important market growth regions. The United States has contributed the majority of the region's market share. The demand for IoT, M2M communications, mobile broadband, and other emerging applications is driving the increase.

In North America, 5G connections will represent more than half of all mobile connections, according to GSMA Intelligence's 'Mobile Economy North America 2020' report. By 2025, 51% of the region's 426 million mobile connections will be on 5G networks. According to the report, the region will have 340 million mobile subscribers by 2025.

Furthermore, according to Cisco Annual Internet Report, the average smartphone connection speed in the United States will be 81.1 Mbps by 2023, up from 19.2 Mbps in 2018, 4.2-fold growth (33% CAGR). Alongside 5G rollouts, operators are also pursuing ambitious network transformation strategies. Moreover, 18 global telecom and consumer device makers partnered with US-based Qualcomm for their 5G chipset.

New safety-sensitive applications, collectively known as V2X or Vehicle-to-Everything, will be made possible by 5G's enhanced throughput, dependability, availability, and decreased latency. To facilitate the convergence of various apps for urban, suburban, and highway driving circumstances, 5G Cellular V2X (C-V2X) offers a common wireless network.

5G Chipset Industry Overview

The 5G chipset market is semi-consolidated, with many regional and global players. Innovation drives the market in product offerings, and each vendor invests in innovation.

- Nov 2023 - MediaTek launched Dimensity 8300 5G chipset with genAI capabilities. The chipset is based on TSMC's second-generation 4nm process and has an octa-core CPU comprising four Arm Cortex-A715 cores and four Cortex-A510 cores built on Arm's v9 CPU architecture. It is paired with the Mali-G615 MC6 GPU. The Dimensity 8300 unlocks new possibilities for the premium smartphone segment, offering users in-hand AI, hyper-realistic entertainment opportunities, and seamless connectivity.

- November 2023 - Viettel High Tech developed its own 5G chipset. The 5G DFE (digital front end) chip can perform 1 quadrillion calculations per second.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for High-speed Internet and Broad Network Coverage with Reduced Latency and Power Consumption

- 5.1.2 Growing Machine-to-machine/IoT Connections

- 5.1.3 Increase in Demand for Mobile Data Services

- 5.2 Market Restraints

- 5.2.1 Fragmented Spectrum Allocation

6 MARKET SEGMENTATION

- 6.1 By Chipset Type

- 6.1.1 Application-specific Integrated Circuits (ASIC)

- 6.1.2 Radio Frequency Integrated Circuit (RFIC)

- 6.1.3 Millimeter Wave Technology Chips

- 6.1.4 Field-programmable Gate Array (FPGA)

- 6.2 By Operational Frequency

- 6.2.1 Sub-6 GHz

- 6.2.2 Between 26 and 39 GHz

- 6.2.3 Above 39 GHz

- 6.3 By End User

- 6.3.1 Consumer Electronics

- 6.3.2 Industrial Automation

- 6.3.3 Automotive and Transportation

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Retail

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 MediaTek Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Xilinx Inc.

- 7.1.5 Nokia Corporation

- 7.1.6 Broadcom Inc.

- 7.1.7 Infineon Technologies AG

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Renesas Electronics Corporation

- 7.1.10 Anokiwave Inc.

- 7.1.11 Qorvo Inc.

- 7.1.12 NXP Semiconductors NV

- 7.1.13 Cavium Inc.

- 7.1.14 Analog Devices Inc.

- 7.1.15 Texas Instruments Inc.