|

市場調査レポート

商品コード

1852089

歯科インプラント:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Dental Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 歯科インプラント:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年08月19日

発行: Mordor Intelligence

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

概要

チタンの機械的信頼性は、2024年に85.1%の市場シェアを獲得しているが、ジルコニアの優れた軟組織応答性が2030年までにCAGR 10.8%で普及を牽引しています。

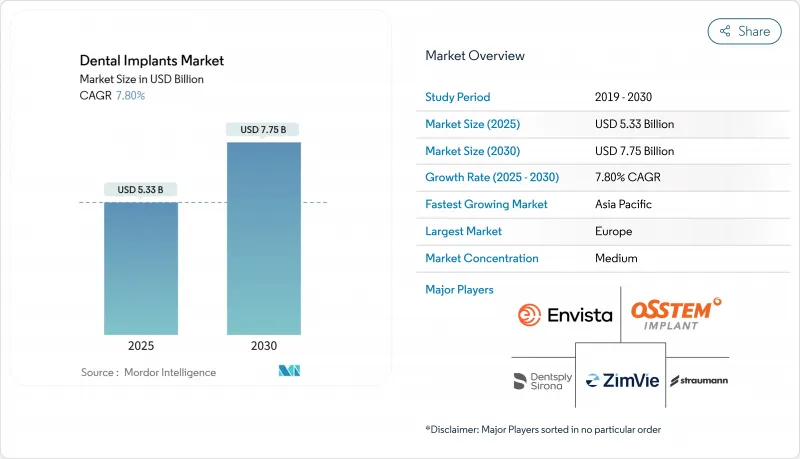

歯科インプラント業界の2024年の市場規模は53億3,000万米ドルで、2030年にはCAGR7.8%を反映して77億5,000万米ドルに拡大すると予想されています。ナノスケールの表面工学に依存した、より治癒の早い即時負荷プロトコルを中心に勢いが増しています。このシフトは治療サイクルを短縮し、診療所のチェアのキャパシティを拡大することなく、より多くの症例に対応することを可能にします。金属過敏症に対する懸念と患者の審美的な期待から、チタンからジルコニアへの着実な移行が進み、セラミック加工を大規模に行えるメーカーに製品のホワイトスペースが広がっています。欧州での保険償還の拡大や、その他の地域での適用範囲の選択的拡大は、患者のアクセスを広げているが、価格だけで競争するのではなく、フィクスチャーにデジタル・プランニング・ソフトウェアや術後ケア・キットをバンドルすることで、マージンを守ろうとするサプライヤーも後押ししています。口腔内スキャニング、CBCT、CAD/CAMテクノロジーを全面的に導入しているクリニックでは、症例受け入れ率の向上が報告されており、インプラントメーカーはスキャナと治療計画プラットフォームを長期的なハードウェア販売への戦略的ゲートウェイと位置付けています。これと並行して、AIによる診断やロボットによる埋入手術への関心も高まっており、これらのツールを一貫したワークフローに組み込むことができる企業は、競争基準をリセットし始めています。

世界の歯科インプラント市場の動向と洞察

新しい表面処理が可能にする即時荷重インプラントの採用拡大

即時荷重プロトコールはCAGR 11.7%で進展しており、市場全体を大きく上回っています。臨床レベルでは、長期的な骨リモデリングを損なうことなくフィブリン付着を促進できる表面化学が成功の鍵を握っています。最新世代のナノテクスチャー・コーティングは、この二面性を実現し、機能的治癒期間を数ヶ月から数週間に短縮し、診療所が即日修復を宣伝できるようにしています。二次的な意味合いとしては、患者一人当たりのアポイントメント数が少なくなるため、診療スケジュールの効率が向上し、チェアの潜在的なキャパシティが解放されることです。

デジタル歯科ワークフローの統合によるインプラント症例数の増加

口腔内スキャナー、CBCT画像、CAD/CAM設計を活用したデジタル治療計画は、標準治療の診断を構成するものを再定義しつつあります。完全にデジタル化されたワークフローに移行した診療所では、患者が手術前に結果を視覚化できるため、症例受け入れが2桁増加したと報告されることがよくあります。実際、現在、一部のメーカーは、特定の骨密度に対応するスレッド形状を微調整するために、匿名化されたスキャンデータを収集しており、設置されたスキャナーはリアルタイムの研究開発資産となっています。

ティア2都市における訓練されたインプラント専門医の不足

インドと中国では、大都市圏以外でのインプラント専門医の供給不足が深刻で、治療件数に制約があります。機器ベンダーは、ガイド付き手術キット、あらかじめ設定されたドリリングプロトコル、遠隔指導者によるサポートを統合したターンキーシステムで対応しています。このモデルは、予測可能な結果を出すために必要な能力の閾値を効果的に下げ、地理的な普及を加速します。投資家は、地方の需要の先行指標としてトレーニングプログラムの受講者数を追跡しており、教育への早期資本投下が、これらの地域が重要な導入のしきい値を超えたときに、先行者利益をもたらす可能性があることを示唆しています。

セグメント分析

2024年のインプラント収益の76%はフィクスチャーが占めるが、市場がマスカスタマイゼーションに軸足を移しているため、アバットメントはCAGR9.2%で進展しています。デジタルライブラリにより、技工所は、エマージェンスプロファイルと歯肉の審美性を最適化する患者固有のアバットメントを設計できるようになりました。現実的な帰結として、複数拠点を持つクリニックの調達チームは、フィクスチャーと補綴コンポーネントの個別契約を交渉することが増えており、これまで単一ベンダーでまとまっていたものが切り離されています。コンポーネント間の精密な適合を証明できないサプライヤーは、このようなモジュール購買の枠組みから排除される危険性があります。

いくつかの学術的なメタアナリシスでは、表面改質ジルコニアと従来のチタンとの間に、骨とインプラントの接触において統計的に意味のある差がないことが判明しており、フルセラミック・フィクスチャーに対する最後の大きな臨床的論拠が崩れてきています。現在進行中の縦断的研究によって、インプラント周囲の軟組織の安定性が確認され続ければ、保険会社は最終的に保険料の差を調整し、ジルコニアの成長路線をさらに強固なものにするかもしれないです。今のところ、早期参入ブランドは、ジルコニアを厳密な医学的改善ではなく、ライフスタイルのアップグレードと位置づけることで、より高いマージンを獲得しています。

地域分析

2024年の世界売上高の34%を占める欧州の成熟したインプラント・セクターは、プレミアム・セラミックに対する高い支払い意欲と、継続教育機関の緻密なネットワークが特徴です。市場規模の見通しは良好で、業界の開示によれば、ドイツだけでも2025年には10億米ドルを超えると予想されています。保険償還制度では、インプラント周囲のメインテナンス・プロトコルのエビデンスがますます義務付けられているため、サプライヤーは現在、各インプラントにフォローアップ・キットをバンドルし、術後ケアを組み込み機能として再構築しています。このバンドルは、臨床医のコンプライアンス上の摩擦を軽減し、診療所を独自の消耗品に微妙に閉じ込め、ベンダーの粘着性を強化します。

アジア太平洋地域の歯科インプラント市場規模は、2025年から2030年にかけてCAGR 9.9%を記録し、他のすべての地域を上回ると予測されています。中国、インド、日本が販売量を牽引しているが、規制の経路が異なるため、微妙な商流が必要となります。特筆すべきは、海外で手術を受け、現地で消耗品を購入することを好む医療観光客に対応するため、地域の流通業者が国境を越えたeコマースに投資していることです。このような二重の需要パターンにより在庫の課題が生じますが、機敏なメーカーは分散型3Dプリンティングハブを通じてこれを克服し、過剰在庫を抱えることなくリードタイムを短縮することができます。

北米の人口動態の高齢化は、耐久消費財の需要を支えています。米国では2030年までに65歳以上の高齢者が18歳未満を上回り、1億5,000万人以上の米国人が少なくとも1本の歯を失っています。年間約100万本しかインプラントが埋入されていないため、潜在的な普及率は依然として大きいです。例えば、AI主導の診断ツールを統合した診療所では、治療計画の受け入れが早まったと報告されており、ソフトウェアの採用が治療件数を押し上げ、それがさらなるソフトウェアアップグレードの財源となるという好循環が強化されています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 新しい表面処理が可能にする即時荷重インプラントの採用拡大

- デジタル歯科ワークフローの統合がインプラント症例数を押し上げる

- 国内インプラント償還制度の拡大

- インプラント周囲炎の流行が代替インプラントの売上を牽引

- 審美性を重視する患者層におけるインプラントの台頭

- 歯科医療サービス機関の統合による一括調達の活発化

- 市場抑制要因

- ティア2都市におけるインプラント専門医の不足

- 発展途上国における認識不足

- チタン需要を抑制する金属過敏症訴訟

- 新製品上市を阻む規制認証の遅れ

- サプライチェーン分析

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- コンポーネント別

- 備品

- 骨内インプラント

- 骨膜下インプラント

- 経骨膜インプラント

- 粘膜内インプラント

- アバットメント

- 備品

- 素材別

- チタンインプラント

- ジルコニウム・インプラント

- 設計別

- テーパーインプラント

- 平行壁インプラント

- 手術タイプ別

- 即時荷重インプラント手術

- 従来の手順

- エンドユーザー別

- 歯科病院&クリニック

- 歯科技工所

- 学術・研究機関

- 地理

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Institut Straumann AG

- Dentsply Sirona Inc.

- ZimVie Inc

- Osstem Implant Co., Ltd.

- Envista Holdings(Nobel Biocare Services AG)

- Dentium Co., Ltd.

- Thommen Medical AG

- Ivoclar Vivadent AG

- Solventum Corporation

- Ziacom Medical SL

- BioHorizons IPH Inc.

- Bicon LLC

- MegaGen Implant Co., Ltd.

- Kyocera Medical Corporation

- GC Corporation

- BEGO GmbH & Co. KG

- Blue Sky Bio LLC

- Cortex Dental Implants Industries Ltd.

- DIO Corporation

- AlphaBio Tec.