|

市場調査レポート

商品コード

1910553

EPAおよびDHA-市場シェア分析、業界動向と統計、成長予測(2026年~2031年)EPA And DHA - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| EPAおよびDHA-市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

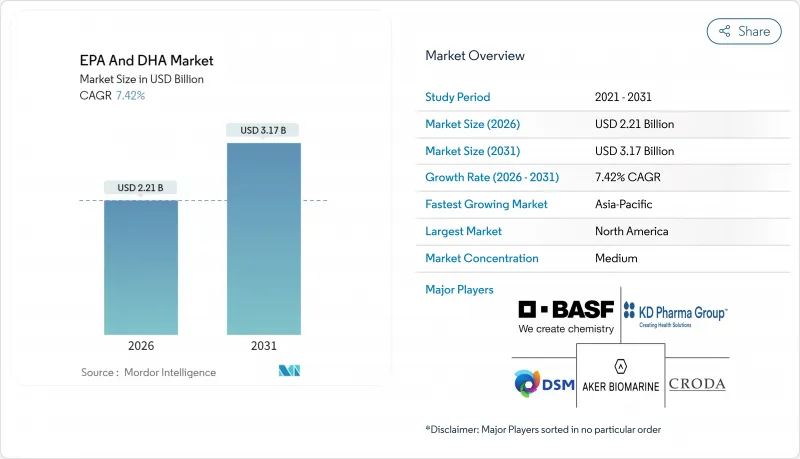

2026年のEPAおよびDHA市場規模は22億1,000万米ドルと推定され、2025年の20億6,000万米ドルから成長が見込まれます。

2031年までの予測では31億7,000万米ドルに達し、2026年から2031年にかけてCAGR7.42%で拡大する見通しです。

強力な臨床的根拠、有利な規制枠組み、および藻類ベースの生産拡大がEPAおよびDHA市場を牽引しております。REDUCE-IT心血管アウトカム試験後の処方箋の急速な普及と、保存期間を延長するリアルタイム酸化制御技術が市場成長を支えております。北米は堅調な医療保険償還政策により引き続き主導的立場を維持し、アジア太平洋地域は迅速な規制承認と高まる健康意識の恩恵を受けております。原料調達源を藻類へ多様化することで、ペルー産アンチョビの割当量への依存度が低下し、供給変動が緩和されます。また、品質認証は消費者の信頼を高めます。持続可能な藻類栽培とプロセス革新への継続的な投資は、コスト効率の向上と長期的な市場拡大を支えると期待されます。

世界のEPAおよびDHA市場の動向と洞察

高用量EPAと心血管リスク低減の関連性を示す臨床的エビデンスの増加

画期的なREDUCE-IT試験の結果、イコサペントエチルによる主要な心血管有害事象の25%減少が明らかになり、世界の臨床診療ガイドラインと規制当局の承認に大きな変化をもたらしました。この結果を受け、FDAは高トリグリセリド血症患者の心血管リスク低減を目的とした高用量EPA製剤を承認いたしました。これにより新たな処方薬カテゴリーが誕生し、2030年までに40億米ドルを超える市場規模が見込まれております。特筆すべきは、REDUCE-IT試験におけるアジア人サブグループ解析で、全体集団よりも顕著な効果(HR 0.72)が確認された点です。この知見は、特に心血管疾患の負担が増大しているアジア太平洋地域において、各市場での規制当局への申請を促進しています。EPAとDHAの複合製剤とは異なるEPAの特有の作用機序を受け、製薬企業は製品の再設計を進めています。この変化により、高純度EPA濃縮物のサプライチェーンにおけるプレミアム価格が形成されています。処方薬分野以外では、栄養補助食品メーカーがREDUCE-ITデータを構造ー機能表示に活用しています。ただし規制当局は警戒を怠らず、治療用途と栄養補助食品の境界を明確に区別しています。このエビデンスの波及効果は医学会のガイドラインにも及んでおり、米国心臓協会と欧州心臓病学会はいずれもオメガ3脂肪酸の推奨を統合し、臨床栄養プロトコルに影響を与えています。

処方薬および医療用栄養食品における高濃度オメガ3の急速な普及

90%以上の高純度を誇る医薬品グレードのオメガ3濃縮物は、処方薬の配合成分として定着しつつあります。この変化は主に、生体利用率の向上とそれに伴う患者様の服薬順守の容易さに起因しています。この動向の代表例がBASF社のK85EEプラットフォームです。同製品は総オメガ3エチルエステルを800-880mg/g含有し、EPA含有量は430-495mg/gに及び、処方用途を支える技術的優位性を示しています。粗製魚油(30-40%)から高濃度製品(90%超)への移行には、最先端の分子蒸留技術とクロマトグラフィー分離技術が不可欠です。こうした進歩は参入障壁を生み、必要な加工能力を有する既存企業に有利に働きます。医療栄養分野では、特定の濃縮グレードへの注目が高まっています。この焦点により、特に1日あたり2~4グラムのEPA/DHA摂取が必要な疾患において、実用的な摂取量範囲内で治療用投与量を確保できます。業界における重要な動きとして、KDファーマグループは2024年10月にDSM-フィルメニヒの海洋性脂質事業を買収しました。この統合により、濃縮物の生産能力が向上しただけでなく、合併後の企業は世界トップのオメガ3メーカーとしての地位を確立し、医薬品グレード市場における価格決定力を強化しました。この動向は従来の原料源に留まらず、藻類ベースの生産も注目を集めています。コービオン社などの企業は、独自の発酵・精製技術により、AlgaPrime製品で50%を超えるDHA濃度を達成するなど、限界に課題しています。

地域市場の分断

主要市場における規制枠組みの相違は、コンプライアンスを複雑化し参入障壁を生むため、世界のオメガ3貿易の流れを制約し、多国籍サプライヤーの運営コストを押し上げています。欧州食品安全機関(EFSA)の新規食品承認は欧州市場へのアクセスを容易にする一方、中国国家薬品監督管理局(NMPA)の枠組みでは独自の文書化と試験プロトコルが義務付けられており、製品発売までの期間を12~18ヶ月延長する可能性があります。この分断は、複数の承認プロセスを同時に進める規制専門知識やリソースを欠く中小企業にとって特に課題となります。結果として、市場集中は世界のコンプライアンス能力を持つ既存企業に有利に働いています。表示要件も管轄区域によって大きく異なり、構造機能表示を認める市場がある一方、治療効果の訴求を制限する市場もあります。この差異により、企業は複数の製品バリエーションと多様なマーケティング戦略を維持せざるを得ません。さらに、品質基準の規制状況も多様です。IFOS認証が十分な市場がある一方、現地での試験や文書化を要求する市場もあります。こうした相違はコンプライアンスコストを増加させるだけでなく、サプライチェーンを複雑化させます。加えて、輸入関税や登録料といった貿易障壁が世界市場をさらに分断しています。保護主義的な政策を採用する地域もあり、国際的な競合他社を犠牲にして国内のオメガ3供給業者を支援しています。

セグメント分析

2025年時点でDHAは市場シェア57.78%を占め、乳児用調製粉乳用途と認知機能サプリメントの両分野における確固たる地位を裏付けております。一方、EPAは心血管系処方薬の急成長に後押しされ、2031年までにCAGR7.86%で急伸中です。REDUCE-IT試験の画期的な結果を受け、EPAを主成分とする製品開発が急増しております。これに対応し、製薬企業はFDAの承認を得て、特に心血管用途においてEPA含有量に重点を置いた配合製品の再設計を進めております。ブレンド製剤はコスト効率と多様な効能のバランスを実現し、適応性の高い原料プラットフォームを求める栄養補助食品メーカーに好まれる選択肢となっております。

EPAの成長勢いは、標的治療用途を重視する精密医療の動きと軌を一にしております。臨床研究はEPAの独自の作用機序を浮き彫りにし、主に膜構造維持を担うDHAとの差異を明確に示しております。この心血管健康への注目の高まりは、高純度EPA濃縮物のサプライチェーンにおけるプレミアム価格の急騰を招いております。特にBASFのK85EEプラットフォームは、最先端の分子蒸留技術を採用し、430~495mg/gという驚異的なEPA含有量を誇ります。一方DHAは、主要市場における乳児栄養規制の承認(例:インドFSSAIによる藻類/菌類由来DHAの乳児用調製粉乳への0.2~0.5%含有量認可)も後押しとなり、依然として優位性を維持しています。タイプ別のセグメンテーションは進化を続けており、画一的なオメガ3アプローチよりも用途特化型の最適化が重視されることで、製品の差別化とプレミアム価格戦略が促進されています。

地域別分析

2025年、北米はオメガ3市場において40.88%という圧倒的なシェアを占めております。これはFDAの堅固な規制枠組みに支えられた結果です。同枠組みは栄養補助食品だけでなく、オメガ3製品の処方薬としての応用も認めております。同地域の確立された臨床研究インフラは治療効果の主張を裏付け、強力な医療保険償還制度が処方オメガ3の普及を促進しております。特にREDUCE-IT試験の有効性検証後はその傾向が顕著です。革新的かつ持続可能な調達への配慮として、カナダ保健省は2024年12月、Nutriterra社の植物由来オメガ3オイルを承認いたしました。成熟した北米サプリメント市場では品質重視の傾向が強まっており、第三者認証が重要な役割を果たしております。特にIFOS認証製品は高価格帯で取引され、高度な加工技術への投資を正当化する結果となっております。一方、メキシコでは急成長する中産階級と近代化する医療が、収益性の高い拡大の道を開いています。さらに、USMCA貿易協定により規制プロセスが合理化され、オメガ3製品の越境貿易が促進されています。

アジア太平洋地域は2031年までCAGR8.19%で、最も急速な成長が見込まれる地域です。この急成長は、高齢化や都市化といった人口動態の変化と、医療費の増加が相まって推進されています。これらの要因により、様々な治療用途におけるオメガ3脂肪酸の需要が高まっています。中国の国家薬品監督管理局(NMPA)の枠組みは、DHAを承認済み栄養補助食品として明確に指定することで、国際的な供給業者の参入を促進しています。さらに、魚油を許容される非栄養原料として認めています。インドでは、食品基準安全局(FSSAI)が乳児用栄養食品における藻類および菌類由来DHAの濃度上限を0.2~0.5%に設定しました。年間2,400万人の新生児が生まれる潜在的な市場拡大を考慮すると、この動きは特に重要です。日本の規制状況も同様に先進的で、オメガ3脂肪酸を「特定保健用食品」のポジティブリストに掲載しています。韓国のMFDS(食品医薬品安全庁)は2025年に健康機能性原料の再評価を予定しています。この地域の急速な成長は、消費者保護とイノベーションへの配慮を巧みに両立させる規制の近代化に起因し、活況を呈するオメガ3市場を育んでいます。

欧州のオメガ3市場は着実な成長を見せており、その一因は欧州食品安全機関(EFSA)の厳格な新規食品承認プロセスにあります。このプロセスにより、Schizochytrium sp.由来のDHA 550オイル(Fermentalg社開発)を含む複数の藻類由来オメガ3製品が規制上の地位を獲得しました。持続可能性を重視する欧州消費者は、藻類由来の代替品や持続可能な方法で調達された魚油を好む傾向が強まっています。この動向は、環境への責任と健康効果の両方を強調するプレミアムポジショニング戦略を導いています。ブレグジットにより規制上の問題が生じたもの、二国間協定によりオメガ3製品は英国とEU間の市場アクセスを維持しています。さらに、EU加盟国間の規制調和が進み、厳格な安全基準を維持しつつコンプライアンス上の課題が簡素化されています。この一貫性がオメガ3製品に対する消費者の信頼を強化しています。欧州市場では透明性とトレーサビリティも重視されており、厳格なサプライチェーン文書化により、強固な品質システムを有するサプライヤーが優位性を保っています。南米、中東・アフリカの新興市場は、進化する規制枠組みに支えられ、有望な成長を示しています。ブラジルにおけるコービオン社のAlgaPrime施設のような現地生産イニシアチブは、地域需要の成長との戦略的整合性を強調しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 高用量EPAと心血管リスク低減の関連性を示す臨床的証拠が増加中

- 処方薬および医療用栄養食品における高濃度オメガ3(純度90%以上)の急速な普及

- ヴィーガン/植物由来製品を支持する消費者層の拡大が、藻類由来DHA製品の発売を促進しております

- 規制および認証の進展

- 国内の出生前DHA補給ガイドラインが乳幼児栄養需要を促進

- 食品・飲料の栄養強化における廃棄物削減と保存期間延長を実現するリアルタイム酸化モニタリング技術

- 市場抑制要因

- 不安定なアンチョビ漁獲枠が魚油供給を逼迫させております

- 高度な精製および抽出コストの高さ

- 地域市場の分断化

- 重金属およびダイオキシン汚染への懸念による検査コストの厳格化

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- エイコサペンタエン酸(EPA)

- ドコサヘキサエン酸(DHA)

- ブレンド

- ソース別

- 魚油

- 藻類油

- オキアミ油

- その他の海洋由来原料(イカ、ムール貝、カラヌス)

- 用途別

- 栄養補助食品

- 乳児用調製粉乳

- 強化飲食品

- 医薬品

- 臨床栄養・医療用食品

- ペット栄養

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- アラブ首長国連邦

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランキング分析

- 企業プロファイル

- BASF SE

- KD Pharma Group

- Croda International PLC

- Omega Protein Corporation

- Corbion NV

- Aker BioMarine ASA

- Koninklijke DSM NV

- Epax Norway(Pelagia)

- Neptune Wellness Solutions

- TASA Omega

- GC Rieber Oils

- OLVEA Fish Oils

- Lysi hf.

- Golden Omega

- Clover Corporation

- Nordic Naturals Inc

- Novotech Nutraceuticals

- Archer Daniels Midland

- Cargill

- Solutex GC