|

|

市場調査レポート

商品コード

1198633

二酸化チタン市場- 成長、動向、予測(2023年-2028年)Titanium Dioxide Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 二酸化チタン市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年01月23日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

二酸化チタン市場は、2021年に600万トン強となり、予測期間(2022~2027年)にはCAGR6%以上で推移すると予測されます。

2020年のCOVID-19により、市場はマイナスの影響を受けました。パンデミック時のサプライチェーンの混乱や労働力不足により、製造活動や建設作業が停止したため、塗料やコーティング、プラスチック、化粧品など、さまざまな応用分野からの需要に影響を及ぼしました。例えば、世界最大の化粧品会社であるロレアルは、2020年上半期に2019年同期比17億3500万ユーロ(20億2452万米ドル)の損失を計上しました。しかし、予測期間初期には状態が回復すると予想されます。

主なハイライト

- 短期的には、塗料およびコーティング産業からの需要の急増が、市場の成長を促進する主な要因になると思われます。

- 一方、二酸化チタンの毒性が市場成長の妨げになると予想されます。

- ペイントとコーティングの用途が市場を独占しています。この分野は、建設活動の継続的な成長により、予測期間中に成長すると思われます。

- アジア太平洋地域は、世界的に市場を独占しています。また、中国とインドでの消費量増加により、予測期間中に最も高い成長率を記録すると予想されます。

二酸化チタン市場動向

塗料・コーティング分野が市場を独占する見込み

- 二酸化チタンは、塗料・コーティング業界で最も広く使用されている白色顔料材料です。可視光を効率的に散乱させ、塗料に組み込むことで白さ、明るさ、不透明度を与えるため、塗料およびコーティング産業で広く使用されています。

- 塗料業界は、建築、建設、自動車産業などのエンドユーザーの急成長に伴い、活況を呈しています。

- 塗料・コーティング産業における様々な拡大が、今後数年間で二酸化チタン市場を増大させる可能性があります。参考までに、2021年5月、PPG Industries Inc.は、中国の塗料・コーティング部門を拡張するために1300万米ドルを投資し、8つの新しい粉体塗装生産ラインと粉体塗装技術センターの拡張を含んでいます。この拡張により、年間8,000トン以上の生産能力の向上が見込まれます。

- 自動車分野では、塗料やコーティング剤は自動車の内外装に使用され、自動車に保護と魅力を与えるものです。自動車の金属部品やプラスチック製の車両部品に使用されています。

- OICAのデータによると、世界の自動車生産台数は2020年同期の5,215万台に対して約10%増加し、2021年1~9月期には5,726万台に達しました。また、自動車販売台数は、2020年対比で2021年上半期に約29%増加し、4,440万台に達しました。この要因は、予測期間中の市場を牽引すると思われます。

- したがって、建設や自動車などの産業におけるこのような動向は、塗料やコーティング剤の需要を増加させており、これが二酸化チタンの需要に拍車をかけ、市場を押し上げると予想されます。

アジア太平洋地域が市場を独占する

- 市場全体を支配しているのはアジア太平洋地域です。化粧品、塗料、プラスチックなどの産業における生産量の増加に伴い、予測期間中に二酸化チタンの消費量が顕著に増加すると予測されています。

- 中国は、世界最大の二酸化チタン製品の生産国および消費国のひとつです。さらに、塗料とコーティングのための二酸化チタンの需要は、建設産業で増加すると思われます。中国国家統計局によると、2020年、中国の建設産業は約7兆3,000億人民元の付加価値を生み出しました。

- 2021年11月、アジアンペインツはインドのグジャラート工場に1億2700万米ドルを投資し、今後2~3年で塗料の製造能力を13万キロリットルから25万キロリットルに拡張する計画を発表しました。

- また、中国とインドでは、プラスチック産業の成長が見込まれています。中国のプラスチック産業は、安価な原材料が入手できることと、新興経済諸国からの膨大な需要により、高い成長率を示しています。

- 中国国家統計局によると、2021年11月の732万トンに対し、2021年12月には約795万トンのプラスチック製品が生産されています。

- プラスチック輸出促進協議会(PLEXCONCIL)によると、インドのプラスチック輸出は2020年4~6月の22億1100万米ドルに対し、2021年4~6月は34億1700万米ドル(累積額)と55%増加しました。

- また、アジア太平洋地域では、10代の若者による使用量の増加や衛生意識の高まりに伴い、化粧品の需要が大きく伸びており、調査対象市場は拡大しています。

- したがって、このような動向は予測期間中に同地域の二酸化チタン需要を促進すると思われます。

二酸化チタン市場の競合他社分析

二酸化チタン市場は、少数の主要プレイヤーが大きなシェアを持つ統合された市場です。市場の主要プレイヤー(順不同)には、The Chemours Company、Tronox Holdings PLC、Venator Materials PLC、KRONOS Worldwide Inc.、LB Groupなどが挙げられます。

その他の特典

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 塗料・コーティングの需要急増

- その他の促進要因

- 抑制要因

- 二酸化チタンの毒性及び厳しい環境政策

- その他の抑制要因

- 産業バリューチェーン分析

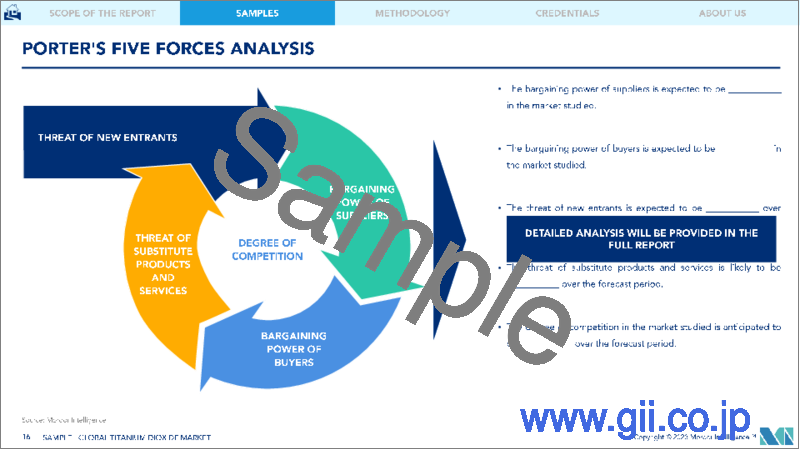

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

- 貿易分析

第5章 市場セグメンテーション

- グレード

- ルチル

- アナターゼ

- 用途

- 塗料・コーティング

- プラスチック

- 紙・パルプ

- 化粧品

- その他の用途(皮革、繊維)

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- 中東地域

- サウジアラビア

- 南アフリカ共和国

- その他の中東地域

- アジア太平洋地域

第6章 競合情勢

- M&A、合弁事業、協業、契約

- 市場シェア(%)**/ランキング分析

- リーディングプレイヤーが採用する戦略

- 企業プロファイル

- Argex Titanium Inc.

- Evonik Industries AG

- Grupa Azoty

- INEOS

- Kemipex

- KRONOS Worldwide Inc.

- LB Group

- Precheza

- TAYCA

- The Chemours Company

- The Kish Company Inc.

- Tronox Holdings PLC

- Venator Materials PLC

第7章 市場機会と今後の動向

- 化粧品と建設業界における超微粒子酸化チタンの使用増加

The titanium dioxide market was estimated at over 6 million ton in 2021, and the market is projected to register a CAGR of more than 6% during the forecast period (2022-2027).

The market was negatively impacted due to COVID-19 in 2020. The manufacturing activities and construction work were halted due to supply chain disruptions and labor shortages during the pandemic, thus affecting the demand from various application sectors, such as paints and coatings, plastics, cosmetics, and other application sectors. For instance, L'Oreal, the largest cosmetics company globally, registered a loss of EUR 1,735 million (USD 2,024.52 million) during the first half of 2020 compared to the same period in 2019. However, the condition is expected to recover during the early forecast period.

Key Highlights

- Over the short term, rapidly increasing demand from the paints and coatings industry is likely to be the major factor driving the market's growth.

- On the flip side, the toxicity of titanium dioxide is expected to hamper the market's growth.

- The paints and coating application segment dominated the market. The segment is likely to grow during the forecast period, with the continuous growth in construction activities.

- The Asia-Pacific region dominated the market worldwide. It is also expected to register the highest growth rate during the forecast period due to increasing consumption from China and India.

Titanium Dioxide Market Trends

Paints and Coatings Segment is Expected to Dominate the Market

- Titanium dioxide is the most widely used white pigment material in the paints and coatings industry. It efficiently scatters visible light and imparts whiteness, brightness, and opacity when incorporated into a coating, making it widely used in the paints and coatings industry.

- The paints and coatings industry is experiencing a boom with the rapid growth of the building, construction, and automotive end-user industries.

- Various expansions in the paints and coatings industry may augment the titanium dioxide market in the coming years. For reference, in May 2021, PPG Industries Inc. invested USD 13 million to expand its paints and coatings unit in China, which includes eight new powder coating production lines and an expanded powder coatings technology center. This expansion is anticipated to increase the capacity by more than 8,000 metric ton per year.

- In the automotive sector, paints and coatings are used in the interior and exterior parts of the vehicle, as they impart protection and appeal to vehicles. They are used in metallic parts and plastic vehicle components of automobiles.

- According to the OICA data, global automotive production increased by around 10% and reached 57.26 million units in the first nine months of 2021 compared to 52.15 million units in the same period in 2020. The car sales increased by around 29% in the first half of 2021 compared to 2020, reaching 44.40 million units. This factor is likely to drive the market during the forecast period.

- Hence, such trends in industries, such as construction and automotive, have been increasing the demand for paints and coatings, which is expected to add to the demand for titanium dioxide and boost the market.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the overall market. With the rising production in industries such as cosmetics, paints and coatings, and plastics, the consumption of titanium dioxide is projected to increase noticeably during the forecast period.

- China is one of the world's largest producers and consumers of titanium dioxide products. Furthermore, the demand for TiO2 for paints and coatings is likely to increase in the construction industry. According to the National Bureau of Statistics of China, in 2020, the Chinese construction industry generated an added value of approximately CNY 7.3 trillion.

- In November 2021, Asian Paints announced plans to invest USD 127 million in the Gujarat plant, India, to expand the paints manufacturing capacity from 130,000 kiloliters to 250,000 kilotons in the next two to three years.

- In addition, the plastic industry is expected to grow in China and India. The Chinese plastic industry is growing at a high rate due to the availability of cheaper raw materials and massive demand from developing economies.

- According to the National Bureau of Statistics of China, about 7.95 million metric ton of plastic products was produced in December 2021, compared to 7.32 million metric ton in November 2021.

- According to the Plastics Export Promotion Council (PLEXCONCIL), India's plastics export increased by 55% to USD 3,417 million (cumulative value) from April to June 2021 compared to USD 2,211 million in April-June 2020.

- The Asia-Pacific region is also witnessing strong growth in the demand for cosmetic products, leading to increased usage by teenagers and increased hygiene awareness, thus augmenting the market studied.

- Hence, such trends are likely to drive the demand for titanium dioxide in the region during the forecast period.

Titanium Dioxide Market Competitor Analysis

The titanium dioxide market is a consolidated market with a few major players holding a significant share of the market. Some of the major players (not in any particular order) in the market include The Chemours Company, Tronox Holdings PLC, Venator Materials PLC, KRONOS Worldwide Inc., and LB Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Increasing Demand for Paints and Coatings

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxicity and Stringent Environmental Policies of Titanium Dioxide

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Trade Analysis

5 MARKET SEGMENTATION

- 5.1 Grade

- 5.1.1 Rutile

- 5.1.2 Anatase

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Plastics

- 5.2.3 Paper and Pulp

- 5.2.4 Cosmetics

- 5.2.5 Other Applications (Leather, Textiles)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Argex Titanium Inc.

- 6.4.2 Evonik Industries AG

- 6.4.3 Grupa Azoty

- 6.4.4 INEOS

- 6.4.5 Kemipex

- 6.4.6 KRONOS Worldwide Inc.

- 6.4.7 LB Group

- 6.4.8 Precheza

- 6.4.9 TAYCA

- 6.4.10 The Chemours Company

- 6.4.11 The Kish Company Inc.

- 6.4.12 Tronox Holdings PLC

- 6.4.13 Venator Materials PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Use of Ultrafine Particles of Titanium Dioxide in Cosmetics and Construction Industries