|

市場調査レポート

商品コード

1687448

建設機械テレマティクス-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Construction Machinery Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 建設機械テレマティクス-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 168 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

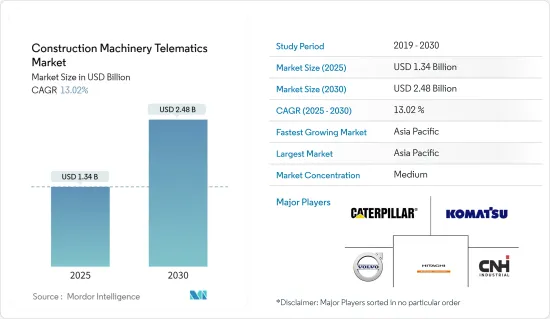

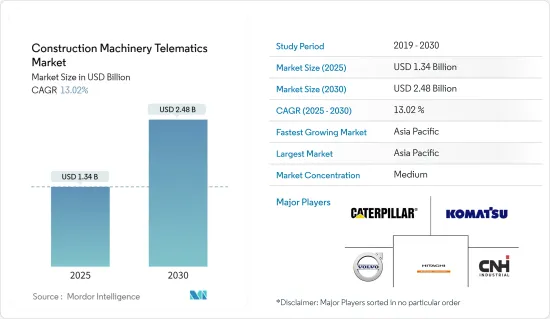

建設機械テレマティクス市場規模は2025年に13億4,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは13.02%で、2030年には24億8,000万米ドルに達すると予測されます。

建設機械テレマティクス市場は、建設機械業界の中でもダイナミックに進化している分野です。急速な都市化、工業化、インフラ開拓への政府投資の増加、地域全体の不動産・建設会社の拡大・成長活動などの要因が、市場の需要を高めると予想されます。

建設機械のテレマティクス市場は、機械の効率性に対する消費者の需要の高まりによって牽引されています。スマートフォンや、近接検知アラートや衝突回避システムのようなADAS(先進運転支援システム)機能など、建設機械における携帯技術の利用が急増していることも、建設機械におけるテレマティクスの採用を後押ししています。しかし、複雑さと高価格の特徴から、フリートオペレーターはこれらの技術に消極的であり、予測期間中の建設機械テレマティクス市場の成長に悪影響を及ぼしています。

市場の成長を促進する主な要因の1つは、インフラ、住宅、非住宅部門に多くの成長機会があるため、特に新興国で建設産業が成長していることです。人口増加や都市化に伴い、建設会社が増加し、道路、高速道路、スマートシティ、地下鉄、橋、高速道路の建設への投資が増加しています。

建設活動とインフラ開発の急増が重機需要を促進しています。建設機械向け重機の増加は、今後数年間の機械テレマティクス市場の成長に寄与するとみられます。

建設機械テレマティクス市場動向

掘削機セグメントが建設機械テレマティクス市場を独占

掘削機におけるテレマティクスの導入は、主に技術の進歩と電動モデルの市場導入により、近年大きな成長を遂げています。テレマティクスは数十年前から掘削機に使用されているが、テレマティクス・ソリューションに対するフリートオーナーやオペレーターの需要はここ最近急増しています。

例えば、2023年3月、CASE Construction Equipmentは、SiteWatchテレマティクスを標準装備したCX15EVとCX25EVの2台の電動ミニショベルを発表しました。この搭載により、機械の性能に関する貴重な洞察が得られ、現地のCASEディーラーとの連携によるシームレスなフリート管理が容易になります。

しかし、業界が直面している大きな課題は、小規模のショベル・フリート・オペレーターの間でテレマティクス・テクノロジーをもっと採用する必要があることです。これは、テレマティクスの使用が複雑であると認識されていることと、そのようなモデルを取得することに関連するコストに起因しています。現在、テレマティクスの主なユーザーは、機器管理と全体的なビジネス効率を高めるためにこのデータを活用する大規模な掘削機フリートのオペレーターです。

市場の多くの企業は、遠隔診断、GPS追跡、包括的なフリート管理などの機能を可能にする高度なテレマティクス・ソリューションと統合された掘削機を積極的に推進しています。例えば、2023年5月、デベロンは、DevelonFleet Management TMS 3.0 Cellularシステムを標準装備した2つの新しい6トンステージVミニショベル、DX62R-7とDX63-7を発表しました。このシステムは、ショベルに取り付けられた様々なセンサーからデータを収集することで、ショベルに堅牢なテレマティクス管理プラットフォームを提供します。

これらの要因を考慮すると、掘削機におけるテレマティクスの利用は、今後数年間も急速な拡大を続けると予想されます。

アジア太平洋地域が引き続き高い市場シェアを占める見込み

この地域の建設産業の成長、多数の重機の利用可能性、モバイルデバイスの消費者ベースの上昇などが、調査された市場を促進する主な要因のいくつかです。

中国はアジア太平洋の主要国のひとつであり、経済成長に支えられた建設活動が盛んです。同国の成長率は高いが、徐々に緩やかな方向に向かっている(人口が高齢化し、経済が投資から消費へ、製造業からサービス業へ、外需から内需へとリバランスするため)。

不動産セクターの不安定な成長にもかかわらず、中国政府による鉄道・道路インフラの大幅な開発(産業やサービスの需要に対応するため)は、建設セクターの大幅な成長につながりました。公開会社と非公開会社が建設セクターを支配しているため、公共支出と民間支出の増加は、このセクターを世界のリーダー的地位へと押し上げると思われます。最近の動向では、中国に大手建設会社(EU出身)が出現し、この分野の開発にさらに拍車をかけています。

2022-23会計年度、インドの建設機械セクターは約15%の成長率を記録しました。建設機械製造の成長は需要ドライバーと結びついています。主な需要属性は、道路建設、灌漑、都市開発、鉱業です。インド産業における土木機械の需要は、都市化、インフラ整備、建設・鉱業部門の成長など様々な要因により増加しています。鉱山。インド政府が国家インフラパイプライン(NIP)やミッション・スマート・シティ(Mission Smart City)などの取り組みを通じてインフラ整備に力を入れていることが、陸上輸送機械の需要をさらに押し上げています。

一部の建設セクターでは短期的な課題があるもの、インドの中長期的な成長ストーリーは変わっていないです。インド経済の成長にとってインフラ部門は重要な柱であるため、インドの建設業界は予測期間中に安定した成長が見込まれます。同国政府は、優れたインフラを時間的制約のない形で整備するため、さまざまな取り組みを行っています。

日本政府もまた、同国が将来経験すると予想される主要な長期プロジェクト(磁気浮上式鉄道の長期・短期開発計画)に絶えず注目しています。例えば、高速道路網のアップグレードや、東京の羽田空港への新しい鉄道リンクは、3億円(200万米ドル)を投資し、2029年までに開通する見込みです。したがって、こうした前向きな成長動向が日本の建設市場を押し上げると予想されます。

その他アジア太平洋地域には、マレーシア、インドネシア、シンガポール、ベトナム、オーストラリア、韓国などのASEAN諸国が含まれます。これらの国々では一貫した成長が続いており、住宅と商業用建物の両方の需要が継続的に増加しています。

地域当局によるこのような積極的な取り組みは、予測期間中に拡大することが予想され、それゆえ予測期間中の建設機械テレマティクス市場の成長を支えています。

建設機械テレマティクス業界の概要

キャタピラー、コマツ、日立建機、現代建設機械、ボルボ建機など、複数の主要企業が市場を独占しています。建設機械オペレーターの増大する需要に対応するため、多くの建設機械メーカーは最先端のテレマティクス・ソリューションを自社製品に組み込むことに重点を置いています。例えば

2023年6月、サセックスに本社を置くSouthern Cranes社は、WebfleetのパートナーであるAES fleet社との提携を発表しました。同社は、91台のクレーン、バン、大型運搬車両で構成される広範な車両に、統合カメラ・テレマティクス・ソリューションの展開を開始しました。

2023年5月、Terex Rough Terrain Cranes社は、TerexT-Telematicsソリューションを搭載したオフロードクレーンTRT 65を発表し、クレーンのリアルタイム性能データを提供しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 建設・インフラ活動の活発化が需要を牽引

- コネクテッドテクノロジーが市場の成長を促進

- 市場の課題

- 初期コストの高さ

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- 機械タイプ別

- クレーン

- 掘削機

- テレスコピックハンドリング

- ローダーとバックホー

- その他

- 販売チャネル別

- OEM

- アフターマーケット

- テレマティック機能別

- トラッキング

- 診断機能

- その他のテレマティクス機能

- 地域別

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 世界のその他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Komatsu Ltd

- Caterpillar Inc.

- Volvo Construction Equipment

- Joseph Cyril Bamford Excavators Ltd(JCB)

- Hitachi Construction Machinery Co. Ltd

- CNH Industrial NV

- Deere & Company

- Hyundai Construction Equipment

- Liebherr Group

- Doosan Infracore Ltd

- ACTIA Group

- Geotab

- Trimble Inc.

- Orbcomm

- Octo Telematics

第7章 市場機会と今後の動向

- テレマティクスに対する車両オーナーの嗜好の変化

The Construction Machinery Telematics Market size is estimated at USD 1.34 billion in 2025, and is expected to reach USD 2.48 billion by 2030, at a CAGR of 13.02% during the forecast period (2025-2030).

The construction machinery telematics market is a dynamic and evolving sector within the construction machinery industry. Factors such as rapid urbanization, industrialization, rising government investments in infrastructure development, and expansion and growth activities of the real estate and construction companies across the region are expected to enhance demand in the market.

The construction machinery telematics market is driven by consumers' growing demand for machinery efficiency. The surge in the usage of portable technology in construction machinery, such as smartphones and advanced driver assistance systems (ADAS) features, like proximity detection alerts and collision avoidance systems, has also pushed the adoption of telematics in construction machinery. However, complexity and high price features make fleet operators reluctant toward these technologies, negatively affecting the growth of the construction machinery telematics market during the forecast period.

One of the major factors driving the market's growth is the growing construction industry, especially in developing countries, owing to numerous growth opportunities in infrastructure, residential, and non-residential sectors. The rise in construction companies and increasing investments in the construction of roads, highways, smart cities, metros, bridges, and expressways due to the growing population and urbanization.

A surge in construction activities and infrastructure development, fueling demand for heavy machinery. The increasing heavy machinery for construction machinery is likely to contribute to the growth of the machinery telematics market over the coming years.

Construction Machinery Telematics Market Trends

The Excavators Segment Dominated the Construction Machinery Telematics Market

The adoption of telematics in excavators has experienced significant growth in recent years, primarily due to technological advancements and the introduction of electric models into the market. While telematics has been in use in excavators for decades, the demand from fleet owners and operators for telematics solutions has surged in recent times.

For instance, in March 2023, CASE Construction Equipment unveiled two electrified mini excavators, the CX15EV and CX25EV, both equipped with SiteWatch telematics as a standard feature. This inclusion provides invaluable insights into machine performance and facilitates seamless fleet management in collaboration with local CASE dealers.

However, a major challenge facing the industry is the need for more adoption of telematics technology among small-scale excavator fleet operators. This can be attributed to the perceived complexity of telematics usage and the cost associated with acquiring such models. Presently, the primary users of telematics are operators of large-scale excavator fleets who leverage this data to enhance equipment management and overall business efficiency.

Many companies in the market are actively promoting excavators integrated with advanced telematics solutions, enabling features like remote diagnostics, GPS tracking, and comprehensive fleet management. For instance, in May 2023, Develon introduced two new 6-tonne Stage V mini-excavators, the DX62R-7 and DX63-7, both featuring the DevelonFleet Management TMS 3.0 Cellular system as a standard component. This system offers a robust telematics management platform for excavators by collecting data from various sensors installed on the machines.

Considering these factors, the usage of telematics in excavators is expected to continue its rapid expansion in the coming years.

The Asia-Pacific Region is Expected to Continue to Account Highest Market Share

Some of the major factors that may aid in driving the market studied are the growing construction industry in the region, the availability of a large number of heavy equipment, and the rising consumer base of mobile devices.

China is also one of the major countries in the Asia-Pacific, with ample construction activities being supported by its growing economy. The country's growth rate is high but is gradually moving toward moderate (as the population ages and the economy rebalances from investment to consumption, from manufacturing to services, and from external to internal demand).

Despite the volatile growth of the real estate sector, significant developments by the Chinese government in rail and road infrastructure (to meet demand from industries and services) are growing services) has led to significant growth in the construction sector. As public and private companies dominate the construction sector, increasing public and private spending will propel the sector to a global leadership position. In recent years, the emergence of large construction companies (from the European Union) in China has further fueled the development of this sector.

During the financial year 2022-23, the Indian construction equipment sector recorded a growth rate of about 15%. Growth in construction equipment manufacturing is tied to demand drivers. The key demand attributes are road construction, irrigation, urban development, and mining. The demand for earthmoving equipment in the Indian industry is increasing due to various factors such as urbanization, infrastructure development, and growth in the construction and mining sectors. Mine. Demand for land transport equipment is further fueled by the Indian government's focus on infrastructure development through initiatives such as the National Infrastructure Pipeline (NIP) and Mission Smart City.

Despite near-term challenges in certain construction sectors, the medium to long-term growth story in India remains intact. The construction industry in India is expected to grow steadily over the forecast period, as the infrastructure sector is a key pillar for the growth of the Indian economy. The government is taking various initiatives to ensure the time-bound creation of excellent infrastructure in the country.

The Japanese government is also constantly focusing on major long-term projects (the Maglev railway long-term and short-term development plans) that the country is expected to witness in the future. For instance, an upgrade of highway networks and a new rail link to Haneda Airport in Tokyo, with an investment of JPY 300 million (USD 2 million) and expected to open the line by 2029. Hence, such positive growth trends are anticipated to boost the Japanese construction market.

The Rest of Asia-Pacific includes ASEAN countries, such as Malaysia, Indonesia, Singapore, Vietnam, Australia, as well as South Korea. With the consistent growth in these countries, the demand for both residential and commercial buildings is continually increasing.

Such active initiatives by regional authorities are expected to grow over the forecast period and hence support the growth of the construction machinery telematics market over the forecast period.

Construction Machinery Telematics Industry Overview

Several key players dominate the market, including Caterpillar, Komatsu Ltd., Hitachi Construction Equipment Co. Ltd., Hyundai Construction Equipment Ltd, Volvo Construction Equipment, and others. To meet the growing demands of construction fleet operators, many construction machinery manufacturers are placing a strong emphasis on integrating cutting-edge telematics solutions into their product offerings. For instance:

In June 2023, Southern Cranes, based in Sussex, announced a partnership with Webfleetpartner AES fleet. They have initiated the deployment of an integrated camera telematics solution across their extensive fleet, which consists of 91 cranes, vans, and heavy haulage transport vehicles.

In May 2023, Terex Rough Terrain Cranes introduced the TRT 65, an off-road crane equipped with the TerexT-Telematics solution, providing real-time performance data for the crane.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Construction and Infrastructure Activities to Drive Demand

- 4.1.2 Connected Technology to Aid in the Growth of the Studied Market

- 4.2 Market Challenges

- 4.2.1 High Upfront Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Machinery Type

- 5.1.1 Crane

- 5.1.2 Excavator

- 5.1.3 Telescopic Handling

- 5.1.4 Loader and Backhoe

- 5.1.5 Other Machinery Types

- 5.2 By Sales Channel Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Telematic Feature

- 5.3.1 Tracking

- 5.3.2 Diagnostic

- 5.3.3 Other Telematics Features

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Komatsu Ltd

- 6.2.2 Caterpillar Inc.

- 6.2.3 Volvo Construction Equipment

- 6.2.4 Joseph Cyril Bamford Excavators Ltd (JCB)

- 6.2.5 Hitachi Construction Machinery Co. Ltd

- 6.2.6 CNH Industrial NV

- 6.2.7 Deere & Company

- 6.2.8 Hyundai Construction Equipment

- 6.2.9 Liebherr Group

- 6.2.10 Doosan Infracore Ltd

- 6.2.11 ACTIA Group

- 6.2.12 Geotab

- 6.2.13 Trimble Inc.

- 6.2.14 Orbcomm

- 6.2.15 Octo Telematics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Fleet Owners Preferences Towards Telematics