|

市場調査レポート

商品コード

1687438

消化管治療薬- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Gastrointestinal Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 消化管治療薬- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

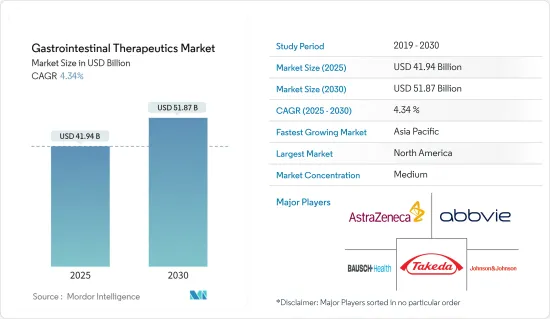

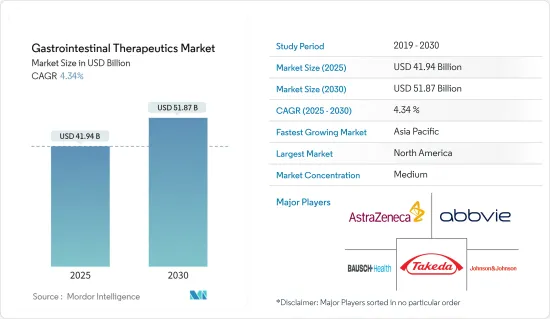

消化管治療薬市場規模は2025年に419億4,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは4.34%で、2030年には518億7,000万米ドルに達すると予測されます。

消化器疾患の新興国市場における有病率の増加や、製薬企業による研究開発投資の増加といった要因が、市場開拓を後押しすると予想されます。

人口の間で潰瘍性大腸炎、過敏性腸症候群、クローン病、セリアック病、胃腸炎などの消化器疾患の負担が増加していることが、市場成長を促進する主な要因です。例えば、International Journal of Colorectal Diseaseが2023年5月に発表した報告書によると、日本では潰瘍性大腸炎(UC)と診断された患者は若年層が多く、女性に比べて男性の有病率が高い傾向が見られたが、米国では逆の傾向が見られました。

さらに、2022年7月にNLMに掲載された論文によると、最も一般的な胃腸疾患であるGERDは、西洋文化圏では20%の人が罹患しています。米国におけるGERDの推定有病率は18.1%~27.8%で、女性より男性の方が高いです。このように、がんやGERDのような消化管疾患の負担が大きいことから、効果的な治療法に対する需要が高まり、市場成長が促進されると予想されます。

さらに、胃腸関連医薬品の研究開発に対する企業の投資増加や、市場における医薬品の入手可能性を高める医薬品上市の増加も、市場成長を後押しすると予想されます。例えば、2023年9月、胃腸の健康企業ビバンテ・ヘルスは、新たな投資家メルカート・パートナーズが主導するシリーズB資金調達ラウンドで3,100万米ドルを受け取り、調達総額は4,700万米ドルに達しました。ビバンテは、患者の症状を追跡し、管理栄養士、内科医、胃腸科医を含む連携ケアチームと患者をつなぐパーソナライズされたケアプランを提供します。同様に2023年6月、米国消化器病学会はOshi Healthに投資しました。オシ・ヘルスは消化器疾患の診断と統合ケアを提供します。

したがって、消化器疾患の有病率の上昇や消化器疾患治療開発のための研究開発活動の活発化など、上記の要因のおかげで、予測期間にわたって消化器治療薬市場の成長を後押しする可能性が高いです。しかし、医薬品の承認に関する厳しい規制基準や特許切れの増加が、予測期間中の市場成長を阻害すると予想されます。

消化管治療薬市場の動向

クローン病セグメントは予測期間中に大幅な成長が見込まれる

慢性免疫疾患であるクローン病は、その特徴的な炎症が主に消化管に影響を及ぼすため、患者にとってもヘルスケアプロバイダーにとっても依然として大きな課題となっています。クローン病の内科的治療では、寛解の導入と維持のために様々な薬剤が使用されています。例えば、インフリキシマブやアダリムマブは、タンパク質を標的として腸の炎症を抑えるために使用されます。

世界中でクローン病の負担が増加していることから、効果的な治療に対する需要が高まり、同分野の成長を後押しすると予想されています。例えば、2023年1月にMedLine.Govに掲載された論文によると、クローン病は西欧と北米で最も多く、人口10万人当たりの有病率は100~300人です。現在、50万人以上のアメリカ人がこの疾患に罹患しています。クローン病は、他の民族の人々よりも、北欧州の先祖を持つ人々や東欧および中央欧州(アシュケナージ)系ユダヤ人に多くみられます。理由は定かではないが、クローン病の有病率は米国をはじめ世界のいくつかの地域で増加しています。そのため、新しい治療法の台頭により、有効かつ安全な医薬品が市場に出回り、同分野の成長を後押しするものと期待されます。

さらに、規制当局による医薬品承認の増加により、クローン病患者の治療に使用される新規治療薬の利用可能性が高まると予想されます。これは予測期間中の市場成長を促進すると予想されます。例えば、2023年10月、イーライリリー・アンド・カンパニーは、インターロイキン-23p19拮抗薬であるミンキズマブ(minkizumab)を中等度から重度の活動性クローン病の成人の治療薬として評価する第3相試験で良好な結果が得られたことを明らかにしました。VIVID-1として知られるこの試験では、ミンキズマブがプラセボと比較して主要評価項目および主要副次評価項目を達成したことが示され、この患者集団に対する有望な治療薬としての可能性が強調されました。クローン病は、腹痛、下痢、体重減少などの症状を特徴とし、重篤な合併症を引き起こす可能性があるため、ミンキズマブのような有効な治療薬が緊急に必要とされています。

したがって、クローン病の負担増加や製品承認といった上記の要因から、調査対象セグメントは予測期間中に成長すると予想されます。

北米が予測期間中に大きな市場シェアを占める見込み

北米は、消化器疾患の負担増、製品上市の増加、企業のイニシアティブの高まりなどの要因により、予測期間にわたって大きな市場シェアを占めると予想されます。

人口の間で潰瘍性大腸炎などの消化器疾患の負担が増加していることが、市場成長を促進する主な要因です。例えば、2023年12月、米国ファームの記事は、米国で約160万人がクローン病や潰瘍性大腸炎を含む炎症性腸疾患(IBD)に罹患していることを強調しました。これらの疾患は消化管の炎症を特徴とし、持続的な下痢、腹部不快感、血便などの症状が現れることがあります。

さらに、NBCユニバーサルが2023年2月に発表した記事では、ノロウイルス(ノロウイルスまたは胃腸風邪としても知られる)の流行が強調されており、2023年の米国における嘔吐と下痢の発生件数は1,900万~2,100万件に上りました。その結果、465,000件の緊急入院と109,000件の入院が発生しました。注目すべきは、2023年の冬季に、患者数と集団感染が顕著に増加したことで、2023年3月にピークを迎え、ノロウイルスの増加傾向は春の終わりまで続いた。

さらに、消化器疾患の研究開発に対する政府資金の増加により、新規治療薬の開発に注力する企業が増加し、市場開拓の推進力になると予想されます。例えば、NIHが発表したデータによると、2022年5月、米国における大腸がん疾患の研究開発に対して、2021年の3億3,500万米ドルに対し、2022年には推定3億5,200万米ドルが政府から資金提供されました。また、同じ情報源によると、クローン病の研究開発に対して、2021年の8,800万米ドルに対し、2022年には推定9,200万米ドルが政府から資金提供されました。

さらに、同地域における新薬の上市や承認の増加、提携やパートナーシップなどの主要戦略の採用に注力する企業の増加も市場成長に寄与しています。例えば、2023年10月、米国食品医薬品局(FDA)は、潰瘍性大腸炎(UC)の治療薬として、新規で非常に有効な治療薬であるミリキズマブを承認し、この慢性的で難治性の炎症性腸疾患と闘う人々に有望な治療手段を提示しました。同様に、2023年8月、ワイル・コーネル・メディスン(Weill Cornell Medicine)およびニューヨーク・プレスビテリアン(NewYork-Presbyterian)と共同で実施された国際共同第3相臨床試験では、新たに開発された標的治療薬であるゾルベツキシマブ(zolbetuximab)を従来の化学療法と並行して投与することで、特定のバイオマーカーの過剰発現を示す進行胃がんまたは胃食道接合部がん患者の生存率が延長することが明らかになりました。

したがって、消化管治療薬の上市の増加、消化管疾患の高い有病率、資金調達の増加、主要企業によるその他の戦略的活動などの要因により、調査対象セグメントは予測期間中に成長すると予想されます。

消化管治療薬産業の概要

消化管治療薬市場は、多くの市場参入企業が存在し、競争は中程度です。各社は市場ポジションを維持するため、新製品開発、提携、パートナーシップなどの主な戦略を採用しています。市場参入企業には、Abbvie Inc.、AstraZeneca、Johnson &Johnson(Janssen Global Services LLC)、武田薬品工業、Bausch Health Companies Inc.(サリックス製薬)などがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 消化器疾患の有病率の増加

- 製薬企業による研究開発投資の増加

- 市場抑制要因

- 医薬品承認に関する厳しい規制基準

- 特許切れの増加

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 薬剤タイプ別

- 生物製剤/バイオシミラー

- 制酸剤

- 緩下剤

- 止瀉剤

- 制吐剤

- 抗潰瘍剤

- その他の薬剤

- 剤形別

- 経口剤

- 非経口剤

- その他の剤形

- 用途別

- 潰瘍性大腸炎

- 過敏性腸症候群

- クローン病

- セリアック病

- 胃腸炎

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 北米

第6章 企業プロファイルと競合情勢

- 企業プロファイル

- Abbott

- Abbvie Inc.

- AstraZeneca

- Bayer AG

- GSK plc

- Johnson & Johnson(Janssen Global Services LLC)

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

- Bausch Health Companies Inc.(Salix Pharmaceuticals Inc.)

- Boehringer Ingelheim International GmbH

- Cipla Inc.

- Sebela Pharmaceuticals

第7章 市場機会と今後の動向

The Gastrointestinal Therapeutics Market size is estimated at USD 41.94 billion in 2025, and is expected to reach USD 51.87 billion by 2030, at a CAGR of 4.34% during the forecast period (2025-2030).

Factors such as the increasing prevalence of gastrointestinal diseases and the rising investments in research and development by pharmaceutical companies are expected to boost the market growth.

The increasing burden of gastrointestinal diseases such as ulcerative colitis, irritable bowel syndrome, Crohn's disease, celiac disease, gastroenteritis, and others among the population is the key factor driving the market growth. For instance, according to a report published by the International Journal of Colorectal Disease in May 2023, in Japan, patients diagnosed with ulcerative colitis (UC) tended to be younger and exhibited a higher prevalence among men compared to women, while the opposite trend was observed in the United States.

Additionally, as per an article published in NLM in July 2022, it was observed that GERD, the most prevalent gastrointestinal condition, affects 20% of individuals in Western culture. As per the same source, an estimated prevalence of GERD in the United States ranges between 18.1% and 27.8%, and the prevalence of GERD is higher among men than women. Thus, the high burden of GI tract diseases such as cancer and GERD is expected to increase demand for effective therapeutics approaches, thereby boosting the market growth.

Furthermore, the rising company's investment in research and development of gastro-related drugs and rising drug launches that increase the availability of the drugs in the market are also expected to fuel the market growth. For instance, in September 2023, gastrointestinal health company Vivante Health received USD 31 million in its Series B funding round led by new investor Mercato Partners, bringing its total raise to USD 47 million. Vivante provides personalized care plans to track their symptoms and connect patients with a coordinated care team, including dietitians, internists, and gastroenterologists. Similarly, in June 2023, the American Gastroenterological Association invested in Oshi Health. Oshi Health provides diagnosis and integrated care for digestive conditions.

Therefore, owing to the factors above, such as the rising prevalence of GI disorders and the increasing R&D activities for the development of gastrointestinal disease treatment, it is likely to boost the growth of the gastrointestinal therapeutics market over the forecast period. However, stringent regulatory norms regarding drug approvals and an increasing number of patent expiries are expected to impede the market growth over the forecast period.

Gastrointestinal Therapeutics Market Trends

Crohn's Disease Segment is Expected to Witness Significant Growth Over the Forecast Period

Crohn's disease, a chronic immune-mediated disorder, remains a significant challenge for both patients and healthcare providers, with its hallmark inflammation primarily affecting the digestive tract. In the medical management of Crohn's disease, various drugs are used to induce and maintain remission. For instance, infliximab and adalimumab are used to target proteins to decrease inflammation in the intestines.

The growing burden of Crohn's disease across the world is expected to create the demand for effective treatment, thereby boosting the segment growth. For instance, according to an article published in MedLine.Gov in January 2023, Crohn's disease is most common in Western Europe and North America, where it has a prevalence of 100 to 300 per 100,000 people. More than half a million Americans are currently affected by this disorder. Crohn's disease occurs more often in people of northern European ancestry and those of eastern and central European (Ashkenazi) Jewish descent than among people of other ethnic backgrounds. For reasons that are not clear, the prevalence of Crohn's disease has been increasing in the United States and some other parts of the world. Thus, the rising new and emerging treatments are expected to increase the availability of effective and safe drugs in the market, boosting segment growth.

Furthermore, the increasing drug approval by regulatory bodies is expected to increase the availability of novel therapeutics for treating Crohn's disease patients. It is anticipated to fuel the market growth over the forecast period. For instance, in October 2023, Eli Lilly and Company revealed positive results from its Phase 3 study evaluating minkizumab, an investigational interleukin-23p19 antagonist, for treating adults with moderately to severely active Crohn's disease. The study, known as VIVID-1, demonstrated that minkizumab met both co-primary and major secondary endpoints compared to placebo, underscoring its potential as a promising therapeutic agent for this patient population. Crohn's disease, characterized by symptoms such as abdominal pain, diarrhea, and weight loss, can lead to serious complications, highlighting the urgent need for effective treatments like minkizumab.

Therefore, owing to the factors above, such as the growing burden of Crohn's Disease and product approvals, the studied segment is expected to grow over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America is expected to hold a significant market share over the forecast period owing to factors such as the increasing burden of gastrointestinal diseases, rising product launches, and growing company initiatives.

The increasing burden of gastrointestinal diseases such as ulcerative colitis and others among the population is the key factor driving the market growth. For instance, in December 2023, an article from US Pharm highlighted that approximately 1.6 million individuals in the United States are afflicted with inflammatory bowel disease (IBD), encompassing Crohn's disease and ulcerative colitis. These conditions are characterized by gastrointestinal tract inflammation and may manifest symptoms, including persistent diarrhea, abdominal discomfort, and hematochezia.

Additionally, an article released by NBC Universal in February 2023 underscored the prevalence of Norovirus, also known as Norovirus or stomach flu, which accounted for 19 to 21 million incidents of vomiting and diarrhea in the United States during the year 2023. This resulted in 465,000 emergency room admissions and 109,000 hospitalizations. Notably, during the winter season in 2023, there was a notable increase in cases and outbreaks, peaking in March 2023, with elevated norovirus activity persisting well into late spring.

Furthermore, the rising government funding for gastrointestinal diseases research and development is expected to increase the company's focus on developing novel treatment drugs, propelling market growth. For instance, according to the data published by NIH, in May 2022, the government-funded an estimated USD 352 million for the research and development of colorectal cancer disease in the United States in 2022, compared to USD 335 million in 2021. In addition, as per the same source, an estimated USD 92 million was funded by the government for research and development of Crohn's disease in 2022, compared to USD 88 million in 2021.

Moreover, the rising drug launches and approvals in the region and an increasing company focus on adopting key strategies such as collaboration, partnerships, and others are also contributing to the market growth. For instance, in October 2023, the US Food and Drug Administration (FDA) approved mirikizumab, a novel and highly efficacious therapy, for the treatment of ulcerative colitis (UC), presenting a promising therapeutic avenue for individuals grappling with this chronic and incapacitating inflammatory bowel ailment. Similarly, in August 2023, an international phase 3 clinical trial conducted in collaboration with Weill Cornell Medicine and NewYork-Presbyterian revealed that zolbetuximab, a newly developed targeted intervention, when administered alongside conventional chemotherapy, prolonged survival rates among patients afflicted with advanced gastric or gastroesophageal junction cancer, demonstrating overexpression of a specific biomarker.

Therefore, owing to factors such as an increase in GI drug launches, high prevalence of GI diseases, rise in funding, and other strategic activities by the key players, the studied segment is expected to grow over the forecast period.

Gastrointestinal Therapeutics Industry Overview

The gastrointestinal therapeutics market is moderately competitive, with the presence of many market players. The companies are adopting key strategies such as new product development, collaborations, partnerships, and others to retain their market position. Some market players include Abbvie Inc., AstraZeneca, Johnson & Johnson (Janssen Global Services LLC), Takeda Pharmaceutical Company Limited, and Bausch Health Companies Inc. (Salix Pharmaceuticals Inc.).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Gastrointestinal Diseases

- 4.2.2 Rising Investments in Research and Development by Pharmaceutical Companies

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Norms Regarding Drug Approvals

- 4.3.2 Increasing Number of Patent Expiries

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Drug Type

- 5.1.1 Biologics/ Biosimilars

- 5.1.2 Antacids

- 5.1.3 Laxatives

- 5.1.4 Antidiarrheal agents

- 5.1.5 Antiemetics

- 5.1.6 Antiulcer agents

- 5.1.7 Other Drug Types

- 5.2 By Dosage Form

- 5.2.1 Oral

- 5.2.2 Parenteral

- 5.2.3 Other Dosage Forms

- 5.3 By Application

- 5.3.1 Ulcerative Colitis

- 5.3.2 Irritable Bowel Syndrome

- 5.3.3 Crohn's Disease

- 5.3.4 Celiac Disease

- 5.3.5 Gastroenteritis

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott

- 6.1.2 Abbvie Inc.

- 6.1.3 AstraZeneca

- 6.1.4 Bayer AG

- 6.1.5 GSK plc

- 6.1.6 Johnson & Johnson(Janssen Global Services LLC)

- 6.1.7 Pfizer Inc.

- 6.1.8 Takeda Pharmaceutical Company Limited

- 6.1.9 Bausch Health Companies Inc. (Salix Pharmaceuticals Inc.)

- 6.1.10 Boehringer Ingelheim International GmbH

- 6.1.11 Cipla Inc.

- 6.1.12 Sebela Pharmaceuticals