|

市場調査レポート

商品コード

1910704

センサー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| センサー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 215 Pages

納期: 2~3営業日

|

概要

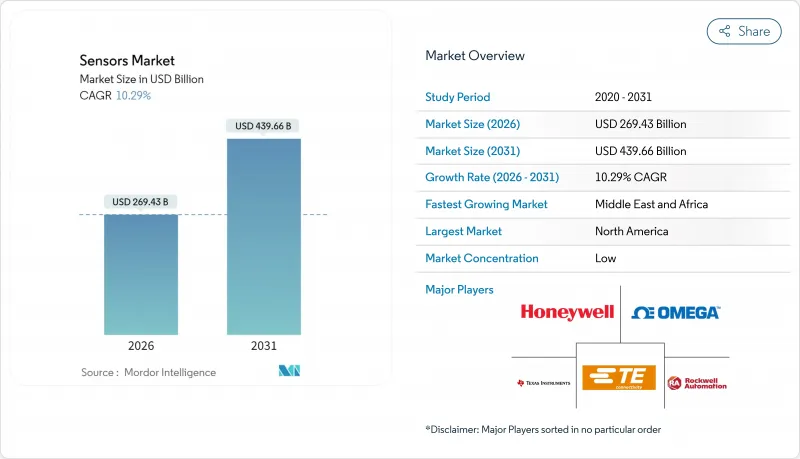

センサー市場は、2025年の2,443億1,000万米ドルから2026年には2,694億3,000万米ドルへ成長し、2026年から2031年にかけてCAGR 10.29%で推移し、2031年には4,396億6,000万米ドルに達すると予測されています。

この成長は、自律移動プラットフォームの普及拡大、産業自動化の急速な進展、およびコネクテッドヘルスケア分野での使用事例の拡大によって推進されています。人工知能とセンサーハードウェアの融合により、予期せぬ工場のダウンタイムを最大50%削減する予知保全システムが実現しています。現在、温度測定デバイスがセンサー市場の23%を占めて主導的立場にありますが、化学センサーは14.8%のCAGRで最も急速な拡大が見込まれています。アジア太平洋地域は、中国のスマート製造プログラム、日本の自動車分野における強力なイノベーション、そして長年にわたる半導体サプライチェーンを背景に需要を牽引しています。一方、中東・アフリカ地域は、大規模なインフラのデジタル化とクリーンエネルギーの整備に支えられ、最も急速に成長する地域として台頭しつつあります。競合の激しさは依然として高く、市場は分散した状態が続いていますが、最近の合弁事業や的を絞った買収により、マルチモーダルおよびAI対応製品ポートフォリオを中心とした統合が加速しています。

世界のセンサー市場の動向と洞察

自律移動体におけるマルチセンサー融合技術の採用拡大

LiDAR、レーダー、カメラの各ストリームは、統合された知覚スタックに組み込まれ、すべての新型車両における先進運転支援システムに関するEU一般安全規制2019/2144を満たす冗長性を実現しています。テスラの完全自動運転コンピューターは、8台のカメラ、12個の超音波ユニット、1台のレーダーからの入力を144 TOPSで処理し、性能のベンチマークを確立しています。ティア1サプライヤーは、統合コストの削減、部品表の圧縮、市場投入までの時間の短縮を実現する、事前調整済みの知覚スイートで対応しています。

アジアの既存工場におけるスマート工場改造の普及

中国の第14次五カ年計画では、デジタルインフラに1兆4,000億米ドルを割り当てており、その多くは既存機械のセンサー強化アップグレードを目的としています。これにより予知保全の実現とライフサイクルの20~30%延長が図られます。既存ラインに設置された振動・温度・流量計測デバイスはクラウド解析にデータを供給し、工場全体の再構築なしにダウンタイム削減と総合設備効率(OEE)向上を実現します。

自動車グレードMEMSファウンダリ容量の供給逼迫

AEC-Q100認証サイクルは最長2年を要し、厳格な基準を満たすアジア太平洋地域のファブはごく一部に限られます。STマイクロエレクトロニクスはクリーンルームの拡張を進めていますが、EVの普及が新たなバッテリー管理・熱監視負荷をもたらし、さらなる圧迫要因となっています。

セグメント分析

温度デバイスは2025年にセンサー市場シェア22.74%を占め、自動車用サーマルループや産業プロセス制御において不可欠な存在であり続けております。化学センサーは排出ガス監視や職場安全規制の強化に伴い、2031年までにCAGR14.12%で最も急速に拡大する見込みです。流量・振動・圧力カテゴリーは予知保全機能によりセンサー市場を深化させ、近接センサーは機械防護のコンプライアンスを確保します。

継続的な小型化により、温度素子内にAIエンジンを統合可能となり、クラウド遅延なしのローカル異常検知を実現しています。慣性・磁気・光学・湿度デバイスが製品ラインを補完し、スマートフォンの姿勢検知からスマートシティの大気質監視網まで幅広く対応しています。

電気抵抗設計は、低コストと産業用・自動車用ダッシュボードへの幅広い設計採用により、2025年のセンサー市場で19.18%を占めました。自律航行に不可欠なLiDARシステムは、価格低下と機械部品を排除した固体アレイへの移行を反映し、2031年までCAGR16.74%で増加すると予測されています。光学式、圧電抵抗式、圧電式、静電容量式、磁気式、音響式といった多様なモードが、視覚、圧力、振動、タッチ、音響といった要求に対応する幅広い分野を構成しています。

Velodyne社の4D LiDARのような進歩は、速度ベクトルを距離と角度に統合し、運転支援機能のための物体分類を鮮明にします。一方、圧電式ハーベスターは、遠隔パイプラインにおけるバッテリーレスセンサーノード向けに、マイクロジュール単位の電力供給を実現します。

センサー市場の市場セグメンテーションは、測定パラメータ(温度、流量など)、動作モード(光学式、ピエゾ抵抗式、圧電式など)、技術(MEMS、フォトニックなど)、統合レベル(ディスクリートセンサー、統合/組み込みセンサー)、出力(アナログ、デジタル)、エンドユーザー産業別(自動車、工業製造など)、地域別に分類されます。市場予測は金額ベース(米ドル)で提供されます。

地域別分析

アジア太平洋地域は2025年に世界収益の36.21%を占め、中国の1兆4,000億米ドル規模のデジタルインフラ整備推進、日本の先進的な自動車サプライチェーン、韓国の露光技術における主導的立場がこれを支えています。政府の優遇措置により、ファブ(製造工場)や組み込みセンサーの新興企業双方にとって資本障壁が低減され、設計・生産ノウハウが密集した地域クラスターが形成されています。サプライヤーは、消費者向け電子機器の組立ラインの大半に近接している利点を享受し、リードタイムと物流コストを圧縮しています。

欧州では、厳しい安全および環境規制により、安定した高付加価値の需要があります。ADASの搭載義務化と産業の脱炭素化目標により、より高性能で機能的に安全な製品の購入が促進されています。EUのチップス法による助成金や、NXPの10億ユーロの融資など、欧州投資銀行による融資により、自動車グレードの生産に新たな生産能力が投入されています。

中東およびアフリカは、湾岸協力会議加盟国がスマートグリッド、海水淡水化モニタリング、および大規模な再生可能エネルギーを導入しているため、14.58%のCAGRで拡大すると予測されています。アフリカの鉱業および輸送回廊では、粉塵、振動、電力の不安定さに耐える堅牢なセンサーがますます導入されています。ラテンアメリカは規模は小さいもの、ブラジルとメキシコでスマート農業のパイロット事業が行われ、生産量が徐々に増加しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 自律移動体におけるマルチセンサー融合技術の普及拡大

- アジアの既存工場におけるスマート工場改修の普及

- 洋上エネルギー分野における状態監視型資産管理への移行

- 次世代EU車両へのADASセンシングスイートの必須搭載

- 電池不要IoTタグ向け超低消費電力環境センシング技術

- 市場抑制要因

- 自動車グレードMEMSファウンダリ生産能力の供給逼迫状況

- 長寿命振動センサーにおける校正ドリフトの課題

- スマートセンサーの相互運用性を阻害する断片化した無線プロトコル規格

- 価値とサプライチェーン分析

- 規制とテクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

- フレキシブルおよびプリンテッドセンサーの動向(現状と予測)

- マクロ経済およびパンデミックの影響評価

第5章 市場規模と成長予測

- 測定パラメータ別

- 温度

- フロー

- 化学

- 振動

- 圧力

- 近接性

- 慣性

- その他のパラメータ

- 運用モード別

- 光学

- 圧電抵抗素子

- 圧電

- 電気抵抗

- 画像

- LiDAR

- その他のモード

- 技術別

- MEMS

- フォトニック

- CMOS

- ナノ電気機械システム(NEMS)

- 統合レベル別

- ディスクリートセンサー

- 統合型/組み込み型センサー

- 生産高別

- アナログ

- デジタル

- エンドユーザー業界別

- 自動車

- 工業製造

- 医療・健康

- 航空宇宙

- 民生用電子機器

- 石油・ガス

- 建設

- 防衛

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Honeywell International Inc.

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- TE Connectivity Ltd

- Rockwell Automation Inc.

- OMEGA Engineering inc.

- STMicroelectronics N.V.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- ams OSRAM AG

- Analog Devices Inc.

- Renesas Electronics Corp.

- Microchip Technology Inc.

- ROHM Semiconductor

- Omron Corp.

- ABB Ltd

- Sick AG

- Qualcomm Technologies Inc.

- Velodyne Lidar Inc.

- LeddarTech Inc.

- TDK Corp.