|

|

市場調査レポート

商品コード

1433490

建物一体型太陽光発電(BIPV):市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Building Integrated Photovoltaic (BIPV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 建物一体型太陽光発電(BIPV):市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

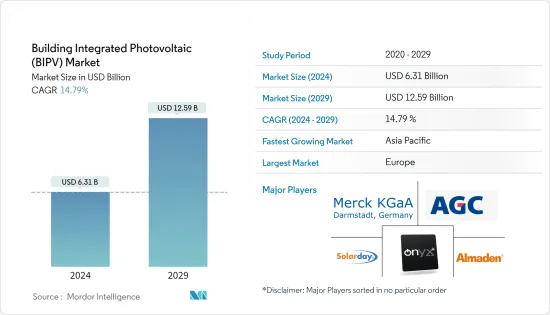

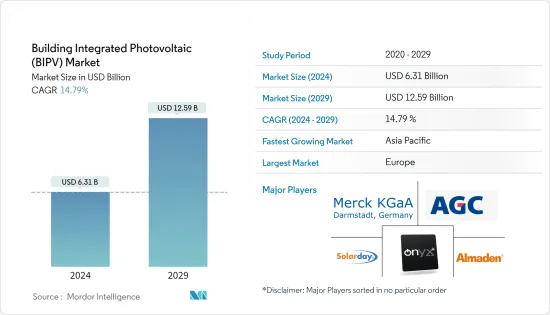

建物一体型太陽光発電の市場規模は、2024年に63億1,000万米ドルと推定され、2029年までに125億9,000万米ドルに達すると予測されており、予測期間(2024年~2029年)中に14.79%のCAGRで成長する見込みです。

主なハイライト

- 中期的には、自家消費による光熱費の削減や建物の二酸化炭素排出量の削減などの要因が、予測期間中に市場を牽引すると予想されます。

- 一方、屋上太陽光発電システムと比較して設置コストが高いため、市場の成長に悪影響を与える可能性があります。

- それにもかかわらず、世界中で再生可能エネルギーベースの発電への傾向が高まっており、BIPVシステムにとっては大きなチャンスとなっています。ほぼすべての国の政府は、カーボンニュートラルの目標を達成するために、再生可能エネルギー指向のエネルギー政策に取り組んでいます。産業部門や商業部門は、よりクリーンなエネルギー生成方法を採用するよう奨励されています。

- 太陽光発電技術コストの低下により、アジア太平洋は予測期間中により速く成長すると予想されます。

建物一体型太陽光発電市場の動向

結晶系PVが市場を独占すると予想される

- 屋根やファサード用途のソーラーパネルのほとんどは結晶シリコンで構成されています。これらは、他の技術よりも多くの電力(太陽の下でPVアレイ1フィート当たり10~12ワット)を生成する厚いガラスです。

- 世界中で太陽光発電モジュールの設置が増加しているため、BIPVシステムの設置もさらに増加しています。2022年の太陽光発電の総設置容量は約1046.6GWとなり、2021年の855.2GWから増加しました。

- ドイツのガラス・建材メーカーであるGrenzebach Groupは2022年9月、同社の子会社Envelonがドイツのバイエルン州に最大30万平方メートルの年間生産能力を持つ建物一体型太陽光発電(BIPV)モジュール生産工場を開設すると発表しました。

- 2021年12月、イタリアのソーラーパネルメーカーSolardayは、赤、緑、金、グレーのガラス製単結晶PERC BIPVパネルを発売しました。この製品の電力変換効率は17.98%、温度係数は1℃あたり-0.39%です。より高い電力変換機能に加えて、色を変えることで建物に美的価値も加えます。

- このような発展は、市場開拓に圧倒的な影響を与えることが予想されます。

アジア太平洋は大幅な成長が見込まれる

- アジア太平洋は、最もコスト効率の高い方法で太陽光発電技術を多くの産業に導入することに成功しています。この地域の技術は成熟段階に達しており、価格は継続的に下落しています。

- 中国、インド、日本、 ASEANなどの国々は、BIPV、屋上、その他多くの用途向けの新しい革新的な技術を用いて太陽光発電の分野でその実力を実証してきました。中国の太陽光発電産業における各技術の生産規模は世界の50%以上を占めており、近い将来もトップの座を維持すると予想されています。

- この発展はこの地域の他の地域でも起こりました。 2021年9月、ガラス、化学薬品、ハイテク材料の日本のメーカーであるAGC Inc.は、同社のBIPVガラスが 2024年までに、シンガポール工科大学のプンゴル新キャンパスに設置されるように選ばれたと発表しました。

- 2023年 5月、オーストラリアのスマート建材会社ClearVue Technologies Limitedは、ソーラービジョンガラスをグレージングユニットまたはIGUに統合するための改良された製品設計の正式リリースを発表しました。同時に、当社は新しい統合型ソーラーファサードソリューションをリリースします。

- このような発展により、アジア太平洋は今後数年間で最も高い成長率を示すことが予想されます。

建物一体型太陽光発電業界の概要

世界の建物一体型太陽光発電(BIPV)市場は適度に統合されています。この市場の主要企業(順不同)には、ONYX Solar Group LLC、Merck KGaA、AGC Inc.、Solarday、Changzhou Almadenなどが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提条件

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場概要

- イントロダクション

- 市場規模と需要予測:2028年まで(単位:百万米ドル)

- 最近の動向と展開

- 政府の規制と政策

- 市場力学

- 促進要因

- 自家発電によるエネルギー料金の削減

- 住宅分野における太陽光発電モジュールの設置増加

- 抑制要因

- 屋上太陽光発電システムに比べ高い設置コスト

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- タイプ

- 薄膜系PV

- 結晶系PV

- エンドユーザー

- 住宅用

- 商業・産業

- 地域

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- フランス

- 英国

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他中東・アフリカ

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Onyx Solar Group LLC

- Merck KGaA

- Nanoflex Power Corporation

- Hanergy Holding Group Ltd.

- AGC Inc.

- Polysolar Domestic

- Issol SA

- Changzhou Almaden Co. Ltd

- Solarday

- Ertex solartechnik GmbH

第7章 市場機会と今後の動向

- 世界の再生可能エネルギー発電への傾斜

目次

Product Code: 62629

The Building Integrated Photovoltaic Market size is estimated at USD 6.31 billion in 2024, and is expected to reach USD 12.59 billion by 2029, growing at a CAGR of 14.79% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the reduction in energy bills due to self-power consumption and the reduction in the building's carbon footprint are expected to drive the market during the forecast period.

- On the other hand, the high installation cost compared to rooftop PV systems is likely to negatively impact the market growth.

- Nevertheless, the inclination towards renewables-based power generation worldwide is an enormous opportunity for BIPV systems. The governments of almost all countries are moving towards renewables-oriented energy policies to reach their carbon neutrality goals. The industrial and commercial sectors are even incentivized to adopt cleaner energy generation methods.

- Due to declining solar technology costs, Asia-Pacific is expected to grow faster during the forecast period.

Building Integrated Photovoltaics Market Trends

Crystalline PV Expected to Dominate the Market

- Most solar panels for roof and facade applications are made up of crystalline silicon. They are thick glasses that produce more power (10-12 watts per ft² of PV array under the full sun) than other technologies.

- The increasing installation of solar PV modules across the globe is further increasing the installation of BIPV systems. In 2022, the total solar PV installed capacity was around 1046.6 GW, which increased from 855.2 GW in 2021.

- In September 2022, Grenzebach Group, a glass and building materials producer in Germany, announced the inauguration of a building-integrated PV (BIPV) module production plant by the company's subsidiary Envelon in Bavaria region in Germany with a capacity of up to 300,000 sq. meter annual capacity.

- In December 2021, Italian solar panel manufacturer Solarday launched a glass-glass monocrystalline PERC BIPV panel in red, green, gold, and grey. The power conversion efficiency of the product is 17.98%, and its temperature coefficient is -0.39% per degree Celsius. Along with higher power conversion capability, it also adds aesthetic value to buildings by varying colors.

- Such developments are expected to have an overwhelming effect on the market development.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region has successfully implemented solar PV technologies in many industries in the most cost-effective way. The technology in the region has reached the maturity stage and has witnessed continuously plummeting prices.

- Countries like China, India, Japan, and ASEAN have proved themselves in solar power generation with new innovative technologies for BIPV, rooftops, and many other applications. China's production scale for each technology in the PV industry accounts for more than 50% of the world and is expected to remain at the top in the near future.

- The developments happened in other parts of the region too. In September 2021, AGC Inc., the Japanese manufacturer of glass, chemicals, and high-tech materials, announced that its BIPV glass had been selected to be installed at the Singapore Institute of Technology's new Punggol campus, which is scheduled to be open by 2024.

- In May 2023, a smart building materials Australian company, ClearVue Technologies Limited, announced the official release of its improved product design for integrating solar vision glass into glazing units or IGUs. At the same time, the Company releases its new integrated solar facade solutions.

- Owing to such developments, Asia-Pacific is expected to have the highest growth rate in the coming years.

Building Integrated Photovoltaics Industry Overview

The global building integrated photovoltaic (BIPV) market is moderately consolidated. The key players in this market (not in particular order) include ONYX Solar Group LLC, Merck KGaA, AGC Inc., Solarday, and Changzhou Almaden Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Reduction in Energy Bills Due to Self-Power Consumption

- 4.5.1.2 Increasing Installation of Solar PV Modules in Residential Segment

- 4.5.2 Restraints

- 4.5.2.1 High Installation Cost as Compared to Rooftop PV Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thin Film PV

- 5.1.2 Crystalline PV

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Onyx Solar Group LLC

- 6.3.2 Merck KGaA

- 6.3.3 Nanoflex Power Corporation

- 6.3.4 Hanergy Holding Group Ltd.

- 6.3.5 AGC Inc.

- 6.3.6 Polysolar Domestic

- 6.3.7 Issol SA

- 6.3.8 Changzhou Almaden Co. Ltd

- 6.3.9 Solarday

- 6.3.10 Ertex solartechnik GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Inclination towards Renewables-based Power Generation Across the World