|

|

市場調査レポート

商品コード

1189781

アルミニウム市場の成長、動向、および予測(2023年~2028年)Aluminum Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| アルミニウム市場の成長、動向、および予測(2023年~2028年) |

|

出版日: 2023年01月18日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

アルミニウム市場は2021年に1120億米ドルと評価され、予測期間2022-2027年には6%を超えるCAGRで推移すると予測されています。

COVID-19のパンデミックは、建設や自動車などの主要なエンドユーザー産業が停止し、市場にマイナスの影響を与えました。しかし、現在ではパンデミック前の水準に達しており、予測期間中は安定した成長が期待されます。

中期的には、アジア太平洋地域における建設需要の拡大が市場の牽引役として期待されます。

一方、世界の自動車産業の減速は、予測期間2022-2027年の市場成長の妨げになると予想されます。

アジア太平洋地域は最大の市場であり、中国、インド、日本などの国での消費増加により、予測期間中に最も急速に成長する市場であると予想されます。

主な市場動向

建築・建設業界からの需要拡大

建築・建設業界において、アルミニウムは2番目に広く使用されている金属です。窓、カーテンウォール、屋根、クラッディング、ソーラーシェード、ソーラーパネル、手すり、棚、その他仮設構造物に広く使用されています。

世界の建設活動の増加は、最近調査された市場を駆動する重要な要因の一つです。

アジア太平洋地域の建設部門は世界最大であり、人口増加、中間所得層の増加、都市化により、健全な速度で成長しています。このため、ホテル、ショッピングモール、高層ビル、アリーナ、スタジアム(屋外および屋内)の需要が高まり、建設産業が活性化し、同地域のアルミニウム需要を促進しています。

また、アジア太平洋地域は、中国、インド、東南アジア諸国を中心とした低コスト住宅建設が盛んな地域です。

北米では、米国が最大の住宅建設市場であり、世界の主要な成長市場の一つとなっています。

北米では、約80%の人が一戸建て住宅を希望し、約70%の人がそれを実現していることから、住宅建設戸数は年々増加しています。

全体として、世界の建設活動の回復が、予測期間中の建築・建設業界におけるアルミニウムの需要を促進すると予想されます。

アジア太平洋地域が市場を独占する見込み

アジア太平洋地域は、予測期間中、アルミニウムの最大市場であると予想されます。電子機器、建築・建設、航空宇宙などの産業が、中国、インド、日本などの国々で成長しています。

アジア太平洋地域の電子機器製造市場は、同地域に多くのOEMが存在するため、今後数年間で急速に成長すると予想されます。

中国国家統計局によると、2020年12月、中国における家電製品および家庭用電子機器の小売販売額は約1,000億人民元にのぼります。

ボーイング社は、同社が中国で370億米ドルの販売を行ったと発表した後、2036年までに中国が1兆1,000億米ドル相当の新型航空機を購入すると推定しました。

インドでは、今後7年間で約1兆3,000億米ドルの住宅投資が見込まれており、その間に6,000万戸の住宅が新たに建設される可能性があります。

日本では、2025年までに包装食品市場の小売売上高が2,045億米ドルに達すると推定され、3.6%、70億米ドルの成長が見込まれています。このような包装業界の成長予測は、予測期間中に包装用箔として使用されるアルミニウムの市場需要を促進するものと思われます。

アジア太平洋地域は、インド、中国、東南アジア諸国における建設業の大規模な成長により、アルミニウムの最大市場となっています。

したがって、アジア太平洋地域の国々のエンドユーザー産業が急速に成長していることから、この地域が予測期間中に世界市場を独占することが予想されます。

競合情勢

アルミニウム市場は、部分的に断片化されています。主要企業は、リオティント、シンファグループ、中国虹橋集団有限公司、中国アルミニウム(Chinalco)等です。

その他の特典

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 イントロダクション

- 調査の前提条件

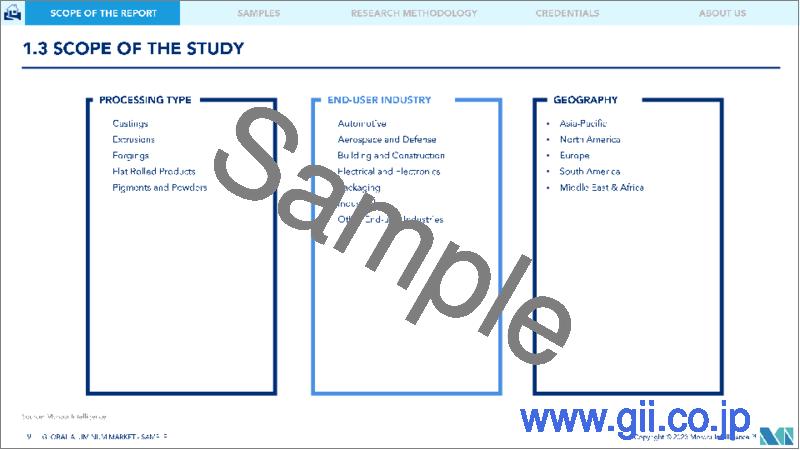

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- アジア太平洋地域における建設活動の活発化

- その他の促進要因

- 抑制要因

- 自動車産業の衰退

- その他の阻害要因

- 業界バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

- 輸出入動向

- 価格分析

第5章 市場セグメンテーション

- 加工タイプ

- 鋳造

- 押出成形

- 鍛造品

- 棒材・棒鋼

- 板およびプレート

- その他の加工タイプ(顔料、パウダーを含む)

- エンドユーザー産業

- 自動車産業

- 航空宇宙・防衛

- 建築・建設

- 電気・電子

- パッケージング

- 工業

- その他のエンドユーザー産業

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- 中東・アフリカ地域

- サウジアラビア

- 南アフリカ共和国

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- M&A、合弁事業、提携、契約

- 市場シェア(%)/ランキング分析

- リーディングプレイヤーが採用する戦略

- 企業プロファイル

- Alcoa Corporation

- Aluminium Bahrain BSC(Alba)

- Aluminum Corporation of China Limited(CHINALCO)

- China Hongqiao Group Limited

- East Hope Group

- Emirates Global Aluminum PJSC

- Novelis Inc.

- Norsk Hydro ASA

- Rio Tinto

- Rusal

- State Power Investment Corporation(SPIC)

- Xinfa Group Co. Ltd

第7章 市場機会と今後の動向

- 電気自動車市場の成長

- その他のビジネスチャンス

The aluminum market was evaluated at USD 112 billion in 2021 and is projected to register a CAGR of over 6% during the forecast period 2022-2027.

The COVID-19 pandemic negatively impacted the market as the major end-user industries, such as construction and automotive, were shut. However, the market has now reached pre-pandemic levels and is expected to grow steadily over the forecast period.

* Over the medium term, the major factor expected to drive the market studied includes increasing construction activities in the Asia-Pacific region.

* On the flip side, the slowdown in the global automotive industry is expected to hinder the growth of the market in the forecast period 2022-2027.

* The Asia-Pacific region represents the largest market, and it is also expected to be the fastest-growing market over the forecast period due to increasing consumption from countries such as China, India, and Japan.

Key Market Trends

Increasing Demand from the Building and Construction Industry

* In the building and construction industry, aluminum is the second most widely used metal. It is extensively used in windows, curtain walls, roofing and cladding, solar shading, solar panels, railings, shelves, and other temporary structures.

* Increasing construction activity worldwide is one of the key factors driving the market studied in recent times.

* The Asia-Pacific construction sector is the largest globally, and it is growing at a healthy rate, owing to increases in the population, middle-class incomes, and urbanization. This has accelerated the demand for hotels, shopping malls, high-rise buildings, arenas, and stadiums (both outdoor and indoor), in turn boosting the construction industry and driving the demand for aluminum in the region.

* In addition to this, Asia-Pacific has the largest low-cost housing construction segment, led by China, India, and various Southeast Asian countries.

* In North America, the US is the largest market for residential construction and is one of the major growth markets in the world.

* Almost 80% of individuals prefer single-family housing as an end goal, and almost 70% of people are executing this goal, thus, resulting in an increase in the number of houses being constructed every year.

* Overall, the recovering construction activities worldwide are expected to drive the demand for aluminum from the building and construction industry during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

* The Asia-Pacific region is expected to be the largest market for aluminum during the forecast period. Industries such as electronics, building and construction, aerospace, etc., are growing in countries such as China, India, and Japan, among others.

* The electronics manufacturing market in Asia-Pacific is expected to grow rapidly during the coming years due to the presence of many OEMs in the region.

* According to the National Bureau of Statistics of China, in December 2020, retail sales of household appliances and consumer electronics in China amounted to about CNY 100 billion.

* Boeing Company estimated that China would purchase USD 1.1 trillion worth of new aircraft by 2036 after the company announced that it made a sale of USD 37 billion in the country.

* India is likely to witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it is likely to witness the construction of 60 million new homes.

* In Japan, it is estimated that by 2025, the retail sales in the packaged food market are expected to reach USD 204.5 billion, a growth of 3.6% or USD 7 billion. Such projected growth in the packaging industry is likely to drive the market demand for aluminum used as foils in packaging during the forecast period

* Asia-Pacific has the largest market for aluminum, owing to the massive growth in construction in India, China, and various Southeast Asian countries.

* Hence, with the rapidly growing end-user industries in countries of the Asia-Pacific region, the region is expected to dominate the global market during the forecast period.

Competitive Landscape

The aluminum market is partially fragmented in nature. The major companies are Rio Tinto, Xinfa Group Co. Ltd, China Hongqiao Group Limited, and RusALand Aluminum Corporation of China Limited (Chinalco), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the Asia-Pacific Region

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Decline in Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-export Trends

- 4.6 Price Analysis

5 MARKET SEGMENTATION

- 5.1 Processing Type

- 5.1.1 Castings

- 5.1.2 Extrusions

- 5.1.3 Forgings

- 5.1.4 Rods and Bars

- 5.1.5 Sheets and Plates

- 5.1.6 Other Processing Types (including Pigments and Powders)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Industrial

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 US

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Aluminium Bahrain BSC (Alba)

- 6.4.3 Aluminum Corporation of China Limited (CHINALCO)

- 6.4.4 China Hongqiao Group Limited

- 6.4.5 East Hope Group

- 6.4.6 Emirates Global Aluminum PJSC

- 6.4.7 Novelis Inc.

- 6.4.8 Norsk Hydro ASA

- 6.4.9 Rio Tinto

- 6.4.10 Rusal

- 6.4.11 State Power Investment Corporation (SPIC)

- 6.4.12 Xinfa Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Electric Vehicles Market

- 7.2 Other Opportunities