|

|

市場調査レポート

商品コード

1641943

UV硬化型接着剤:市場シェア分析、産業動向と統計、成長予測(2025~2030年)UV-Curable Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| UV硬化型接着剤:市場シェア分析、産業動向と統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

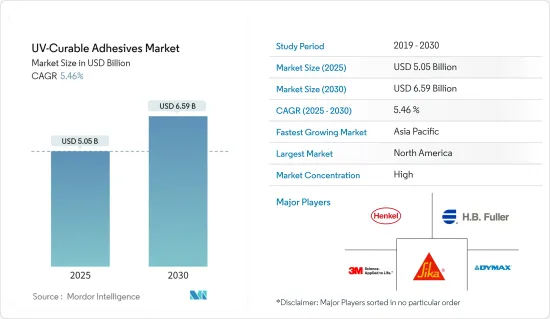

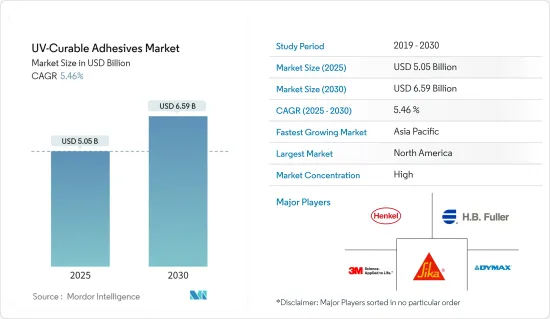

UV硬化型接着剤の市場規模は2025年に50億5,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは5.46%で、2030年には65億9,000万米ドルに達すると予測されます。

COVID-19のパンデミックにより、2020年には世界中で全国的な封鎖、製造活動やサプライチェーンの混乱、生産停止が発生し、市場にマイナスの影響を与えました。しかし、2021年には状況が回復し始め、それによって市場の成長軌道が回復しました。

主なハイライト

- 市場を牽引している主な要因は、自動車・航空宇宙用途でのUV接着剤需要の高まりと、環境規制によるUV接着剤需要の増加です。

- その反面、UV硬化型接着剤の製造コストが高く、代替接着剤が利用可能であることが市場成長の妨げになると予想されます。

- 包装業界からの需要の増加とUV硬化型接着剤の技術の向上は、市場調査の機会として作用すると予想されます。

- 北米が世界市場を独占し、米国で最も高い消費が記録されました。

UV硬化型接着剤の市場動向

市場セグメンテーションは力強い成長を遂げる

- UV硬化型接着剤は、耐久性、生体適合性、潤滑性、化学物質や傷に対する耐性で有名であり、様々な医療用途の表示基準を満たす上で極めて重要です。これには、医薬品、投薬パッチ、ハイドロゲル、フィルター、検査ストリップ、血液バッグや医療用電子機器のような使い捨てアイテムが含まれます。

- UV硬化型接着剤は、その特徴的な特性により、医療業界においてニッチな地位を築きつつあります。UV硬化型接着剤は医療機器の組み立てに役立っており、特にカテーテル部品の接着では、漏れのない強固なシールが実現されています。

- 中国は世界最大級の急成長ヘルスケア市場です。2023年、国家医療製品管理局(NMPA)は、クラスIII(国内および海外)およびクラスII(海外)の医療機器および体外診断用医薬品の新規登録、登録更新、ライセンス項目の変更について、合計13,260件の申請を受理しました。申請件数は2022年比で25.4%増加しました。申請件数13,260件のうち、NMPAは合計12,213件を承認し、前年に比べ278品目が追加承認されました。

- インドのヘルスケアおよび医療機器産業は近年著しい成長を遂げています。消耗品から埋め込み型医療機器まで、幅広い医療機器がインドで製造されています。インドで生産される医療機器の多くは、カテーテル、灌流セット、延長ライン、カニューレ、栄養チューブ、注射針、注射器などの消耗品と、心臓ステント、薬剤溶出ステント、眼内レンズ、整形外科用インプラントなどのインプラントです。

- MedTech Europeによると、欧州の医療技術市場は2024年に約1,600億ユーロ(1,772億5,000万米ドル)に達すると予測されています。主要市場には、ドイツ、フランス、英国、イタリア、スペインが含まれます。メーカー価格で評価すると、欧州医療機器市場は世界市場の26.1%を占め、47.2%を占める米国に次ぐ第2位の株主となっています。過去10年間、欧州医療機器市場は年平均5.4%の成長を記録しました。2024年には、欧州の医療機器貿易収支は110億ユーロの黒字となります。例年通り、欧州の医療機器の主要貿易相手国は米国、中国、日本、メキシコです。

- 上記の要因はすべて、今後数年間の市場需要の伸びに対する明るい見通しを示しています。

市場を独占する北米

- 北米諸国がUV硬化型接着剤市場を独占すると予想されます。最近では、米国とカナダで半導体生産への投資が増加しており、この地域のUV硬化型接着剤需要を促進しています。

- 2024年8月、米国商務省はテキサス・インスツルメンツの半導体生産を強化するために16億米ドルを投資すると発表しました。テキサスインスツルメンツ社のシャーマン工場が完全に稼動すれば、毎日1億個以上のチップが生産されることになります。

- 2024年7月、カナダ革新・科学・経済開発省(ISED)は、FABrIC(Fabrication of Integrated Components for the Internet's Edge)ネットワークへの1億2,000万米ドルの投資を発表しました。総額2億2,000万米ドルを超えるこの5カ年計画は、カナダの半導体製造と商業化を強化するものです。

- 医療業界もまた、近年この地域でUV硬化型接着剤の主要な消費者となっています。UV硬化型接着剤は、注射器の組み立てや医療機器の電子部品など、幅広い医療用途で使用されています。

- 北米は米国を筆頭に世界最大の医療機器産業を誇っています。最近では、国内各地の新たなヘルスケア製造施設に多額の投資が行われています。

- 2023年11月、米国の製薬会社であるイーライ・リリーは、糖尿病や肥満の治療薬を含む注射用医薬品や医療機器を製造するための新しい医薬品製造施設をドイツに建設するため、約25億米ドルを投資しました。建設は2024年に開始され、2027年までに稼働する予定です。

- こうした開発は、医薬品や医療機器製造におけるUV硬化型接着剤の需要を押し上げると予想されます。

- このような要因がすべて、予測期間中の北米のUV硬化型接着剤市場の需要を押し上げると予想されます。

UV硬化型接着剤産業の概要

UV硬化型接着剤市場は細分化されており、大手企業から小規模な地域企業まで多様な市場参入企業が存在します。主な市場プレイヤー(順不同)には、Henkel AG &Co.KGaA、H.B. Fuller Company、3M Company、Sika AG、Dymaxなどです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 自動車・航空宇宙分野で人気を集めるUV硬化型接着剤

- 有利な環境規制による人気の高まり

- その他の促進要因

- 抑制要因

- UV硬化型接着剤の生産に伴う高コスト

- 代替品の入手可能性

- その他の阻害要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(金額ベース市場規模)

- 樹脂タイプ別

- シリコーン

- アクリル

- ポリウレタン

- エポキシ

- その他の樹脂タイプ

- エンドユーザー産業別

- 医療

- 電気・電子

- 輸送

- 包装

- 家具

- その他のエンドユーザー産業

- 地域別

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- 北欧諸国

- トルコ

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他南米

- 中東・アフリカ

- サウジアラビア

- カタール

- アラブ首長国連邦

- ナイジェリア

- エジプト

- 南アフリカ

- その他中東とアフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場ランキング分析

- 主要企業の戦略

- 企業プロファイル

- 3M

- Delo

- Dymax

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Master Bond Inc.

- Panacol-elosol Gmbh

- Parson Adhesives Inc.

- Permabond LLC

- Sika AG

第7章 市場機会と今後の動向

- 活況を呈する包装業界におけるUV硬化型接着剤需要の高まり

- 先端技術との融合

The UV-Curable Adhesives Market size is estimated at USD 5.05 billion in 2025, and is expected to reach USD 6.59 billion by 2030, at a CAGR of 5.46% during the forecast period (2025-2030).

Due to the COVID-19 pandemic, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, conditions started recovering in 2021, thereby restoring the growth trajectory of the market.

Key Highlights

- The major factors driving the market studied are the rising demand for UV adhesives in automotive and aerospace applications and the increasing demand for these adhesives due to favorable environmental regulations.

- On the flip side, the high cost of producing UV-curable adhesives and the availability of alternative adhesives are expected to hinder the market's growth.

- An increase in demand from the packaging industry and a rise in the technologies for UV-curable adhesives are expected to act as opportunities for the market studied.

- North America dominated the global market, with the highest consumption registered in the United States.

UV-Curable Adhesives Market Trends

Medical Segment to Witness Strong Market Growth

- UV-curable adhesives, celebrated for their durability, biocompatibility, lubricity, and resistance to chemicals and scratches, are pivotal in meeting labeling standards for various medical applications. These include medicines, medication patches, hydrogels, filters, test strips, and disposable items like blood bags and medical electronics.

- Owing to their distinct properties, UV-curable adhesives are carving a niche in the medical industry. They are instrumental in medical device assembly, notably bonding catheter components for robust, leak-proof seals.

- China is one of the world's largest and fastest-growing healthcare markets. In 2023, the National Medical Products Administration (NMPA) received a total of 13,260 applications for initial registrations, registration renewals, and changes in licensing items of Class III (Domestic and Overseas) and Class II (Overseas) medical devices and IVDs. The number of applications represented a 25.4% increase when compared to 2022. Of the 13,260 applications, the NMPA approved a total of 12,213 applications, and an additional 278 products were approved in comparison with the previous year.

- The healthcare and medical device industries in India have experienced significant growth in recent years. A wide range of medical devices, from consumables to implantable medical devices, are manufactured in India. Most medical devices produced in India are disposables like catheters, perfusion sets, extension lines, cannulas, feeding tubes, needles, syringes, and implants like cardiac stents, drug-eluting stents, intraocular lenses, and orthopedic implants.

- As per MedTech Europe, the European medical technologies market has been projected to reach approximately EUR 160 billion (USD 177.25 billion) in 2024. The leading markets include Germany, France, the United Kingdom, Italy, and Spain. Valued at manufacturer prices, the European medical devices market constitutes 26.1% of the global market, making it the second-largest shareholder after the United States, which accounts for a 47.2% share. Over the past decade, the European medical devices market registered an average annual growth of 5.4%. In 2024, Europe boasts a positive trade balance in medical devices, standing at EUR 11 billion. Consistent with previous years, Europe's primary trade partners for medical devices have been the United States, China, Japan, and Mexico.

- All the abovementioned factors indicate a positive outlook for growth in market demand over the coming years.

North America to Dominate the Market

- North American countries are expected to dominate the UV-curable adhesives market. In recent times, there have been growing investments in semiconductor production in the United States and Canada, which has propelled demand for UV-curable adhesives in the region.

- In August 2024, the US Department of Commerce announced a USD 1.6 billion investment to enhance semiconductor production at Texas Instruments. Once fully operational, TI's Sherman facilities are projected to churn out over 100 million chips daily.

- In July 2024, Innovation, Science and Economic Development Canada (ISED) unveiled a USD 120 million investment into the FABrIC (Fabrication of Integrated Components for the Internet's Edge) network. This five-year initiative, with a total commitment exceeding USD 220 million, is set to strengthen Canada's semiconductor manufacturing and commercialization landscape.

- The medical industry has been another major consumer of UV-curable adhesives in the region in recent times. UV-curable adhesives are used in a wide range of medical applications, including syringe assembly and electronic components in medical devices.

- North America boasts the largest medical devices industry globally, spearheaded by the United States. In recent times, significant investments have been made in new healthcare manufacturing facilities across the country.

- In November 2023, Eli Lilly, a US pharmaceutical company, invested around USD 2.5 billion to build a new pharmaceutical manufacturing facility in Germany for producing injectable pharmaceutical products and medical devices, including those for diabetes and obesity. The construction began in 2024, and the facility is expected to be operational by 2027.

- Such developments are expected to boost the demand for UV-curable adhesives in pharmaceutical products and medical device manufacturing.

- All such factors are expected to boost the demand in the North American UV-curable adhesives market during the forecast period.

UV-Curable Adhesives Industry Overview

The UV-curable adhesives market is fragmented and features diverse participants, ranging from major corporations to smaller regional entities. The major market players (not in any particular order) include Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Sika AG, and Dymax.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 UV-curable Adhesives Gaining Traction in the Automotive and Aerospace Sectors

- 4.1.2 Growing Popularity Due to Favorable Environmental Regulations

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 High Costs Associated With the Production of UV-curable Adhesives

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Silicone

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Medical

- 5.2.2 Electrical and Electronics

- 5.2.3 Transportation

- 5.2.4 Packaging

- 5.2.5 Furniture

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Delo

- 6.4.3 Dymax

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Master Bond Inc.

- 6.4.7 Panacol-elosol Gmbh

- 6.4.8 Parson Adhesives Inc.

- 6.4.9 Permabond LLC

- 6.4.10 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for UV-curable Adhesives in the Booming Packaging Industry

- 7.2 Integration With Advanced Technologies