|

市場調査レポート

商品コード

1273464

スマートグリッドデータ分析市場- 成長、動向、予測(2023年-2028年)Smart Grid Data Analytics Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| スマートグリッドデータ分析市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年04月14日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

予測期間中、スマートグリッドデータ分析市場は12.76%のCAGRで推移すると予想されています。

スマートグリッドへの取り組みへの投資の増加により、スマートグリッドデータ分析市場は予測期間中、より速い速度で発展すると予想されます。IoT などの最新テクノロジーの導入により、プレイヤーはスマートグリッドソリューションの統合をより重要視しています。データ作成の継続的な動向により、電力事業者はビッグデータと数十億列以上の新しいIoTおよびスマートセンサーデータを融合しています。スマートメーターデータは、顧客の行動をより深く理解することで、より効率的に顧客をセグメント化することを支援することができます。

主なハイライト

- スマートグリッドデータ分析市場の大きなニーズは、電力ニーズの高まりから生まれると考えられます。国際エネルギー機関(IEA)によると、2030年までに世界の電力需要は、定型政策シナリオ(STEPS)で5,900テラワット時(TWh)、発表済み公約シナリオ(APS)で7,000TWh以上増加するとされています。これは、米国と欧州連合の現在の需要を足したのと同じです。

- さらに、各組織は、レジリエンス向上のために電力インフラの拡張、近代化、分散化に投資する予定です。電力網のインフラは時代とともにデジタル化、接続化が進み、重要なデジタル通信を確実かつ安全に流すことができるようになりました。インド亜大陸全域では、電力問題を解決するためのプロジェクトも数多く始まっています。

- 膨大なデータの流入が、市場の成長を後押ししています。IEEEによると、スマート化を実現するために、グリッドの構成要素とこれらの構成要素を管理する企業システムとの間で大量のデータが交換されています。アプリケーションに応じて、交換された情報は、電力会社とその顧客間の双方向の電力フローを経済的に最適化するのに役立ちます。

- さらに、スマートグリッドは、手動のエネルギー検針システムよりもはるかに多くのデータを収集します。そのため、より多くの変数が考慮されるため、データ分析技術を使用し、非常に現実的な消費予測を作成することができます。そのため、分析モデルを開発するために利用できるデータ量が飛躍的に増加し、スマートグリッド分析の機会は拡大しています。

- しかし、スマートグリッドシステムのコストが高く、より熟練した専門家が必要であることが、市場の成長を抑制しています。スマートメーターの最も顕著な制限は、資本資金の確保です。スマートシステムは、ほとんどのサービスプロバイダーやユーザーが採用している標準的なメータリング機器よりも比較的高価です。さらに、さまざまなスマートメーターは、運用や消費者の要件に基づいてさまざまなパラメータで設計されているため、取り扱いや設置に熟練した労働力を必要とする複雑な機器の使用を抑制することができます。

- COVID-19の流行は、電力部門を中心に多くの企業に打撃を与え、他の多くの部門でも仕事をストップさせたため、世界経済に打撃を与えました。COVID-19が発生した後、電気の値段が下がり、エネルギーや電力業界の多くの企業に打撃を与えました。さらに、米国国土安全保障省(DHS)によると、電力部門は、COVID-19の流行が深刻な影響を与えた16の必須インフラ部門の1つでした。

スマートグリッドデータ分析の市場動向

スマートグリッドプロジェクトへの投資の拡大

- 世界のスマートグリッドデータ分析市場は、スマートグリッドに多くの資金が費やされ、既存のグリッドに多くの再生可能エネルギー源が追加されていることから、成長が見込まれています。また、新興経済諸国では研究開発がより多く更新されており、市場の成長に貢献すると考えられます。

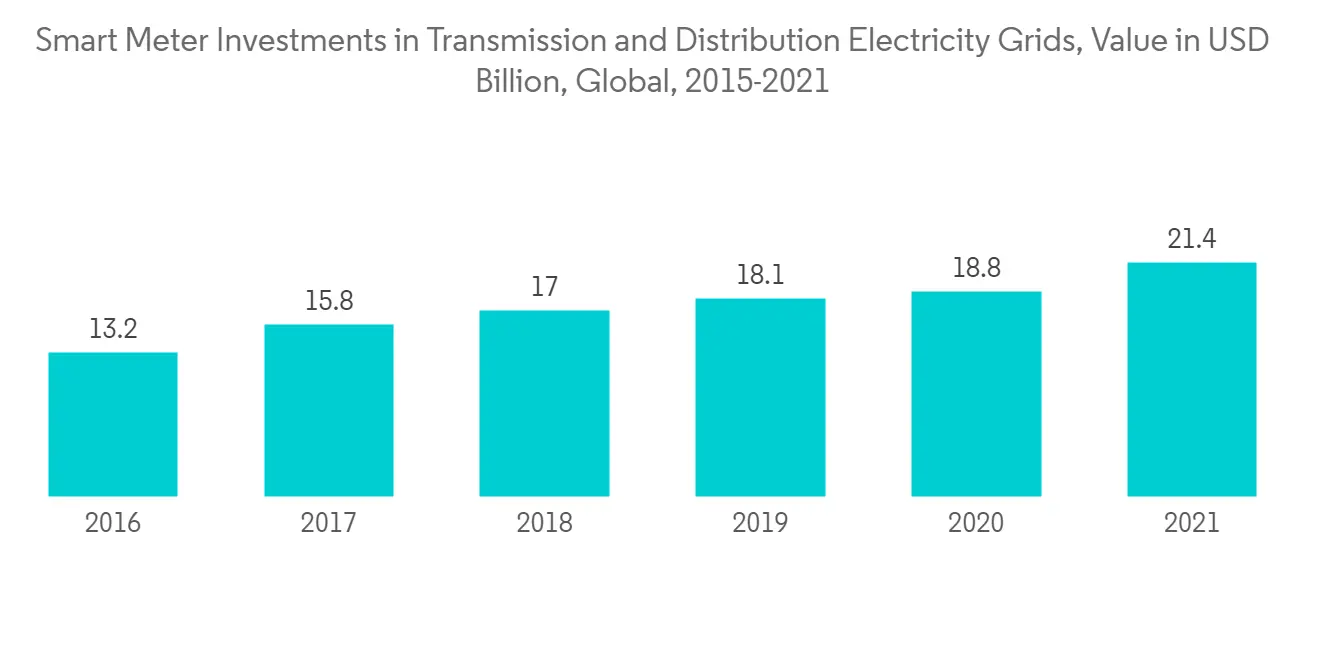

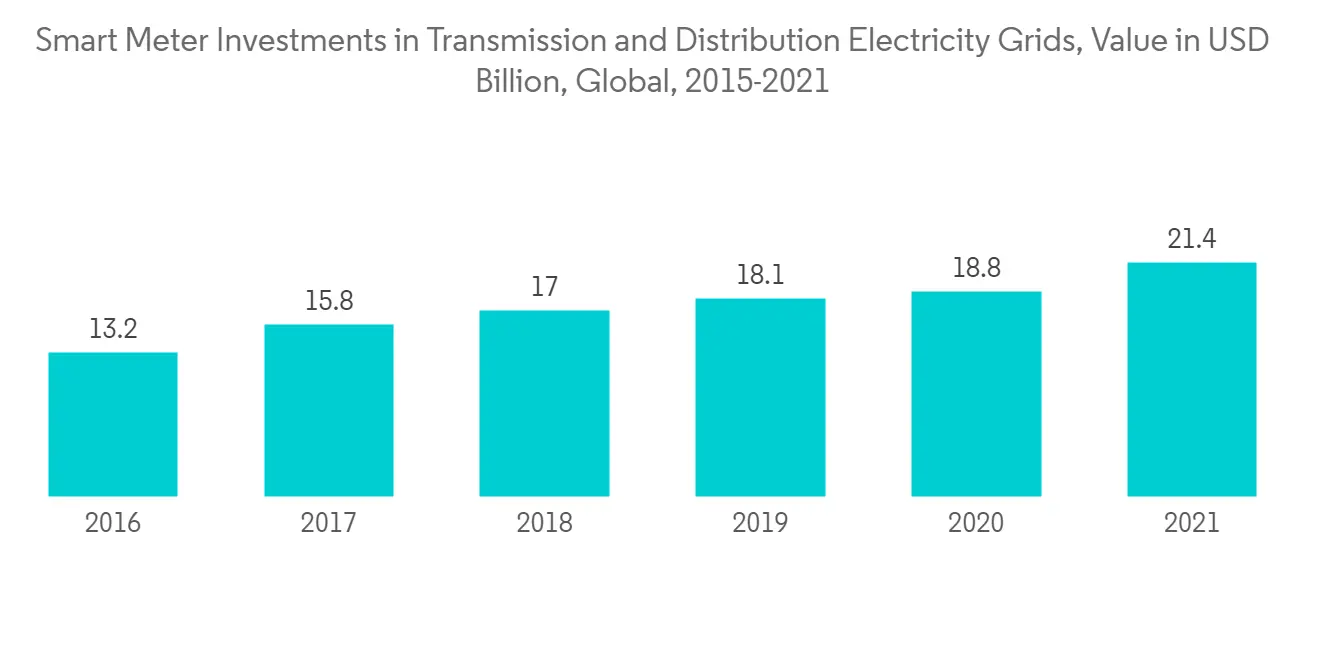

- 例えば、IEAによると、2021年の送配電網におけるスマートメーターへの投資額は約214億米ドルとなり、前年の2020年と比較して13.8%の投資額増となりました。このような投資の大幅な増加は、デジタルインフラに対するニーズの高まりを示すものと考えられ、それによって、同市場で事業を展開するベンダーに大きな利益をもたらしています。

- 中国や米国を含むいくつかの新興国は、主にそれぞれの政府の継続的な支援により、スマートメーターの大規模な展開を行っています。これらの要因により、スマートメーターから得られる膨大なデータを処理するための分析ソリューションの需要が高まると予想されます。

- スマートメーターは、ConEd社やDuke社など、米国の民間電力会社で利用が進んでいます。このことは、米国の電力会社で導入されたスマートメーターにより、2021年には約1億1,100万台の先進(スマート)計測インフラ(AMI)が設置され、全電気メーター設置数の69%以上を占めているという事実からもわかります。

さらに、インド政府のスマートメーターに関する国家的取り組み(SMNP)では、2022年6月に2億5,000万個の旧式メーターを新型メーターに交換する方針が示されています。これにより、エネルギー消費と監視の効果が向上し、ディスクムの年収が向上します。その結果、年間により多くのデータが生成される可能性があります。2022年、中国は投資拡大計画を発表し、中国国家電網公司は5000億元以上の予算を組み、超高圧プロジェクト、配電網のアップグレード、送電網のデジタル化のレベルアップに集中的に取り組みます。これらの要因から、予測期間中、この市場は成長を遂げると予想されます。

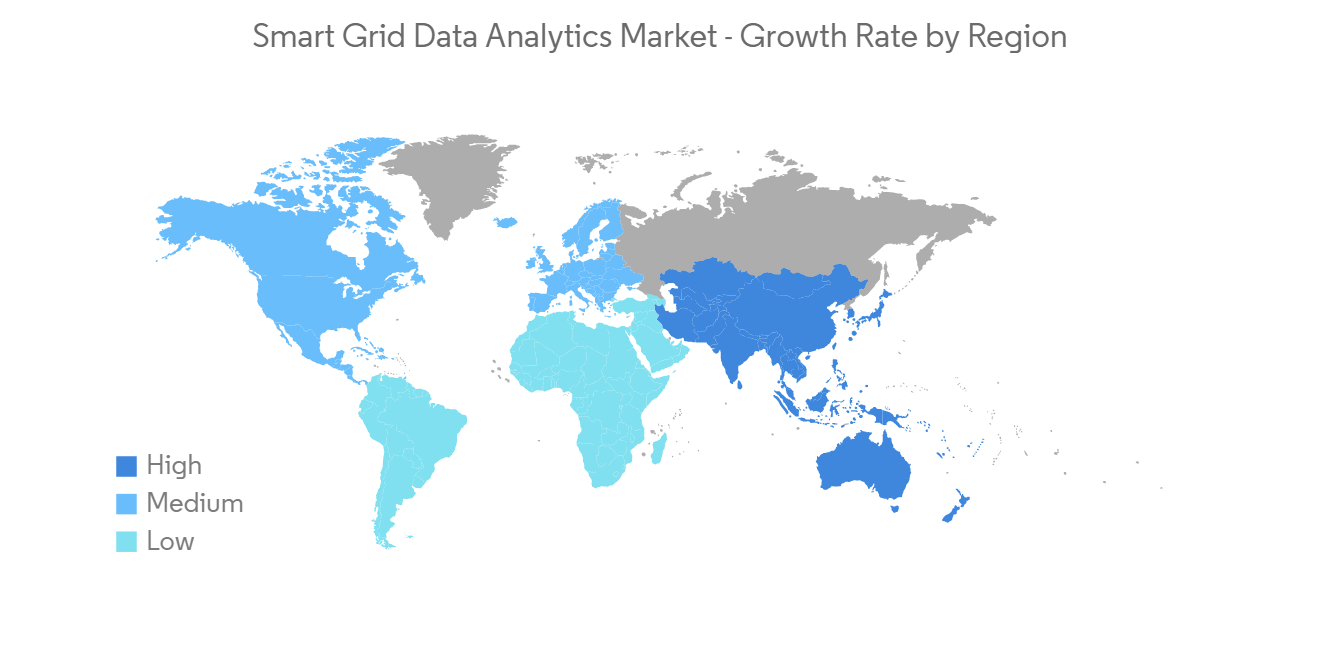

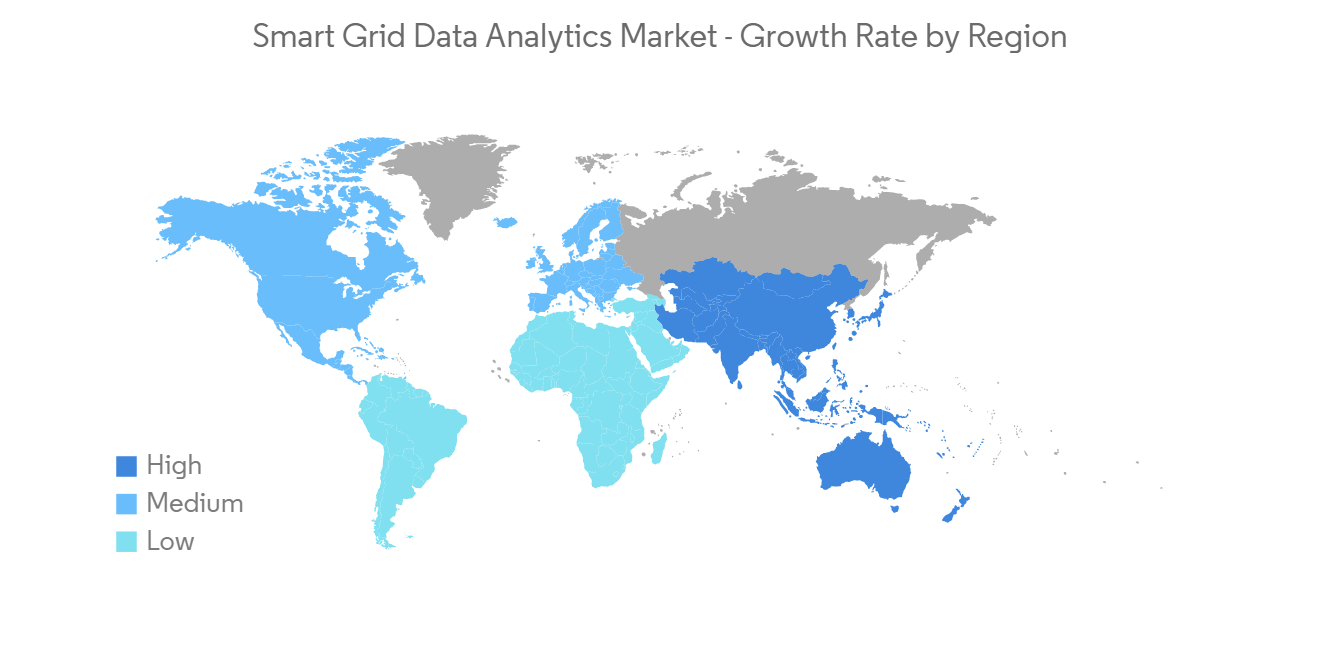

アジア太平洋地域が著しい成長率を示す

- 中国、日本、インドなどで人口が増加し、住宅インフラや電力使用への需要が高まっています。このため、スマートグリッドの使用をサポートする国々では電力需要が増加しており、スマートグリッドデータ解析の市場が形成される可能性があります。

- スマートシティの成長は、この地域の市場競争力を高めると予想されます。韓国は、国内でのIoTエコシステムの開発を支援するため、約300社に3億5,000万米ドルを投資する計画を発表しました。ソウル南東部の町では、サムスン電子とSKテレコムと共同で、再生可能エネルギーのためのIoTベースのインフラを設置するための試験運用が開始されています。

- 中国、インド、日本などの国々では電力消費が増加しており、電力を効率的に作り、分配し、あるいは消費するための新しい政策への需要が高まっています。スマートグリッド技術は、中国、インド、日本、オーストラリア、韓国、その他の地域の国々で多く使われています。IEAの報告によると、東南アジアのエネルギー消費は、過去20年間平均で毎年約3%ずつ増加しています。この傾向は、STEPSの現在の政策設定では、2030年まで続くと予想されています。

- より革新的なエネルギー貯蔵技術が使用されているため、APACのスマートグリッド市場は成長するでしょう。現在、APACのエネルギー企業は、スマートグリッド技術やインフラ整備への依存度を高めています。例えば、2022年2月、LITE-ONとNTUシンガポールは、よりエネルギー効率の高いスマートグリッドとスマートホーム技術の実現に向けて協業しました。LITE-ONシンガポールは、台湾の家電事業者であるLITEONの子会社であり、半導体の研究開発のほか、スマートビークルやパワーデバイスの開発にも力を入れています。

- したがって、上記のすべての要因が組み合わさって、スマートグリッドデータ分析市場を促進し、ひいては予測期間中にアジア太平洋地域のスマートグリッドデータ分析市場を押し上げる可能性があります。

スマートグリッドデータ分析業界の概要

スマートグリッドデータ分析市場は、細分化され、競争が激しい市場です。多様な産業要件に対応する革新的なソリューションを幅広く提供する新興企業の出現により、市場は競争企業間の敵対関係の激化を目の当たりにしてきました。また、大手企業は優れたパフォーマンスの代名詞とされているため、競争優位に立つことが期待されます。主要プレイヤーには、Siemens AG、Itron Inc.、IBM Corporationなどが含まれます。

2022年12月、シーメンスはナイルデルタのダミエッタ地区で17万5000台のスマートメーターと高度な配電管理システムを提供する計画を発表しました。4,000万ユーロ(4,200万米ドル)を超えるこの受注は、グリッド近代化・改善構想の一環として、ノース・デルタ配電会社(NDEDC)に与えられたものです。

2022年9月、イトロンは、産業用モノのインターネット(IIoT)ネットワークソリューションとサムスンのSmartThingsサービスを組み合わせ、分散型エネルギー資源管理(DERMS)の改善、二酸化炭素排出量の削減、顧客の関心を高めるシステムへのアクセスを電力会社に提供します。このパートナーシップでは、SmartThings Energyサービスを使用して、Itronの分散型インテリジェンス(DI)ネットワークを使用して、リアルタイムのエネルギー測定値や使用動向を提供する予定です。このネットワークは、数百万のエンドポイントにリンクされていると同社は主張しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 本調査の対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 マーケット洞察

- 市場概要

- 業界のバリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19が市場に与える影響の評価

第5章 市場力学

- 市場促進要因

- スマートグリッドプロジェクトへの投資拡大

- 膨大なデータの流入

- 市場の課題

- スマートグリッドシステムの高コストと熟練した専門家の不足

- 規制上の問題、データセキュリティリスク、技術的要件が市場を抑制する可能性

第6章 市場セグメンテーション

- デプロイメント別

- クラウドベース

- オンプレミス

- ソリューション別

- 送電・配電(T&D)ネットワーク

- メータリング

- カスタマーアナリティクス

- アプリケーション別

- 先進メータリングインフラの分析

- デマンドレスポンス分析

- グリッド最適化分析

- エンドユーザー業界別

- 民間企業(中小企業、大企業)

- 公共部門

- 地域別

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東&アフリカ

第7章 競合情勢

- 企業プロファイル

- Siemens AG

- Itron Inc.

- AutoGrid Systems Inc.

- General Electric Company

- IBM Corporation

- SAP SE

- Tantalus System Corporation

- SAS Institute Inc.

- Hitachi Ltd

- Uplight Inc.

- Landis & Gyr Group AG

- Uptake Technologies Inc.

- Schneider Electric SE

- Oracle Corporation

- Amdocs Corporation

- Sensus USA Inc.(Xylem Inc.)

第8章 投資分析

第9章 市場機会と将来動向

During the time frame of the forecast, the smart grid data analytics market is expected to register a CAGR of 12.76%. The smart grid data analytics market is expected to develop at a faster rate during the projected period due to increased investment in smart grid initiatives. With the introduction of modern technologies such as IoT, players have been focusing on integrating smart grid solutions in a more significant way. Due to the continuing trend in data creation, power utility businesses are merging big data with billions more rows of new IoT and smart sensor data. Smart meter data can assist in more efficiently segmenting customers by providing a better understanding of their behavior.

Key Highlights

- A big need for a smart grid data analytics market is likely to come from the growing need for electricity. According to the International Energy Agency (IEA), the world's electricity demand will rise by 5,900 terawatt-hours (TWh) in the Stated Policies Scenario (STEPS) and by over 7,000 TWh in the Announced Pledges Scenario (APS) by 2030. This is the same as adding the current demand in the United States and the European Union.

- Moreover, organizations plan to invest in the expansion, modernization, and decentralization of the electricity infrastructure for improved resiliency. The infrastructure of the power grid has been getting more digitalized and connected over time, making it possible for important digital communications to flow reliably and safely. Across the Indian subcontinent, there have also been the beginnings of a number of projects that will help people with their electricity problems.

- An enormous influx of data has been driving market growth. According to the IEEE, to enable being smart, a massive amount of data has been exchanged between grid components and the enterprise systems that manage these components. Based on the application, the information exchanged helps economically optimize the bidirectional power flow between a utility and its customers.

- Furthermore, smart grids collect much more data than the manual energy meter reading system. This permits the use of data analysis techniques and the preparation of highly realistic consumption forecasts, as many more variables are taken into account. Therefore, the opportunities for smart grid analytics have been expanding because there has been an exponential increase in the amount of data available in order to develop analytical models.

- However, the high costs of smart grid systems and the need for more skilled professionals have been restraining the market's growth. The most prominent limitation of smart metering is the availability of capital funding. Smart systems are comparatively more expensive than the standard metering equipment that most service providers and users employ. Furthermore, different smart meters have been designed with various parameters based on operational and consumer requirements, inhibiting the use of complicated equipment that needs skilled labor for handling and installation.

- The COVID-19 epidemic hurt the world economy because it hurt a lot of businesses, especially in the electricity sector, and stopped work in a lot of other sectors. After COVID-19 broke out, the price of electricity went down, which hurt a lot of companies in the energy and power industries. Additionally, according to the US Department of Homeland Security (DHS), the utility sector was one of the 16 essential infrastructure sectors that the COVID-19 epidemic severely impacted.

Smart Grid Data Analytics Market Trends

Growing Investments in Smart Grid Projects

- The global smart metering analytics market is expected to grow because more money is being spent on smart grids and more renewable energy sources are being added to existing grids. Also, R&D is being updated more in developed economies, which should help the market grow.

- For instance, according to the IEA, in 2021, investments in smart meters in transmission and distribution electricity grids were valued at around USD 21.4 billion, a 13.8% rise in investments compared to the previous year, 2020. Such a significant rise in investments may indicate the growing need for digital infrastructure, thereby providing substantial profits to the vendors operating in the market.

- The rate of installations in the residential, commercial, and industrial sectors has been going up because of how the government framework and policies are always changing.Several emerging nations, including China and the United States, have witnessed a high-scale deployment of smart meters, mainly due to the continuous support of their respective governments. The factors above are expected to drive the demand for analytic solutions to handle the vast data from these smart meters.

- Smart meters are being used more and more by private utility companies in the United States, like ConEd and Duke.This is evident by the fact that, with smart meters deployed by utilities in the United States, about 111 million advanced (smart) metering infrastructure (AMI) installations were made in 2021, accounting for over 69% of all electric meter installations.

Additionally, the government of India's national initiative for smart meters (SMNP) intends to replace 250 million outdated meters with new ones in June 2022. It would improve the effectiveness of energy consumption and monitoring and enhance discoms' yearly income. This may result in the generation of more data per year. In 2022, China announced plans to increase investment, with the State Grid Corporation of China budgeting for more than CNY 500 billion and concentrating on ultra-high-voltage projects, upgrading the distribution network, and increasing levels of digitalization of its grids. Owing to these factors, the market studied is expected to witness growth during the forecast period.

Asia-Pacific to Witness the Significant Growth Rates

- Two highly populated nations, namely India and China, significantly dominate the Asia-Pacific region.Rising populations in places like China, Japan, and India have increased the demand for residential infrastructure and electricity use. This has increased the demand for electricity in countries that support the use of smart grids, which may create a market for smart grid data analytics.

- The growth of smart cities is anticipated to increase the region's market competencies. South Korea announced plans to invest USD 350 million in around 300 companies to help develop an IoT ecosystem within the country. A pilot is being launched in a town southeast of Seoul, in partnership with Samsung Electronics and SK Telecom, to set up IoT-based infrastructure for renewable energy.

- Power consumption has increased in nations like China, India, and Japan, which has increased the demand for new policies to create, distribute, or consume electricity effectively. Smart grid technology is used a lot in China, India, Japan, Australia, South Korea, and other countries in the area.According to IEA reports, Southeast Asia's energy consumption has grown by around 3% annually over the last twenty years on average. This trend is expected to continue until 2030 with STEPS' current policy settings.

- Because more innovative energy storage technologies are being used, the market for smart grids in APAC will grow.Energy companies in APAC nowadays are increasingly dependent on smart grid technologies and infrastructure development. For instance, in February 2022, LITE-ON and NTU Singapore collaborated to create a more energy-efficient smart grid and smart home technologies. LITE-ON Singapore is a subsidiary of the Taiwanese consumer electronics business LITEON, which focuses on semiconductor R&D as well as smart vehicle and power device development.

- Therefore, all the above factors combined may fuel the smart grid data analytics market, which, in turn, may boost the smart grid data analytics market in the Asia-Pacific region during the forecast period.

Smart Grid Data Analytics Industry Overview

The smart grid data analytics market is fragmented and highly competitive in nature. Owing to the emergence of new startups offering a broad range of innovative solutions catering to diverse industry requirements, the market has been witnessing intensifying competitive rivalry. Also, as the major players have been considered synonymous with good performance, they are expected to have a competitive edge. Key players include Siemens AG, Itron Inc., and IBM Corporation, among others.

In December 2022, Siemens announced plans to provide 175,000 smart meters and an advanced distribution management system in the Damietta area of the Nile Delta. The order, valued at over EUR 40 million (USD 42 million), was given to the North Delta Electricity Distribution Company (NDEDC) as part of the grid modernization and improvement initiative.

In September 2022, Itron combined its Industrial Internet of Things (IIoT) network solution with Samsung's SmartThings services to give utilities access to a system that improves distributed energy resource management (DERMS), cuts carbon emissions, and engages customers. The partnership will use the SmartThings Energy service to give real-time energy readings and usage trends using Itron's distributed intelligence (DI) network, which the business claims has millions of linked endpoints.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in Smart Grid Projects

- 5.1.2 Enormous Influx of Data

- 5.2 Market Challenges

- 5.2.1 High Costs of Smart Grid Systems and Lack of Skilled Professionals

- 5.2.2 Regulatory Issues, Data Security Risks, and Technical Requirements may Restrain the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud-based

- 6.1.2 On-premise

- 6.2 By Solution

- 6.2.1 Transmission and Distribution (T&D) Network

- 6.2.2 Metering

- 6.2.3 Customer Analytics

- 6.3 By Application

- 6.3.1 Advanced Metering Infrastructure Analysis

- 6.3.2 Demand Response Analysis

- 6.3.3 Grid Optimization Analysis

- 6.4 By End-user Vertical

- 6.4.1 Private Sector (SMEs and Large Enterprises)

- 6.4.2 Public Sector

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Itron Inc.

- 7.1.3 AutoGrid Systems Inc.

- 7.1.4 General Electric Company

- 7.1.5 IBM Corporation

- 7.1.6 SAP SE

- 7.1.7 Tantalus System Corporation

- 7.1.8 SAS Institute Inc.

- 7.1.9 Hitachi Ltd

- 7.1.10 Uplight Inc.

- 7.1.11 Landis & Gyr Group AG

- 7.1.12 Uptake Technologies Inc.

- 7.1.13 Schneider Electric SE

- 7.1.14 Oracle Corporation

- 7.1.15 Amdocs Corporation

- 7.1.16 Sensus USA Inc. (Xylem Inc.)