|

市場調査レポート

商品コード

1850321

ソリッドステートドライブ(SSD):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Solid State Drive (SSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ソリッドステートドライブ(SSD):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月20日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

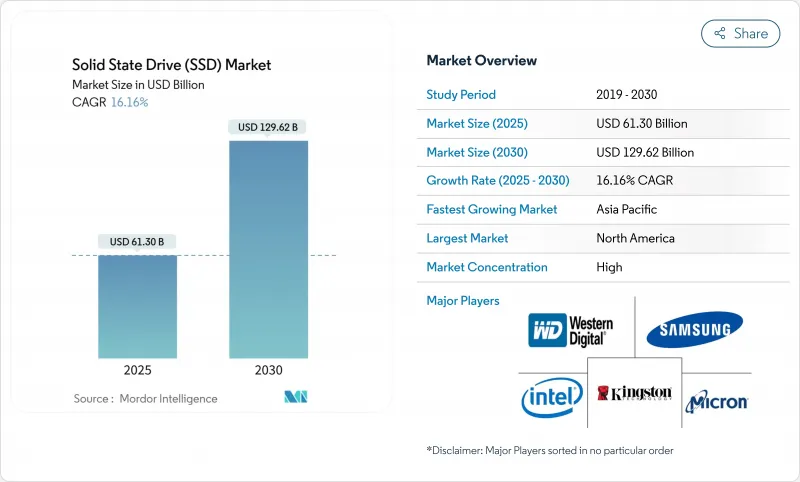

SSD市場は、2025年に613億米ドル、2030年には1,296億2,000万米ドルに達し、CAGR 16.16%で成長する見通しです。

企業のAIトレーニングクラスターに対する需要の急増、ハイパースケーラの設備投資の記録的増加、機械式メディアから高性能ソリッドステートアレイへの継続的な移行が、この勢いを支えています。データセンターアーキテクトが密度、効率、低レイテンシーを優先する中、高レイヤーNAND、高度なPCIeインターフェイス、洗練された熱設計を組み合わせるベンダーは利益を得る立場にあります。NANDメーカーは現在、マージンを維持するためにウエハーのスタートとレイヤーの移行を調整しているため、価格は流動的なままですが、健全な需要シグナルにより、選択的な値上げを通過することができます。競合の激しさも増しています。中国サプライヤーが国内シェアを拡大し、既存サプライヤーは大容量QLCの提供とサービス指向のファームウェア更新を加速させています。

世界のソリッドステートドライブ(SSD)市場の動向と洞察

データセンターにおけるNVMeとPCIe Gen4-5の急速な普及

PCIe Gen4およびGen5レーンは、AIアクセラレータとリアルタイム分析が現在必要とする帯域幅を供給するため、エンタープライズアーキテクトはNVMeに決定的に移行します。ハイパースケーラは、1Uあたり最大64台のドライブを搭載するEDSFF E1.Sエンクロージャを採用し、ホットスワップ保守性を維持しながら、密度を従来のU.2アレイの10倍に高めています。メタ、マイクロソフト、その他のクラウド事業者は、フリートサービスと冷却を簡素化するため、新しいフォームファクターを標準としています。CorsairのMP700のような消費者向けGen5ドライブのテストでは、冷却が不十分な場合、3分以内にシャットダウンすることが示されており、サーバーシャーシのエアフローの重要性が浮き彫りになっています。PCIe 6.0用のファームウェアベースのスロットリングはすでに試作されており、インターフェイス速度の向上は、熱バジェットがプロアクティブに管理されている場合にのみ、アプリケーションのパフォーマンスに反映されることが確認されています。

クラウド・ハイパースケーラの構築がSSD需要を押し上げる

AIサービスはGPUを飽和状態に保つためにオールフラッシュ層を必要とするため、これらのクラウド・ハイパースケール・プロジェクトはペタバイト規模のSSD入札に直結します。東南アジアのある銀行は、厳格なRAID耐性を満たしつつ、オールNVMeファブリックに移行することで、データベースのレイテンシを60%削減しました。このようなケーススタディは、特に、統合によってラック数が削減され、電力スケジューリングが容易になる場合、フラッシュのみのアーキテクチャを好む傾向を強めています。

NANDのサプライチェーンと価格変動

生産者は、長引く価格下落を食い止めるために2024年を通してウエハーの出荷を抑制し、2024年第3四半期には契約価格を意図的に15~20%引き上げ、収益性を再調整しました。このサイクルは、予測可能なコストカーブに依存しているバイヤーに予算編成の不確実性をもたらします。業界再編は変動をさらに悪化させる:SKハイニックスは19億米ドルでインテルのNAND資産の買収を完了し、より少数の意思決定者の下に生産量を集中させました。中国のYMTCは同時に232層QLCを加速させ、輸出規制下でもビット密度を19.8Gb/mm2に押し上げました。そのため、供給とハイパースケール需要との間の突然の整合または不整合は、四半期ごとの価格帯を拡大し、長期的なTCO計画を複雑にする可能性があります。

セグメント分析

M.2は、そのスリムなプロファイルがクライアント・デバイスやエントリー・レベルのサーバーに適しているため、2024年のSSD市場シェアの42.70%を占めました。しかし、EDSFF E1.Sは、2030年まで16.9%のCAGRで推移する見込みです。これは、クラウド・プロバイダーが、熱を管理しながら高密度のラックに適合するツールレス・ホットスワップ・スレッドを好むためです。U.2は、主にHAトポロジーを重視する金融取引ハブなど、デュアルポートPCIeが必須とされる場所に残っています。E3.Sは、PCIe 5.0の性能とEDSFFの保守性を求めるハイパースケーラー向けに試験的に導入されました。消費者向けボードは、キャディがないためBOMコストを抑えることができるM.2への依存を続けていますが、ノートパソコンのOEMは、QLCのコストカーブが縮小するにつれて、すでにCAMMとはんだ付けBGAフラッシュをテストしています。予測期間中、企業は調達方針を段階的に拡大し、E1.Sを含めるようになり、最終的にはGen6の展開にE3.Sを含めるようになるでしょう。

2024年のSSD市場規模の45.1%は企業向けワークロードが占めているが、AIにチューニングされた導入はより広範な企業向けストレージを凌駕し、毎年17.5%のペースで拡大する予定です。金融分析、リスク・モデリング、生成的AI推論は、ストレージ・アーキテクトにフラッシュとアクセラレータの同居を促しているため、ラック・プランでは、クロスバー・レイテンシを低減するために、より少ない、より大きなドライブが必要になっています。AIに最適化されたストレージのSSD市場シェアは、GPUが各業界で普及するにつれて、2030年までに30%を超えると予想されています。

クライアント・デバイスの出荷台数は依然として最大だが、コモディティ化がマージンを抑制。スマートフォンは4,200 MB/秒のリードを実現するUFS 4.0 NANDを採用し、薄型軽量ノートパソコンはクリエイターが8Kプロジェクトキャッシュを要求する中、4TBモジュールに移行します。これらのアプリケーションは-40 °Cから85 °Cの環境で動作し、15万回のP/Eサイクルが期待されるため、ATP ElectronicsのようなベンダーはpSLCモードとECCアルゴリズムを活用して長時間のデューティ要件を満たしています。

ソリッド・ステート・ドライブは、フォームファクタ(2.5インチ、M.2、その他)、アプリケーション(企業/データセンター、クライアント/コンシューマ・デバイス、その他)、ストレージ容量(1TB未満、1~2TB、その他)、エンドユーザー産業(クラウド・サービス・プロバイダー、ゲームおよびEsports、その他)、地域別に分類されます。市場予測は金額(米ドル)で提供されます。

地域別分析

北米は2024年の売上高の26.7%を占め、高密度のハイパースケーラ・キャンパスと金融およびヘルスケア領域における早期のAI導入によってその地位を確立しました。北米のSSD市場規模は、2030年までに314億米ドルに成長すると予測されているが、インストールベースがすでに大規模であるため、CAGRは10%台半ばでアジア太平洋に遅れをとっています。投資税制上の優遇措置と豊富なコロケーション・エコシステムが、新しいモジュールの展開を維持し、チャネル在庫のバランスを保っています。この地域の企業はデータ主権を重視しており、その結果、事業者は複数の大都市キャンパスにゾーン・ストレージ・クラスタを配備し、データ居住コンプライアンスを強化しています。

アジア太平洋地域のCAGRは18.2%と最も速いが、これは中国、韓国、日本のファブによるもので、輸出規制が強化されても現地での供給を確保しています。現在、SSDの最大手ブランド10社のうち4社が中国企業であり、2024年の独身の日(Singles'Day)のプロモーションでは、両社を合わせて世界シェア23%を獲得しました。Alibaba CloudやTencent Cloudのような国内ハイパースケーラは、これらのドライブをホワイトボックスサーバーに統合し、数量増加を加速させています。半導体投資に対する税制優遇措置を提供する政府プログラムはビット出力をさらに刺激し、インドとインドネシアの地域コロケーション・プレーヤーは国内のコンピュートと低遅延ストレージを組み合わせた新しいゾーンを開設します。

欧州は炭素予算と循環型経済目標に注力しているため、事業者は耐久性分析、電力損失保護、検証済みのリサイクル経路を備えたSSDラインを選好しています。エネルギー上限と立地許可がハイパースケールのグリーンフィールド構築を遅らせているため、市場の成長は健全だが緩やかなままです。その代わりに、既存のシェルでHDDをフラッシュに置き換えるブラウンフィールドの改修が出荷の大半を占めています。中東では、サウジアラビアとUAEのデータセンター・プロジェクトが増加傾向にある一方、アフリカでは、電話会社アプリケーション向けのエッジ・キャッシングが最初のユースケースとして採用され、普及の初期段階にとどまっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- データセンターにおけるNVMeとPCIe Gen4-5の急速な普及

- クラウド・ハイパースケーラーの構築がSSD需要を押し上げる

- スマートフォンとタブレットへのOEM統合

- NANDのUSD/GBの下落でアドレス可能ベースが拡大

- AI/MLトレーニングサーバーにおける高耐久性QLCとTLCの必要性

- エッジコンピューティングのホットスワップ可能なE1.S/EDSFFへの移行

- 市場抑制要因

- コールドストレージ層ではSSDがHDDよりも価格が高め

- NANDサプライチェーンと価格変動

- アーカイブ用途ではHDDに比べて書き込み耐久性が限られる

- PCIe Gen5におけるサーマルスロットリングと電力消費の課題

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 市場におけるマクロ経済要因の評価

第5章 市場規模と成長予測

- フォームファクター別

- 2.5インチ

- M.2

- U.2

- その他

- 用途別

- エンタープライズ/ データセンター

- クライアント/コンシューマーデバイス

- 産業および自動車

- その他(エッジ、監視、IoT)

- ストレージ容量別

- 1TB未満

- 1~2TB

- その他

- エンドユーザー業界別

- クラウドサービスプロバイダー

- ゲームとeスポーツ

- 金融サービス

- 政府と防衛

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- 台湾

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Samsung Electronics Co. Ltd.

- Western Digital Corporation

- SK hynix Inc.(incl. Solidigm)

- Micron Technology Inc.

- Kioxia Holdings Corporation

- Seagate Technology LLC

- Kingston Technology Corporation

- ADATA Technology Co. Ltd.

- Transcend Information Inc.

- Crucial(Micron Consumer)

- Silicon Motion Technology Corp.

- Marvell Technology Group

- Phison Electronics Corp.

- Corsair Memory Inc.

- Patriot Memory LLC

- Team Group Inc.

- PNY Technologies Inc.

- G.SKILL International Enterprise

- Intel Corporation

- Sabrent