|

市場調査レポート

商品コード

1687399

ヘルスケアRFID:市場シェア分析、産業動向、成長予測(2025年~2030年)Healthcare RFID - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ヘルスケアRFID:市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 156 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

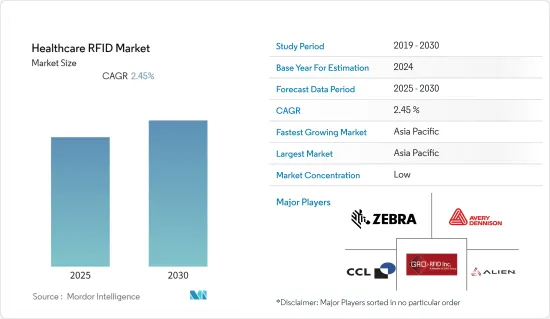

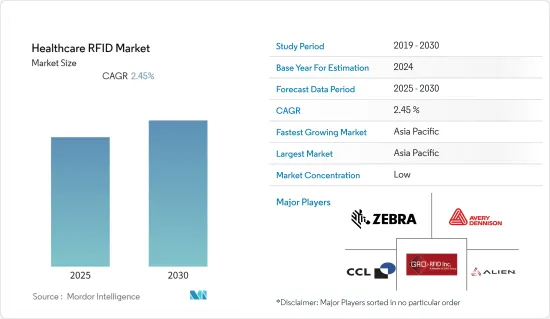

ヘルスケアRFID市場は予測期間中に2.45%のCAGRで推移する見込みです。

RFID技術は、世界中の病院、診療所、ヘルスケアシステム、流通業者、メーカーに大きな影響を与えているが、今後数年でさらに大きな成果を上げる予定です。医療分野でのRFIDの採用は、サプライチェーンを管理するために医薬品のラベルにRFIDタグを貼付する製薬会社が増えるきっかけとなっています。このように、RFIDの採用はヘルスケア分野でより重要な役割を持ち続けると思われます。

主なハイライト

- 多国籍製薬会社は数十年にわたって医薬品を製造し、世界中に販売してきました。しかし、ラベリングは厳格で困難な課題であり、その複雑さは増す一方です。RFID市場の成長を大きく刺激すると予測される、国や地域によって大きく異なる新たなラベリング規制により、製薬企業は世界なニーズに対応できるシステムを構築するか、専門家に任せる必要があります。

- 医薬品にRFIDを組み込むことで、サプライチェーン全体を通してより正確な医薬品の管理と認証が可能になり、エラーをほぼゼロにすることを目指すため、患者の安全性を高めることができます。加えて、コストがかかり、さらに重要なことは、労働集約的な院内投薬ラベリングが不要になるため、病院スタッフの大きな負担が軽減されます。

- RFIDは病院や薬局の在庫管理にも応用でき、品質を確保し、無駄を省くことができます。RFIDは人命を救う可能性を秘めているため、そのメリットは投資対効果にとどまらないです。そのため、薬局、病院、患者に重要な情報を提供するために、業界各社は改ざん防止RFIDタグや発光ラベルを含むプレミアム製品ポートフォリオを揃えています。これらのスマートRFIDソリューションは、コスト削減、精度向上、業務スピードアップに役立つと同時に、医薬品ブランドを偽造から保護します。

- 市場を減速させている要因としては、ヘルスケアにおけるRFIDシステムの導入コストの高さやシステムの相互運用性などが挙げられます。RFIDを採用する業界は、リーダー、タグ、ソフトウエア、電気、交換サービスの運用に多額の投資をしなければならないです。モノのインターネット(Internet of Things)コンポーネントの統合、システムの信頼性テスト、トレーニング費用などの追加機能は、RFIDソリューションのコストを増加させる。

- 病院では、COVID-19の流行によるパンデミック時に、RFID技術を使用して患者とスタッフをより適切に管理しています。ヘルスケア業界では、電波を利用して資産や機器を識別・追跡するRFID機器の導入が大きく進んでいます。RFIDは、公衆衛生上の緊急事態に直面し続けるヘルスケアチームの効率と説明責任を高めると思われます。

ヘルスケアにおけるRFIDの市場動向

成長する医薬品

- RFタグ識別機能を備えたスマートラベルのメーカー対応が進み、医薬品と他の薬局技術ソリューションとの相互運用性が高まるにつれて、施設内の医薬品追跡にRFIDタグを採用する病院やヘルスケアシステムが増え始めています。

- しかし、RFIDは製薬業界においても、さまざまな処方箋薬の偽造を防止するために採用されており、サプライチェーンや業務上のメリットも加わっています。継続的な技術進歩の結果、製造業者はデータ分析技術とRFID技術を使用して消費と在庫データを正確に分析することができます。カリフォルニア州薬局委員会(California Board of Pharmacy)が義務付けているように、サプライチェーンにおけるe-Pedigreeの導入などの規制上の要求も、医薬品セクターにおけるRFIDの大きな需要を生み出すと思われます。

- ヘルスケアRFID市場は、医薬品分野におけるますます厳しくなる規制環境によって大きく牽引されています。医薬品の分野では、偽造品やその他の健康問題によって引き起こされる問題を減らすために、各国の政府やその他の規制機関によって厳しい措置が導入されています。

- 処方箋が薬箱に入れられると、製薬会社はサプライチェーン全体を通して医薬品を管理する改善方法を探します。RFIDは現在、そのデータ取得・送信能力により、この問題に対する答えとみなされています。製薬業界は、品質の向上、コストの削減、そして何よりも患者の安全性を高めることによって、これを達成しようとしています。

アジア太平洋が急成長

- RFIDは、患者や医療機器の常時・直接追跡など、ヘルスケア分野における幅広い用途に応用されています。RFIDはヘルスケアの専門家によるヘルスケアの質の向上と促進を支援し、医療ミスを減少させ、患者の識別、医薬品のチェック、患者の紹介など、データの収集、整合性、入力、確認における大量の作業を行うことでヘルスケアプロセスを最適化し、自動化します。

- この地域の市場成長にプラスの影響を与える主な要因は、医療費の上昇とヘルスケアインフラの改善です。病院関連の医療従事者の増加、規制枠組みの改善、患者の安全性の優先、医療機器の追跡など、地域の発展に寄与する開発要因は、疾病負担の増加による効率的な医療サービスの需要を促進すると予想されます。

- また、オーストラリアでは資産追跡のためのRFIDソリューションの利用が広まっています。病院や高齢者介護施設では、包帯、注射針、個人保護具などの使い捨て物品を大量に扱わなければならないです。消耗品や使い捨て品が入っている箱には、パッシブRFIDタグを取り付けることができます。

- しかし、RFID技術は医療機器、機械、支援機器など、ヘルスケア産業で広く使用されています。ヘルスケアRFID市場の成長は、効率的な患者ケアを提供するために、さまざまな医療環境でこれらの機器を監視するためにRFIDの使用が増加していることによって促進されています。

ヘルスケアにおけるRFID産業の概要

ヘルスケアのRFID市場は、主に複数の地域および国際的な企業で構成され、かなり競争の激しい市場となっています。さらに、企業は技術の進歩により持続的な競争力を獲得しています。モノのインターネットやクラウドコンピューティングのような技術が市場開拓に変化をもたらしています。全体として、ベンダー間の競合の激しさは対象期間を通じて高く、今後も続くと予想されます。市場の主要企業としては、Alien Technology Corporation、Zebra Technologies Corporation、CCL Industries Inc.、Avery Dennison Corporation、Biolog-id GAO RFID, Inc.などが挙げられます。

2023年6月、アスコムはドイツのNiels-Stensen-Kliniken Groupと、アスコムの革新的な警報システムソリューションとIP-DECTインフラ、医療インフラのデジタル化を導入し、全体的なコストを最適化しながら、より効率的で優れた患者ケアを確保することを可能にする契約合意を結んだと発表しました。

2023年3月、ゼブラ・テクノロジーズ・コーポレーションは、アルプロ薬局がゼブラのモバイルコンピューティングとRFIDソリューションを導入し、手作業による在庫管理システムをデジタル化して急成長するビジネスを推進したと発表しました。デジタル化の第一段階は、アルプロ薬局の第一線で働く従業員にゼブラのTC21タッチコンピュータを装備させ、ペンと紙を使った手作業の在庫管理システムに置き換えることでした。モバイルデバイスは、Alpro Pharmacyの配送センターでの商品の受け取りから、小売店やeコマースの注文のための商品のピッキングなど、あらゆる在庫管理業務を支援するために導入されました。このソリューションにより、Alpro Pharmacyの効率は約80%向上し、人為的ミスを減らすことで精度が向上しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 市場力学

- 市場促進要因

- 医薬品ラベリングに関する医薬品セクターの厳格化

- ヘルスケア分野におけるRFID対応機器の用途と利用の増加

- 市場抑制要因

- 代替ラベリング方法の開発

第6章 市場セグメンテーション

- 製品別

- タグとラベル

- RFIDシステム

- 資産追跡システム

- 患者追跡システム

- 医薬品追跡システム

- 血液モニタリング・システム

- エンドユーザー別

- 病院

- 製薬会社

- その他のエンドユーザー(研究機関、研究所)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 南米

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Zebra Technologies Corporation

- Avery Dennison Corporation

- CCL Industries Inc.

- Alien Technology Corporation

- GAO RFID, Inc

- Honeywell International Inc.

- S3Edge Inc.

- STANLEY Healthcare

- Biolog-id

- Impinj Inc.

- Mobile Aspects Inc.

- RF Technologies

- STid Groupe

- Terso Solutions Inc.

- Spacecode Technologies

第8章 投資分析

第9章 市場の将来

The Healthcare RFID Market is expected to register a CAGR of 2.45% during the forecast period.

RFID technology has significantly impacted hospitals, clinics, healthcare systems, distributors, and manufacturers worldwide but is due to achieve even more in years to come. The adoption of RFID in the medical field has become a catalyst for more and more pharmaceutical companies to put RFID tags on medicine labels to control their supply chain. The adoption of RFID will thus continue to have a more vital role in the healthcare sector.

Key Highlights

- Multinational pharmaceutical companies have been manufacturing medicines for decades to distribute worldwide. Labelling, however, is a rigorous and challenging task that continues to grow more complex. With new labeling regulations that can vary widely across the country and region, which are predicted To stimulate growth in the RFID market by a large margin, pharmaceutical companies must either build their systems to meet global needs or delegate them to experts to be able to do so.

- Integrating RFID in pharmaceutical products will help increase patient safety because it allows for more precise control and authentication of medicinal products throughout the supply chain, aiming to reduce errors to almost zero. In addition, it eliminates the need for costly and, more importantly, labor-intensive in-house medication labeling, thereby relieving a significant burden on hospital staff.

- RFID may be applied for inventory management at hospitals and pharmacies to ensure quality and reduce waste. The benefits go beyond the return on investment since it has the potential to save lives. That is why, to provide pharmacies, hospitals, and patients with critical information, industry players are putting together a premium product portfolio that includes tamper-evident RFID tags and luminous labels; these smart RFID solutions will help to reduce costs, raise accuracy, and speed up operations while protecting pharmaceutical brands from counterfeiting.

- A few factors slowing down the market studied include high installation costs for RFID systems in healthcare and system interoperability. Any industry adopting RFID must invest significantly in readers, tags, software, electricity, and operating replacement services. Additional features such as integration of Internet of Things components, system reliability testing, and training costs add to the cost of an RFID solution.

- Hospitals use RFID technology to manage patients and staff better during pandemics due to the COVID-19 outbreak. The healthcare industry has seen a great uptake of RFID devices, which use radio waves to identify and track assets and equipment. RFID will increase the efficiency and accountability of healthcare teams as we continue to face a Public Health Emergency.

RFID in Healthcare Market Trends

Pharmaceuticals to Witness the Growth

- More hospitals and healthcare systems are beginning to adopt RFID tags for tracking medication inside their facilities as manufacturer-enabled smart labels with RF tag identification increases, in addition to more interoperability between medications and other pharmacy technology solutions.

- However, RFID has also been adopted by the pharmaceutical industry to prevent the counterfeiting of different prescription medicines with added supply chains and operational benefits. As a result of continued technological advancement, manufacturers can accurately analyze consumption and inventory data using data analysis techniques and RFID technology. As mandated by the California Board of Pharmacy, regulatory demands such as implementing e-Pedigree in the supply chain will also generate substantial demand for RFID in the pharmaceutical sector.

- The healthcare RFID market has been significantly driven by an increasingly strict regulatory environment in the pharmaceuticals sector. In the field of pharmaceuticals, stringent measures have been introduced by governments and other regulatory bodies throughout different countries to reduce problems caused by counterfeits and other health issues.

- Once a prescription has been put in the medicine cabinet, pharmaceutical companies look for improved ways of controlling their medicines throughout the supply chain. RFID is currently regarded as the answer to this question due to its capacity for capturing and transmitting data. The pharmaceutical industry tries to achieve that by improving quality, reducing costs, or, most of all, enhancing patient safety.

Asia Pacific to Register Fastest Growth

- RFID is applied to a wide range of applications in the healthcare sector, such as constant and direct patient or medical device tracking. It helps and supports healthcare professionals to improve and promote healthcare quality, decreases medical errors, and optimizes and automates the healthcare process by carrying out large amounts of work in data collection, integrity, entry, and confirmation such as patient identification, pharmaceuticals checks, and patient referrals, among others.

- The main factors positively influencing growth in the region's market are rising medical costs and improved healthcare infrastructure. Growth factors contributing to regional development, including the increasing number of healthcare professionals associated with hospitals, improved regulatory framework, prioritizing patient safety, and tracking medical devices, are expected to drive demand for efficient health services due to the rising disease burden.

- In addition, the use of RFID solutions to track assets is widespread in Australia. Large quantities of disposable goods like bandages, needles, and personal protection equipment must be handled by hospitals and elderly care facilities. Box containing consumables and disposable items may be fitted with passive RFID tags.

- However, RFID technology has been extensively used in the healthcare industry, for instance, in medicine devices, machinery, and support equipment. The growth of the healthcare RFID market is fueled by the increasing use of RFID to monitor these devices in different health environments to provide efficient patient care.

RFID in Healthcare Industry Overview

The RFID market in healthcare primarily comprises multiple regional and international players in a fairly contested market space. Furthermore, firms gain a sustained competitive edge due to technological progress. Technologies like the Internet of Things and cloud computing are altering market developments. Overall, it is anticipated that the intensity of competitive competition between vendors will be high throughout the period under review and continue to do so. Some key players in the market are Alien Technology Corporation, Zebra Technologies Corporation, CCL Industries Inc., Avery Dennison Corporation, and Biolog-id GAO RFID, Inc., among others.

In June 2023, Ascom announced a contract agreement with Niels-Stensen-Kliniken Group in Germany with the installation of the Ascom innovative alarming system solution and IP-DECT infrastructure and Digitization of the healthcare infrastructure, making it possible to ensure more efficient and better patient care while optimizing overall costs.

In March 2023, Zebra Technologies Corporation announced that Alpro Pharmacy had introduced Zebra's mobile computing and RFID solutions to digitalize its manual inventory management system to advance its fast-growing business. The first stage of digitalization was to equip Alpro Pharmacy's front-line workers with Zebra's TC21 touch computers to replace their manual inventory management system using pen and paper. The mobile devices were introduced to assist with all inventory management tasks, from receiving goods at Alpro Pharmacy's distribution center to picking goods for its retail stores and e-commerce orders, to name a few. The solution has since enhanced Alpro Pharmacy's efficiency by approximately 80% and improved its accuracy by reducing human errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Stringency in the Pharmaceutical Sector with Regards to Medicine Labeling

- 5.1.2 Increased Applications and Use of Devices Supporting RFID Across the Healthcare Sector

- 5.2 Market Restraints

- 5.2.1 Development of Alternate Labeling Methods

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Tags and Labels

- 6.1.2 RFID Systems

- 6.1.2.1 Asset Tracking Systems

- 6.1.2.2 Patient Tracking Systems

- 6.1.2.3 Pharmaceutical Tracking Systems

- 6.1.2.4 Blood Monitoring Systems

- 6.2 By End User

- 6.2.1 Hospitals

- 6.2.2 Pharmaceuticals

- 6.2.3 Other End Users (Research Institutes and Laboratories)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 South Korea

- 6.3.3.6 Rest of Asia Pacific

- 6.3.4 South America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zebra Technologies Corporation

- 7.1.2 Avery Dennison Corporation

- 7.1.3 CCL Industries Inc.

- 7.1.4 Alien Technology Corporation

- 7.1.5 GAO RFID, Inc

- 7.1.6 Honeywell International Inc.

- 7.1.7 S3Edge Inc.

- 7.1.8 STANLEY Healthcare

- 7.1.9 Biolog-id

- 7.1.10 Impinj Inc.

- 7.1.11 Mobile Aspects Inc.

- 7.1.12 RF Technologies

- 7.1.13 STid Groupe

- 7.1.14 Terso Solutions Inc.

- 7.1.15 Spacecode Technologies