|

|

市場調査レポート

商品コード

1443934

医療美容機器:市場シェア分析、業界動向と統計、成長予測(2024-2029)Medical Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医療美容機器:市場シェア分析、業界動向と統計、成長予測(2024-2029) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

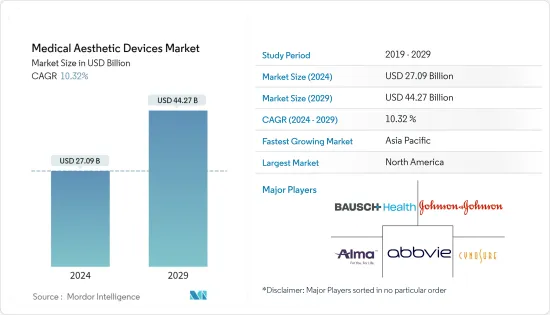

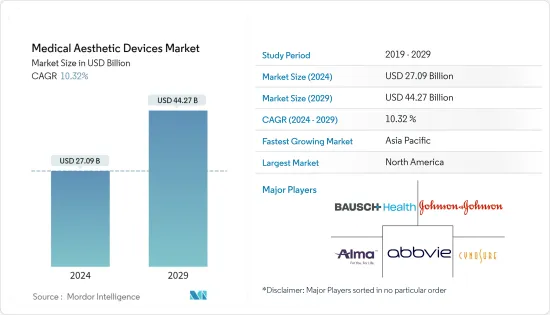

医療美容機器の市場規模は、2024年に270億9,000万米ドルと推定され、2029年までに442億7,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に10.32%のCAGRで成長します。

COVID-19のパンデミックは、ロックダウンが課され、多くの美容処置がキャンセルされたため、2020年初頭に美容医療機器市場の成長に大きな影響を与えました。 2021年6月にJournal of Clinics in Dermatologyに掲載された記事によると、COVID-19のパンデミック下では皮膚バリアの破壊のため、ディープピーリングやレーザー治療などのさまざまな処置が避けられていたといいます。また、ステンレス鋼、金、またはプラスチック製のハンドピースとプローブを備えた高密度焦点式超音波、フラクショナル高周波、クリオリポリシスなどの処置は、汚染のリスクのため延期されました。

しかし、COVID-19のパンデミック後、消費者が自宅で使用できる美容機器が増加しました。 2022年2月にInternational Journal of Trichologyに掲載された記事によると、近年、家庭用の美容機器が増加しています。COVID-19のパンデミック中、緊急以外の理由で診療所を訪れることをためらう患者が増えたため、その重要性はさらに高まりました。

肥満人口の増加、美容処置に関する意識、低侵襲機器の採用の増加、美容機器の技術進歩などの主要な要因が市場の成長を推進しています。

世界中で美容処置の量が増加していることも、市場の成長に貢献しています。たとえば、2021年12月に発表されたISAPS調査によると、2020年には世界中で10,129,528件の外科手術と14,400,347件の非外科的美容手術が行われました。さらに、2021年2月に発表されたBAAPS調査によると、米国では15,405件の美容外科手術が行われました。 2021年のキングダム。美容医療機器を必要とする美容処置が増えています。これにより、美容医療機器のニーズが生まれ、市場の成長を促進しています。

また、低侵襲性および非侵襲性の美容処置の採用の増加により、市場の調査が促進されています。 2021年11月にJournal Archives of Plastic Surgeryに掲載された記事によると、美容処置の需要は世界中、特に東アジア諸国で高まっていました。インターネットの出現により、誰もが情報にアクセスできるようになり、人々は審美的な手順をより意識し始めました。これらすべての要因が合わさって、医療美容処置に対する一般の意識が高まり、その結果、医療美容機器の売上も増加しました。これにより、美容医療機器の市場規模が大幅に成長しています。

さらに、さまざまな規制当局による製品の承認も市場の成長を促進しています。たとえば、2022年 1月に、Lumenisは英国で脱毛、血管治療、色素性病変、しわの治療を目的としてCE認可を受けたSplendor Xデバイスを発売しました。

したがって、上記の要因により、調査対象の市場は予測期間中に成長すると予想されます。ただし、社会的な偏見や不十分な償還シナリオが市場の成長を妨げる可能性があります。

メディカルエステ市場の動向

ボツリヌス毒素は予測期間中に大幅に増加すると予想される

ボツリヌス毒素は、ボツリヌス菌によって産生される神経毒性タンパク質です。ボツリヌス毒素注射は、注射された筋肉への神経信号をブロックする傾向があります。筋肉は信号がなければ収縮できないため、顔の不要なシワや外観が減少または減少します。その結果、高度に希釈された濃度のボツリヌス毒素が、眉間の眉間のしわ、ジストニア、慢性片頭痛などの治療など、美容目的および非化粧目的に使用されています。

若者の間でのボツリヌス毒素処置の人気、低侵襲美容法への需要の増加、美容意識の高い人口の増加、製品の発売などの要因が、市場セグメントの成長を推進しています。

米国形成外科医協会の調査は、米国で2022年 6月に発表されました。 A型ボツリヌス毒素は、2021年から2022年にかけて患者の間で最も低侵襲な美容処置の1つであると報告しました。また、31~45歳の患者がA型ボツリヌス毒素による美容処置を最も一般的に求めていることも報告しました。さらに、2021年12月に発表されたISAPSの調査では、2020年に世界中で行われた非外科的美容処置のうち、43.2%がボツリヌス毒素処置であったことが明らかになった。また、合計6,213,859件のボツリヌス毒素処置が実施されたと報告しました。ボツリヌス毒素処置のこのような高い採用は、それに対するより多くの需要を生み出し、その結果、市場セグメントの成長を促進します。

市場の主要企業もボツリヌス毒素製品の輸出入への投資を増やしており、技術の進歩にも熱心に投資しています。たとえば、2022年 9月にRevance Therapeutics Inc.は、成人の中等度から重度の眉間のしわ(眉間のしわ)を一時的に改善するための注射用 DAXXIFY(ダキシボツリヌムトキシンA-lanm)をUSFDAから承認されました。

したがって、上記の要因により、ボツリヌス毒素セグメントは予測期間中に大幅な成長を予測すると予想されます。

北米が大きなシェアを占めており、予測期間中にも同様のシェアを獲得すると予想される

北米の美容医療機器市場は、さまざまな美容処置の量の増加、審美的かつ低侵襲処置に対する意識の高まり、この地域の技術進歩により、大幅な成長が見込まれています。

この地域では大量の美容処置が行われているため、美容機器の必要性が生まれ、市場の成長を促進しています。 2022年3月に発表されたAAFPRSの調査によると、2021年に米国で推定140万件の外科的および非外科的処置が行われ、これは2020年に行われた手術と比べて40%増加しました。 2021年12月、メキシコでは2021年に86万718件の美容処置が行われ、そのうち45万6489件が美容外科手術、40万4229件が非外科的美容処置でした。したがって、人口の間での美容処置の数の増加は、予測期間中に市場の成長を促進すると予想されます。

また、この地域の主要企業の集中とその後の製品発売は、この地域の市場の成長に重要な役割を果たしています。たとえば、Alma Lasersは2021年 4月に、体の輪郭形成と肌の引き締めのための究極の非侵襲的プラットフォームであるAlma PrimeXを発売しました。

さらに、市場参加者が自らの地位を強化するために戦略的イニシアチブを講じることも、この地域の市場の成長を促進します。たとえば、2021年 11月に、NanoPass TechnologiesとAesthetic Management Partners(AMP)は、NanoPassのMicronJet 600皮内送達デバイスを米国で商品化する契約に署名しました。したがって、前述の要因は、北米の予測期間中に市場を押し上げると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 肥満人口の増加

- 審美的処置に関する意識の高まりと低侵襲機器の採用の増加

- エステティック機器の技術進歩

- 市場抑制要因

- 社会的偏見の懸念

- 不十分な償還シナリオ

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- デバイスの種類別

- エネルギーを利用した美容機器

- レーザーを用いたエステティック機器

- 高周波(RF)を利用したエステティック機器

- 光エステ機器

- 超音波エステ器

- エネルギーを使わない美容機器

- ボツリヌス毒素

- 真皮フィラーと審美用糸

- マイクロダーマブレーション

- インプラント

- フェイシャルインプラント

- 豊胸手術

- その他のインプラント

- その他の美容機器

- エネルギーを利用した美容機器

- 用途別

- 皮膚の再表面と引き締め

- 体の輪郭形成とセルライトの減少

- 脱毛

- フェイシャルエステの施術

- 豊胸

- その他の用途

- エンドユーザー別

- 病院

- クリニック

- ホーム設定

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東およびアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 企業プロファイルと競合情勢

- 企業プロファイル

- Abbvie Inc.(Allergan PLC)

- Alma Lasers(Sisram Med)

- Bausch Health Companies Inc.(Solta Medical Inc.)

- Cutera

- El.En. SpA(Asclepion Laser Technologies)

- Cynosure

- Boston Scientific Corporation(Lumenis Inc.)

- Sciton Inc.

- Candela Corporation

- Venus Concept

- Johnson &Johnson Private Limited

- Merz Pharma

第7章 市場機会と将来の動向

The Medical Aesthetic Devices Market size is estimated at USD 27.09 billion in 2024, and is expected to reach USD 44.27 billion by 2029, growing at a CAGR of 10.32% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the growth of the medical aesthetic devices market in early 2020 due to the lockdown imposed and many aesthetic procedures being canceled. An article published in the Journal of Clinics in Dermatology in June 2021 indicated that various procedures, such as deep peeling and laser treatments, were avoided during the COVID-19 pandemic because of the disruptions in the skin barrier. Also, the procedures, such as high-intensity focused ultrasound, fractional radiofrequency, and cryolipolysis equipped with stainless steel, gold, or plastic handpieces and probes, were postponed due to the risk of contamination.

However, aesthetic devices that consumers could use in their homes increased after the COVID-19 pandemic. According to an article published in the International Journal of Trichology in February 2022, home-based aesthetic devices have increased in recent years. They became more relevant during the COVID-19 pandemic, as more patients were hesitant to visit clinics for non-emergency reasons.

Major factors such as the increasing obese population, awareness regarding the aesthetic procedure, rising adoption of minimally invasive devices, and technological advancement in aesthetic devices are propelling the growth of the market.

The increasing volume of aesthetic procedures worldwide is also contributing to the market's growth. For instance, according to the ISAPS survey released in December 2021, 10,129,528 surgical procedures and 14,400,347 nonsurgical cosmetic procedures were performed around the globe in 2020. Furthermore, according to the BAAPS survey released in February 2021, 15,405 cosmetic surgical procedures were performed in the United Kingdom in 2021. The increasing number of aesthetic procedures requires medical aesthetic devices. This is creating the need for medical aesthetic devices and driving the market's growth.

Also, the growing adoption of minimally invasive and non-invasive aesthetic procedures drives the market studied. As per an article published in the Journal Archives of Plastic Surgery in November 2021, the demand for aesthetic procedures was on the rise all over the world, especially in East Asian countries. With the advent of the internet, information became accessible to everyone, and people started becoming more aware of aesthetic procedures. All these factors together increased the public's awareness of medical aesthetic procedures, which, in turn, increased the sales of medical aesthetic devices. This is resulting in a huge growth in the market size of medical aesthetic devices.

Additionally, the approval of products by various regulatory authorities is also boosting the market's growth. For instance, in January 2022, Lumenis launched the Splendor X device, CE cleared for hair removal, vascular treatments, pigmented lesions, and wrinkles in the United Kingdom.

Thus, owing to the abovementioned factors, the market studied is expected to grow during the forecast period. However, social stigma and poor reimbursement scenarios may hinder the market's growth.

Medical Aesthetics Market Trends

Botulinum Toxin is Expected to Witness the Significant Growth During the Forecast Period

Botulinum toxin is a neurotoxic protein produced by the bacterium clostridium botulinum. The botulinum toxin injections tend to block the nerve signals to the muscle in which it is injected. As the muscle cannot contract without a signal, it diminishes or decreases unwanted facial wrinkles or appearance. As a result, highly diluted concentrations of botulinum toxin are used for cosmetic and non-cosmetic purposes, such as for treating frown lines between the eyebrows, dystonia, chronic migraine, and other purposes.

Factors like the popularity of botulinum toxin procedures among young adults, the rise in demand for minimally invasive cosmetic methods, a higher number of beauty-conscious populations, and the launch of products are propelling the growth of the market segment.

The American Society of Plastic Surgeons survey was released in June 2022 in the United States. It reported that botulinum toxin Type A is one of the top minimally invasive cosmetic procedures among patients during 2021-2022. It also reported that patients aged 31- 45 year most commonly seek botulinum toxin type A cosmetic procedures. Additionally, an ISAPS survey released in December 2021 revealed that among all the non-surgical cosmetic procedures performed globally in 2020, 43.2% were Botulinum Toxin procedures. It also reported that a total of 6,213,859 botulinum toxin procedures were performed. Such a high adoption of botulinum toxin procedures creates more demand for it and thus drives the growth of the market segment.

The major players in the market are also investing more in the import and export of botulinum toxin products and are keenly investing in technological advancements. For example, in September 2022, Revance Therapeutics Inc. received approval from USFDA approved DAXXIFY (DaxibotulinumtoxinA-lanm) for injection for the temporary improvement of moderate to severe frown lines (glabellar lines) in adults.

Thus, owing to the abovementioned factors, the botulinum toxin segments are expected to project significant growth during the forecast period.

North America Holds Significant Share and Expected to do the Same During the Forecast Period

North America's medical aesthetic devices market is expected to project significant growth owing to the increasing volume of different aesthetic procedures, rising awareness about aesthetic and minimally invasive procedures, and technological advancement in the region.

The large volume of aesthetic procedures in the region creates the need for aesthetic devices and thus drives the growth of the market. According to the AAFPRS survey released in March 2022, an estimated 1.4 million surgical and non-surgical procedures were performed in the United States in 2021, an increase of 40% over the procedures performed in 2020. Additionally, according to the ISAPS survey released in December 2021, 860,718 aesthetic procedures were performed in Mexico in 2021, of which 456,489 were aesthetic surgical procedures and 404,229 were non-surgical aesthetic procedures. Thus, the increasing number of cosmetic procedures among the population is anticipated to boost the growth of the market during the forecast period.

Also, the high concentration of key players in the region and subsequent product launches play a vital role in the growth of the market in the region. For instance, in April 2021, Alma Lasers launched Alma PrimeX, the ultimate non-invasive platform for body contouring and skin tightening.

Additionally, strategic initiatives are taken by the market players to strengthen their position also boosts the growth of the market in the region. For instance, in November 2021, NanoPass Technologies and Aesthetic Management Partners (AMP) signed an agreement to commercialize NanoPass's MicronJet 600 intradermal delivery device in the United States.

Thus, the aforementioned factors are expected to boost the market during the forecast period in North America.

Medical Aesthetics Industry Overview

The medical aesthetic devices market is moderately competitive and consists of many players. Companies like Abbvie Inc. (Allergan PLC), Alma Lasers Ltd (Sisram Med), Bausch Health Companies Inc. (Solta Medical Inc.), Cutera Inc., El. En. (Asclepion Laser Technologies), Lumenis Inc., Sciton Inc., and Syneron Medical Ltd hold a substantial share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Obese Population

- 4.2.2 Increasing Awareness Regarding Aesthetic Procedures and Rising Adoption of Minimally Invasive Devices

- 4.2.3 Technological Advancement in Aesthetics Devices

- 4.3 Market Restraints

- 4.3.1 Social Stigma Concerns

- 4.3.2 Poor Reimbursement Scenario

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type of Device

- 5.1.1 Energy-based Aesthetic Device

- 5.1.1.1 Laser-based Aesthetic Device

- 5.1.1.2 Radiofrequency (RF)-based Aesthetic Device

- 5.1.1.3 Light-based Aesthetic Device

- 5.1.1.4 Ultrasound Aesthetic Device

- 5.1.2 Non-energy-based Aesthetic Device

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers and Aesthetic Threads

- 5.1.2.3 Microdermabrasion

- 5.1.2.4 Implants

- 5.1.2.4.1 Facial Implants

- 5.1.2.4.2 Breast Implants

- 5.1.2.4.3 Other Implants

- 5.1.2.5 Other Aesthetic Devices

- 5.1.1 Energy-based Aesthetic Device

- 5.2 By Application

- 5.2.1 Skin Resurfacing and Tightening

- 5.2.2 Body Contouring and Cellulite Reduction

- 5.2.3 Hair Removal

- 5.2.4 Facial Aesthetic Procedures

- 5.2.5 Breast Augmentation

- 5.2.6 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics

- 5.3.3 Home Settings

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbvie Inc. (Allergan PLC)

- 6.1.2 Alma Lasers (Sisram Med)

- 6.1.3 Bausch Health Companies Inc. (Solta Medical Inc.)

- 6.1.4 Cutera

- 6.1.5 El.En. S.p.A. (Asclepion Laser Technologies)

- 6.1.6 Cynosure

- 6.1.7 Boston Scientific Corporation (Lumenis Inc.)

- 6.1.8 Sciton Inc.

- 6.1.9 Candela Corporation

- 6.1.10 Venus Concept

- 6.1.11 Johnson & Johnson Private Limited

- 6.1.12 Merz Pharma