|

市場調査レポート

商品コード

1850294

オピオイド:世界市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Global Opioids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オピオイド:世界市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月23日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

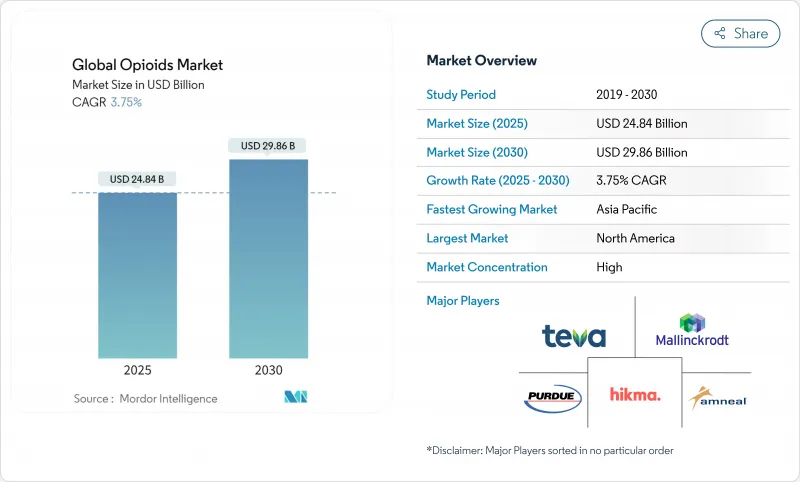

オピオイド市場は2025年に248億4,000万米ドルの収益を上げ、2030年には298億6,000万米ドルに達し、CAGR 3.75%で成長すると予測されています。

オピオイド市場の着実な拡大は、強力な鎮痛薬に対する持続的な臨床ニーズと、転用や誤用を抑制することを目的とした厳格な世界的規制との間の慎重な均衡を反映しています。需要は外科、腫瘍、重篤な慢性疼痛に支えられているが、生産枠の削減、処方監視の強化、代替療法の利用可能性の高まりによって成長は抑制されています。注射用モルヒネ、ヒドロモルフォン、フェンタニルの不足により、医療提供者は供給量を制限し、多剤併用療法を採用せざるを得ないが、オピオイド消費の大部分は引き続き世界の病院が占めています。製品革新は乱用抑止型製剤や、2025年にFDAの承認を取得したNaV1.8阻害剤スゼトリギンのようなファースト・イン・クラスの非オピオイド鎮痛薬に軸足を移しつつあり、高度な疼痛オプションの多様化という並行した動向を示しています。一方、正確なオピオイド投与をガイドするデジタル治療薬は、平均処方サイズを低下させ、データ主導のスチュワードシップ・プログラムに対する支払者の選好を強めています。

世界のオピオイド市場動向と洞察

整形外科疾患と慢性疼痛の有病率の上昇

人口の高齢化、肥満、座りっぱなしのライフスタイルにより、変形性関節症や背部疾患の罹患率が上昇し、オピオイド市場の需要を支えています。米国では5,000万人以上の成人が慢性疼痛を患っており、オピオイドは非薬物療法が奏効しない場合の画期的な治療薬として不可欠です。現在、洗練されたケア・パスウェイでは、オピオイドと補助的な理学療法や認知サポートが組み合わされているが、処方上の制限や段階的治療の義務化により、治療開始までの時間が長くなっています。有害事象を最小限に抑えなければならないというプレッシャーが市販後調査を強化し、不正開封防止包装や異常処方にフラグを立てる分析ダッシュボードへの投資に拍車をかけています。その結果、実臨床での安全性のベネフィットを証明できるメーカーは、オピオイド市場全体において、優遇的な償還を確保し、高いフォーミュラリー層を維持しています。

徐放性オピオイド製剤への傾斜

臨床医は、血漿中濃度を安定化させ、夜間のブレークスルー疼痛を軽減するために、1日1回または1日2回投与の徐放性錠剤を選択することが多くなっています。FDAのADFパスウェイの進化により、破砕や注射の乱用を防ぐためにマイクロスフェア技術を採用したXtampza ERなどの承認が加速しています。徐放性製剤は、処方数量が横ばいであるにもかかわらず、割高な価格設定で売上を伸ばしています。しかし、複雑な製造工程と厳密な乱用シミュレーション研究が新規参入を制限し、必要資本を増加させるため、オピオイド市場における既存企業の競争は激化しています。

代替薬としての大麻の登場と合法化

米国39州と欧州の司法管轄区域で医療用大麻に関する法律が制定され、代替効果が生じており、メディケイド患者のスケジュールIIIオピオイド処方が30%近く削減されています。無作為化試験では、大麻をオピオイドと併用した場合、モルヒネ・ミリグラム当量が39.3%減少したと報告されています。とはいえ、大麻は複雑な手術に必要な高力価のオピオイドに完全に取って代わるわけではないので、その影響は専門病院よりもプライマリ・ケアにおいてより顕著です。この動向は全体的な数量成長を抑制する一方で、オピオイド市場において高い急性期治療が必要なニッチをターゲットとするようメーカーに促しています。

セグメント分析

オキシコドンは2024年に32.17%のオピオイド市場シェアを確保したが、これは急性期から慢性期まで幅広い適応症をカバーする即時放出型と徐放型の両方に対する医師の嗜好が持続していることを反映しています。オピオイドのバイオアベイラビリティ(生物学的利用能)プロファイル、予測可能な代謝、数十年にわたる臨床経験により、DEAの規制削減や製造停止により定期的に供給が制限される中でも、処方箋への高い浸透が見込まれています。複数の供給業者(Alvogen、Amneal、Camber)から供給不足が報告されており、病院の購買チームは調達網を広げ、医療の継続性を維持するよう求められています。メタドンのシェアは4.16%で、依然としてオピオイド代替治療の要です。血漿中半減期が長いため離脱リスクが低く、治療プログラムにおける連日の観察投与を支えています。

モルヒネとヒドロコドンについては、2015年以降ヒドロコドンの生産枠が73%減少しており、製造キャンペーンが遅れるとモルヒネが不足するため、ボラティリティが続いています。メペリジンの使用量は神経毒性代謝物の懸念から減少し続けており、オキシモルフォンなどのニッチな薬剤は持続的な供給不足に直面しています。抑止力の重視とサプライチェーンへの配慮が相まって、オピオイド市場の競争階層が再構築されつつあります。

2024年のオピオイド市場シェアの50.71%は強力な作動薬で占められており、重篤な術後腫瘍学や外傷治療における役割を支えています。μ受容体を完全に活性化するため、比類のない効力を発揮するが、リスク軽減のためには酸素飽和度の継続的モニタリングと漸減プロトコールの加速が必要です。ブプレノルフィンを筆頭とする部分作動薬のシェアは4.51%で、事前に面会することなく電子処方することを認める遠隔医療ルールの緩和のもと、拡大を続けています。この柔軟性は治療プログラムへの登録を促進し、専門メーカーの収益を安定させる。

オピオイド業界は、中枢神経系への浸透を最小限に抑え、呼吸抑制を抑えて鎮痛を維持する末梢選択的な分子の研究開発に力を注いでいます。ナロキソンのような拮抗薬は、救急医療に不可欠な補助薬であり続け、アゴニズムとエンドサイトーシス偏向を併せ持つ新規の二重作用分子が第Ⅱ相試験に入りつつあります。規制当局の監視が厳しくなるにつれ、受容体結合選択性がオピオイド市場における差別化戦略と価値獲得をますます明確にしていくと思われます。

地域分析

北米は2024年にオピオイド市場の42.91%という圧倒的なシェアを維持したが、これは高度な外科手術能力、包括的な保険適用、高度急性期医療における強力な鎮痛薬への継続的な依存によって支えられています。DEA(麻薬取締局)による2015年以降のオキシコドンの68%、ヒドロコドンの73%の生産割当削減は、供給を引き締めたが、需要に歯止めをかけませんでした。米国の医療ネットワークは、術後の新規開始を3.5%削減し、錠剤数を41.8%削減する処方スチュワードシップで対応したが、ADF製品が処方シェアを拡大したため、価格ミックスの上昇により、この地域のオピオイド市場規模は依然として増加しています。カナダは集中監視システムにより転用を抑えており、メキシコは国内の必要性と完成医薬品の中継地としての役割のバランスをとっています。

欧州は第2位の地域プールを形成しており、深い製造能力と強固な疼痛ケアインフラに支えられています。ドイツ、フランス、英国はADFの調達を優先し、イタリアとスペインは画期的なエピソードのためにオピオイドを備蓄する多剤併用レジメンへの依存を強めています。欧州麻薬・薬物中毒監視センターは、ニタゼンなどの合成オピオイドの脅威に対する対応プロトコルを調整し、各国の処方ガイドラインに情報を提供しています。ブレグジットに伴う税関検査は手続き上の摩擦をもたらしたが、相互承認協定の継続により、海峡を越えた安定した医薬品の流れが維持され、オピオイド市場全体の成長は維持されています。

2024年のオピオイド市場シェアが5.43%であるアジア太平洋は、最も急速に成長している地域であり、2030年までのCAGRは5.9%と予測されます。日本は超高齢化社会を迎えており、経皮吸収型製剤や経口放出制御型製剤の需要が堅調です。中国では2024年7月にデキストロメトルファンが向精神薬第2類に分類変更され、規制薬物規制がより強化されることになります。国内当局が患者のアクセスと横流しリスクとのバランスに苦慮するなかでも、インドは製造国と消費国という二重の役割を担っているため、輸出拡大から利益を得ることができます。インドネシア、タイ、ベトナムでは、外科手術のキャパシティが拡大しているため、地域全体の生産量がさらに増加し、オピオイド市場の長期的な成長見通しが強化されています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 整形外科疾患と慢性疼痛の有病率の上昇

- 徐放性オピオイド製剤への傾向

- 乱用抑止製剤への注目の高まり(ADF)

- 術中鎮痛を必要とする外科手術の増加

- 新興市場におけるオピオイド代替療法の導入

- 個別化オピオイド投与のためのデジタル治療の統合

- 市場抑制要因

- 代替手段としての大麻の出現と合法化

- 処方薬の乱用と依存症の懸念

- より厳しい生産割当と規制制限

- 後期段階の非オピオイド鎮痛剤(Nav1.7、TRPV1など)が将来の需要を減少させる

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- モルヒネ

- オキシコドン

- ヒドロコドン

- メペリジン

- メサドン

- その他

- 受容体結合別

- 強力な作動薬

- 軽度から中等度の作動薬

- 部分作動薬

- 拮抗薬

- 投与経路別

- 経口

- 非経口/静脈内

- 経皮

- その他(舌下、鼻腔など)

- 用途別

- 疼痛管理

- がんの痛み

- 神経障害性疼痛

- 術後/外傷性疼痛

- 変形性関節症の痛み

- その他の痛み

- 風邪と咳

- 下痢

- オピオイド依存症治療

- その他

- 疼痛管理

- 流通チャネル別

- 病院

- 小売薬局

- オンライン薬局

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- AbbVie(Allergan)

- Purdue Pharma

- Johnson & Johnson(Janssen)

- Mallinckrodt

- Teva Pharmaceutical

- Hikma Pharmaceuticals

- Endo International

- Pfizer

- Sun Pharma

- Vertice Pharma

- Amneal Pharma

- Zyla Life Sciences

- AcelRx Pharma

- Alcaliber SA

- Collegium Pharmaceutical

- Indivior PLC

- Camurus AB

- Lupin Ltd

- Mundipharma