|

市場調査レポート

商品コード

1444237

迫撃砲弾:市場シェア分析、業界動向と統計、成長予測(2024-2029年)Mortar Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 迫撃砲弾:市場シェア分析、業界動向と統計、成長予測(2024-2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

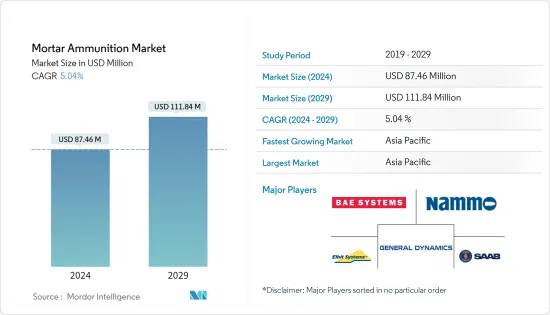

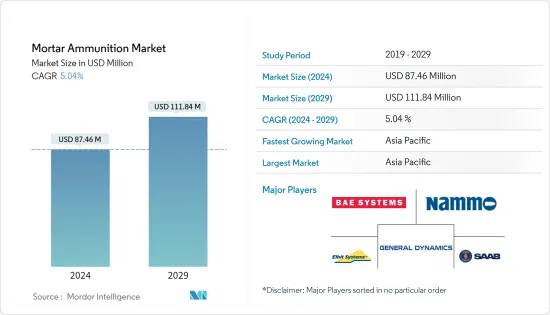

迫撃砲弾の市場規模は2024年に8,746万米ドルと推定され、2029年までに1億1,184万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.04%のCAGRで成長します。

COVID-19による市場全体の収益への影響は軽微でした。しかし、主要国の政府が課したロックダウンによりサプライチェーンに混乱が生じ、2020年の製造遅延につながりました。世界全体の国防支出は2020年まで増加傾向にありましたが、経済危機に直面している新興諸国は削減を選択する可能性があります。今後数年間の国防支出レベルは大幅に低下し、新しい迫撃砲弾システムや関連弾薬の調達が妨げられる可能性があります。

いくつかの国は、新しい兵器システムを調達したり、既存の配備されているシステムを先進的な弾薬で近代化することにより、現在の軍事力を増強するために多大な資源を費やしています。領土問題の拡大により、陸上軍による迫撃砲弾システムの調達も長年にわたって推進されてきました。

現在、迫撃砲弾は、新しい技術の統合と世界軍の歩兵および砲兵部隊による配備範囲の拡大により、需要が活性化しています。より軽量でありながら射程が向上し、より強力な迫撃砲弾を開発するために、いくつかの新しい迫撃砲弾開発プログラムが進行中です。精密誘導迫撃砲弾の開発に投資が行われており、今後数年間で市場に新たな展望が開かれる可能性があります。

迫撃砲弾の市場動向

大口径セグメントは予測期間中に最高の成長を遂げると予想される

市場の大口径セグメントは、予測期間中に最も高い成長を遂げると予想されます。口径が100 mm以上の迫撃砲弾は大口径迫撃砲弾として分類されます。従来の大口径迫撃砲弾の射程は7,200m~9,500mで、迫撃砲弾のサイズに応じて1.2kg~4.2kgの爆発物を搭載できます。大口径迫撃砲弾は通常、敵の要塞を平らにしたり、装甲車両を撤去したりするために使用されます。世界中のいくつかの国では、広範な兵器近代化プログラムの一環として調達プログラムが進行中です。たとえば、2021年11月、エストニア国防投資センターは、最大1,727万米ドル相当の枠組み協定に基づいて、単独入札者であるイスラエルのElbit Systemsに非公開の数の120mm迫撃砲弾システムを発注したと発表しました。契約の一環として、Elbitはエストニア軍とのシステムのライフサイクルサポートも提供します。需要の高まりにより、大口径迫撃砲弾セグメントにおける広範な革新が促進されました。例えば、同社によれば、イスラエルは2021年3月、民間人の巻き添え被害を軽減できるレーザー誘導迫撃砲弾システムを発表しました。イスラエル軍が地元企業Elbit Systemsと共同で開発した「アイアン・スティング」システムは、レーザーとGPS技術を使用して120mm迫撃砲弾に最大の精度を提供します。このような先進兵器の開発と調達注文により、予測期間中にこのセグメントの成長が加速すると予想されます。

アジア太平洋が2021年の迫撃砲弾市場で大きなシェアを占める

アジア太平洋地域は現在市場を独占しており、予測期間中もその支配が続くと予想されます。中国、インド、韓国などの国々は、この地域で地政学的な緊張が続いているため、過去数年にわたり軍事支出を急速に増加させています。中国とインドは2015年から2020年にかけて軍事支出をそれぞれ25%以上、30%以上増加させました。このような国防支出の増加に伴い、これらの国々は新世代の迫撃砲弾システムと関連弾薬の開発と調達に投資を行っています。 2021年3月、インド陸軍は、最新技術を採用した新しい装備に道を譲るため、最も長く使用されてきた2つの砲システム、すなわち130mm自走M-46カタパルト砲と160mmタンペラ迫撃砲弾を退役させました。新しい迫撃砲弾システムの調達も、予測期間中に関連弾薬の需要を生み出すことが予想されます。迫撃砲弾システムの先住民開発への注目の高まりが、この地域の市場の成長を促進すると予測されています。 2021年 7月、大韓民国陸軍(RoKA)は、現地開発の81 mm迫撃砲弾システムのアップグレード版の配備を開始しました。迫撃砲弾システムは、レーザーや全地球測位システム(GPS)などの高度な技術を使用して目標位置を特定し、迫撃砲弾の設定を計算することで、発射弾丸の速度と精度を向上させます。

先進的な迫撃砲弾システムの調達に加えて、各国は迫撃砲弾システム用の先進的な弾薬を入手しています。 2019年4月、Elbit Systemsは、アジア太平洋地域の非公開顧客に精密誘導迫撃砲弾(GMM)であるSTYLETを供給する3,000万米ドル相当の契約を獲得したと発表しました。弾薬の納入は2022年に完了する予定です。STYLETは、戦術戦闘部隊や特殊部隊向けに設計された、射程1,000~8,500メートルのマルチモードGPS/INS誘導式120mm GMMです。高度な精密誘導迫撃砲弾のこのような投資と調達は、予測期間中にアジア太平洋の市場の成長を促進すると予想されます。

迫撃砲弾業界の概要

迫撃砲弾市場の主要企業は、Elbit Systems Ltd、BAE Systems PLC、Nammo AS、General Dynamics Corporation、およびSaab ABです。企業は新しい弾薬を開発し、新しい市場機会を探るために協力しています。たとえば、最近では、Singapore Technologies Engineering Ltd、SAMI、Hanwha Defenseなどの企業が協力して、迫撃砲弾を含むさまざまな種類の弾薬を製造しました。このようなコラボレーションは、予測期間中に市場での存在感と世界市場でのシェアを高めるのに役立つと期待されています。射程、精度、致死性などの迫撃砲弾の性能の進歩は、メーカーが新規顧客を引き付ける主な要因となっています。一方、他の製造業者と提携して軍需品を現地生産することで、予測期間中に新しい市場に参入できるようになります。軍需品の国産化への動きの高まりを受けて、数か国の地元企業が今後数年で市場に参入すると予想されています。この要因により、今後数年間で市場での競合が激化すると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

- USDの通貨換算レート

第2章 調査手法

第3章 エグゼクティブサマリー

- 市場規模と予測、世界、2018~2027年

- 口径タイプ別の市場シェア、2021年

- 地域別の市場シェア、2021年

- 市場促進要因と抑制要因

- 市場の構造と主要参入企業

- 迫撃砲弾市場に関する専門家の意見

第4章 市場力学

- 市場概要

- 市場指標

- 市場促進要因

- 市場抑制要因

- 市場動向

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション(金額別の市場規模と予測、10億米ドル、2018~2031年)

- 口径タイプ別

- 小口径

- 中口径

- 大口径

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- その他欧州

- アジア太平洋

- 中国

- インド

- 韓国

- 日本

- その他アジア太平洋

- ラテンアメリカ

- メキシコ

- その他ラテンアメリカ

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他中東とアフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- Elbit Systems Ltd

- General Dynamics Corporation

- Nexter Systems SA

- BAE Systems PLC

- Rheinmetall AG

- Saab AB

- Nammo AS

- Denel SOC Ltd

- Hirtenberger Defence Systems GmbH &Co. KG

- Singapore Technologies Engineering Ltd

- Mechanical and Chemical Industry Company(MKEK)

- ARSENAL JSCo.

- Hanwha Corporation

第7章 市場機会

The Mortar Ammunition Market size is estimated at USD 87.46 million in 2024, and is expected to reach USD 111.84 million by 2029, growing at a CAGR of 5.04% during the forecast period (2024-2029).

The impact of COVID-19 on the overall market revenue was low. However, the lockdown imposed by the governments in major countries caused disruptions in the supply chain, leading to manufacturing delays in 2020. Although the overall global defense spending saw an increasing trend till 2020, developing countries facing an economic crisis may opt for a reduction in defense spending levels in the coming years, which may hamper the procurement of new mortar systems and related ammunition.

Several countries are expending significant resources toward augmenting their current military prowess by procuring new weapon systems or modernizing their existing deployed systems with advanced ammunition rounds. The growth in territorial issues has also propelled the procurement of mortar systems by the land forces over the years.

Mortars are now witnessing rejuvenated demand due to new technology integration and enhanced deployment scope by infantry and artillery units of global armed forces. Several new mortar development programs are underway to develop lighter but deadlier mortar ammunition with an enhanced range. Investments are being made to develop precision-guided mortar ammunition, which may open new prospects for the market in the coming years.

Mortar Ammunition Market Trends

Heavy Caliber Segment is Expected to Witness Highest Growth During the Forecast Period

The heavy-caliber segment of the market is expected to witness the highest growth during the forecast period. Mortar ammunition with a caliber size of 100 mm and above are classified as heavy caliber mortars. Conventional heavy-caliber mortars have a range of 7,200m to 9,500m and can carry an explosive payload of 1.2kg to 4.2kg, depending on the size of the mortar. Heavy mortars are generally used to level enemy strongholds and decommission armored vehicles. Several nations across the globe have procurement programs underway as part of their extensive weaponry modernization program. For instance, in November 2021, the Estonian National Defense Investment Centre announced that it has ordered an undisclosed number of 120mm mortar systems from the sole bidder Elbit Systems of Israel, under a framework agreement worth up to USD 17.27 million. As part of the contract, Elbit will also provide lifecycle support for the systems with the Estonian Army. The rise in demand has fostered extensive innovations in the heavy caliber mortar segment. For instance, in March 2021, Israel unveiled a laser-guided mortar system that could reduce civilian collateral damage, according to the company. The "Iron Sting" system, developed by the Israeli military with local firm Elbit Systems, will use laser and GPS technology to provide maximal accuracy to 120mm mortar rounds. Such developments and procurement orders of advanced munitions is expected to accelerate the growth of this segment during the forecast period.

Asia-Pacific Accounted for a Major Share in the Mortar Ammunition Market in 2021

The Asia-Pacific region is currently dominating the market and is expected to continue its dominance during the forecast period. Countries such as China, India, and South Korea have been rapidly increasing their military spending over the past few years due to the ongoing geopolitical tensions in the region. China and India increased their military expenditures by more than 25% and 30%, respectively, during 2015-2020. With such a growth in defense expenditure, these countries have been investing in developing and procuring newer generation mortar systems and related ammunition. In March 2021, the Indian Army decommissioned two of the longest-serving artillery systems, namely, the 130mm self-propelled M-46 catapult guns and 160mm Tampella Mortars from service, to make way for newer equipment employing the latest technologies. The procurement of new mortar systems is also expected to generate demand for related ammunition during the forecast period. The growing focus on indigenous development of mortar systems is projected to drive the market's growth in the region. In July 2021, the Republic of Korea Army (RoKA) began deploying an upgraded version of its locally developed 81mm mortar system. The mortar system uses advanced technologies, like laser and the global positioning system (GPS), to identify the target locations and calculate the mortar settings, thus increasing the speed and accuracy of the rounds delivered.

Along with the procurement of advanced mortar systems, countries are acquiring advanced ammunition for the mortar systems. In April 2019, Elbit Systems announced that it was awarded a contract worth USD 30 million to supply STYLET, a precise Guided Mortar Munition (GMM), to an undisclosed customer in Asia-Pacific. The deliveries of the munitions are expected to be completed in 2022. STYLET is a multimode GPS/INS guided 120mm GMM with a range of 1,000-8,500 m designed for tactical combat units and Special Forces. Such investments and procurement of advanced precision-guided mortar ammunition are anticipated to boost the market's growth in Asia-Pacific during the forecast period.

Mortar Ammunition Industry Overview

The major players in the mortar ammunition market are Elbit Systems Ltd, BAE Systems PLC, Nammo AS, General Dynamics Corporation, and Saab AB. Companies are collaborating to develop new ammunition and explore new market opportunities. For instance, recently, companies like Singapore Technologies Engineering Ltd, SAMI, and Hanwha Defense collaborated to produce different kinds of ammunition, including mortars. Such collaborations are expected to help them increase their market presence and share in global markets during the forecast period. Advancements in mortar ammunition capabilities, like range, precision, and lethality, are the major factors for manufacturers to attract new customers. On the other hand, partnerships with other manufacturers to locally produce munitions will allow them to enter new markets during the forecast period. Local players from several countries are expected to enter the market in the coming years, driven by the growing push for the localization of military equipment. This factor is expected to increase the competition in the market in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2027

- 3.2 Market Share by Caliber Type, 2021

- 3.3 Market Share by Geography, 2021

- 3.4 Market Drivers and Restraints

- 3.5 Structure of the Market and Key Participants

- 3.6 Expert Opinion on Mortar Ammunition Market

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Indicators

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Market Trends

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD billion, 2018 - 2031)

- 5.1 Caliber Type

- 5.1.1 Light Caliber

- 5.1.2 Medium Caliber

- 5.1.3 Heavy Caliber

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.1.1 By Caliber Type

- 5.2.1.2 Canada

- 5.2.1.2.1 By Caliber Type

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.1.1 By Caliber Type

- 5.2.2.2 France

- 5.2.2.2.1 By Caliber Type

- 5.2.2.3 Germany

- 5.2.2.3.1 By Caliber Type

- 5.2.2.4 Rest of Europe

- 5.2.2.4.1 By Caliber Type

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.1.1 By Caliber Type

- 5.2.3.2 India

- 5.2.3.2.1 By Caliber Type

- 5.2.3.3 South Korea

- 5.2.3.3.1 By Caliber Type

- 5.2.3.4 Japan

- 5.2.3.4.1 By Caliber Type

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.3.5.1 By Caliber Type

- 5.2.4 Latin America

- 5.2.4.1 Mexico

- 5.2.4.1.1 By Caliber Type

- 5.2.4.2 Rest of Latin America

- 5.2.4.2.1 By Caliber Type

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.1.1 By Caliber Type

- 5.2.5.2 United Arab Emirates

- 5.2.5.2.1 By Caliber Type

- 5.2.5.3 South Africa

- 5.2.5.3.1 By Caliber Type

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.5.4.1 By Caliber Type

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Elbit Systems Ltd

- 6.2.2 General Dynamics Corporation

- 6.2.3 Nexter Systems SA

- 6.2.4 BAE Systems PLC

- 6.2.5 Rheinmetall AG

- 6.2.6 Saab AB

- 6.2.7 Nammo AS

- 6.2.8 Denel SOC Ltd

- 6.2.9 Hirtenberger Defence Systems GmbH & Co. KG

- 6.2.10 Singapore Technologies Engineering Ltd

- 6.2.11 Mechanical and Chemical Industry Company (MKEK)

- 6.2.12 ARSENAL JSCo.

- 6.2.13 Hanwha Corporation