|

市場調査レポート

商品コード

1639532

医療ロボットシステム-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Medical Robotic Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医療ロボットシステム-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

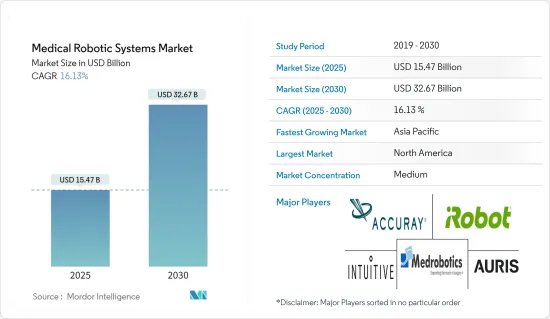

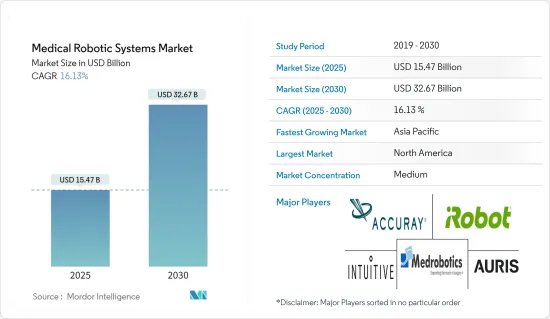

医療ロボットシステム市場規模は2025年に154億7,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは16.13%で、2030年には326億7,000万米ドルに達すると予測されます。

高齢者施設における医療ロボットに対する一般の認識は、ここ数年で改善されてきています。偶発的な転倒によってもたらされるER受診件数を減少させ、在宅ケアの利用しやすさと手頃な価格を向上させる可能性のある重要な取り組みの1つが、ロボットケアの導入です。

高齢者における外科手術の件数の増加や、外傷の症例の増加に伴い、正確で適切な腹腔鏡手術や医療処置ソリューションの需要が増加しています。その結果、外科領域全体で低侵襲手術の機会が増えているため、ロボット支援手術が急速に拡大しています。ロボット手術の商業利用が10年に近づくにつれ、市場は多様化し、新技術によるコスト削減と小型化を実現した斬新な手術方法が利用可能になりつつあります。

例えば、医療ロボットも介入や診断目的で増加しています。近年、ロボット工学と自動化ソリューションの用途セグメントは、医療/医薬品ラボにも広がっており、手作業、反復作業、大量作業を自動化することで、科学者や技術者がより戦略的な作業に集中し、発見をより早く実現できるようにするために、ロボットの利用が増えています。

直感的な外科手術がロボット手術市場を独占し、かなりの市場シェアを維持してきた時期も長かった。ダ・ヴィンチの特許が失効し、自動システム開発が飛躍的に増加する段階にあります。新型システムは、新技術、コスト削減、小型化という3つの主要手段を通じて、ダ・ヴィンチ・モデルの改良を目指しています。

さらに、米国や欧州の病院では、さまざまな疾患の治療にロボット手術が急速に採用されています。最も広く使用されている臨床用ロボット手術システムのひとつに、手術器具を取り付けた機械式アームとカメラアームがあります。ロボット支援手術の例としては、生検、がん腫瘍の除去、心臓弁の修復、胃バイパス術などがあります。

このような利点があるにもかかわらず、導入コストが高いこと、特に新興国市場では認知度が低いこと、ロボット医療システムを操作する技術的専門知識が不足していることなどが、調査対象市場の成長を阻む大きな課題となっています。

COVID-19が外科医にもたらす重大なリスクのため、さまざまな外科学会が、現在のパンデミックにおけるこれらの処置に対する安全勧告を策定しました。ロボットは、各外科患者が入院中に通過する一連の流れのさまざまな部分に組み込むことができ、病原体の拡散をうまく防ぐことができます。パンデミックがもたらした大きな影響と、これらのシステムが提供する利点の結果として、ロボット医療システムの採用は予測期間中にさらに拡大すると予想されます。

医療ロボットシステム市場動向

手術ロボットが市場を席巻

ロボット手術は、外科処置を行うためにロボット工学を利用した低侵襲手術です。これらのロボットシステムは外科医によって操作され、ロボットアームに取り付けられた小型化された手術器具で構成されているため、外科医は正確に手術を行うことができます。

手術用ロボットセグメントを押し上げる主要要因は、医療自動化のニーズの高まりと、先進的ロボット手術への動向です。運動抵抗や組織抵抗に対処するため、研究開発は協働ロボットを採用した新しい戦略を開発しています。例えば、協働ロボットは、繊細な手術や無菌環境における人体汚染の可能性を低減するのに役立っています。

手術用ロボットセグメントは、医療ロボットの中で大きな割合を占めています。これは、Tier-1病院でのロボット手術システムの採用が増加していること、高効率で交換可能なコンポーネントへの需要が高まっていること、世界中で実施されるロボット手術の件数が増加していること、手術ごとに繰り返し必要になるため器具や付属品への需要が高まっていることによる。

ロボット手術が従来の腹腔鏡手術や胸腔鏡手術の欠点を効果的に解決し、複雑で先進的外科手術をより高い精度と最小限の侵襲で完了できるようになったことも、手術ロボットの採用を促進する大きな要因となっています。先端医療機器への投資の拡大も、研究対象市場の成長に有利な展望を生み出しています。例えば、投資銀行会社Mediobancaによると、医療機器産業の収益は2017年の3,760億ユーロ(約4,020億米ドル)から2024年には5,210億ユーロ(約5,570億米ドル)に成長すると予測されています。

さらに、外科手術用ロボットの需要が大幅に増加すると予測されています。これは、肥満手術、ヘラー筋切開術、胃切除術、ヘルニア修復術、胆嚢摘出術、経口腔手術、膵切除術など、さまざまな外科手術における手術ロボットの使用が増加していることや、世界的に一般外科手術の実施件数が増加していることに起因しています。

アジア太平洋が最も高い成長を遂げる

アジア太平洋における高度で革新的な医療インフラシステムに対する需要は、予測期間中に健全な成長を遂げると考えられます。アジア太平洋における医療ロボット市場の可能性は急速に拡大しています。各国の政府も医療製薬セグメントでの技術的ブレークスルーを模索しており、これも市場拡大には欠かせないです。このことは、医療ロボットへのアクセスの拡大、さらなる進歩、今後数年間の大規模投資への扉を開くことになります。

この地域では中国が市場シェアの大半を占めています。中国の医療ロボットの需要は、主に機器ベースのサービスの採用が増加していることが要因となっています。また、熟練した理学療法士や介護士の不足といった他の要因も需要を支えています。

South China Morningによると、ダ・ヴィンチシステムは中国で現在までに6万件以上の手術に広く使用されているが、中国政府は外国技術への依存度を下げることに熱心で、その結果、過去数年間に手術ロボットを含むインテリジェントロボットやロボット医療機器を開発する30社以上の医療機器メーカーを支援してきました。

このような動向は、医療機器メーカーが革新的なソリューションを開発するための研究開発努力をさらに強化することにもつながっています。例えば、2022年9月、上海のロボット企業は、医師が狭いスペースで複雑な手術を行うのを助ける4本腕の腹腔鏡手術ロボットを開発しました。

さらに、恵州のZhongkaiHi-Techゾーンでは、SS Innovationsが、複雑な動作制御が可能な手頃な価格のモジュール型ロボット手術システムの開発とテストを行っています。同社は、中国政府から約1,500万米ドルの予算を獲得し、世界中の人材を採用・育成しています。

オーストラリアでは約20年前からロボット支援によるミニマムアクセス手術(MAS)が行われているため、オーストラリアの医療ロボットセグメントは洗練されています。従来の手術ロボットを使用する外科医の肉体的負担を軽減するために設計された手術ロボットVersiusが最近オーストラリアに導入され、世界の医療ロボット産業におけるオーストラリアの地位が実証され、確保されました。

医療ロボットシステム産業概要

医療ロボットシステム市場は、複数の参入企業が存在するにもかかわらず、市場の需要の大半が大手参入企業の先進的な製品によって満たされているため、競合が激しいです。成長と競合の背景には、医療改善のための欧米との提携、国内メーカーによる手術用ロボットの開発、研究開発目的の地域大学との複数の政府提携などがあります。これらの企業は、市場シェアと収益性を高めるため、戦略的共同イニシアティブを採用しています。主要市場参入企業には、Intuitive Surgical Inc.、Auris Surgical Rbots Inc.、iRobot Corporationなどがあります。

2023年4月、Apollo Cancer Centres, Navi Mumbaiは、腫瘍学、泌尿器学、大腸肛門外科、婦人科、胸部、心臓病学、小児科、消化器外科、腎臓移植、肝臓移植のセグメントで使用できる第4世代の先進的ダヴィンチXiロボットシステムを発売しました。

2023年2月、ムンバイを拠点とするGlobal Hospitalは、ダ・ヴィンチXiロボット手術システムを発売しました。このロボット手術システムは、外科医が低侵襲手術を正確かつ安全に行えるように設計されています。同社によると、この先進的なシステムは、婦人科、泌尿器科、腫瘍科、肝移植、心臓外科、胸部外科、小児外科、消化器外科など、さまざまな外科セグメントで使用され、患者の治療成績と生活の質を向上させています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- がん、神経疾患、整形外科疾患、心血管疾患などの疾患の有病率の増加

- 世界の高齢者の増加

- 費用対効果の高い医療ロボットの採用

- 市場課題

- 設置とメンテナンスの初期コストの高さ

- ロボット手術機器に対する安全性とセキュリティの懸念

第6章 市場セグメンテーション

- 製品タイプ別

- 手術用ロボットシステム

- リハビリ用ロボットシステム

- 非侵襲的放射線手術ロボット

- 病院・薬局ロボットシステム

- その他ロボットシステム

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Accuray Incorporated

- Auris Surgical Robotics Inc.(Hansen Medical Inc.)

- Intuitive Surgical Inc.

- Medrobotics Corporation

- iRobot Corporation

- Tital Medical Inc.

- Stryker Corporation

- Omnicell Technologies

- Renishaw PLC

- Mazor Robotics Ltd

- MAKO Surgical Corp.(Stryker Corporation)

- Hitachi Medical Systems

- Siemens Healthineers AG

- Smith & Nephew PLC

第8章 投資分析

第9章 今後の動向

The Medical Robotic Systems Market size is estimated at USD 15.47 billion in 2025, and is expected to reach USD 32.67 billion by 2030, at a CAGR of 16.13% during the forecast period (2025-2030).

The public's perception of medical robots in senior living facilities has improved over the last few years. One of the key initiatives that could lower the number of ER visits brought on by accidental falls and increase the accessibility and affordability of at-home care is the implementation of robotic care.

With the rising number of surgical procedures in the geriatric population and mounting cases of trauma injuries, the demand for accurate and proper laparoscopic surgeries and medical procedure solutions has been increasing. As a result, robot-assisted surgery has quickly expanded due to growing opportunities for minimally invasive surgery across the surgical domains. As robotic surgery approaches a decade of commercial use, the market is diversifying, and novel surgical modalities with the new technology decreased costs, and smaller sizes are becoming available.

For instance, medical robots have also increased for intervention and diagnostic purposes. Recent years have also witnessed the application area of robotics and automation solutions extending to medical/pharmaceutical research laboratories, where they are increasingly being used to automate manual, repetitive, and high-volume tasks so scientists and technicians can focus their attention on more strategic tasks to ensure discoveries happen faster.

For a significant period, intuitive surgical procedures have dominated the robotic surgical market and maintained a considerable market share. With original da Vinci patents expiring, the stage is set for an exponential increase in automatic system development. The newer systems seek to improve the da Vinci model through three main avenues: novel technology, reduced cost, and size reduction.

Furthermore, US and European hospitals have rapidly adopted robotic surgery to treat various conditions. One of the most widely used clinical robotic surgical systems includes mechanical and camera arms with surgical instruments attached. Examples of robot-assisted procedures include biopsies, removal of cancerous tumors, repairing heart valves, and gastric bypasses.

Despite all these benefits, factors such as a higher adoption cost, a lower awareness, especially in developing regions, and a lack of technical expertise to operate robotic medical systems are among the significant factor challenging the growth of the studied market.

Due to the significant risk that COVID-19 poses to surgeons, various surgical associations developed safety recommendations for these procedures in the present pandemic. Robots can be included in different parts of the sequence that each surgical patient travels through during their hospital stay to successfully prevent the spread of pathogens. As a result of the greater exposure the pandemic has provided and the benefits these systems offer, the adoption of robotic medical systems is anticipated to grow further during the forecast period.

Medical Robotic Systems Market Trends

Surgical Robots to Dominate the Market

Robotic surgery is a minimally invasive surgery utilizing robotics for performing surgical procedures. These robotic systems are operated by surgeons and consist of miniaturized surgical instruments mounted on robotic arms, thus allowing surgeons to perform the surgeries precisely.

The key factors boosting the surgical robots segment are the increasing need for healthcare automation and the trend toward advanced robotic surgeries. To address motion and tissue resistance, researchers are developing new strategies with the adoption of collaborative robots. For instance, Collaborative robots assist in lowering the possibility of human contamination in delicate operations and sterile settings.

The surgical robotics segment accounted for a significant portion of medical robotics, owing to the rising adoption of robotic surgical systems across Tier-1 hospitals, demand for highly efficient replaceable components, increase in the volume of robotic procedures performed worldwide, and growing demand for instruments & accessories due to their recurring need per procedure.

Another major factor driving the adoption of surgical robots is that robotic surgeries have effectively solved the drawbacks of conventional laparoscopic and thoracoscopic surgery, enabling the completion of intricate and advanced surgical procedures with higher precision and a minimally intrusive method. Growing investment in advanced medical devices also creates a favorable outlook for the growth of the studied market. For instance, according to Mediobanca, an investment banking company, the revenue of the medical device industry is anticipated to grow from EUR 376 billion (~USD 402 billion) in 2017 to EUR 521 billion (~USD 557 billion) by 2024.

Furthermore, there is projected to be a major increase in the market's demand for surgical robots. This can be attributed to the increasing use of surgical robots in a variety of surgical procedures, including bariatric surgery, heller myotomy, gastrectomy, hernia repair, cholecystectomy, transoral surgery, and pancreatectomy, as well as an increase in the volume of general surgery procedures performed globally.

Asia Pacific to Witness the Highest Growth

The demand for the advanced and innovative healthcare infrastructure system in APAC will witness healthy growth during the forecast period. Medical robotics' market potential in the APAC area is expanding quickly. Governments across various countries are also looking for technological breakthroughs in their medical and pharmaceutical sectors, which are also critical to market expansion. This opens the door for greater accessibility to medical robotics, additional advancements, and larger investment in the upcoming years.

China contributes a majority of its market share in the region. Chinese demand for medical robots is mainly driven by the increasing adoption of instrument-based services. The demand is also supported by other factors, such as the lack of skilled physiotherapists and caretakers.

According to the South China Morning, while the da Vinci system is broadly used in China in more than 60,000 operations to date, the Chinese government is eager to reduce its dependence on foreign technology; as a result, it has backed more than 30 MedTech manufacturers who develop intelligent robots and robotic medical devices, including surgical robots in the past few years.

Such trends are also encouraging medical device manufacturers further enhance their R&D efforts to develop innovative solutions. For instance, in September 2022, a Shanghai-based robotics enterprise developed a four-arm laparoscopic surgical robot to help doctors carry out complex surgeries in narrow spaces.

Furthermore, in the ZhongkaiHi-Tech zone in Huizhou, SS Innovations is developing and testing an affordable, modular robotic surgical system capable of complex motion control. The company is working with a budget of around USD 15 million from the Chinese government to recruit and train talent worldwide.

Because Australia has been using robotic-assisted minimal access surgery (MAS) for approximately 20 years, the Australian medical robotics sector is well-sophisticated. Versius, a surgical robot designed to reduce the heavy physical demand on surgeons using conventional surgical robots, was recently introduced in Australia, demonstrating and securing the nation's position in the worldwide medical robotics industry.

Medical Robotic Systems Industry Overview

The Medical Robotic Systems Market is competitive as the majority of the market demand is satisfied by the advanced offerings from major players despite the presence of several players. The growth and competitiveness can be attributed to Western partnerships to improve healthcare, the developing of surgical robots by domestic manufacturers, and multiple government collaborations with regional universities for research and development purposes. These companies are adopting strategic collaborative initiatives to increase their market share and profitability. Some key market players include Intuitive Surgical Inc., Auris Surgical Rbots Inc., and iRobot Corporation.

In April 2023, Apollo Cancer Centres, Navi Mumbai, launched the fourth-generation advanced Da Vinci Xi Robotic System that can be used in the field of oncology, urology, colorectal surgeries, gynecology, thoracic, cardiology, pediatric and gastrointestinal surgeries, kidney transplants and in liver transplantation.

In February 2023, Global Hospital, a Mumbai-based hospital, launched Da Vinci Xi Robotic Surgical System. This robotic surgical system is designed to allow surgeons to perform minimally invasive surgeries precisely and safely. According to the company, this advanced system will be used in various surgical fields, including gynecology, urology, oncology, liver transplantation, cardiology, thoracic, pediatric, and gastrointestinal surgery, to improve patient outcomes and quality of life.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Prevalence of Diseases like Cancer Neurological Disorders, Orthopedic Surgery, and Cardiovascular Diseases

- 5.1.2 Rising Global Geriatric Population

- 5.1.3 Introduction of Cost-effective Medical Robots

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Installation and Maintenance

- 5.2.2 Safety and Security Concerns over Robotic Surgery Devices

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Surgical Robotic Systems

- 6.1.2 Rehabilitative Robotic Systems

- 6.1.3 Non-invasive Radiosurgery Robots

- 6.1.4 Hospital and Pharmacy Robotic Systems

- 6.1.5 Other Robotic Systems

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia Pacific

- 6.2.4 Rest of the World

- 6.2.4.1 Latin America

- 6.2.4.2 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accuray Incorporated

- 7.1.2 Auris Surgical Robotics Inc. (Hansen Medical Inc.)

- 7.1.3 Intuitive Surgical Inc.

- 7.1.4 Medrobotics Corporation

- 7.1.5 iRobot Corporation

- 7.1.6 Tital Medical Inc.

- 7.1.7 Stryker Corporation

- 7.1.8 Omnicell Technologies

- 7.1.9 Renishaw PLC

- 7.1.10 Mazor Robotics Ltd

- 7.1.11 MAKO Surgical Corp. (Stryker Corporation)

- 7.1.12 Hitachi Medical Systems

- 7.1.13 Siemens Healthineers AG

- 7.1.14 Smith & Nephew PLC