|

市場調査レポート

商品コード

1849809

金融クラウド:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Finance Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 金融クラウド:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月23日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

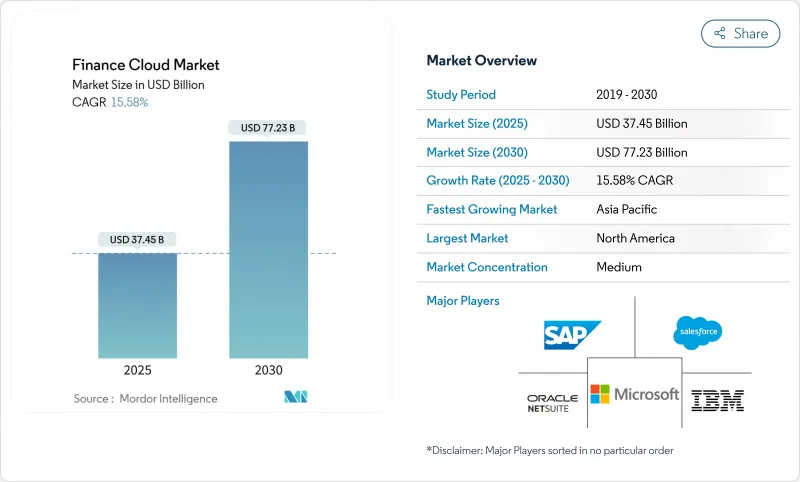

金融クラウド市場規模は、2025年に374億5,000万米ドル、2030年には772億3,000万米ドルに達し、CAGR 15.6%で成長すると予測されています。

デジタルファーストに対する消費者の期待の高まり、規制監督の強化、クラウドセキュリティフレームワークの成熟が、金融の中核ワークロードのパブリッククラウドやハイブリッドクラウドへの広範な移行を促進しています。欧州連合(EU)のデジタル・オペレーショナル・レジリエンス法(DORA)だけでも、約22,000の金融機関とそのテクノロジー・パートナーに対してICTリスク管理のアップグレードが義務付けられており、地域全体でプラットフォームの近代化が加速しています。同時に、世界の金融機関の98%がすでに少なくとも1つのクラウドサービスを利用しており、これは2020年の91%から増加し、金融クラウド市場がクリティカル・マスに達していることを裏付けています。クラウドインフラストラクチャ上でのジェネレーティブAIの展開は現在、自動照合からキャッシュフローの予測モデリングまで、あらゆるものを支えており、クラウドプロバイダーは競争力強化のための戦略的パートナーとなっています。北米の銀行は数千のアプリケーションを移行するために数十億米ドルの技術予算を投入し、アジア太平洋の金融機関は膨大なデジタル顧客ベースに対応するためにクラウドネイティブコアの規模を拡大しています。

世界の金融クラウド市場の動向と洞察

顧客関係管理の改善ニーズ

クラウドベースのCRMスイートは、金融機関に行動パターンをリアルタイムで把握させ、超パーソナライズされたオファーを可能にし、混雑した市場でのリテンションを向上させます。アジア太平洋地域の銀行は、1億人以上の顧客にサービスを提供するAIBankのマイクロサービス・コアに代表されるように、数千万の同時セッションをサポートできるクラウドプラットフォームを運用しています。これと並行して、北米の金融機関はクラウド・アナリティクスとロイヤルティ・エンジンを統合し、レガシーな金融機関の60%以上に依然として影響を与えている解約を削減しています。金融データは高度に規制されているため、ベンダーはプラットフォーム内の暗号化、監査証跡、規制当局を満足させながらクロスチャネルのオーケストレーションを可能にするデータ居住管理によって差別化を図っています。顧客生涯価値が極めて重要なKPIとなる中、金融クラウド市場は、銀行が老朽化したCRMツールを弾力性のあるAI対応の代替ツールに置き換えようとする意欲から、さらに勢いを増しています。

金融セクターにおける業務効率化の需要

金融のワークロードを消費型クラウドに移行することで、資本支出を変動運用コストに変換し、製品イノベーションのための資金を確保することができます。クラウドへの完全移行を完了した金融機関では、月末の決算サイクルが20~30%短縮され、規制当局への報告スピードも同様に向上したと報告されています。クラウドERPにネイティブに組み込まれた自動化機能により、手作業による仕訳が不要になり、サーバーレス・コンピューティングにより、パフォーマンスを低下させることなく、予測不可能な決済量の急増に対応できます。例えば、ディスカバー・ファイナンシャル・サービスは、季節的な支出のピーク時にリソースを融通するために、ハイブリッド・エステートに依存しています。マージンが厳しくなるにつれ、コスト・インカム・レシオは収益と並んで取締役会のダッシュボードに表示されるようになり、金融クラウド市場を引き続き推進する効率性の物語が強化されています。

クラウドベースのサイバー脅威の台頭

金融サービスは依然として高度な攻撃の最重要ターゲットであり、クラウド環境が脅威の標的を拡大しています。米国の規制当局の報告によると、重要な決済インフラを混乱させる身代金要求事件がエスカレートしており、銀行はゼロトラスト・アーキテクチャと拡張検知プラットフォームへの投資を倍増させる必要に迫られています。それに見合ったセキュリティの向上なしに機密データを移行することは、金融機関を年間IT予算を超えるほどの規制上の罰金にさらすことになります。クラウド・プロバイダーは、機密コンピューティング、ハードウェアに根ざした暗号化、ソブリン・クラウドの青写真で回答しているが、これらの管理を実装するにはコストと複雑さが伴うため、金融クラウド市場の短期的な加速は抑制されます。

セグメント分析

財務予測とプランニングセグメントは、2024年に38.3%の収益を維持します。これは、経済のボラティリティが高い状況が続く中、シナリオ・モデリングの普遍的なニーズを反映しています。クラウドベースのEPMスイートにより、財務チームは何千ものコストセンターにわたってローリング予測を作成し、データ主導の意思決定を強化することができます。統合されたドライバーベースのモデルは、金利や為替ショックの後、即座に利益見通しを更新し、移行の緊急性を強化します。同時に、リスク・コンプライアンス・レグテックは最も急成長しているソリューション分野であり、DORAやそれに匹敵する規制を背景に、2030年までのCAGRが15.9%で進んでいます。ベンダーはAPI対応の規制当局向けライブラリを組み込み、金融機関はワンクリックで詳細な取引データを監督当局に報告できます。継続的な管理モニタリング機能により監査準備作業の負荷が軽減され、コンプライアンス予算がそのまま金融クラウド市場の需要に反映されます。

コア会計および総勘定元帳プラットフォームは、他のすべてのクラウド財務モジュールのシステム・オブ・レコードのアンカーとして機能し、引き続き不可欠です。トレジャリーおよびキャッシュ・マネジメント・ツールは、不安定な資金調達市場がリアルタイムの流動性インサイトを優先させる中、新たな勢いを増しています。例えばシティグループは、クラウド・トレジャリー・ワークスペースを拡張し、グローバルなキャッシュポジションを分単位で集計できるようにしました。Workdayの最新リリースでは、人員計画と支出分析がバンドルされており、統合されたスイートがいかに企業のアライメントを向上させるかが明確に示されています。ベンダーがこれらの機能を統合データファブリックの下にパッケージ化することで、アップセルパイプラインが拡大し、金融クラウド市場における持続可能な収益ストリームが促進されます。

パブリック・クラウドは、ハイパースケーラのグローバルな事業展開、高度なセキュリティ認証、継続的なイノベーション・ロードマップにより、2024年の売上高の57.6%を占めています。銀行は日常的にマネージドPaaSデータベースを採用し、ハードウェアをプロビジョニングすることなく新製品の展開を加速させています。しかし、単一のプロバイダーへの依存は弾力性に懸念をもたらし、ハイブリッドおよびマルチクラウドの利用をCAGR17.0%で促進しています。欧州の金融機関は、規制当局が指摘する集中リスクを考慮し、超低遅延の取引エンジンをプライベート・クラウドに保持する一方で、ワークロードを少なくとも2つのベンダーに分割する傾向が強まっています。Form3のペイメント・プラットフォームはこの戦略の典型で、ルーティング・ロジックを抽象化することで、銀行が障害時にクラウド間でエンドポイントを切り替えられるようにしています。

プライベート・クラウドは、パフォーマンスやデータ保全の要件が厳しい使用事例には不可欠であることに変わりはないです。JPモルガン・チェースは、レイテンシーに敏感なリスク計算を支える4つの新しいプライベート・クラウド・データセンターに20億米ドルを費やしています。統一された観測可能性スタックとポリシー・アズ・コードは、混在する施設間の運用摩擦を軽減し、ハイブリッドを真にシームレスにします。規制当局が「出口計画」について明確に言及するようになったため、金融機関はロックインを回避するためにコンテナ化されたワークロードとオープンAPIを好むようになっています。

地域分析

北米は2024年の売上高の41.0%を占めたが、これはテクノロジー予算が潤沢であることと、規制が明確化されたことで移行が加速したためです。米国は、JPMorgan Chaseだけで年間170億米ドルを技術に割り当て、6,000のアプリケーションをクラウドプラットフォームに移行しています。カナダはオープンバンキングのガイドラインでセキュアなAPIエコシステムを奨励し、メキシコの銀行は国境を越えた報告基準を満たすためにクラウドを採用しています。サイバーセキュリティとデジタル・アイデンティティのフレームワークに関する官民協業は、採用リスクをさらに軽減し、この地域の金融クラウド市場を強化しています。プロバイダーは、高頻度トレーダーが要求する10ミリ秒以下のレイテンシーに対応するため、データセンターの集積度を高めています。

アジア太平洋地域は、2030年までのCAGRが16.2%と最も急成長している地域です。政府が推進するデジタル経済の青写真では、クラウドが金融包摂計画の中心に位置づけられ、2030年までに1兆米ドルに達すると予想される地域のデジタル経済価値を下支えしています。中国のAIBankは、コンテナ化されたプラットフォームで1億人以上の顧客にサービスを提供し、クラウドのスケーラビリティを実証しています。インドのパブリッククラウド政策により、規制と政策上の主体が厳格な暗号化キーのもとでコアデータをオフショアでホスティングできるようになり、ハイパースケーラの採用が拡大。日本とオーストラリアは、現地の監督機関向けに事前認証されたコンプライアンス成果物を提供するインダストリー・クラウド・モデルを承認しています。APACの銀行は、2030年までに利益プールの40%をデジタル隣接サービスが供給すると予想しており、手数料ベースの収益目標の上昇と相まって、これらの動向は金融クラウド市場の持続的な上昇を確実なものにしています。

欧州では、DORAの運用回復の指令の下、クラウドの近代化が加速しており、約22,000の金融組織に影響を及ぼしています。ドイツ、フランス、英国は、サイバーインシデントシミュレーションのための共有テストフレームワークを展開し、証拠収集を自動化するプラットフォームの採用を奨励。大手プロバイダーが運営するソブリン・クラウド地域はデータ主権条項を満たし、マルチベンダー戦略はシステミック・リスクを軽減します。南米は、2024年に20億米ドルの利益を計上したNubankのようなブラジルの支店のないチャレンジャーバンクが、完全にクラウドインフラストラクチャで運用しながら、高い成長を示しています。中東・アフリカではクラウドの導入が急速に進んでおり、中東・アフリカ地域の金融機関の83%がクラウドワークロードを利用しており、2年以内に年間2,114万米ドルのコスト削減を見込んでいます。湾岸協力理事会の銀行は、国家のクラウド指令を野心的なデジタルトランスフォーメーションのロードマップと整合させ、金融クラウド市場の新たな需要ポケットを固める。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 顧客関係管理の改善の必要性

- 金融セクターにおける業務効率化の需要

- リアルタイムの透明性と報告を求める規制の推進

- GenAI対応のセルフサービス財務分析

- クラウド支出を最適化するためのFinOpsの導入

- BFSI業界向け業界クラウドプラットフォーム

- 市場抑制要因

- クラウドベースのサイバー脅威の台頭

- レガシーコア統合の複雑さ

- クラウドFinOpsとデータエンジニアリングにおける人材ギャップ

- ベンダーロックインとGenAIのコスト超過

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済動向の市場への影響評価

第5章 市場規模と成長予測

- ソリューション別

- コア会計とGL

- 財務予測と計画

- リスク、コンプライアンス、Reg-Tech

- 財務および現金管理

- 給与計算と労働力財務

- 展開モデル別

- パブリッククラウド

- プライベートクラウド

- ハイブリッド/マルチクラウド

- エンドユーザー別

- 銀行業務

- 保険

- 資本市場

- フィンテック/ ネオバンク

- 企業規模別

- 大企業

- 中小企業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Oracle Corporation(Netsuite)

- SAP

- Microsoft

- Salesforce

- IBM

- Workday

- Sage Intacct

- Unit4/FinancialForce

- Intuit

- Anaplan

- Workiva

- BlackLine

- Coupa

- Xero

- FIS

- Fiserv

- Temenos

- Finastra

- Acumatica

- AWS

- Google Cloud

- Huawei