|

|

市場調査レポート

商品コード

1639393

電子棚札:市場シェア分析、産業動向&統計、成長予測(2025~2030年)Electronic Shelf Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電子棚札:市場シェア分析、産業動向&統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

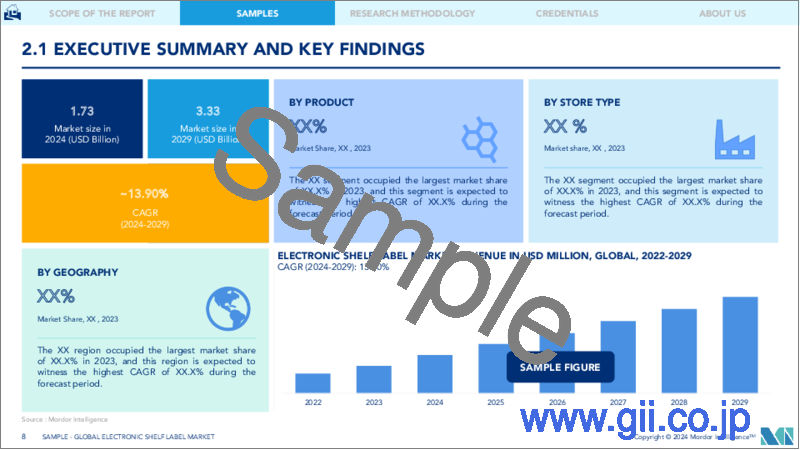

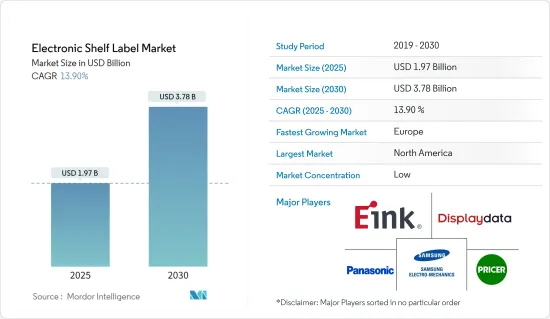

電子棚札の市場規模は2025年に19億7,000万米ドルと推計され、予測期間(2025-2030年)のCAGRは13.9%で、2030年には37億8,000万米ドルに達すると予測されます。

電子棚札(ESL)市場は、自動化強化、業務効率化、顧客体験向上のニーズを背景に、世界の小売セクターで導入が拡大しています。ESL技術は小売業に最新のソリューションを提供し、電子値札を通じてダイナミックな価格設定やリアルタイムでの商品情報更新を可能にします。小売自動化技術への大きな動向の一環として、ESLシステムは店舗内のオペレーションを合理化し、顧客とのやり取りを改善します。大手スーパーマーケットやハイパーマーケットでは、デジタル化が進む中で競争力を維持するため、スマート小売ソリューションの活用に特に力を入れています。

主なハイライト

- エネルギー効率の高い電子ペーパー棚ラベルが小売価格に革命を起こす:電子ペーパー棚ラベルは、消費電力が低く、小売環境におけるIoTとの互換性が高いことから人気を集めています。ワイヤレス棚ラベルは、小売業者の在庫管理と価格戦略をさらに変革しています。これらの技術は、従来の手間のかかる紙タグに代わって、集中管理システムから直接、電子価格表示の更新を可能にします。小売ディスプレイ技術の採用は、スマートストア・ソリューションとIoT主導の小売業務にとって極めて重要です。

- スマート小売ソリューションへの戦略的注力:小売企業は、業務効率と顧客満足度を向上させる大規模な戦略の一環として、ESLのようなスマート・リテール・ソリューションの導入を進めています。このシフトは、ダイナミックプライシングシステムの導入が進んでいることと一致しており、小売企業は需要や競合に基づいてリアルタイムで価格を調整することができます。しかし、特に初期投資や統合の複雑さに直面している小規模小売企業にとっては、課題も残されています。とはいえ、小売デジタルサイネージやその他のスマートストア技術に対する需要の高まりが成長を牽引しており、ESL技術の市場見通しは引き続き有望です。

市場イノベーションを促進する非接触決済技術

主なハイライト

- NFC統合によるESL機能の強化:近距離無線通信(NFC)技術は、小売業におけるESL採用の大きな原動力となっています。NFC対応機器はESLシステムと通信し、スマートフォンを通じて顧客にリアルタイムの商品情報やダイナミックプライシングを提供することができます。この動向は、小売業におけるIoTの台頭と密接に関連しており、企業はシームレスでコネクテッドなショッピング体験の創造を目指しています。電子価格表示システムをPOS(販売時点情報管理)インフラと統合することで、取引速度が向上し、全体的な顧客満足度が向上します。

- NFC技術は非接触型決済を促進します:NFC対応ESLシステムは、消費者がスマートフォンを通じてデジタル値札とやりとりできるようにすることで、ショッピングの利便性を高めます。NFCの普及が世界的に進むにつれ、小売業者は価格更新や販促、その他の小売自動化技術を一体化したシステムに統合する新たな機会を与えられています。この統合により、より迅速なチェックアウトプロセスと即時の価格調整が可能になり、顧客に応答性の高いショッピング体験を提供することができます。

- ESLと連動したダイナミックプライシングシステム:NFC対応ESLと統合されたダイナミックプライシングシステムは、小売体験に革命をもたらしつつあります。これらのシステムは、需要と供給の変動に基づいた即時の価格変更を可能にし、小売業者にペースの速い市場での競争力を与えます。NFC対応のモバイル決済システムを採用する消費者が増えるにつれ、ESLソリューションに対する需要は高まり、今後数年間の市場成長を牽引すると予想されます。

高額な初期投資が参入障壁に

主なハイライト

- 多額の初期費用がESLの採用を制限:ESL技術には長期的なメリットがあるにもかかわらず、その導入に伴う高額な初期費用が、中小小売企業にとって依然として大きな障害となっています。電子ペーパー棚ラベル、バッテリー、通信システムなどのハードウェアの購入費用や、既存のインフラへの統合費用などが、小売自動化技術への投資を躊躇させる要因となっています。この制約が、特に新興市場におけるESLシステムの導入を遅らせています。

- 初期コストは長期的な節約で相殺:ESLシステムへの先行投資は相当なものであるが、長期的な人件費の節約や価格設定の正確性の向上により、相殺されることが多いです。手作業による更新の必要性が減り、自動化システムの効率が向上するため、大手小売チェーンにとっては投資対効果の高いものとなります。しかし、小規模な小売企業は、既存のPOSや在庫管理プラットフォームにESLシステムを統合する際の複雑さに苦労するかもしれないです。

- 統合とメンテナンスの課題:小規模小売企業にとって、システムの保守やアップグレードは、さらなる課題となります。ESLシステムを既存の小売自動化技術と統合する際の技術的な複雑さがリソースを圧迫し、市場全体の成長を鈍らせる可能性があります。とはいえ、大規模な小売チェーンは、業務の効率化やリアルタイムの価格更新が期待できることから、ESLテクノロジーの採用を続けています。

電子棚札(ESL)市場動向

NFCモバイル決済が市場成長を後押しする見込み

- NFCの統合がESLに革命をもたらす:NFC技術の統合はESL市場を再構築し、消費者がスマートフォンを介してデジタル値札とやりとりし、より迅速なモバイル決済を可能にします。この技術革新により、取引速度が向上し、リアルタイムの商品情報が提供されるため、顧客のショッピング体験が向上します。

- ダイナミックプライシングによる店舗効率の向上:NFC対応ESLに接続された自動価格設定システムにより、小売業者は需要や競合、市場動向に基づいて即座に価格を調整することができます。このダイナミックプライシングシステムは、店舗が競争力を維持し、より効率的で迅速な小売環境を提供し、売上を向上させます。

- 電子ペーパー・テクノロジーが業務効率を改善:消費電力が最小限に抑えられ、鮮明で高解像度の表示が可能な電子ペーパー棚ラベルは、小売業で好まれる選択肢になりつつあります。これらのラベルは遠隔操作で更新できるため、手作業による価格変更の必要性が減り、スタッフの作業効率が向上します。小売業におけるIoT動向の一環として、ESLは在庫管理と店舗運営の改善に貢献しています。

- スマート小売ソリューションの需要拡大スマートストア・ソリューションへの需要が市場成長を牽引しており、NFC対応ESLシステムが中心的な役割を果たしています。小売企業は、顧客エンゲージメントと業務効率を高めるためにESL技術に投資しており、小売自動化技術の世界の拡大に貢献しています。

北米が主要市場シェアを占める

- 高度な小売インフラがESLの普及を後押し:北米は、小売自動化技術のインフラが進んでいることから、ESL市場をリードしています。米国とカナダの小売企業は、業務の効率化と顧客体験の向上というニーズを背景に、スマートストア・ソリューションの採用で最先端を走っています。この地域には大手小売チェーンが存在するため、電子価格表示システムの導入がさらに進んでいます。

- IoTの統合がリアルタイムの効率性を高める:北米の小売企業は、IoT対応のESLシステムを活用して、消費者行動、在庫レベル、価格動向に関するリアルタイムデータを収集しています。このデータにより、小売業者は、在庫管理、価格戦略、店舗運営を強化し、より多くの情報に基づいた意思決定を行うことができます。

- 小売デジタルサイネージと電子ペーパーラベルへの高い需要:北米の小売市場は競合が多いため、デジタルサイネージや電子ペーパー棚ラベルの需要が高まっています。これらの技術により、販促や価格のリアルタイム更新が可能になり、店舗内の効率と顧客体験が向上します。

- 良好な規制環境が成長を支える:米国では、技術革新に対する政府の支援が、ESLのような小売自動化ソリューションの採用を加速させています。小売業者はワイヤレス棚ラベルやダイナミックプライシングシステムなど、顧客中心の技術にますます注力するようになっており、北米はESL市場成長の主要地域となっています。

電子棚札(ESL)産業概要

多様なプレーヤーによる細分化された市場:ESL市場は非常に細分化されており、大企業と専門企業の両方が市場シェアを争っています。Samsung Electro-MechanicsやPanasonic Corporationのような大手世界企業が優位を占める一方、Pricer ABやDisplaydata Ltdのような企業は革新的なESLソリューションを提供しており、多様で競争の激しい市場環境となっています。

イノベーションを推進する主要企業E Ink Holdings Inc.、Displaydata Ltd.、Samsung Electro-Mechanicsなどの企業は、先進的な電子ディスプレイ技術で知られ、世界の小売部門に大きな影響力を持っています。これらの企業は、包括的な小売自動化ソリューションを提供することで、市場での地位を確固たるものにしています。

今後の市場の成功は技術の進歩が鍵を握る:ESL市場の将来を形成する主な動向として、リアルタイムの価格更新やスマート小売ソリューションに対する需要の高まりが挙げられます。継続的な成功のためには、企業はエネルギー効率の高いESLシステム、店舗管理システムとのシームレスな統合、ダイナミックな価格戦略をサポートする機能に注力する必要があります。ワイヤレス通信技術の進歩に伴い、大規模在庫に対応できる企業は競争力を維持できるでしょう。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場イノベーションを促進する非接触決済技術

- 市場抑制要因

- 高額な初期投資が参入障壁に

- 業界バリューチェーン分析

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 技術スナップショット

- 通信技術(RF、NFC、IRなど)

- コンポーネント(バッテリー、ディスプレイなど)

第6章 市場セグメンテーション

- 製品別

- LCD ESL

- 電子ペーパーESL

- 店舗タイプ別

- ハイパーマーケット

- スーパー

- 専門店・非食品小売店

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- E Ink Holdings Inc.

- Displaydata Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pricer AB

- Panasonic Corporation

- Altierre Corporation

- Diebold Nixdorf

- LG Corporation

- M2 Communication Inc.

- SES-imagotag

- Wincor Nixdorf AG

- AdvanTech Inc.

第8章 投資分析

第9章 市場機会と今後の動向

The Electronic Shelf Label Market size is estimated at USD 1.97 billion in 2025, and is expected to reach USD 3.78 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

The electronic shelf label (ESL) market has seen rising adoption across the global retail sector, driven by the need for enhanced automation, operational efficiency, and improved customer experiences. ESL technology provides a modern solution for retailers, allowing dynamic pricing and real-time product information updates through electronic price tags. As part of the larger trend toward retail automation technology, ESL systems streamline in-store operations while improving customer interactions. Large supermarkets and hypermarkets are especially keen on leveraging smart retail solutions to remain competitive in an increasingly digital landscape.

Key Highlights

- Energy-Efficient E-Paper Shelf Labels Revolutionize Retail Pricing: E-paper shelf labels are gaining popularity due to their low energy consumption and compatibility with IoT in retail environments. Wireless shelf labels have further transformed inventory management and pricing strategies for retailers. These technologies enable electronic price display updates directly from centralized management systems, replacing the traditional, labor-intensive paper tags. The adoption of retail display technology is critical for smart store solutions and IoT-driven retail operations.

- Strategic Focus on Smart Retail Solutions: Retailers are increasingly integrating smart retail solutions, like ESLs, as part of larger strategies to improve operational efficiency and customer satisfaction. This shift aligns with the growing adoption of dynamic pricing systems, allowing retailers to adjust prices in real-time based on demand and competition. However, challenges remain, especially for small retailers facing high initial investments and integration complexities. Nevertheless, the market outlook for ESL technology remains promising, with increasing demand for retail digital signage and other smart store technologies driving growth.

Contactless Payment Technologies Driving Market Innovation

Key Highlights

- NFC Integration Enhances ESL Capabilities: Near-field communication (NFC) technology has become a significant driver of ESL adoption in retail. NFC-enabled devices can communicate with ESL systems, offering customers real-time product information and dynamic pricing through smartphones. This trend is closely connected to the rise of IoT in retail, as businesses aim to create seamless, connected shopping experiences. Integrating electronic price display systems with point-of-sale (POS) infrastructure enhances transaction speeds and improves overall customer satisfaction.

- NFC Technology Facilitates Contactless Payments: NFC-enabled ESL systems enhance shopping convenience by allowing consumers to interact with digital price tags through their smartphones. As NFC penetration increases worldwide, retailers are presented with new opportunities to integrate price updates, promotions, and other retail automation technologies into a cohesive system. This convergence allows for faster checkout processes and immediate price adjustments, offering customers a highly responsive shopping experience.

- Dynamic Pricing Systems Linked to ESLs: Dynamic pricing systems integrated with NFC-enabled ESLs are revolutionizing the retail experience. These systems allow for immediate price changes based on fluctuating demand and supply, giving retailers a competitive edge in a fast-paced market. As more consumers adopt NFC-enabled mobile payment systems, the demand for ESL solutions is expected to rise, driving market growth in the coming years.

High Initial Investments Present a Barrier to Entry

Key Highlights

- Significant Upfront Costs Limit ESL Adoption: Despite the long-term benefits of ESL technology, the high initial costs associated with its implementation remain a major obstacle for smaller retailers. The expenses of purchasing hardware such as E-paper shelf labels, batteries, and communication systems, along with integration into existing infrastructure, deter some businesses from investing in this retail automation technology. This limitation slows down the adoption of ESL systems, particularly in emerging markets.

- Initial Costs Offset by Long-Term Savings: While the upfront investments in ESL systems are considerable, they are often offset by long-term savings in labor costs and increased pricing accuracy. The need for fewer manual updates and the improved efficiency of automated systems provide a strong return on investment for large retail chains. However, smaller retailers may struggle with the complexities of integrating ESL systems into existing POS and inventory management platforms.

- Challenges in Integration and Maintenance: For small retailers, maintaining and upgrading these systems presents additional challenges. The technical complexities of integrating ESL systems with existing retail automation technology can strain resources, slowing the market's overall growth. Nonetheless, larger retail chains continue to adopt ESL technology, driven by the promise of operational efficiency and real-time pricing updates.

Electronic Shelf Label (ESL) Market Trends

NFC Mobile Payment is expected to boost market growth

- NFC Integration Revolutionizes ESL: The integration of NFC technology is reshaping the ESL market, allowing consumers to interact with digital price tags via smartphones for faster mobile payments. This innovation enhances transaction speeds and offers real-time product information, elevating the customer shopping experience.

- Dynamic Pricing Improves Store Efficiency: Automated pricing systems connected to NFC-enabled ESLs allow retailers to adjust prices immediately based on demand, competition, and market trends. This dynamic pricing system helps stores stay competitive and offers a more efficient and responsive retail environment, boosting sales.

- E-Paper Technology Improves Operational Efficiency: E-paper shelf labels, which consume minimal energy and offer clear, high-resolution displays, are becoming a preferred choice in retail. These labels can be updated remotely, reducing the need for manual price changes and increasing staff efficiency. As part of the IoT trend in retail, ESLs contribute to better inventory management and store operations.

- Demand for Smart Retail Solutions Grows: The demand for smart store solutions is driving market growth, with NFC-enabled ESL systems playing a central role. Retailers are investing in ESL technology to enhance customer engagement and operational efficiency, contributing to the expansion of retail automation technologies worldwide.

North America to Hold a Major Market Share

- Advanced Retail Infrastructure Fuels ESL Adoption: North America leads the ESL market due to its advanced retail automation technology infrastructure. U.S. and Canadian retailers are at the forefront of adopting smart store solutions, driven by the need for operational efficiency and improved customer experiences. The presence of major retail chains in the region further drives the implementation of electronic price display systems.

- IoT Integration Boosts Real-Time Efficiency: North American retailers are leveraging IoT-enabled ESL systems to collect real-time data on consumer behavior, inventory levels, and pricing trends. This data allows retailers to make more informed decisions, enhancing inventory management, pricing strategies, and store operations.

- High Demand for Retail Digital Signage and E-Paper Labels: The competitive nature of the North American retail market is driving demand for retail digital signage and e-paper shelf labels. These technologies enable real-time updates on promotions and pricing, improving in-store efficiency and customer experiences.

- Favorable Regulatory Environment Supports Growth: Government support for technological innovation in the U.S. accelerates the adoption of retail automation solutions like ESLs. Retailers are increasingly focusing on customer-centric technologies such as wireless shelf labels and dynamic pricing systems, positioning North America as a key region for ESL market growth.

Electronic Shelf Label (ESL) Industry Overview

Fragmented Market with Diverse Players: The ESL market is highly fragmented, with both large corporations and specialized companies competing for market share. Major global players like Samsung Electro-Mechanics and Panasonic Corporation dominate, while firms such as Pricer AB and Displaydata Ltd offer innovative ESL solutions, contributing to a diverse and competitive market landscape.

Key Leaders Driving Innovation: Companies like E Ink Holdings Inc., Displaydata Ltd, and Samsung Electro-Mechanics are known for their advanced electronic display technologies and significant influence in the global retail sector. These companies have solidified their market positions by delivering comprehensive retail automation solutions.

Future Market Success Tied to Technological Advancements: Key trends shaping the future of the ESL market include the growing demand for real-time pricing updates and smart retail solutions. For continued success, companies must focus on energy-efficient ESL systems, seamless integration with store management systems, and the capacity to support dynamic pricing strategies. As wireless communication technologies advance, businesses capable of handling large-scale inventories will maintain a competitive edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Contactless Payment Technologies Driving Market Innovation

- 4.3 Market Restraints

- 4.3.1 High Initial Investments Present a Barrier to Entry

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

- 5.1 Communication Technology (RF, NFC, IR etc.)

- 5.2 Components (Batteries, Display etc.)

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 LCD ESLs

- 6.1.2 E-paper ESLs

- 6.2 By Store Type

- 6.2.1 Hyper Markets

- 6.2.2 Super Markets

- 6.2.3 Specialty Stores and Non-food Retail Stores

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E Ink Holdings Inc.

- 7.1.2 Displaydata Ltd

- 7.1.3 Samsung Electro-Mechanics Co. Ltd

- 7.1.4 Pricer AB

- 7.1.5 Panasonic Corporation

- 7.1.6 Altierre Corporation

- 7.1.7 Diebold Nixdorf

- 7.1.8 LG Corporation

- 7.1.9 M2 Communication Inc.

- 7.1.10 SES-imagotag

- 7.1.11 Wincor Nixdorf AG

- 7.1.12 AdvanTech Inc.