|

市場調査レポート

商品コード

1910569

フィールドプログラマブルゲートアレイ(FPGA)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Field Programmable Gate Array (FPGA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フィールドプログラマブルゲートアレイ(FPGA)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 144 Pages

納期: 2~3営業日

|

概要

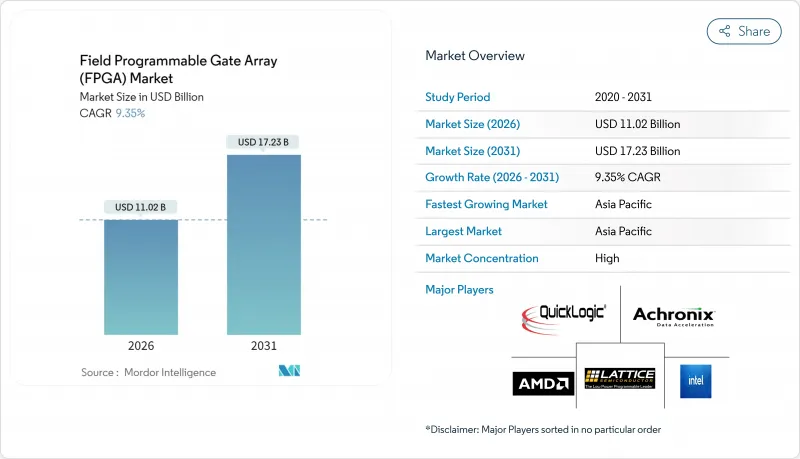

フィールドプログラマブルゲートアレイ(FPGA)市場は、2025年に100億8,000万米ドルと評価され、2026年の110億2,000万米ドルから2031年までに172億3,000万米ドルに達すると予測されています。

予測期間(2026年~2031年)におけるCAGRは9.35%と見込まれています。

ハイパースケールデータセンターにおけるエッジAI推論の急速な普及、5Gオープン無線アーキテクチャへの移行、ならびに自動車・航空宇宙電子機器分野における導入後の再構成可能性への需要増加が、市場に明確な成長の勢いをもたらしました。ハイエンドデバイスが収益の基盤を維持する一方、設計チームがFPGA技術をコスト重視の産業用・IoT・民生システムへ展開したことで、ミドルレンジおよびローエンド製品が急速に成長しました。アジア太平洋地域は、電気自動車用パワートレインや新宇宙コンステレーションの需要拡大により、最大の製造拠点かつ最速成長の需要センターとして台頭しました。インテルがアルテラを分離独立させることに合意した後、競合は激化し、サプライヤーの力学が再構築されました。一方、輸出規制は中国における並行した国内開発を促進しました。300mmファウンダリの生産能力の逼迫と、16nm以下のノードへの高コストな移行も、ベンダーに高収益アプリケーションの優先化と、TSMCおよびサムスンとの長期的なウエハー予約を迫りました。

世界のFPGA(フィールドプログラマブルゲートアレイ)市場の動向と洞察

ハイパースケールデータセンターにおけるエッジAI推論需要

ハイパースケール事業者は、レイテンシと電力予算が純粋なスループット要件を上回り始めた段階で、AI推論を加速させるためFPGAを導入しました。AMDのVersal AI Edge Gen 2デバイスは、第一世代製品と比較して最大3倍の高いTOPS/ワット効率を実現し、運用コストを抑えつつリアルタイムの映像解析を可能にしました。アクロニクス社は、大規模言語モデル実行時にGPU代替品と比較して200%のコスト・電力優位性を報告し、メモリ制約ワークロードにおけるFPGAの効率性を強調しました。この移行により、推論処理がデータソースに近接する分散型コンピューティングモデルが実現され、帯域幅制約とデータ主権リスクが緩和されました。主要FPGAファミリーへのオンパッケージHBMおよびハード化AIエンジンの統合は、クラウド・エッジトポロジーにおける地位を強化しました。その結果、フィールドプログラマブルゲートアレイ市場は、ハイパースケール資本支出計画において持続的な成長の柱を見出しました。

5G ORANの移行により、無線装置に再プログラム可能なロジックが必要に

オープン無線アクセスネットワーク構想により、通信事業者はベンダー非依存の無線ユニットを採用せざるを得なくなりました。これは、設備の全面的な更新ではなく、ソフトウェアアップグレードによる進化を可能にするものです。インテルのAgilexポートフォリオは10nm SuperFin技術を採用し、新たな5Gリリースに適応するソフトウェア定義無線を実現し、総所有コストを低減しました。ラティスセミコンダクターは、分散型ネットワーク向けにゼロトラストセキュリティとリアルタイム暗号化を提供するリファレンススタックで、このハードウェアを補完しました。AMDのZynq RFSoC DFEは、従来デバイスと比較してワット当たりの性能を倍増させ、コンパクトで電力制約のある無線ヘッド内部でのマルチバンド運用を可能にしました。柔軟なロジックは展開サイクルを短縮し、通信事業者がプライベート5G、固定無線アクセス、ミリ波サービスを統合する上で重要な要素となりました。この柔軟性は、通信インフラ全体におけるフィールドプログラマブルゲートアレイ市場に新たな大量導入の機会をもたらしました。

高性能FPGAの中国向け輸出規制(米国・EU)

米国産業安全保障局(BIS)の新規則により、2023年末に中国向け先進FPGAの民生用途免除が撤廃され、AIや軍事用途に適したデバイスの輸出が制限されました。この変更により、AMD-ザイリンクスとインテルーアルテラは多くの注文を停止またはライセンシングの対象とし、短期的な出荷台数が減少しました。GOWINやPangoなどの中国サプライヤーが供給ギャップの埋め合わせを図りましたが、設計ツール、IP、先進プロセスへのアクセスにおける障壁が即時の代替を制限しました。多国籍企業のお客様は、機密性の高い生産を中国から移転するか、非米国製デバイスに対応するようシステムを再設計し、従来の世界のサプライチェーンを分断しました。この結果生じた不確実性は、新たな貿易規範が安定するまで、フィールドプログラマブルゲートアレイ市場に重くのしかかりました。

セグメント分析

2025年時点で、ハイエンドデバイスはFPGA市場シェアの65.80%を占めました。これはデータセンター高速化や5Gインフラにおける中核的役割を反映しています。100万ロジックセルを超えるこれらのプラットフォームは高価格帯ながら、GPUでは実現不可能な確定的なレイテンシを提供。安全性が極めて重要な航空宇宙分野やフィンテックワークロードにおける需要を維持しました。中位および低位デバイスは、ラティス社などのメーカーがエッジコンピューティングの予算に適合するハードウェア実装済みAIエンジンを搭載したコスト最適化部品を出荷したことで、2031年までにCAGR10.85%を示しました。設計ツールはより直感的に進化し、ハードウェアの専門知識を持たない組込みエンジニアでも構成可能ロジックを採用できるようになりました。

AMDが消費電力30%削減かつ比類なきI/O数を誇るSpartan UltraScale+を導入し、上位からミドルレンジ市場に攻勢をかけることで、価値提案は進化しました。同時に、モジュールベンダーは事前検証済みボードを提供し、ピン配置計画やPCBレイアウトを抽象化することで設計サイクルを短縮しました。こうした変化により各階層間の価格差は縮小すると予想されますが、新たなAIやネットワーク規格が登場し、最上位ノードのシリコンのみが対応可能な場合、ハイエンドデバイスがフィールドプログラマブルゲートアレイ市場規模の大半を占め続ける見込みです。

SRAMベースのソリューションは、無制限の再プログラムサイクルと深いソフトウェアエコシステムにより、2025年に54.85%の収益シェアを獲得し、11.45%のCAGR見通しを示しました。一方、フラッシュベースのバリエーションは、即時起動が不可欠なウェアラブル機器や自動車テレマティクス分野で認知度を高めています。マイクロチップ社のRT PolarFireはMIL-STD-883クラスBを達成し、同等のSRAM部品より50%低い消費電力で100 kradの放射線耐性を実現しています。アンチヒューズプラットフォームは防衛航空電子機器分野でニッチを維持しており、ワンタイムプログラマビリティにより改ざんリスクを排除します。

ソフトウェアの移植性向上により従来の障壁が縮小したため、設計者はツールの習熟度ではなく消費電力とセキュリティに基づいて選択可能となりました。新興のヘテロジニアスアーキテクチャはSRAMファブリックとオンダイ不揮発性領域を統合し、両方の長所を提供します。SRAMデバイスがFPGA市場収益を牽引し続ける一方、フラッシュおよびアンチヒューズ製品は低消費電力・過酷環境用途でより大きなシェアを獲得する見込みです。

フィールドプログラマブルゲートアレイは、構成(ハイエンドFPGA、ミッドレンジ/ローエンドFPGA)、アーキテクチャ(SRAMベースFPGA、フラッシュベースFPGAなど)、技術ノード(90nm以上、20-90nm、16nm以下)、エンドマーケット(データセンター・クラウドコンピューティング、通信・5Gインフラ、自動車など)、地域(北米、欧州、アジア太平洋、南米、中東・アフリカ)ごとに分類されます。

地域別分析

アジア太平洋地域は2025年に39.10%の収益でFPGA市場を牽引し、2031年までCAGR16.20%の見通しを示しました。中国が推進する半導体自給自足政策は、電気自動車駆動装置や衛星ペイロード分野の国内イノベーターによって顕著となり、FPGAの大規模な需要を喚起しました。台湾と韓国は先進的な製造技術を提供し、日本は自動車用モジュールと工場自動化サブシステムを専門としています。ラティスがプネに研究開発センターを開設したことで、インドの設計サービス部門は進展し、エンジニアリング人材プールが拡大しました。

北米はデータセンターインフラ、高信頼性航空宇宙、EDAソフトウェア分野で主導権を維持しました。ハイパースケーラー企業はAIサービスコスト管理のため適応型アクセラレータへ巨額の資本予算を投入し、同地域の強い購買シェアを確保しました。輸出ライセンス審査が出荷パターンに影響を与えた一方、FPGA市場を支える先進パッケージング技術やOSAT(受託組立・テスト)能力への国内投資を促進しました。

欧州はドイツの自動車サプライチェーンと北欧の通信機器プロバイダーに依存しました。ISO 26262準拠が車載用途を促進する一方、エネルギー転換プロジェクトが低損失電力変換器の需要を生み出しました。EUデジタルデケイド政策は再構成性を重視する主権的エッジコンピューティングプラットフォームを奨励しました。南米、中東・アフリカは現在シェアが小さいもの、5Gインフラと産業近代化における成長可能性が予測期間中の貢献度向上に寄与する見込みです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3か月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ハイパースケールデータセンターにおけるエッジAI推論需要

- 5G ORAN移行に伴う無線機器における再プログラム可能ロジックの必要性

- ASIC/SoCの微細化サイクルにおける迅速なプロトタイピングの必要性(<=7 nm)

- 自動車分野における機能安全規格準拠(ISO 26262)

- 新宇宙コンステレーション向け耐放射線設計

- 中国EVパワートレインOEMメーカーにおけるモーター制御向けeFPGAの採用

- 市場抑制要因

- 米国・EUによる中国向け高性能FPGA輸出規制

- 300mmファウンダリ生産能力配分の変動性

- 専用ASICと比較した静的消費電力の増加

- バリューチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済動向がFPGA産業に与える影響

第5章 市場規模と成長予測

- 構成別

- ハイエンドFPGA

- ミドルレンジ/ローエンドFPGA

- アーキテクチャ別

- SRAMベースのFPGA

- フラッシュベースのFPGA

- アンチフィューズFPGA

- 技術ノード別

- 90nm以上

- 20~90 nm

- 16 nm以下

- エンドマーケット別

- データセンターおよびクラウドコンピューティング

- 電気通信および5Gインフラ

- 自動車(ADAS、電動化)

- 産業オートメーションおよびロボティクス

- 航空宇宙・防衛(航空電子機器、衛星通信)

- 民生用電子機器およびウェアラブル機器

- 試験、計測、医療機器

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- 北欧諸国(スウェーデン、ノルウェー、フィンランド、デンマーク)

- その他欧州

- アジア太平洋

- 中国

- 台湾

- 日本

- 韓国

- インド

- ASEAN

- その他アジア太平洋

- 南米

- メキシコ

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Advanced Micro Devices Inc.(Xilinx)

- Intel Corporation

- Lattice Semiconductor Corp.

- Microchip Technology Inc.(Microsemi)

- Achronix Semiconductor Corp.

- QuickLogic Corporation

- Efinix Inc.

- GOWIN Semiconductor Corp.

- Flex Logix Technologies Inc.

- NanoXplore SAS

- Anlogic Infotech Co. Ltd.

- Pango Microsystems Inc.

- Shenzhen S2C Ltd.

- BittWare(Molex Company)

- Digilent Inc.

- AlphaData Parallel Systems Ltd.

- Colfax International

- Reflex Ces SAS

- Aldec Inc.

- Beijing Tsinghua Tongfang Co. Ltd.