|

市場調査レポート

商品コード

1851321

クラウドサービスブローカー(CSB):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Cloud Services Brokerage (CSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クラウドサービスブローカー(CSB):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月01日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

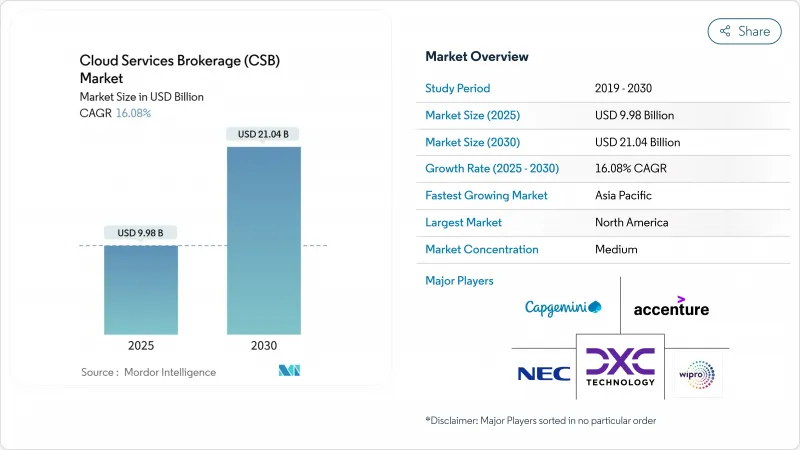

クラウドサービスブローカー市場の規模は、2025年に99億8,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは16.08%で、2030年には210億4,000万米ドルに達すると予測されます。

この成長は、複雑化するマルチクラウド環境を管理するための単一のガラスペインに対する企業のニーズを反映しています。特に欧州では、デジタルサービス法とデータ法が厳格なポータビリティと主権に関する規則を定めており、ブローカーによる管理に対する需要が高まっています。ブロードコムのVMware買収に代表されるサプライヤーの統合は、交渉力を維持し、ロックインを回避するために、多くのITリーダーを独立プラットフォームへと向かわせた。一方、ハイパースケーラのマーケットプレースは爆発的に拡大し、Amazon Web Services、Microsoft Azure、Google Cloudのエコシステムと連携するブローカーにとって有利な共同販売の道が生まれました。半導体の制約により地域のインフラコストが15~20%上昇するなど、サプライチェーンへの逆風は続いているが、コストガバナンスツールが不可欠であることが証明されたため、クラウドサービス仲介市場はこの圧力を吸収し続けています。

世界のクラウドサービスブローカー(CSB)市場の動向と洞察

ハイブリッドおよびマルチクラウドの採用急増

ハイブリッドおよびマルチクラウド戦略は今やCIOのロードマップを支配しており、2025年までに企業の92%がマルチクラウドアーキテクチャを追求すると予想されています。その結果、企業はベンダーのロックインを回避しながら、異種環境を統合されたポリシー・ドメインに統合するブローカー・プラットフォームを必要としています。金融サービス企業は、データ居住の義務化によってパブリッククラウドへの移行が全面的に禁止されているため、その最前線に立っています。オラクルとグーグル・クラウドの直接相互接続は、サービス・ブローカーがオープン・インターネットを横断することなく、低レイテンシーでクロス・クラウドのデータ・フローを可能にすることを示しています。コンテナの普及は複雑さを増しており、CSBはKubernetesのオーケストレーション機能を強化し、DevOpsチームがコンソール固有のスクリプトを操作しなくても済むようにする必要があります。エッジワークロードが混在する中、ブローカーはオンプレミス、パブリック、エッジノードにまたがる1つのガバナンスファブリックを提供し、スキルギャップと運用リスクを最小限に抑えます。

企業のクラウド支出加速

エンドユーザーのクラウド支出は、2025年には7,234億米ドルに達し、2024年の水準を21.20%上回る勢いです。大規模な請求書によって財務リーダーは予算超過にさらされ、FinOpsの洞察が取締役会レベルの義務に変わります。CSBのプラットフォームは現在、機械学習アルゴリズムを組み込んでおり、消費量の急増を予測し、自動的な適正化を行う。銀行はその緊急性を示しています。コミットされたクラウド支出の49%しか使用していないにもかかわらず、彼らはプレミアムGPUを必要とするAIモデルを実行するために、割り当てをさらに増やすことを計画しています。ブローカー主導のガードレールがなければ、多くのCFOは「請求書ショック」を恐れています。

セキュリティとコンプライアンスの懸念

共有責任モデルは、特にデジタルサービス法がクラウド事業者に新たな通知と措置のルールを課す場合、多くのリスク担当者を混乱させる。そのため、ブローカーは、接続されているすべてのプロバイダーにわたって、きめ細かなアクセス制御、ジオフェンシング、改ざん防止監査ログをサポートする必要があります。このような深い機能を実装することは、研究開発コストを上昇させ、バイヤーが徹底的な侵入テストの証拠を要求するため、販売サイクルが長くなります。アイデンティティ管理は依然として最も難しい要素である:CSBは、最小特権のデフォルトを維持しながら、Azure AD、AWS IAM、Google Identity間で認証情報をフェデレートしなければならないです。

セグメント分析

外部Brokerage Enablementプラットフォームは、ベンダーに依存しない魅力と成熟した機能セットにより、2024年のクラウドサービス仲介市場シェアの48%を占めました。一方、内部ブローカレッジ・イネーブルメントは、企業のDevOpsパイプラインにクラウド・ガバナンスをネイティブに組み込もうとする経営陣の動きを反映して、CAGR 18.70%で推移すると予測されます。フォーチュン500の銀行や通信事業者がServiceNow、Jira、CI/CDスタックにリンクした特注のポータルを立ち上げるにつれて、社内プラットフォームに関連するクラウドサービス・ブローカー市場の規模は2030年までに2倍以上になると予測されています。

このような社内の急増は、プラットフォームエンジニアリングの人員数の増加や、TerraformとVaultの自動化を1つ屋根の下で提供するHashiCorpのIBMによる64億米ドルの買収のような戦略的買収に乗じています。社内CSBはまた、長期的にライセンス費用を削減し、セキュリティチームがコードレベルで組織固有のコントロールを導入できるようにします。外部ベンダーは、より迅速なTime-to-Valueと常時利用可能なマーケットプレース統合を提供することで、レガシー、社内、SaaSを一括管理する「ブローカー・オブ・ブローカー」レイヤーとしての地位を確立しています。

パブリック・クラウド・サービスは、拡大し続けるハイパースケーラのアベイラビリティ・ゾーンに後押しされ、2024年のクラウド・サービス・ブローカー市場の54%を維持します。しかし、ハイブリッド・クラウドの導入はCAGR 20.30%で加速しています。EUのソブリン・イニシアチブは、MicrosoftのEU Sovereign Cloudが明示的にターゲットとしているパターンである、規制対象データをオンプレミスに残し、アナリティクスをパブリックな容量に弾力的にバーストさせるアーキテクチャへと購入者を誘導しています。

エッジ・コンピューティングはハイブリッドの採用をさらに後押ししています。製造業はレイテンシが重要なワークロードを工場で処理することを望んでいるからです。ブローカーは現在、ローカルのKubernetesクラスタとクラウドのバックエンドを結びつけ、ワンクリックでワークロードのモビリティを実現しています。5Gプライベート・ネットワークが普及するにつれて、CSBコンソールが従来のIaaSリソースと一緒にオンプレミスのMECノードを管理することが期待されます。

クラウドサービスブローカー(CSB)市場レポートは、プラットフォーム別(内部ブローカー支援、外部ブローカー支援)、展開モデル別(パブリッククラウド、プライベートクラウド、ハイブリッドクラウド)、企業別(中小企業、大企業)、エンドユーザー産業別(IT・通信、銀行、金融サービス、保険、小売・消費財、その他)、地域別に分類されています。

地域分析

北米は、クラウドの早期成熟と濃密なパートナーエコシステムにより、2024年の世界売上高の44%を維持。サーベンス・オクスリー法(Sarbanes-Oxley)やHIPAA報告を合理化するブローカーに引き寄せられ、金融サービスとヘルスケア・プロバイダーが採用の中心となっています。半導体不足により地域のラックコストは上昇を続けているが、ブローカーは低コストのゾーンにワークロードを最適配置することで、その影響を軽減しています。連邦政府機関や防衛請負業者が国内データ居住の保証を求め、ブローカーにFedRAMP Highコントロールの認証を促しているため、主権クラウドの話題は大きくなっています。

アジア太平洋地域は、2030年までのCAGRが18.50%と最も急速に成長している地域です。インドから日本まで、各国政府は「クラウドファースト」の指示を出しており、クラウドコンピューティングによる地域のGDP増加は0.25%~2.23%と推定されています。さくらインターネットのような日本のプロバイダーは現在、仲介機能を国内のクラウドにバンドルし、国境を越えたデータ転送規則を警戒する企業にアピールしています。一方、台湾と韓国の半導体製造クラスターは、地政学的リスクとバランスを取りながら、国内のデータセンター展開のための部品供給を確保しています。

EUデータ法とGAIA-Xは、厳格なポータビリティと主権目標を定めています。マイクロソフトのソブリン・クラウド・ロードマップやオラクルのEU規制クラウドは、ブローカーのオーバーレイに適したサービス環境を示唆しています。UAE、サウジアラビア、ブラジルの国家デジタル経済プログラムは、ハイパースケーラ地域の立ち上げに資金を提供しており、接続性のギャップが解消されれば、ブローカーの取り込みのための肥沃な土壌を形成しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ハイブリッドおよびマルチクラウドの導入急増

- 企業のクラウド投資の加速

- コストとガバナンスの一元化の必要性

- ハイパースケーラー・マーケットプレースの併売ブーム

- CSBにおけるAI主導のFinOps

- ソブリン・クラウド・コンプライアンス層

- 市場抑制要因

- セキュリティとコンプライアンスへの懸念

- CSBの価値に対する中小企業の認知度の低さ

- ネイティブ・ハイパースケーラ・ツールがCSBをカニバリゼーション

- 手数料圧縮がマージンを圧迫

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- ライバルの激しさ

第5章 市場規模と成長予測

- プラットフォーム別

- 内部ブローカー支援

- 外部ブローカー支援

- 展開モデル別

- パブリック・クラウド

- プライベートクラウド

- ハイブリッド・クラウド

- 企業規模別

- 中小企業

- 大企業

- エンドユーザー業界別

- IT・通信

- 銀行、金融サービス、保険

- 小売・消費財

- ヘルスケアとライフサイエンス

- 政府・公共部門

- 製造業

- メディアとエンターテイメント

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Accenture

- IBM

- Wipro

- Capgemini

- DXC Technology

- NEC

- NTT Data

- Cognizant

- Jamcracker

- VMware

- Flexera(RightScale)

- Ingram Micro Cloud

- Arrow Electronics(CloudBlue)

- AppDirect

- Pax8

- Cloudmore

- Boomi

- DoubleHorn

- TietoEVRY

- Tech Mahindra