|

市場調査レポート

商品コード

1851579

署名検証:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Signature Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 署名検証:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月06日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

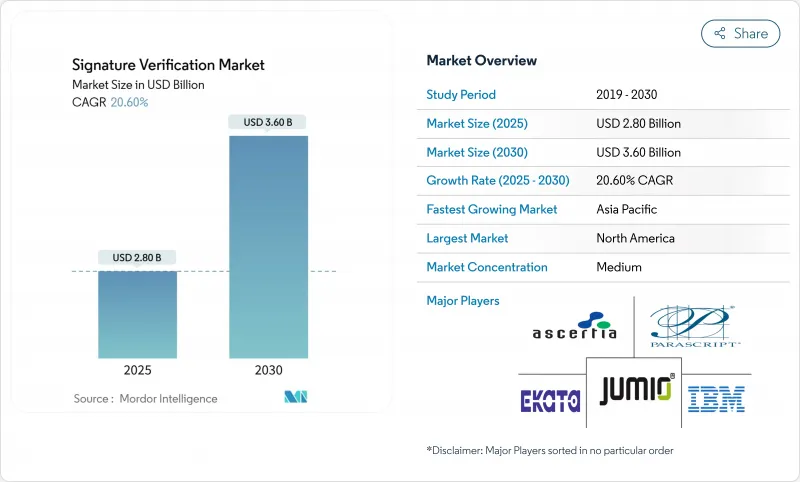

署名検証市場は2025年に28億米ドルに達し、2030年には36億米ドルに成長すると予測され、予測期間のCAGRは20.6%です。

欧州ではeIDAS 2.0、米国では21 CFR Part 11がその勢いを加速させており、いずれも規制部門に信頼性の高いデジタル署名検証の採用を促しています。不正被害の増加、AIによる偽造分析の進歩、クラウドへの急速な移行が需要をさらに高めています。AIによる郵便投票処理からAadhaarにリンクしたウォレットまで、政府プログラムは使用事例と地理的範囲を拡大しています。一方、マルチモーダル認証とAPIファーストのデリバリーモデルは、署名検証市場全体の競争ポジショニングを再構築しています。

世界の署名検証市場の動向と洞察

eIDAS 2.0と米国CFR Part 11に基づくコンプライアンスの義務化

eIDAS 2.0は、2026年までにすべてのEU市民が相互運用可能なデジタルIDウォレットを保有することを義務付け、認定されたトラストサービスプロバイダに裏打ちされた適格な電子署名の基準を引き上げています。同時に、FDAガイダンスが更新され、監査証跡とリスクベースのバリデーションが強調され、製薬スポンサーはAI対応の署名検証プラットフォームへの移行を迫られています。その結果、多国籍企業は両制度を満たす統一された検証アーキテクチャを求め、グローバルなポリシーコンプライアンスが可能なクラウドプレイヤーを中心とした統合が加速しています。

2024年選挙後の郵送投票署名チェックの急増

米国では31の州で不在者投票に署名検証が必要となり、高スループットのシステムに対する需要が高まっています。ノースカロライナ州の試験運用では、自動化されたプラットフォームが1時間あたり1,000枚の投票用紙を処理し、手作業による審査時間を95%削減することが実証されました。その後カリフォルニア州では、スピードよりも監査性を重視し、手作業によるフェイルセーフを備えたテクノロジー支援レビューが義務付けられました。多文化間の署名のばらつきや年齢による変化に対応できるベンダーは、選挙機関が正確性、裁決の透明性、規制当局による監査機能に対価を支払うため、割高な価格設定となっています。

キャプチャーデバイス間のばらつきとレガシーサイロの統合

組織は多くの場合、署名パッド、タブレット、モバイルアプリのパッチワークに依存しており、それぞれが異なる解像度とサンプリングレートでデータを生成します。アルゴリズムは、一貫性のない圧力カーブやタイミングデータを補正する必要があり、これは不合格率を高め、総所有コストを増加させます。最新の検証をレガシーな記録システムと統合すると、データがサイロ化されて全体的な不正分析ができなくなるため、複雑さが増します。小規模な金融機関では、ハードウェアの交換が認識されるメリットを上回るため、アップグレードが先延ばしされ、セキュリティの向上が期待できるにもかかわらず、短期的な導入が抑制されています。

セグメント分析

2024年の署名検証市場の58%をソフトウェアが占めました。これは、ウェブ、モバイル、支店の各チャネルでリアルタイムの不正検知を実現するクラウドネイティブAIモデルの普及を反映しています。署名パッドのようなハードウェアデバイスは、規制された環境では依然として定着しているが、リモートワークフローが主流になるにつれ、そのシェアは低下し続けると思われます。ソフトウェア分野は、銀行、ヘルスケア、政府機関のポータルに認証を組み込むSDKに後押しされ、2030年までCAGR 23.7%を記録すると予測されます。ベンダーは、静的な画像比較の上に行動分析を重ねることで、手作業によるレビューの割合を減らし、意思決定の待ち時間を短縮しています。エッジ展開可能なモデルは、接続が断続的な場所にも対応し、ロジスティクスやフィールドサービスの使用事例への訴求力を高めています。また、継続的なモデルの再トレーニングにより、ベンダーは顧客側でコードを変更することなく、新たな攻撃パターンに対応できるようになり、署名検証市場におけるソフトウェアの構造的優位性が明確になりました。

ハードウェアは、成長は鈍化しているもの、ウェットインク署名の物理的保管が譲れないニッチな関連性を維持しています。裁判所、公証人、一部のライフサイエンス研究所では、暗号化タイムスタンプを付加する認証されたデバイスを使用した、対面でのキャプチャを依然として要求しています。しかし、これらの業界では、調達サイクルは依然として長く、資本予算は固定され、改修コストは高いです。クラウドの経済学が意思決定基準を運用支出にシフトさせる中、多くのバイヤーは現在、耐用年数終了時にデバイスを段階的に廃止し、モバイル・キャプチャーとバックエンドのAI検証に移行しています。この移行は、ソフトウェア中心のビジネスモデルの優位性を強化し、プロバイダーが1回限りのハードウェア販売ではなく、サブスクリプションの収益源に重点を置くことを確実なものにしています。

2024年の署名検証市場規模の55%はオンプレミスで、これは規制の厳しい銀行、保険会社、ライフサイエンス企業が監査やレイテンシーの観点からローカル管理を好んだためです。しかし、クラウド/SaaSの導入は2030年まで毎年28.2%ずつ増加し、スケールメリットと普遍的なAPIリーチによって導入ベースの格差が縮小すると予測されています。クラウドプラットフォームは、モデルのトレーニングを集中化された環境に集中させ、ディープフェイクの脅威に対する精度を研ぎ澄ます多様なデータセットを活用します。弾力的なコンピュート・プロビジョニングは、アイドル状態のインフラ支出を削減します。これは、投票のピーク時にワークロードを集中的に処理する選挙管理委員会にとって重要な利点です。

地域クラウド・ゾーンは、GDPRとeIDAS 2.0に基づくデータ居住の義務付けをサポートし、統一されたポリシー・エンジンを維持します。署名の成果物のローカルストレージとクラウドベースの推論を組み合わせたハイブリッドアーキテクチャは、慎重な採用企業にとってコンプライアンスに適した橋渡しとなります。プロバイダーは、アップタイムSLA、自動化されたパッチ適用、シームレスな機能ロールアウトによって価値提案を強化します。企業が、運用の俊敏性を、認識されたソブリンリスクよりも上回ると結論付けるにつれ、署名検証市場は、SaaSサブスクリプションへのシフトを加速させる態勢を整えています。

地域分析

北米は2024年の売上高の34%を占め、成熟した規制体制とベンチャー支援によるイノベーション・エコシステムに支えられています。各州は2024年サイクル以降、選挙の完全性を高めるために自動投票用紙署名システムを導入し、選挙管理委員会の急速なアップグレードを促しました。金融機関も、高度化・大規模化する小切手詐欺を阻止するため、AI分析を活用して入金時の微妙な署名のずれを検出するシステムの導入を拡大した。USAAの継続的なライセンシングの勝利は収益を生むが、遠隔預金モジュールを統合する銀行のコンプライアンス・コストを上昇させる。この地域はFDA Part 11の監査対応に重点を置いているため、署名の証明とチェーン・オブ・カストディを文書化する専門プラットフォームへの需要がさらに高まっています。

アジア太平洋地域は、2025年から2030年のCAGRが25.44%と最も高くなると予測され、インドのAadhaarと連動したウォレットとモバイル決済エコシステムの急成長がその要因となっています。膨大な取引量と頻発する詐欺事件が、インド準備銀行によるKYC基準の厳格化を促し、銀行がオンボーディング・ワークフローにマルチモーダル署名検証を組み込むよう促しています。日本と韓国は指静脈や行動バイオメトリクス調査を進め、しばしばこれらのテクノロジーと署名分析を組み合わせて信頼性の高い企業ログインを実現しています。クラウド・ハイパースケールは国内アベイラビリティ・ゾーンを通じて、署名検証市場がグローバルな脅威インテリジェンス・フィードを活用しながらも、厳格な居住規則を満たすことを保証します。

欧州の成長シナリオはeIDAS 2.0を中心に展開されます。eIDAS 2.0は適格な電子署名を正式化し、域内の国境を越えた相互運用性を強制するものです。認定トラスト・サービス・プロバイダーは、署名ペイロードに埋め込まれたデジタル証明書の発行において極めて重要な役割を果たし、アルゴリズム検証の技術的要件を高めています。ブレグジットは英国とEUのワークフローを複雑にし、ベンダーはシームレスなユーザー体験を約束しながら、二重のコンプライアンス・スタックを維持することを余儀なくされます。プライバシー・バイ・デザインに対するGDPRの期待により、プロバイダはフェデレーテッド・ラーニングのテクニックを採用し、管轄の境界を越えて署名の成果物をエクスポートすることなくモデルをトレーニングする必要に迫られています。その結果、欧州のバイヤーは、アルゴリズムの精度と実証可能なプライバシー保護措置を比較検討し、両方を提供するベンダーを選好します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- eIDAS 2.0と米国CFR Part 11に基づくコンプライアンス指令

- 2024年選挙後の郵送投票署名チェックの急増

- AIベースの小切手詐欺分析を促進する金融犯罪被害

- 電子署名スイートへのクラウドネイティブAPIの組み込み

- GenAIの偽造署名検出アルゴリズム

- インドのAadhaar連動デジタル署名ウォレット(UPI 3.0)

- 市場抑制要因

- キャプチャデバイス間のばらつきとレガシーサイロの統合

- 多文化有権者名簿の高いFRRが訴訟に飛び火

- データ主権による国境を越えたモデルトレーニングの制限

- 特許訴訟リスク(例:MITK vs USAA)

- バリュー/サプライチェーン分析

- 規制情勢

- 技術的展望(AI、エッジ、GenAI)

- ポーターズファイブフォース

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- ソリューションタイプ別

- ハードウェア

- サインパッドとセンサー

- バイオメトリック端末/キオスク

- ソフトウェア

- 静的(オフライン)検証

- ダイナミック(オンライン)検証

- SDK/APIプラットフォーム

- ハードウェア

- 展開モデル別

- オンプレミス

- クラウド/SaaS

- 認証モード別

- スタンドアロン署名

- マルチモーダル(署名+ 文書画像/ID/活性化)

- エンドユーザー業界別

- 金融サービス

- 政府と選挙

- ヘルスケア

- 輸送と物流

- 法律と不動産

- その他の業界

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Mitek Systems Inc.

- Parascript LLC

- IBM Corp.

- Adobe Inc.

- DocuSign Inc.

- Ascertia Ltd

- Jumio Corp.

- Ekata Inc.

- Acuant Inc.

- SutiSoft Inc.

- CERTIFY Global Inc.

- Scriptel Corp.

- iSign Solutions Inc.

- Veriff

- Hitachi Ltd.(Biometric systems)

- HID Global(Assa Abloy)

- Signicat AS

- Topaz Systems Inc.

- Aratek Biometrics

- Biometric Signature ID