|

市場調査レポート

商品コード

1687271

フォトニック集積回路:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Photonic Integrated Circuit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フォトニック集積回路:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

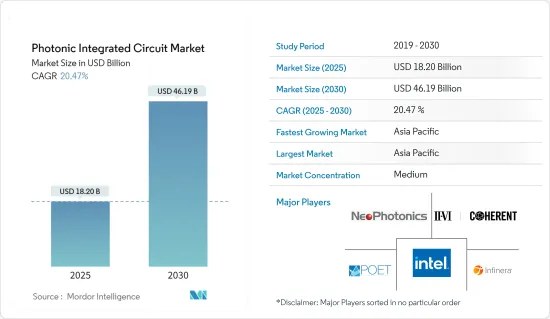

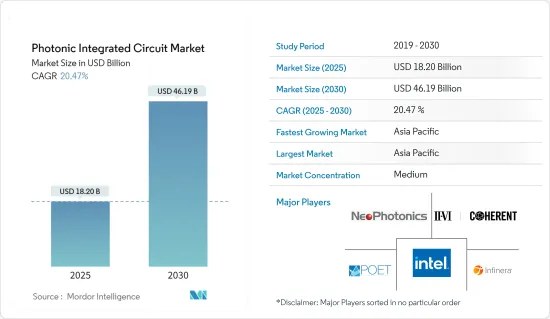

フォトニック集積回路の市場規模は2025年に182億米ドルと予測され、予測期間中(2025~2030年)のCAGRは20.47%で、2030年には461億9,000万米ドルに達すると予測されます。

用途の拡大が光集積回路市場を牽引

主要ハイライト

- フォトニック集積回路(PIC)市場は、通信やデータセンターでの用途拡大により力強い成長を遂げています。PICは従来の集積回路に比べて優れた性能を発揮し、高速化、帯域幅の拡大、電力効率の改善などの利点を記載しています。これらの利点により、PICはデータセンターの短距離接続や長距離光通信ネットワークの破壊的技術となっています。

- 効率の改善:PICはクリティカルな用途の消費電力を少なくとも50%削減します。

- 周波数の優位性:PICの周波数はマイクロエレクトロニクスの1,000倍から1万倍高いです。

- より高いエネルギー効率:この技術は、従来のICよりもエネルギー効率に優れながら、はるかに高い周波数をサポートします。

通信とデータセンター用途が成長の原動力

主要ハイライト

- 通信は、高速インターネット通信システムへの需要の高まりにより、PICの採用が広がっています。モバイルデータ使用量は毎年約40%拡大しており、PICは帯域幅ニーズを満たす上で重要な役割を果たしています。北米はモバイルデータ消費でリードしており、2023年末にはトラフィックがスマートフォン1台あたり月48GBに達すると予測されています。

- スペースとコストの節約:光通信システムに組み込まれたPICは、スペース、電力、コストを大幅に削減します。

- 容量の増強:この技術により、トランスミッションの容量が増加すると同時に、新たな機能を実現できます。

- データセンターの革新:データセンターにおける長距離通信ネットワーク用のハイブリッドフォトニクスは、フォトニックデータを電気信号に変換して処理し、フォトニックスイッチングコンポーネントへの移行を促進します。

- 投資と調査が小型化を推進:PICの小型化は、自動車、航空、通信などのセグメントで推進されています。各社は、分光計やLiDARのような機器に使用される、より小型でコスト効率が高く、信頼性の高いPICを開発しています。

- 最近の進歩:2020年8月、研究者は最大11Gbit/sのスイッチング速度を持つ最小のオンチップ光変調器を開発しました。

- Mitsubishiのイノベーション:同社は、プロセッサの機能を拡大するための新しいシリコンフォトニクスビルディングブロックを探求しています。

- センサと計測における新たな用途:ADAS(先進運転支援システム)用のLiDARを含む光センサでPICの使用が増加しており、市場を後押ししています。機械や検査などの産業で高精度距離センサの需要が増加していることも、市場成長に寄与しています。

- Intelの投資:Mobileyeは2025年までに次世代LiDAR技術にPICを採用する予定。

- 新たな提携:タワー・セミコンダクターはアネロフォトニクスと提携し、自動車LiDARやその他の向けに低損失シリコン光導波路技術を開発しています。

- 市場力学と将来展望:戦略的パートナーシップと買収が市場を定義し、各社は新規契約を獲得し、さまざまなセグメントに進出しています。PIC市場の将来は有望で、シリコンフォトニックチップは今後3年間でデータセンター間の高速データ伝送に普及すると予想されます。

- パートナーシップ主導の成長:2022年3月、AnsysとGlobalFoundries(GF)は、フォトニック設計能力を強化するために提携しました。

- 長期的な予測:AlibabaのDAMOアカデミーは、シリコンフォトニックチップが5~10年以内にさまざまなコンピューター産業で電子チップに取って代わるだろうと予測しています。

フォトニック集積回路の市場動向

データセンターセグメントが市場を独占

フォトニック集積回路(PIC)市場をリードしているのはデータセンター用途で、2021年の市場シェアの67.88%を占めます。この優位性は、高速データ伝送のニーズとクラウドコンピューティングインフラの急速な拡大によってもたらされています。

- トラフィックの急増シスコのCloud Indexでは、2021年までに北米で年間7.7ZBのクラウドトラフィックが発生すると予測しており、効率的なデータ処理に対するニーズの高まりを浮き彫りにしています。

- データセンターの集中:米国には約2,600のデータセンターがあり、これは世界全体の33%に相当します。

- 共同イノベーション:IBM、Intel、Ciscoなどの企業が、学界や政府と協力してPICベースのソリューションを開発しています。

- 成長予測:このセグメントは、2021年の54億2,964万米ドルから2027年には174億8,597万米ドルに成長し、CAGRは19.96%になると予測されています。

アジア太平洋が大きな成長を確認

アジア太平洋は、PIC市場において最も急成長している地域であり、技術の進歩と投資の増加により、2022~2027年のCAGRは23.36%になると予測されます。

- 市場の急増:アジア太平洋のPIC市場は、2021年の16億1,515万米ドルから2027年には61億5,074万米ドルに成長すると予測されます。

- 革新的なブレークスルー:2021年11月、イリノイ大学の調査チームは、音波を使って光を分離・調整する小型フォトニック回路を作成しました。

- 戦略的パートナーシップ:2022年のアンシスとジーエフの提携のように、この地域のデータセンターとスーパーコンピューティングのためのフォトニック設計の進歩を推進しています。

- 政府の支援:オンタリオ・フォトニクス産業ネットワークなどの官民イニシアチブが、この地域のPICイノベーションを後押ししています。

フォトニック集積回路産業概要

競合情勢分析:フォトニック集積回路(PIC)市場は少数の世界的企業によって支配されており、Neophotonics Corporation、Poet Technologies、II-VI Incorporated、Intel Corporationなどの企業が市場を主導しています。これらの企業は地域情勢に強く、強固な市場シェアを有しており、産業の競合情勢を形成しています。

技術的リーダーシップ:主要企業は研究開発に多額の投資を行い、技術革新と小型化に注力しています。例えば、II-VI Incorporatedの高効率多機能メタレンズは、超小型光センサ用に設計されています。

戦略的パートナーシップ:コラボレーションは、市場でのリーダーシップを維持するための鍵です。アンシスとGFとのパートナーシップはその一例であり、フォトニクス設計能力をセグメント横断的に拡大しています。

将来の成功に向けた戦略:PIC市場で将来の成功を目指す企業は、いくつかの重要な戦略に注力すべきです。

研究開発投資:R&D投資:PIC技術の進歩、特に小型化と集積化への投資は極めて重要です。

費用対効果の高いソリューション:製造コストを下げ、拡大性を向上させるために製造能力を拡大する必要があります。

パートナーシップと協力関係:POET TechnologiesとLiobate Technologiesのような戦略的パートナーシップは、より迅速な製品開発を可能にします。

多様化:自動車、航空宇宙、バイオメディカル産業など、従来のセグメントを超えた新たな用途を開拓することで、新たな市場機会が開かれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- 主要マクロ経済要因が市場に与える影響の評価

第5章 市場力学

- 市場促進要因

- 通信とデータセンターにおける用途の成長

- PIC小型化のための投資と研究

- 用途の拡大が光集積回路市場を牽引

- センサと計測における新たな用途

- 市場課題

- 従来型ICへの需要継続

- 光ネットワークの容量不足

第6章 市場セグメンテーション

- 原料タイプ別

- III-V材料

- ニオブ酸リチウム

- シリカ・オン・シリコン

- その他

- 統合プロセス別

- ハイブリッド

- モノリシック

- 用途別

- 通信

- バイオメディカル

- データセンター

- その他の用途(光学センサ(LiDAR)、計測機器)

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- NeoPhotonics Corporation

- POET Technologies

- II-VI Incorporated

- Infinera Corporation

- Intel Corporation

- Cisco Systems Inc.

- Source Photonics Inc.

- Lumentum Holdings

- Caliopa(Huawei Technologies Co. Ltd)

- Effect Photonics

- Colorchip Ltd

第8章 投資分析

第9章 市場の将来

The Photonic Integrated Circuit Market size is estimated at USD 18.20 billion in 2025, and is expected to reach USD 46.19 billion by 2030, at a CAGR of 20.47% during the forecast period (2025-2030).

Growing Applications Drive Photonic Integrated Circuit Market

Key Highlights

- The Photonic Integrated Circuit (PIC) market is experiencing robust growth due to expanding applications in telecommunications and data centers. PICs provide superior performance compared to traditional integrated circuits, offering advantages like higher speed, increased bandwidth, and improved power efficiency. These benefits make PICs a disruptive technology for short-range connections in data centers and long-haul optical communication networks.

- Efficiency improvement: PICs reduce power consumption in critical applications by at least 50%.

- Frequency advantage: PIC frequencies are 1,000 to 10,000 times higher than those of microelectronics.

- Higher energy efficiency: The technology supports much higher frequencies while being more energy-efficient than traditional ICs.

Telecommunications and Data Center Applications Fuel Growth:

Key Highlights

- Telecommunications is seeing widespread PIC adoption due to the growing demand for high-speed internet communication systems. With mobile data usage expanding by about 40% annually, PICs play a key role in meeting bandwidth needs. North America leads in mobile data consumption, with traffic forecasted to reach 48 GB per month per smartphone by the end of 2023.

- Space and cost savings: PICs integrated into optical communication systems provide significant space, power, and cost reductions.

- Capacity enhancement: The technology increases transmission capacity while enabling new functionalities.

- Data center innovations: Hybrid photonics for long-haul communication networks in data centers convert photonic data to electrical signals for processing, facilitating the shift towards photonic switching components.

- Investments and Research Drive Miniaturization: The push for miniaturizing PICs is driven by sectors like automotive, aeronautics, and telecommunications. Companies are developing smaller, cost-effective, and reliable PICs for use in devices like spectrometers and LiDAR.

- Recent advances: In August 2020, researchers developed the smallest on-chip optical modulator with a switching speed of up to 11 Gbit/s.

- Mitsubishi's innovations: The company is exploring new silicon photonics building blocks to extend processor capabilities.

- Emerging Applications in Sensors and Metrology: The rising use of PICs in optical sensors, including LiDAR for Advanced Driver Assistance Systems (ADAS), is boosting the market. The increasing demand for high-precision distance sensors in industries like machinery and inspection contributes to market growth.

- Intel's investment: Mobileye plans to use PICs in its next-gen LiDAR technology by 2025.

- New collaborations: Tower Semiconductor's partnership with AnelloPhotonics is developing low-loss Silicon Optical Waveguide technology for automotive LiDAR and other applications.

- Market Dynamics and Future Outlook: Strategic partnerships and acquisitions define the market, with companies securing new contracts and expanding into different sectors. The future of the PIC market looks promising, with silicon photonic chips expected to become widespread in high-speed data transmission between data centers over the next three years.

- Partnership-driven growth: In March 2022, Ansys and GlobalFoundries (GF) partnered to enhance photonic design capabilities.

- Long-term predictions: Alibaba's DAMO Academy predicts silicon photonic chips will replace electronic chips in various computer industries within 5-10 years.

Photonic Integrated Circuit Market Trends

Data Center Segment Dominates Market

Data center applications are leading the Photonic Integrated Circuit (PIC) market, accounting for 67.88% of the market share in 2021. This dominance is driven by the need for high-speed data transmission and the rapid expansion of cloud computing infrastructure.

- Traffic surge: Cisco's Cloud Index forecasts North America generating 7.7 ZB of cloud traffic annually by 2021, highlighting the growing need for efficient data processing.

- Data center concentration: The U.S. has about 2,600 data centers, representing 33% of the global total, creating a sizable market for PIC solutions.

- Collaborative innovation: Companies like IBM, Intel, and Cisco are developing PIC-based solutions in collaboration with academia and government.

- Growth forecast: The segment is projected to grow from USD 5,429.64 million in 2021 to USD 17,485.97 million by 2027, with a CAGR of 19.96%.

Asia-Pacific Witness Major Growth

Asia-Pacific is the fastest-growing region in the PIC market, expected to achieve a CAGR of 23.36% between 2022 and 2027, driven by technological advancements and increasing investment.

- Market surge: The Asia-Pacific PIC market is forecasted to grow from USD 1,615.15 million in 2021 to USD 6,150.74 million by 2027.

- Innovative breakthroughs: In November 2021, researchers at the University of Illinois created a miniature photonic circuit using sound waves to isolate and regulate light.

- Strategic partnerships: Collaborations like the one between Ansys and GF in 2022 are driving advancements in photonic design for data centers and supercomputing in the region.

- Government support: Public-private initiatives, such as the Ontario Photonics Industry Network, are boosting PIC innovation in the region.

Photonic Integrated Circuit Industry Overview

Competitive Landscape Analysis: The Photonic Integrated Circuit (PIC) market is dominated by a few global players, with companies such as Neophotonics Corporation, Poet Technologies, II-VI Incorporated, and Intel Corporation leading the market. These companies have strong geographical presence and robust market shares, shaping the competitive landscape of the industry.

Technological leadership: Leading companies invest heavily in research and development, focusing on innovation and miniaturization. For example, II-VI Incorporated's high-efficiency multifunctional metalenses are designed for ultracompact optical sensors.

Strategic partnerships: Collaborations are key to maintaining market leadership. Ansys' partnership with GF is one example, expanding photonic design capabilities across sectors.

Strategies for Future Success: Companies aiming for future success in the PIC market should focus on several critical strategies:

R&D investment: Investing in the advancement of PIC technology, particularly in miniaturization and integration, is crucial.

Cost-effective solutions: Expanding manufacturing capabilities to lower production costs and improve scalability is necessary.

Partnerships and collaborations: Strategic partnerships like POET Technologies' with Liobate Technologies will enable faster product development.

Diversification: Exploring new applications beyond traditional sectors, including automotive, aerospace, and biomedical industries, will open new market opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of Key Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Applications in Telecommunications and Data Centers

- 5.1.2 Investments and Research to Miniaturize the PICs

- 5.1.3 Growing Applications Drive Photonic Integrated Circuit Market

- 5.1.4 Emerging Applications in Sensors and Metrology

- 5.2 Market Challenges

- 5.2.1 Continued Demand for Traditional ICs

- 5.2.2 Optical Networks Capacity Crunch

6 MARKET SEGMENTATION

- 6.1 By Type of Raw Material

- 6.1.1 III-V Material

- 6.1.2 Lithium Niobate

- 6.1.3 Silica-on-silicon

- 6.1.4 Other Raw Materials

- 6.2 By Integration Process

- 6.2.1 Hybrid

- 6.2.2 Monolithic

- 6.3 By Application

- 6.3.1 Telecommunications

- 6.3.2 Biomedical

- 6.3.3 Data Centers

- 6.3.4 Other Applications (Optical Sensors (LiDAR), Metrology)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NeoPhotonics Corporation

- 7.1.2 POET Technologies

- 7.1.3 II-VI Incorporated

- 7.1.4 Infinera Corporation

- 7.1.5 Intel Corporation

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Source Photonics Inc.

- 7.1.8 Lumentum Holdings

- 7.1.9 Caliopa (Huawei Technologies Co. Ltd)

- 7.1.10 Effect Photonics

- 7.1.11 Colorchip Ltd