|

市場調査レポート

商品コード

1906991

電気自動車充電ステーション:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Electric Vehicle Charging Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電気自動車充電ステーション:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

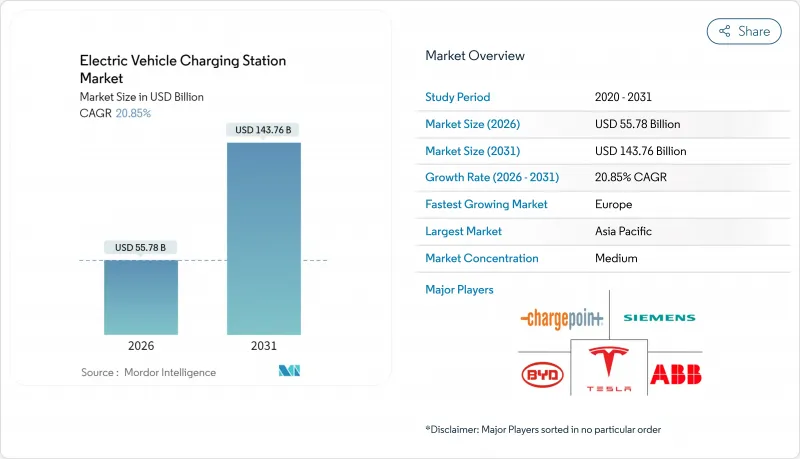

2026年の電気自動車充電ステーション市場規模は557億8,000万米ドルと推定され、2025年の461億3,000万米ドルから成長が見込まれます。

2031年までの予測では1,437億6,000万米ドルに達し、2026年から2031年にかけてCAGR20.85%で拡大する見通しです。

内燃機関の段階的廃止に向けた継続的な政策圧力、総所有コストの均衡化を前倒しする急激なバッテリーコスト低下、走行距離不安を解消する高速道路急速充電回廊の展開が、需要を急激に押し上げる中核的な要因となっております。大規模フリート事業者は複数年にわたる電動化目標を確定し、充電器の高稼働率を保証する一方、V2G(車両から電力網への電力供給)ビジネスモデルが追加収益層を創出し、プロジェクト収益性を向上させております。設置台数では依然としてアジア太平洋地域が最大ですが、欧州では国境を越えたネットワーク連携を背景に、現在最も急速な増加率を示しています。北米では、NEVIフォーミュラプログラムとテスラ社のスーパーチャージャーシステム他ブランド開放が展開を加速させると同時に、技術基盤への期待値を高めています。一方、シェルなどのエネルギー大手は石油スタンドを閉鎖し、資本を高出力充電器へ再配分しており、競合激化を促す戦略的転換を示しています。

世界の電気自動車充電ステーション市場の動向と洞察

政府主導のゼロエミッション義務化と内燃機関車禁止スケジュール

規制の勢いにより充電インフラの展開が加速しています。各国政府が拘束力のあるゼロエミッション車義務化政策を実施し、具体的な充電容量要件を定めているためです。EUの代替燃料インフラ規制では、加盟国に対しEV登録台数に比例した充電容量の増強を義務付けています。同時にカリフォルニア州の先進的クリーンフリート規則では、公共・民間フリート事業者に業種別期限までにゼロエミッション車への移行を求めています。中国国家発展改革委員会は2024年、高速道路サービスエリアの充電インフラを拡充し、充電スタンド3,000基と駐車スペース5,000台分を追加。これにより同国における新エネルギー車の市場浸透率40.9%を支えています。サウジアラビアが2025年までに5万基の充電ステーション設置を公約し、アラブ首長国連邦が2050年までに電気自動車またはハイブリッド車の割合を50%とする目標を掲げることで、新興市場にも規制圧力が及んでいます。こうした義務付けは予測可能な需要シグナルを生み出し、充電インフラへの民間資本投入を正当化するものです。これにより投資リスクが軽減され、市場拡大が加速します。

バッテリー単価の低下による総所有コスト(TCO)の均衡化

バッテリーコストの低減は、電気自動車が内燃機関車と総所有コスト(TCO)で同等となる臨界点に近づいており、充電インフラ需要を促進しています。主要調達契約ではリチウムイオンパック価格が100米ドル/kWhを下回りつつあり、使用頻度の高いセグメントにおいて電気自動車がガソリン車と同等のコスト競争力を獲得する一助となっています。炭化ケイ素インバーターなどの部品革新は充電効率を向上させエネルギー損失を低減し、事業者にとって設置キロワット当たりの対応可能車両数を増加させます。また、安価なバッテリーは、資本支出を車両群全体で分散させる交換ステーションモデルを可能にし、電気自動車充電ステーション業界におけるサービス形態の多様化を促進します。バッテリーコストの低下と充電効率の向上が相まって相乗効果を生み、充電時間の短縮とインフラ利用要件の低減が導入経済性を加速させます。特に商用車両運営事業者はこの動きから恩恵を受け、バッテリーコストの低下により小型化・高頻度化された充電セッションが可能となり、運用柔軟性の最適化が図られます。

150kW超充電器の高額な初期設備投資

高出力充電インフラの資本支出要件は、特に独立系事業者や新興市場において導入障壁となります。P3グループの欧州eトラック充電インフラ分析によれば、2030年までに45,000基の公共充電ポイントと235,000基のデポ充電ポイントが必要と予測され、高初期資本支出と送電網拡張の長期承認プロセスが主要課題と特定されています。カリフォルニア州エネルギー委員会の調査によれば、直流急速充電ステーションは資金調達面で大きな課題に直面しており、採算性を高めるためには需要料金軽減による年間4,300米ドルの節約効果と、太陽光発電統合による4,780~6,000米ドルの節約効果が必要です。大型車両向けに最大3.75MWを供給可能なメガワット級充電システムの導入には、設置場所ごとに100万米ドルを超える大規模な電気インフラのアップグレードが求められます。特に高い設備投資(CAPEX)要件は、利用率が投資を正当化できない可能性のある地方やサービスが行き届いていない地域での導入を制約し、充電インフラの可用性に地理的な格差を生み出しています。

セグメント分析

2025年時点で乗用車が電気自動車充電ステーション市場の88.45%を占めておりますが、商用車は2031年までにCAGR52.20%と最も急速な成長を示しており、これはフリート電動化義務に伴うインフラ要件を反映したものです。バスは重要な商用セグメントであり、都市部の大気質規制と予測可能な運行ルートパターンにより充電インフラの最適配置が可能となるため、電動化が加速しております。二輪車は新興市場で普及が進んでおり、特にインドではバッテリー交換モデルが経済的に有効であることが証明されています。トラックは重量制約と運用上の要求から最も高度な充電インフラを必要とし、高出力充電システムやデポベースのソリューションにおける技術革新を推進しています。

商用車の電動化は、充電インフラ投資を正当化する基幹需要を生み出します。フリート事業者は予測可能な利用パターンを提供し、乗用車よりも高い電力要件を有するためです。CharINはオスロで開催されたEVS35においてメガワット充電システムを正式に発表し、商用車がディーゼル車と同等の運用性能を達成可能とする最大3.75MWの充電容量基準を確立しました。乗用車向けインフラは商用車の導入により恩恵を受けます。充電回廊の共有化により単位当たりのインフラコストが削減され、車種を問わずネットワーク利用率が向上するためです。

直流充電ステーションは2025年時点で電気自動車充電ステーション市場の77.95%のシェアを維持し、予測期間中はCAGR53.10%で加速しました。これは充電セッション時間の短縮と処理能力向上を目指す事業者戦略が牽引したものです。オークリッジ国立研究所はワイヤレス充電技術において画期的な成果を達成し、5インチのエアギャップを隔てて乗用車へ96%の効率で100kWの電力伝送を実証しました。これは従来のコネクター式充電に革新をもたらす可能性があります。22kW未満のAC充電は主に住宅や職場向けアプリケーションに利用され、長時間の駐車時間が低速充電に対応できる一方で、利用頻度が低い設置環境におけるコスト優位性を維持します。商用車向けメガワット級充電システムの登場により、専用の電気インフラと冷却システムを必要とする独自の超高電力カテゴリーが形成されています。

SAEインターナショナルは、無線式小型EV充電に関する新基準を公表しました。これには、異なるサプライヤーのハードウェア間で相互互換性を実現する差動誘導位置決めシステム(DIPOS)が含まれ、最大93%の効率を達成します。ワイヤレス充電技術は、摩耗や破壊行為のリスクがある物理的なコネクターを排除することで、ユーザーの利便性への懸念に対応し、インフラのメンテナンス要件を軽減します。高出力充電システムへの移行は、事業者の経済性を反映しています。充電時間の短縮により、特に土地コストが高いため高速充電が正当化される交通量の多い場所において、ステーションの利用率向上と投資収益率の改善が可能となります。

地域別分析

アジア太平洋地域は2025年に60.10%のシェアで電気自動車充電ステーション市場をリードします。中国における1,282万基の公共コネクタと年間25%の設置増加がこれを支えています。国家プログラムにより現在6,000ヶ所の高速道路サービスエリアに設備が整備され、長距離カバー率が同国における40.9%の新エネルギー車販売構成比を反映しています。日本では大型トラック向けメガワット級システムの導入が先行し、インドでは二輪車向けバッテリー交換ステーションが低コスト移動需要による充電器密度向上の可能性を示しています。韓国は貿易摩擦の中で代替電池材料供給国としての地位を確立しつつあり、オーストラリアは広大な都市間距離を埋めるため遠隔地回廊サイトへの資金提供を進めています。

欧州は2031年までにCAGR40.50%と地域で最も急速な成長を示しています。スパーク・アライアンスは25カ国に11,000基の高出力コネクターを統合し、透明性のある価格設定と100%再生可能電力を提供しています。ドイツは2030年までに100万基以上の新規充電ポイント設置を計画しており、これはインフラ割当をEV登録台数に連動させるEU規制に沿ったものです。ノルウェーは世界最高の人口当たり充電器数を維持し、フランスは低金利融資で民間設置を促進しています。英国は2035年からのガソリン車新規販売禁止政策に加え、公共充電器での決済カード相互運用性を義務化し、消費者の信頼をさらに強化しています。

北米ではNEVI計画による50億米ドルの資金投入で加速し、20万4千の公共充電ポートが整備されます。7社の自動車メーカーが参画するIONNA事業では3万基の高出力コネクターが追加され、テスラ・スーパーチャージャーの他ブランド対応改修により、2030年までに60億~120億米ドルの追加収益が見込まれます。業界横断的な連携により、充電と小売施設の連携が進み、欧州のサービスステーション戦略を反映した形となります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3か月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 政府主導のゼロエミッション義務化と内燃機関車禁止スケジュール

- バッテリー単価($/kWh)の低下による総所有コスト(TCO)の均衡化

- 高速道路急速充電回廊の世界の整備

- 物流大手企業による電気自動車導入計画の急増

- グリッドサービス収益化(V2G/V2X)ビジネスモデル

- AI最適化による充電器設置の改善が稼働率向上に寄与

- 市場抑制要因

- 150kW超充電器における高額な初期設備投資費用

- 不均一な許可取得と電力会社接続のスケジュール

- SiC MOSFETの原材料供給不足

- ネットワーク接続型充電器におけるサイバーセキュリティ上の脆弱性

- 規制情勢

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測(金額)

- 車両タイプ別

- 乗用車

- 商用車

- バスおよび長距離バス

- 充電器タイプ別

- AC充電ステーション

- 直流充電ステーション

- 所有別

- 一般

- プライベート- 住宅

- プライベート- フリート/職場

- 設置場所別

- ホーム

- 目的地/小売

- 高速道路/公共交通機関

- フリートデポ

- コネクタ規格別

- CCS

- CHAdeMO

- GB/T

- Tesla NACS

- ワイヤレス

- 地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 南米

- ブラジル

- チリ

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- ノルウェー

- イタリア

- スペイン

- オランダ

- ポーランド

- オーストリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- インドネシア

- ベトナム

- フィリピン

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- トルコ

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ABB Ltd.

- ChargePoint Inc.

- Tesla Inc.

- Siemens AG

- Schneider Electric Corporation

- Shell Plc.

- ENGIE SA(EVBox)

- BYD Motors Inc.

- Tritium Charging Inc.

- Blink Charging o.

- Delta Electronics Inc.

- Kempower Oyj

- Electrify America, LLC

- IONITY GmbH

- Leviton Manufacturing Co. Inc.