|

市場調査レポート

商品コード

1850067

自動車用サスペンションシステム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Automotive Suspension System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用サスペンションシステム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月18日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

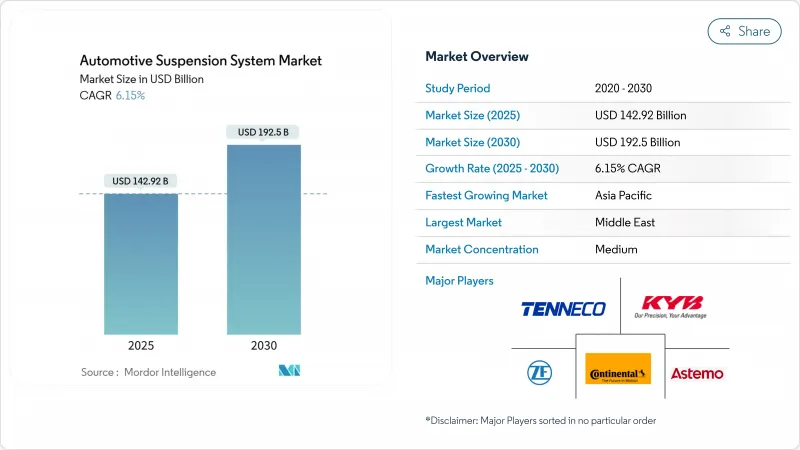

自動車用サスペンションシステム市場の2025年の市場規模は1,429億2,000万米ドルで、2030年にはCAGR 6.15%で成長し1,925億米ドルに達すると予測されます。

この市場拡大は、電動化、ソフトウェアで定義された車両アーキテクチャ、強化される安全義務によって、どの地域でもシャーシコンポーネントが再構築されることを反映しています。自動車メーカーは、純粋に機械的なレイアウトから、乗り心地、エネルギー回生、バッテリー電気プラットフォームのパッケージング制約のバランスをとる電子制御のセミアクティブ設計やアクティブ設計に切り替えつつあります。センサー、コントロールユニット、クラウド接続がサスペンション戦略の中心となり、空中で継続的な性能アップデートが可能になりました。同時に、レアアース材料や半導体のサプライチェーンが不安定なため、材料集約度を下げ、調達先を多様化する再設計が迫られています。このような背景から、自動車用サスペンション・システム市場は、機械的なノウハウと高度なエレクトロニクス、ソフトウェア、データ分析を融合させることのできるプレーヤーに報われ続けています。

世界の自動車用サスペンションシステム市場の動向と洞察

乗り心地とハンドリングの向上に対する需要の高まり

静かで振動のない車内に対する消費者の期待の高まりにより、自動車メーカーはあらゆる価格帯でリアルタイム減衰力制御を組み込むようになっています。磁気レオロジーダンパーは、流体の粘度を数ミリ秒以内に調整するもので、MagneRideのようなシステムで実用化された機能です。電気自動車はエンジン音がないため、サスペンションのハーシュネスがわずかでも乗員に伝わるため、この焦点はさらに大きくなります。シェアード・モビリティ・フリートや自律走行プロトタイプは、運転から切り離された乗員が乗り心地を鋭く意識するようになるため、監視のレイヤーがさらに増えます。サプライヤーは、加速度計、ストロークセンサー、エッジプロセッサーを統合し、エネルギー消費を最小限に抑えながらホイールごとに減衰力を調整することで対応しています。

電動化主導のシャシー再設計

バッテリーパックは車両の重心を下げるが、数百キログラム増加するため、サスペンションエンジニアは、強度を損なうことなく質量の増加に対抗する複合リンクと中空スタビライザーバーを採用するよう促されます。静電回生ダンパーの調査によると、ピーク時のエネルギー回収率は45%で、車両のエネルギー管理ロジックと統合した場合、5.25g/kmのCO2削減に相当します。

スマート・サスペンション・アーキテクチャの高い初期コストとライフサイクルコスト

アクティブ・システムは、モーター、ソレノイド・バルブ、加速度センサー、ドメイン・コントローラーを組み合わせるため、パッシブ・セットアップに比べて車両1台あたり数百ドルのコスト増となります。OEMは、義務化されるか多額の補助金が出ない限り、薄利多売の主流セグメントでこのようなコストをバンドルすることをためらう。また、サービス・プロバイダーにとって専門的な診断ツールやキャリブレーション・リグが必要になるため、総所有コストも上昇します。このような経済性により、普及はプレミアムトリムに限定され、基礎技術が成熟しても大衆市場への普及は遅れます。

セグメント分析

2024年におけるショックアブソーバーのシェアは39.07%に達し、エネルギー放散の中核要素としてのショックアブソーバーの永続的な役割が確認されます。しかし、電子制御ユニットとセンサーは、ADAS統合、エッジ処理能力の向上、クラウドリンクアップデートへの軸足によって支えられ、CAGR 9.82%で最速の上昇を見せています。自動車用サスペンション・システム市場は、複数の安全機能をホストするようになった制御モジュールの恩恵を受け、OTAキャリブレーションが可能になり、ハードウェア改訂の必要性が減少しました。その結果、エレクトロニクスに起因する自動車用サスペンション・システムの市場規模は、2024年のベースラインから2030年までに倍増する勢いです。コイルスプリングとリーフスプリングは、耐久性が精巧さを凌駕する商業輸送で依然として普及しているが、空気ばねは高級セダンとハイルーフのバンでシェアを伸ばしています。

ソフトウェア定義の車両ロードマップは、車輪走行センサー、ロードセル、ステアリングエンコーダからのデータを編成しながら、制御ユニットをASIL-Dの安全レベルを満たすモジュラーコンピュータノードに変えます。AIが支援する予測アルゴリズムは、クラウド由来の路面情報を減衰戦略にフィードバックし、予測不可能な路面でもプロアクティブな制御を実現し、乗員の快適性を高めます。機械部品とデジタル・インテリジェンスの融合は、両領域を大規模に製造できるサプライヤーの競合を強化し、自動車用サスペンション・システム市場を前進させる。

パッシブ構成は、シンプルでランニングコストが低いため、2024年の自動車用サスペンション・システム市場規模において65.28%のシェアを維持した。しかし、セミアクティブセッティングは、フルアクティブデザインのようなエネルギー消費と部品点数を伴わずに有意義な乗り心地向上を実現するため、CAGR12.04%を記録しています。この採用はまた、ZFのEasyTurnアクスルのような新しいステアリング革新の下支えにもなっており、このアクスルはステアリングロックを80度まで高め、市街地での俊敏性を向上させています。

磁気レオロジー・バルブと電気機械式バルブは、ミリ秒単位の減衰力シフトを可能にし、高速操縦時の車体のロールとピッチを平らにします。クラウドソースによるポットホールマップから得られる予測分析と組み合わせることで、セミアクティブシステムはアクティブに近いパフォーマンスエンベロープを達成します。予測期間中、バッテリーのエネルギー密度が上昇し、回生ダンパーが動作損失を相殺するにつれて、アクティブ・サスペンションの認知度が高まる可能性があるが、自動車サスペンション・システム市場において有利なコスト・ベネフィット・レシオのおかげで、セミアクティブ設計が増加台数の大部分を占めると予想されます。

地域分析

アジア太平洋地域は、2024年の自動車用サスペンション・システム市場の48.96%のシェアを占めており、中国の規模とインドの急速な生産能力増強に支えられています。北京の新エネルギー車補助金と厳しい乗り心地ベンチマークが、大衆向けセダンへのセミアクティブ・ダンピングの採用を後押ししています。同時に、インドのOEMは小型商用トラックの積載効率を向上させるために軽量複合スプリングを組み込んでいます。インドのAutomotive Mission Plan 2047のような政府の制度は、高価値のシャーシアッセンブリーの現地生産を支援し、地域供給の弾力性を強化しています。日本と韓国のサプライヤーは、精密バルブ、スマートブッシング、ソフトウェアスタックに貢献し、先進サスペンションキットを世界中に輸出するエコシステムに厚みをもたらしています。

中東・アフリカはCAGR 7.65%で成長し、砂漠の暑さと険しい地形に耐えなければならないプレミアムSUVと商用車の需要の中心地として台頭しつつあります。湾岸航空会社のモータースポーツ・エンターテインメントへの多角化とサウジアラビアのグランプリへの投資が、厳しい熱負荷に対応できる高性能ダンパー技術への関心を高めています。サプライヤーは、特殊なシール、ロングストロークのエアベローズ、研磨砂環境用に設計された耐腐食性コーティングで対応しています。現地化プログラムと自由貿易区は輸入関税を引き下げ、自動車用サスペンション・システム市場のTier-1製造ラインにとってこの地域の魅力を高めています。

北米と欧州は、規制による引き込みとプレミアムモデルの集中により、強力な価値シェアを維持しています。米国インフレ削減法の国産バッテリー奨励策は、電動ピックアップのフロアマウント・パックを保護する軽量マルチリンク・リアアクスルの需要を拡大します。欧州では「ビジョン・ゼロ」と「一般安全規則II」に重点を置くことで、セミアクティブダンピングと車高制御がホモロゲーションチェックリストに組み込まれ、インテリジェントサスペンションがOEMのコンプライアンス要件として事実上定着しています。成熟したサプライチェーン、高度なシミュレーションインフラ、堅牢なテストトラックにより、両地域は世界の自動車用サスペンションシステム市場に波及する性能と安全性のベンチマークを設定し続けています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 乗り心地とハンドリングの向上に対する需要の高まり

- 電動化に対応したシャシーの再設計(軽量アダプティブサスペンション)

- ADAS連動型シャーシ安全性の規制強化

- 新興国におけるSUVと高級車の販売が急増

- アクティブサスペンション機能のロックを解除するサブスクリプションベースのOTAアップグレード

- 3Dプリントされた複合サスペンション部品により金型コストを削減

- 市場抑制要因

- スマートサスペンションアーキテクチャの初期費用とライフサイクルコストが高め

- 過酷な条件下での信頼性とメンテナンスの課題

- サイバーセキュリティと機能安全コンプライアンスの負担

- 希土類MR流体と半導体センサーの供給ボトルネック

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力/消費者

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- コンポーネントタイプ別

- コイルスプリング

- リーフスプリング

- エアスプリング

- ショックアブソーバー

- スタビライザー/アンチロールバー

- サスペンションアーム&リンク

- 電子制御ユニットとセンサー

- その他のコンポーネント

- サスペンションシステムタイプ別

- パッシブサスペンション

- セミアクティブサスペンション

- アクティブサスペンション

- ジオメトリー/アーキテクチャ別

- マクファーソンストラット

- ダブルウィッシュボーン

- マルチリンク

- トーションビーム/ツイストビーム

- その他の形状

- 車両タイプ別

- 乗用車

- 小型商用車

- 大型商用車

- 販売チャネル別

- OEM

- アフターマーケット

- 推進別

- 内燃機関車

- 電気自動車とハイブリッド車

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- アジア太平洋地域の残り

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- エジプト

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Continental AG

- ZF Friedrichshafen AG

- Tenneco Inc.

- KYB Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp AG

- Mando Corporation

- Marelli Corporation

- Hyundai Mobis Co. Ltd.

- BWI Group

- Sogefi SpA

- Parker LORD Corporation

- Benteler International AG

- Fox Factory Holding Corp.

- Hendrickson International

- Ohlins Racing AB

- Showa Corporation

- Multimatic Inc.

- SAF-HOLLAND SE

- WABCO(ZF CVS)