|

市場調査レポート

商品コード

1444065

殺ダニ剤:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Acaricides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 殺ダニ剤:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 132 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

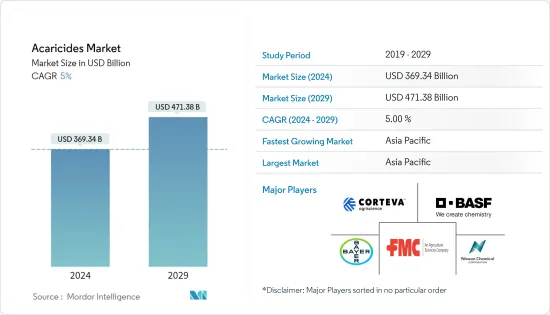

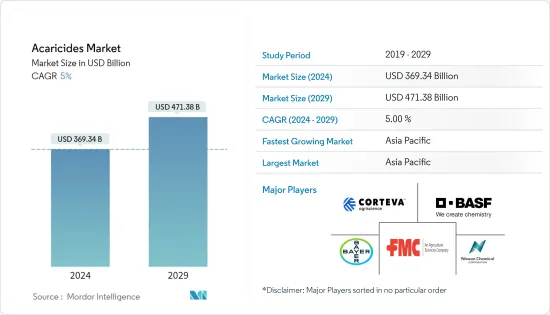

殺ダニ剤市場規模は、2024年に3,693億4,000万米ドルと推定され、2029年までに4,713億8,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5%のCAGRで成長します。

COVID-19の感染拡大により、世界中でロックダウンが実施され、サプライチェーンに混乱が生じた。この流行により、感染者数の増加、労働力不足、施設の閉鎖により世界の閉鎖が発生しました。このような要因により、殺ダニ剤を含む農薬の生産量が減少しました。したがって、パンデミックは世界レベルで殺ダニ剤の供給に間接的に影響を与えました。

長期的には、人口の増加に伴う食料需要の増加、耕地の減少、天然産物の需要の増加、持続可能な農業実践への需要の増加により、殺ダニ剤の需要が増加する可能性があります。ダニの攻撃による収量損失は、多くの作物で13.8%に達する可能性があると推定されています。ダニは乾燥した天候でも生き延びますが、地球の気温の上昇がこの問題をさらに悪化させます。近年、世界中で長期にわたる日照りの発生率が増加しているため、殺ダニ剤市場は急速に成長すると予測されています。しかし、殺ダニ剤の使用に対する厳しい規制により、今後数年間の市場の成長が抑制されることが予想されます。

亜熱帯および温帯で栽培される果物や野菜は、ダニの影響を最も受けやすいです。アジア太平洋地域の市場は、ダニやダニが媒介する病気の蔓延を抑制するための農薬の使用量が増加しているため、特に農業分野で目覚ましい成長を遂げています。

殺ダニ剤市場動向

天然物に対する需要の増加

環境への懸念の高まりと有機農業の面積の増加に伴い、天然作物保護製品の需要が世界中で大幅に増加しています。農業における植物性殺虫剤の使用も増加しました。 FAOによると、ドイツでは、植物性殺虫剤の農業使用は2018年の15トンから2019年には25トンに増加しました。また、マレーシアでも、2019年の植物性および生物学的殺虫剤の農業使用は101トンでした。農業生産者が作物を処理するために天然物を求める需要が高まっているため、企業はバイオベースの製品を市場に導入するようになりました。たとえば、2020年2月、オロ・アグリは、オランダのホリンヘムにあるホルティ・コンタクトで新しい殺虫剤/殺ダニ剤「オロガニック」を発売しました。オランダ理事会は最近、この植物保護製品を植物保護製品認可(CTGB)として承認しました。天然由来の活性物質であるオレンジオイルをベースにしています。これは、6%のオレンジ油から得られる植物検疫製品であり、殺虫、殺ダニ、殺菌特性があります。うどんこ病、べと病、アザミウマなどの病気や害虫と効率的かつ持続的に闘います。その後、2020年3月にバイオテクノロジー企業イダイ・ネイチャーは、登録された天然物であるオロシドをスペインで商業開発するため、南アフリカの企業オロ・アグリと独占販売契約に達しました。

アジア太平洋が殺ダニ剤市場を独占

アジア太平洋地域の農業産業は急速に発展しており、中国とインドが殺ダニ剤の主要消費国となっています。従来の殺虫剤や殺ダニ剤は吸汁害虫の防除に広く使用されていますが、そのほとんどは有効性の低下と高い抵抗力の発達により失敗に終わりました。ハダニは中国では主要な害虫とみなされており、長年にわたってかなりの損失を引き起こしています。世代が重なり、繁殖力が強く、虫体が小さく、殺虫剤耐性が高いため、防除が困難です。 2020年、Chengdu Newsun Crop Scienceは、ハダニを駆除するための斬新で革新的な植物性殺ダニ剤「Marvee」を発売しました。同様に、インドでは、ダニを含む多くの吸汁害虫が直接摂食することで被害を引き起こしています。それらのほとんどは、特に野菜において、いくつかの植物病原性ウイルスのベクターとしても機能します。これらの課題に対処するために、大手農薬会社Insecticides(India)Limited(IIL)は2019年に「Kunoichi」を発売しました。これはダニのすべての段階で有効な殺ダニ剤です。 Kunoichiはシエノピラフェン30% SCを含み、日本の日産化学株式会社によって開発されました。 IILは、日本の日産化学株式会社の製品を販売するインドのパートナーです。

殺ダニ剤業界の概要

農業用殺ダニ剤の市場は統合されており、少数の大手企業が高い市場シェアを占めています。この市場は、さまざまな殺ダニ剤製品の小売入手可能性を高めることに重点を置き、製品イノベーションの点で急速な成長を遂げています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 化学物質タイプ

- 有機リン酸塩

- カルバマート

- 有機塩素系

- ピレトリン

- ピレスロイド

- その他

- 用途

- スプレー

- 浸漬

- ハンドドレッシング

- その他

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- ドイツ

- 英国

- スペイン

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Corteva Agriscience

- Nissan Chemical Industries Ltd

- BASF SE

- Bayer CropScience

- FMC Corporation

- Syngenta International AG

- UPL Limited

第7章 市場機会と将来の動向

第8章 COVID-19の市場への影響

The Acaricides Market size is estimated at USD 369.34 billion in 2024, and is expected to reach USD 471.38 billion by 2029, growing at a CAGR of 5% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, lockdowns were imposed worldwide, resulting in supply chain disruptions. The outbreak resulted in global shutdowns due to an increase in the number of cases, the shortage of labor, and the closing down of facilities. Such factors led to low production of agrochemicals, including acaricides. Thus, the pandemic indirectly impacted acaricide supplies on a global level.

Over the long term, the growing food demand with expanding population, decreasing arable land, increasing demand for natural products, and increasing demand for sustainable agricultural practices may increase the demand for acaricides. It has been estimated that the yield losses due to attacks by mites could be as high as 13.8% in many crops. Mites survive in dry weather, and increasing global temperatures add to this problem. The acaricides market is projected to grow rapidly due to the increasing incidences of prolonged dry spells worldwide in recent years. However, the strict regulations over the use of acaricides are expected to restrain the market's growth in the coming years.

Fruits and vegetables grown in the sub-tropical and temperate zones are most susceptible to mites. The Asia-Pacific market is growing at an impressive rate, especially in agriculture, due to the increasing usage of crop protection chemicals to control the spread of tick and mite-borne diseases.

Acaricides Market Trends

Increasing Demand for Natural Products

With the rising environmental concerns and increasing area under organic farming, the demand for natural crop protection products has significantly increased worldwide. The use of botanical insecticides in agriculture also increased. According to FAO, in Germany, the agricultural use of botanical insecticides increased to 25 ton in 2019 from 15 ton in 2018. Also, in Malaysia, the agricultural use of botanical and biological insecticide in 2019 was 101 metric ton. The growing demand for natural products from agricultural producers to treat their crops has led the companies to introduce bio-based products in the market. For instance, in February 2020, Oro Agri launched its new insecticide/acaricide, Oroganic, at HortiContact in Gorinchem, in the Netherlands. The Dutch Board recently approved this plant protection product for the Authorization of Plant Protection Products (CTGB). It is based on orange oil, an active substance of natural origin. It is a phytosanitary product obtained from 6% orange oil, with insecticidal, acaricidal, and fungicidal properties. It fights diseases and pests such as powdery mildew, mildew, or thrips efficiently and sustainably. Later, in March 2020, a biotech company Idai Nature reached an exclusive distribution agreement with the South African company Oro Agri to commercially develop its registered natural product, OROCIDE, in Spain.

Asia-Pacific Dominates the Acaricides Market

The agricultural industry in the Asia-Pacific region is evolving rapidly, and China and India are the major consumers of acaricides. Conventional insecticides or acaricides are extensively used to control sucking pests, but most of them have failed due to lower efficacy and the development of high folds of resistance. Red spider mites are considered a major pest in China, causing considerable losses over the years. They have overlapping generations, a strong reproductive capacity, small insect bodies, and high insecticide resistance, making them difficult to control. In 2020, Chengdu Newsun Crop Science Co. Ltd launched its novel and innovative botanical acaricide, 'Marvee,' to control red spider mites. Similarly, in India, many sucking pests, including mites, cause damage by direct feeding. Most of them also act as vectors for several plant pathogenic viruses, particularly in vegetables. To address these challenges, the leading agrochemical company Insecticides (India) Limited (IIL) launched 'Kunoichi' in 2019. It is a miticide that is effective at all stages of the mite. Kunoichi comprises Cyenopyrafen 30% SC, and it was developed by Nissan Chemical Corporation, Japan. IIL is the Indian partner of Nissan Chemical Corporation, Japan, for marketing its products.

Acaricides Industry Overview

The market for agricultural acaricides is consolidated, with a few major players occupying the higher market share. Key participants in the agricultural acaricides market are BASF SE, UPL, Bayer CropScience, FMC Corporation, and Nissan Chemical Industries Ltd. The market is witnessing rapid growth in terms of product innovation, with a focus on increasing retail availability of various acaricide products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Type

- 5.1.1 Organophosphates

- 5.1.2 Carbamates

- 5.1.3 Organochlorines

- 5.1.4 Pyrethrins

- 5.1.5 Pyrethroids

- 5.1.6 Other Chemical Types

- 5.2 Application

- 5.2.1 Spray

- 5.2.2 Dipping

- 5.2.3 Hand Dressing

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Corteva Agriscience

- 6.3.2 Nissan Chemical Industries Ltd

- 6.3.3 BASF SE

- 6.3.4 Bayer CropScience

- 6.3.5 FMC Corporation

- 6.3.6 Syngenta International AG

- 6.3.7 UPL Limited